Maine Labor Law Guide

A comprehensive guide to Maine labor laws: Covering essential topics like minimum wage guidelines, overtime regulations, mandatory rest breaks and other key employment provisions specific to the Pine Tree State.

Key Takeaways

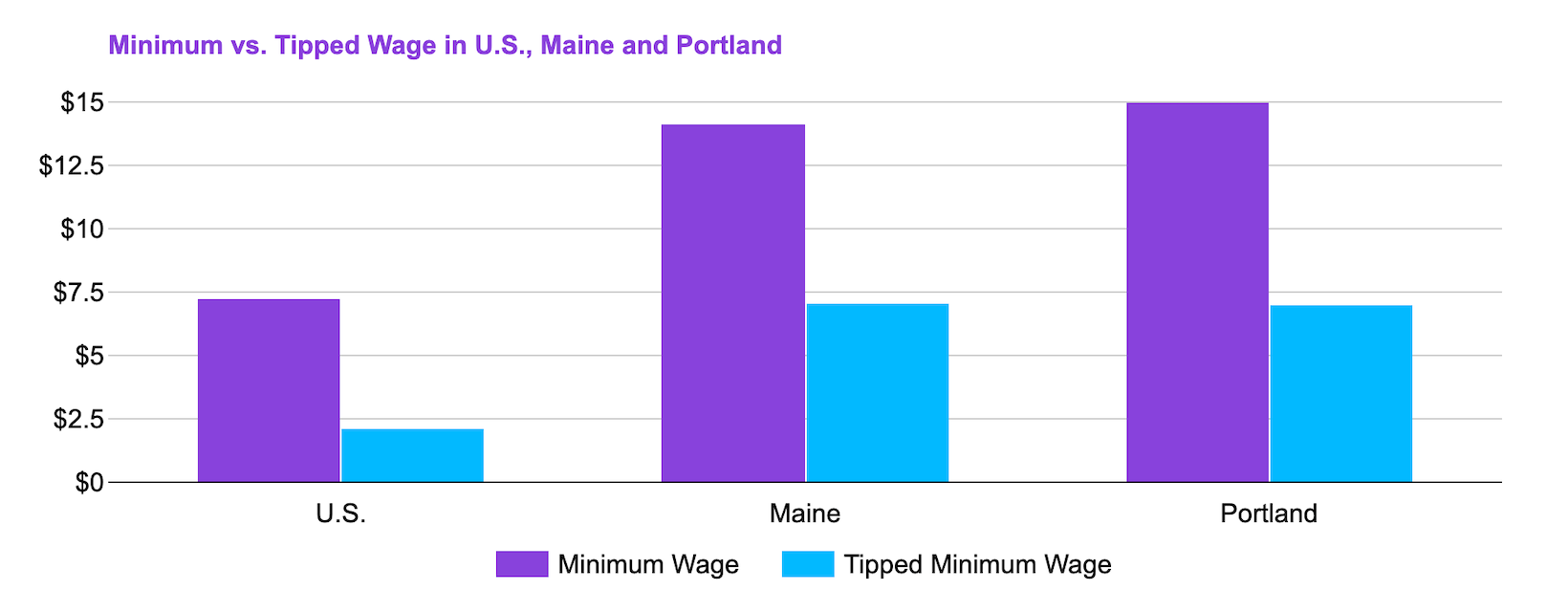

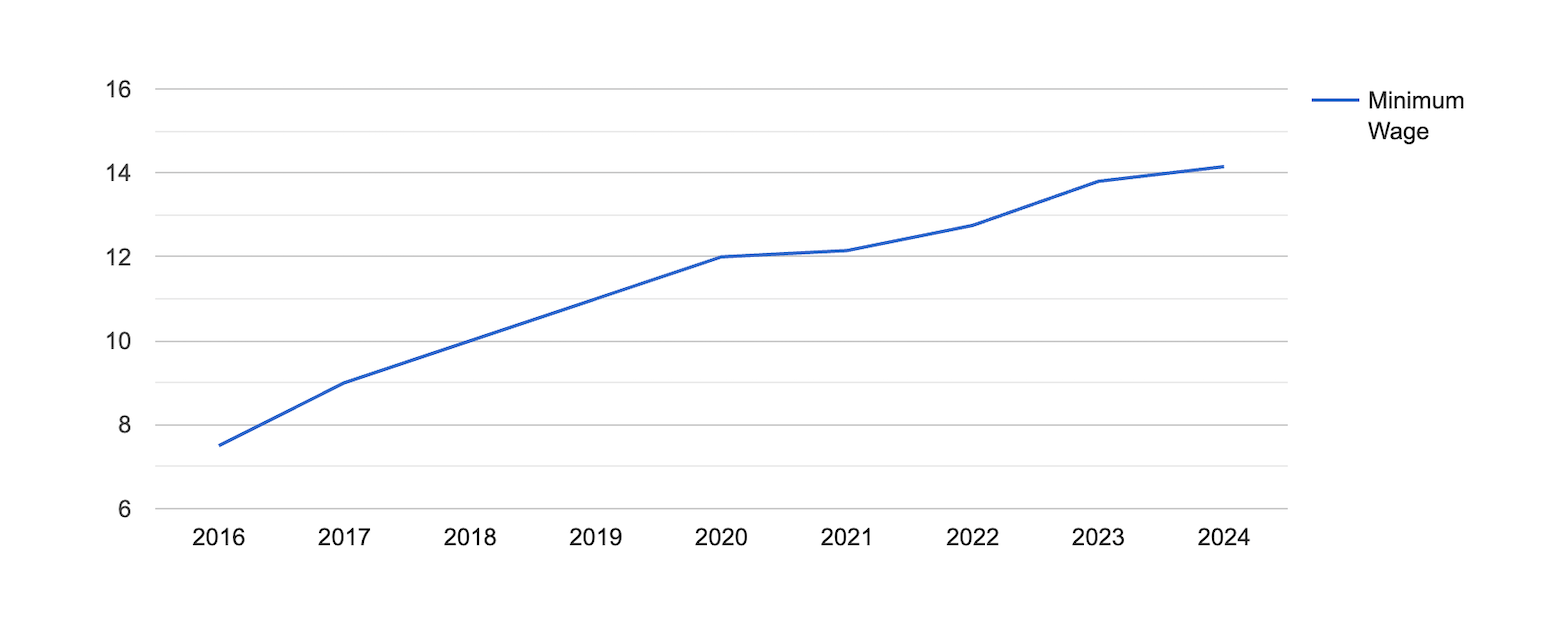

- As of 2024, Maine's minimum wage is $14.15 per hour

- In Portland, the minimum wage for hourly employees in 2024 is $15.00 per hour

- Tipped employees' minimum wage is $7.08 per hour

- Employees receive at least 1.5 times their regular pay rate for hours worked over 40 in a workweek

- To be exempt from overtime, a worker's minimum salary in Maine must be $735.58 per week

- Employers in Maine must provide a 30-minute meal break after six consecutive hours of work

Minimum Wage Regulations in Maine

As of 2024, the state minimum wage rate in Maine stands at $14.15 per hour.

You can also compare the Maine minimum wage with the minimum wage in other US states by checking the table below.

| State/District | Minimum wage |

| Alabama | $7.25 |

| Alaska | $11.73 |

| Arizona | $14.35 |

| Arkansas | $11 |

| California | $16 |

| Colorado | $14.42 |

