Maryland Labor Law Guide

A comprehensive guide to Maryland labor laws: Covering key topics including minimum wage regulations, overtime provisions, mandated breaks, hiring and termination procedures and other miscellaneous employment laws.

Key Takeaways

- As of January 1, 2024, the minimum wage rate in Maryland stands at $15.00 per hour.

- Nonexempt employees are eligible for overtime pay at a rate of 1.5 times their standard wage when they work over 40 hours in a week.

- Unlike adult workers, young employees under 18 must receive a 30-minute break for every five hours of work.

Minimum Wage Regulations in Maryland

The state of Maryland has specific regulations governing minimum wage. These regulations establish distinct minimum hourly rates for regular and tipped employees, dictating what employers must pay their workers.

| State/District | Minimum wage |

| Alabama | $7.25 |

| Alaska | $11.73 |

| Arizona | $14.35 |

| Arkansas | $11 |

| California | $16 |

| Colorado | $14.42 |

| Connecticut | $15.69 |

| Delaware | $13.25 |

| Florida | $13 |

| Georgia | $7.25 |

| Hawaii | $14 |

| Idaho | $7.25 |

| Illinois | $14 |

| Indiana | $7.25 |

| Iowa | $7.25 |

| Kansas | $7.25 |

| Kentucky | $7.25 |

| Louisiana | $7.25 |

| Maine | $14.15 |

| Maryland | $15 |

| Massachusetts | $15 |

| Michigan | $10.33 |

| Minnesota | $10.85 |

| Mississippi | $7.25 |

| Missouri | $12.3 |

| Montana | $10.3 |

| Nebraska | $12 |

| Nevada | $12 |

| New Hampshire | $7.25 |

| New Jersey | $15.13 |

| New Mexico | $12 |

| New York | $15 |

| North Carolina | $7.25 |

| North Dakota | $7.25 |

| Ohio | $10.45 |

| Oklahoma | $7.25 |

| Oregon | $14.2 |

| Pennsylvania | $7.25 |

| Rhode Island | $14 |

| South Carolina | $7.25 |

| South Dakota | $11.2 |

| Tennessee | $7.25 |

| Texas | $7.25 |

| Utah | $7.25 |

| Vermont | $13.67 |

| Virginia | $12 |

| Washington | $16.28 |

| West Virginia | $8.75 |

| Wisconsin | $7.25 |

| Wyoming | $7.25 |

| District of Columbia | $16.5 |

[Source: FRED]

Regular Employees

Minimum wage rates in Maryland for regular employees, effective as of January 1, 2024, stands at $15.00 per hour for employers of all sizes/

Tipped Employees

Tipped employees (that is, employees making more than $30 in tips per month) must earn the state's minimum wage per hour, while employers are required to pay a minimum of $3.63 per hour. The sum of this amount and tips must be at least the state minimum wage rate.

Restaurant employers who use a tip credit system are required to give employees a written or electronic wage statement for each pay period. This wage statement must show the employee's effective hourly rate of pay, including employer-paid cash wages and tips for tip credit hours worked for each workweek of the pay period.

Note that young employees under the age of 18 have their own wage considerations. They must be compensated at a rate equivalent to at least 85% of the state minimum wage rate.

Overtime Rules and Regulations in Maryland

Overtime rules and regulations hold significant importance in protecting workers' rights and ensuring fair compensation for extra work hours. In Maryland, these regulations apply differently to nonexempt and exempt employees.

Accurate categorization of employees as either nonexempt or exempt, based on the criteria specified in the Fair Labor Standards Act (FLSA) and state labor laws, is a critical responsibility for employers. Misclassifying employees can lead to legal complications and possible violations of wage and hour regulations.

Nonexempt Employees

Nonexempt employees are those who are not exempt from the overtime provisions of the FLSA and state labor laws. In Maryland, overtime pay is typically required for nonexempt employees who work beyond 40 hours in a seven-day week. These employees are entitled to receive overtime compensation at a rate of 1.5 times their regular hourly wage for each hour worked beyond the standard 40-hour workweek.

Leave hours, such as vacation, sick time and holidays, do not count toward the accumulated hours for overtime calculations. Overtime is specifically calculated based on hours actually worked. Employers must keep accurate records of nonexempt employees' hours worked to ensure they receive the appropriate overtime pay.

Exempt Employees

Exempt employees, specifically those categorized as "Executive," "Administrative" or "Professional" employees under the FLSA and Maryland labor laws, are generally exempt from overtime pay. These employees receive a predetermined salary and are not eligible for overtime, regardless of the number of hours worked in a week.