| Connecticut | $15.69 |

| Delaware | $13.25 |

| Florida | $13 |

| Georgia | $7.25 |

| Hawaii | $14 |

| Idaho | $7.25 |

| Illinois | $14 |

| Indiana | $7.25 |

| Iowa | $7.25 |

| Kansas | $7.25 |

| Kentucky | $7.25 |

| Louisiana | $7.25 |

| Maine | $14.15 |

| Maryland | $15 |

| Massachusetts | $15 |

| Michigan | $10.33 |

| Minnesota | $10.85 |

| Mississippi | $7.25 |

| Missouri | $12.3 |

| Montana | $10.3 |

| Nebraska | $12 |

| Nevada | $12 |

| New Hampshire | $7.25 |

| New Jersey | $15.13 |

| New Mexico | $12 |

| New York | $15 |

| North Carolina | $7.25 |

| North Dakota | $7.25 |

| Ohio | $10.45 |

| Oklahoma | $7.25 |

| Oregon | $14.2 |

| Pennsylvania | $7.25 |

| Rhode Island | $14 |

| South Carolina | $7.25 |

| South Dakota | $11.2 |

| Tennessee | $7.25 |

| Texas | $7.25 |

| Utah | $7.25 |

| Vermont | $13.67 |

| Virginia | $12 |

| Washington | $16.28 |

| West Virginia | $8.75 |

| Wisconsin | $7.25 |

| Wyoming | $7.25 |

| District of Columbia | $16.5 |

[Source: FRED]

The Maine minimum wage has seen significant changes over the years following the ascending trajectory and is set to reach $14.15 starting on January 1st, 2024.

In addition to the state minimum wage, there are also local variations. For instance, in the City of Portland, the minimum wage for hourly employees in 2024 is $15.00 per hour.

Tipped Minimum Wage

Maine's minimum wage for tipped employees such as waiters or bartenders is $7.08 per hour.

If, at the end of the week, the total earnings of a tipped employee, including tips, fall short of the state minimum wage of $14.15 per hour, the employer is responsible for making up the difference.

Exceptions to Minimum Wage Requirements

In Maine, there are specific exemptions to the minimum wage requirements that apply to certain categories of employees. These exemptions are defined to accommodate various work arrangements and situations.

Employees who are exempt from the Maine minimum wage requirements:

- Certain agriculture employees: Some employees in the agriculture sector are exempt from the state's minimum wage requirements. This exemption may apply to workers engaged in specific agricultural activities.

- Commissioned employees: Employees who work on a commissioned basis and have a high degree of control over their hours and the location of their work may be exempt from the minimum wage regulations.

- Taxicab drivers: Taxicab drivers, who often have unique work arrangements and income structures, are exempt from the standard minimum wage requirements in Maine.

- Camp counselors: Employees serving as camp counselors may also be exempt from minimum wage regulations. This exemption recognizes the distinct nature of their work and the compensation structure in the camp industry.

- Some employees in the fishing industry: Certain employees working in the fishing industry may be exempt from the minimum wage requirements. This exemption acknowledges the seasonal and variable nature of their work.

- Bona fide executive, administrative or professional employees: Employees classified as bona fide executive, administrative or professional employees under specific criteria may be exempt from the minimum wage regulations.

- Certain incarcerated individuals: Individuals who are incarcerated and involved in work programs within correctional facilities may have different wage arrangements, which are exempt from the standard minimum wage requirements.

Subminimum Wage

In Maine, several categories fall under subminimum wage requirements, including:

- Young workers under the age of 20: This group of employees can be paid a reduced minimum wage of $4.25 per hour during the first 90 days of employment with any employer. After this initial period or when the employee turns 20, whichever comes first, they must be paid the full minimum wage.

- Student workers: Various exemptions apply to student workers, including high school and college students. Specific employers, such as retail or service stores, agriculture, and colleges or universities, can pay full-time students 85% of the minimum wage, provided they are registered students. Additionally, the "Student-Learner Program" enables students aged 16 or older, enrolled in vocational schools, to be hired for as little as 75% of the regular minimum wage, with the requirement of a certificate from the DOL.

- Employees with disabilities: Employers can pay sub-minimum wages to workers with physical or mental disabilities that affect their work quantity and quality, under the Fair Labor Standards Act. To do this, employers must obtain a certificate from the Department of Labor.

Additionally, certain nonprofit and educational organizations can apply for a certificate from the Department of Labor, allowing them to hire workers at 85% of the applicable minimum wage.

This exemption is commonly utilized by colleges, universities and nonprofit organizations to reduce labor costs.

When discussing wages, it’s important to keep in mind the taxes for complete financial clarity. Our Maine Paycheck Calculator gives you an estimate of your earnings after accounting for taxes and deductions, in adherence to your state’s tax laws.

Overtime Rules and Regulations in Maine

Overtime regulations in Maine encompass a combination of state and federal laws, with certain local variations coming into play.

First and foremost, overtime in Maine is calculated based on the number of hours worked in a week, not on a daily basis.

Employees are entitled to overtime pay of at least 1.5 times their regular pay rate when they work more than 40 hours in a workweek.

The overtime base wage in Maine is $21.23 per hour. This means that for every hour worked beyond the standard 40 hours per week, qualified employees should receive compensation at this elevated rate.

Overtime Exceptions and Exemptions

In Maine, the minimum salary requirement for exempting a worker from overtime is $735.58 per week.