However, if an employer deducts or "docks" an exempt employee's wages for less than a full day of work, it may jeopardize the employee's exempt status, making them eligible for overtime pay. To qualify for one of the exempt categories, employees must meet certain criteria based on their job duties and salary:

- Executive employees: This category includes employees compensated on a salary basis of at least $684 a week (excluding certain benefits) who primarily manage the enterprise, regularly direct the work of two or more employees and have authority over hiring or firing decisions.

- Administrative employees: Administrative employees are those paid on a salary basis of at least $684 a week (excluding certain benefits). Their primary duties involve office or non-manual work directly related to the management or general business operations of the employer and they must exercise discretion and independent judgment.

- Professional employees: Professional employees are also compensated on a salary basis of at least $684 a week (excluding certain benefits). Their primary duties involve specialized intellectual instruction or creative endeavors that require advanced knowledge, invention, imagination, originality or talent.

Break Periods in Maryland

Maryland's regulations regarding break periods primarily apply to young workers under 18 years of age and employees working in certain retail establishments.

Breaks for Minors

Young employees under 18 years of age have specific requirements for break periods. They must receive a 30-minute break for every five hours of work. This provision aims to ensure that young workers have adequate rest and meal breaks to protect their well-being and comply with labor laws.

Breaks for Employees of Certain Retail Establishments

When it comes to adult employees, Maryland labor laws grant a break entitlement only to those working in certain retail establishments. To qualify for a break period, employers must have 50 or more retail employees for each working day over the last 20 or more calendar weeks.

If an employer opts to offer break periods, they are not obliged to compensate employees for lunch or other breaks lasting over 20 minutes where they allow the employee to leave their work area (or workstation, if leaving the workplace is not possible).

Family and Medical Leave Laws in Maryland

In Maryland, there are several laws and regulations related to Family and Medical Leave, including the federal Family and Medical Leave Act (FMLA). Here's an overview of these leave laws:

The Maryland Healthy Working Families Act

The Maryland Healthy Working Families Act, also known as "Sick and Safe Leave," mandates that Maryland employers, regardless of their location, must offer earned sick and safe leave. Employers with 15 or more employees must provide paid leave, while those with fewer than 15 employees must offer unpaid leave.

All employees working in Maryland can accrue leave at the rate of one hour for every 30 hours worked. Leave cannot be accrued in certain cases of limited work hours. Employers can choose to provide more leave if they wish.

Flexible Leave Act

The Flexible Leave Act allows employees of employers with 15 or more individuals to use "leave with pay" to care for an immediate family member who is ill or for bereavement leave upon the death of an immediate family member. Immediate family members include children, spouses or parents.

Employees can use earned leave types like sick leave, vacation time and compensatory time for these purposes. However, they are required to comply with the terms of any collective bargaining agreement or employment policy. The act also prohibits employers from taking adverse actions against employees who exercise their rights under this law.

Adoption Leave

Maryland's Adoption Leave law requires employers who provide paid leave to employees following the birth of their child to provide the same paid leave when a child is placed with the employee for adoption.

Deployment Leave

Deployment Leave allows employees of employers with 50 or more employees to take leave from work when an immediate family member, including a spouse, parent, stepparent, child, stepchild or sibling, is leaving for or returning from active duty outside the United States as a member of the U.S. armed forces. Employers cannot require employees to use compensatory, sick or vacation leave for this purpose.

Parental Leave

This law entitles eligible employees to up to six work weeks of unpaid parental leave during any 12-month period for the birth of their child or the placement of a child with the employee for adoption or foster care. Starting on January 1, 2025, most Maryland workers will qualify for a maximum of 12 weeks of paid parental leave.

Workplace Safety and Health Regulations in Maryland

The Maryland Occupational Safety and Health Act, commonly referred to as MOSHA, is a legislative framework that ensures the safety and well-being of employees in the state of Maryland. Its primary goal is to establish and maintain safe and healthy working environments for workers across the state.