The employee categories exempt from overtime laws include:

- Executive, administrative and professional employees

- Certain seasonal amusement or recreational establishments

- Farmworkers

- Casual babysitters and companions to the elderly or infirm

- Certain commissioned employees of retail or service establishments

- Employees of railroads and air carriers

- Announcers, news editors and chief engineers of non-metropolitan broadcasting stations

- Domestic service workers living in the employer's residence

- Employees of motion picture theaters

- Farmworkers

Rest and Meal Breaks

In Maine, employers are obliged to allow employees a 30-minute meal break after working for six consecutive hours, except in cases of emergency.

Importantly, this meal break is unpaid, unless the employer voluntarily chooses to pay employees for their breaks.

Additionally, there is an exemption for small businesses in Maine. If a business has three or fewer employees on duty at a given time and if these employees can take frequent breaks during the workday, the employer is not mandated to provide a 30-minute meal break.

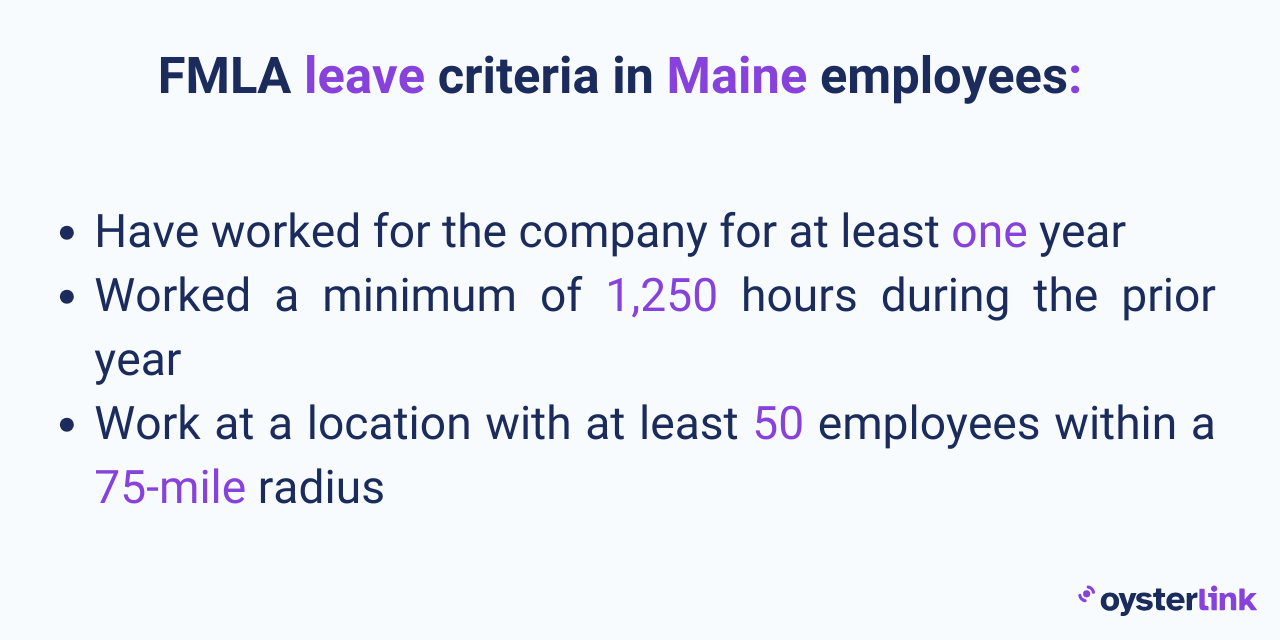

Family and Medical Leave Laws in Maine In Maine, family and medical leave applies to workers at larger companies and various government agencies, including schools.

To be eligible, the following criteria must be met:

- The workplace must have at least 50 employees within a 75-mile radius.

- An employee should have worked for at least 1,250 hours in the past 12 months, averaging around 24 hours per week.

- The employee must have been employed by the current employer for a minimum of 12 months, and these months do not have to be consecutive or all at once.

Maine's family and medical leave justify leave for the following reasons:

- When an employee is unable to perform their job due to a serious health condition

- For the birth of a child and to provide care for the newborn

- When adopting a child or becoming a foster parent

- To care for a spouse, child or parent with a serious health condition

- To make arrangements and attend activities when a spouse, child or parent in the National Guard or Reserves is on active duty or has been called to active duty

- To care for a seriously injured or ill parent, child or spouse who is a member of the Armed Forces

Eligible employees in Maine can take up to 12 weeks of family and medical leave during a 12-month period.