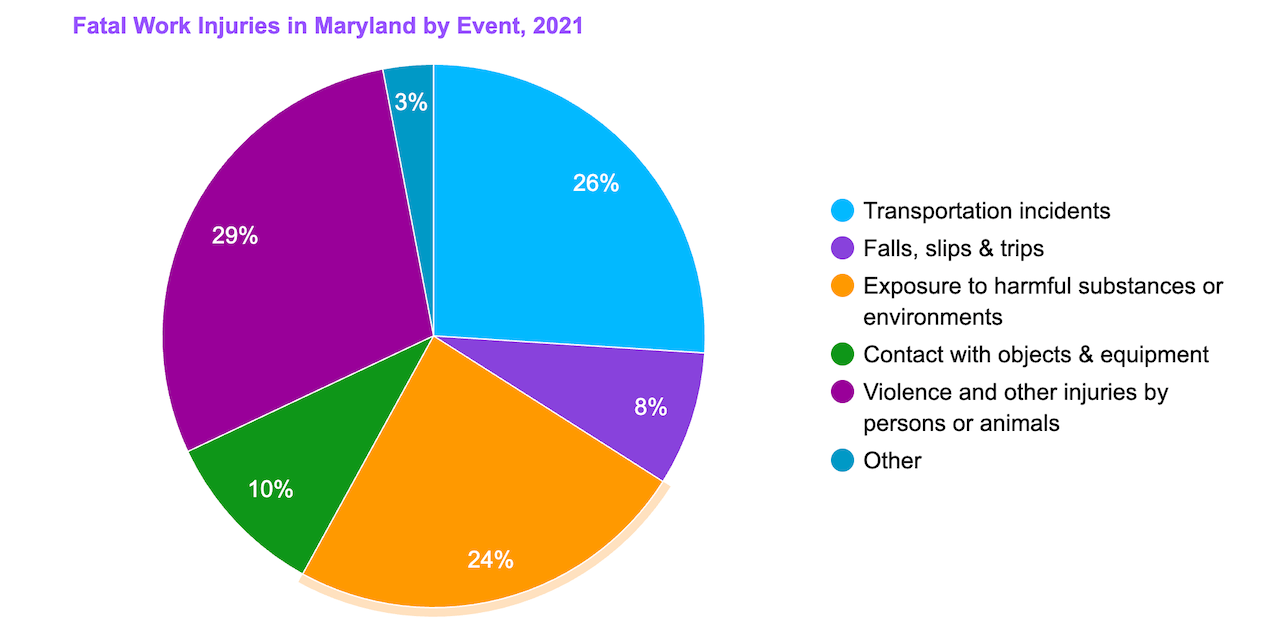

The last known data show there have been 80 fatal occupational injuries in the state of Maryland, most of which are associated with violence and transportation incidents.

[Source: U.S. Bureau of Labor Statistics]

You can see how Maryland compares to other states in the US when it comes to occupational fatal injuries by browsing our interactive map below.

| State/District | No. of Fatal Work Injuries |

| Alabama | 111 |

| Alaska | 20 |

| Arizona | 67 |

| Arkansas | 74 |

| California | 462 |

| Colorado | 96 |

| Connecticut | 23 |

| Delaware | 13 |

| Florida | 315 |

| Georgia | 187 |

| Hawaii | 15 |

| Idaho | 30 |

| Illinois | 176 |

| Indiana | 157 |

| Iowa | 49 |

| Kansas | 63 |

| Kentucky | 97 |

| Louisiana | 141 |

| Maine | 19 |

| Maryland | 80 |

| Massachusetts | 97 |

| Michigan | 140 |

| Minnesota | 80 |

| Mississippi | 41 |

| Missouri | 147 |

| Montana | 40 |

| Nebraska | 39 |

| Nevada | 43 |

| New Hampshire | 21 |

| New Jersey | 110 |

| New Mexico | 53 |

| New York | 247 |

| North Carolina | 179 |

| North Dakota | 34 |

| Ohio | 171 |

| Oklahoma | 86 |

| Oregon | 66 |

| Pennsylvania | 162 |

| Rhode Island | 5 |

| South Carolina | 107 |

| South Dakota | 20 |

| Tennessee | 132 |

| Texas | 533 |

| Utah | 52 |

| Vermont | 10 |

| Virginia | 125 |

| Washington | 73 |

| West Virginia | 36 |

| Wisconsin | 105 |

| Wyoming | 27 |

| District of Columbia | 12 |

[Source: U.S. Bureau of Labor Statistics]

The Maryland Occupational Safety and Health (MOSH) Department is in charge of enforcing these essential regulations. MOSH has jurisdiction over all public and private sector establishments within Maryland, with specific exemptions that include:

- Employees of federal government entities and their divisions

- Workers whose job safety and health are safeguarded by:

- The Federal Mine Safety and Health Act of 1977

- The Longshore and Harbor Workers' Compensation Act

- The Atomic Energy Act of 1954

Anti-Discrimination and Fair Employment Practices in Maryland

The Maryland Fair Employment Practices Act (FEPA) is a state law designed to protect employees from discrimination in the workplace. The key features of FEPA include:

- Protected characteristics: FEPA prohibits workplace discrimination based on several protected characteristics, such as race, color, religion, sex, age, national origin, marital status, sexual orientation, gender identity, genetic information and disability.

- Employer size: FEPA applies to employers with 15 or more employees, meaning that employers of this size are legally obligated to adhere to these anti-discrimination provisions.

- Harassment protections: In addition to addressing discrimination, the law explicitly addresses workplace harassment, expanding the rights of employees who experience harassment based on the specified protected characteristics.

- Expansion to independent contractors: A significant expansion introduced to FEPA in 2019 allows independent contractors to claim rights against discrimination. This change ensures that all workers, whether classified as employees or independent contractors, are entitled to FEPA's protections.

Independent Contractor Classification in Maryland

The primary principle used in Maryland to distinguish between an independent contractor and an employee is the degree of control and direction that the person or entity receiving the services exercises over the worker. This control extends not only to the result of the work but also to the details and means by which that result is achieved.

The right to discharge is another critical factor. If the person or entity has the authority to hire or fire the worker, it strongly indicates an employer-employee relationship. Additionally, providing tools, materials and a workspace for the individual who performs the services suggests an employer-employee relationship.

Here are the key characteristics of independent contractors in Maryland:

- Self-employed status: Independent contractors in Maryland are self-employed individuals who operate their own businesses.

- Use of personal tools and workspaces: They use their own tools, equipment and workspaces to perform their work, distinguishing them from employees who may use company-provided resources.

- Distinct work: Their line of work is typically different from that of the person or entity they provide services to, and they are often hired for specific, project-based tasks.

- Financial risk: Independent contractors in Maryland bear the financial risk associated with their work, as they are not guaranteed a regular wage or benefits. Their income is based on the success of their business operations and the contracts they secure.

Maryland recognizes that many government agencies may have their own criteria for classifying workers, and these criteria often align with separate laws and regulations specific to certain industries or occupations.

While certain professions like physicians, lawyers and dentists often operate as independent contractors, their employment status may vary depending on the specifics of their work arrangement.

Termination and Final Paychecks in Maryland

In Maryland, the termination of employment is governed by the principle of employment at will, which means that employees can be hired or fired for almost any reason, whether fair or not or for no reason at all. However, certain exceptions exist to protect employees from illegal discrimination and unjust termination.

These exceptions include safeguards against discrimination based on factors such as race, gender, age, disability, etc., as well as protections for actions like filing workers' compensation claims, asserting wage-related rights, ensuring workplace safety and more.

When it comes to final paychecks, Maryland has clear regulations in place to ensure that employees receive their due compensation promptly:

- Wage payment at termination: Upon the termination of employment, each employer in Maryland is legally obligated to pay an employee all wages owed for the work performed before the termination. This payment must be made on or before the day when the employee would have received their wages if the employment had not ended.

- Notice of termination: There is no requirement for employers to allow employees to work the full notice period specified by the employee. Additionally, employers are not obligated to pay employees for the time not actually worked during the notice period, unless this is expressly provided in an employment contract, agreement or policy.

- Unused vacation and sick leave: Whether unused vacation leave and sick leave are payable upon termination hinges on the employer's written policy and whether this policy was communicated to the employee at the time of hiring.

When navigating Maryland labor laws and termination procedures, ensure you're equipped with financial clarity. Our Paycheck Calculator allows you to estimate your earnings after accounting for taxes and deductions, tailored to your state's tax laws.

Summary of Maryland Labor Laws

Maryland's minimum wage rates can vary based on factors like the number of employees and the county. Overtime pay is mandated for nonexempt employees who work beyond 40 hours a week.

Rules concerning break periods differ for young workers and adults in the retail sales industry. Furthermore, Maryland extends its anti-discrimination employment laws to employers with 15 or more employees.

The classification of independent contractors in the state is determined by criteria such as the level of control, tools used and work arrangements.

Frequently Asked Questions About Maryland Labor Laws

How many hours can you work without a break in Maryland?

Unless an employee falls under the Healthy Retail Employee Act's criteria, there's no legal obligation for employers to offer breaks, including lunch breaks, except for those under 18 who must receive a 30-minute break for every five hours of work.

Does Maryland require paid breaks?

Federal law mandates that employers must compensate employees for short breaks granted during the day. Breaks that range from five to 20 minutes are regarded as part of the workday and must be paid.

Can an employer ask for a doctor’s note in Maryland?

Yes, employers in Maryland can request a doctor's note or medical documentation from an employee, but only after an absence of more than two consecutive shifts or if sick time was used before the 120th calendar day of employment with an agreement to provide verification.

How many sick days are required by law in MD?

According to Maryland legislation, workers have the right to accrue sick and safe leave at a rate of 1 hour for every 30 hours worked, up to a maximum of 40 hours. In adherence to this statute, employees will receive a total of 40 hours of paid or unpaid sick leave at the start of each year.

Disclaimer: This information serves as a concise summary and educational reference for Maryland state labor laws. It does not constitute legal advice. For personalized legal guidance, it is recommended to consult with an attorney.