Leave to care for a seriously injured or ill parent, child, or spouse who is a member of the Armed Forces may extend to 26 weeks and can be intermittent.

Employers are not mandated to provide paid leave under these family and medical leave laws in Maine.

If you have paid sick leave or vacation time, you can utilize this paid leave during the 12-week Family Medical Leave.

However, you cannot add paid leave to your 12 weeks of family medical leave unless your employer agrees to it.

Your employer may also require you to use your paid time off during your family medical leave, rather than saving it for future vacation or illness.

Family Members That Qualify for FMLA

In Maine, family members considered eligible for family and medical leave typically include:

- Spouse

- Domestic partner

- Child

- Parent

- A sibling with whom an employee shares a home

Workplace Safety and Health Regulations in Maine

The Maine State Plan primarily covers state and local government workers within the state. However, it does not extend its jurisdiction to federal government workers, including those employed by the United States Postal Service and civilian workers on military bases.

Maine has adopted many of the Occupational Safety and Health Administration (OSHA) standards. While these standards generally align with OSHA's regulations, they may not be identical.

Notably, Maine has specific standards related to respiratory protection and Video Display Terminals (VDTs), which set it apart from federal OSHA standards.

Workplace inspections in Maine are conducted by the Maine Department of Labor. When violations are identified during these inspections, the department issues citations and proposed assessments of penalties.

State and local government employers have the option to contest these citations and penalties before the Board of Occupational Safety and Health.

In addition to enforcement, the Maine Department of Labor enforces a provision that protects workers from retaliation for engaging in occupational safety or health activities.

The Maine Department of Labor offers free, voluntary, and non-enforcement occupational safety and health training and consultation for both state and local government workplaces and private sector workplaces.

The last available data show there have been 19 fatal occupational injuries in Maine, most of which are related to transportation incidents.

You can see how Maine compares to other states in the US when it comes to occupational fatal injuries by browsing the table below.

| State/District | No. of Fatal Work Injuries |

| Alabama | 111 |

| Alaska | 20 |

| Arizona | 67 |

| Arkansas | 74 |

| California | 462 |

| Colorado | 96 |

| Connecticut | 23 |

| Delaware | 13 |

| Florida | 315 |

| Georgia | 187 |

| Hawaii | 15 |

| Idaho | 30 |

| Illinois | 176 |

| Indiana | 157 |

| Iowa | 49 |

| Kansas | 63 |

| Kentucky | 97 |

| Louisiana | 141 |

| Maine | 19 |

| Maryland | 80 |

| Massachusetts | 97 |

| Michigan | 140 |

| Minnesota | 80 |

| Mississippi | 41 |

| Missouri | 147 |

| Montana | 40 |

| Nebraska | 39 |

| Nevada | 43 |

| New Hampshire | 21 |

| New Jersey | 110 |

| New Mexico | 53 |

| New York | 247 |

| North Carolina | 179 |

| North Dakota | 34 |

| Ohio | 171 |

| Oklahoma | 86 |

| Oregon | 66 |

| Pennsylvania | 162 |

| Rhode Island | 5 |

| South Carolina | 107 |

| South Dakota | 20 |

| Tennessee | 132 |

| Texas | 533 |

| Utah | 52 |

| Vermont | 10 |

| Virginia | 125 |

| Washington | 73 |

| West Virginia | 36 |

| Wisconsin | 105 |

| Wyoming | 27 |

| District of Columbia | 12 |

[Source: U.S. Bureau of Labor Statistics]

Child Labor Laws in Maine

Maine has specific child labor laws that regulate the employment of minors based on their age. These laws are designed to ensure the safety and well-being of young workers.

Minors who are 16 and older are permitted to work in non-hazardous jobs in various industries, including:

- Manufacturing establishments

- Bakeries

- Dry cleaning establishments

- Hotels and garages

- Commercial places of amusement

15-year-old minors are allowed to work in:

- Dining rooms

- Kitchens

- Lobbies

- Offices of hotels and motels

They may also engage in occupations approved for 14-year-old minors, but they are restricted from performing room service, making deliveries to hotel rooms or entering hallways leading to those rooms.

14-year-old minors can legally work in several industries and occupations, including:

- Restaurants (excluding those on the premises of hotels or motels)

- Sporting and overnight camps

- Stores

- Filling stations

- Ice cream stands

- Laundromats

- Hospitals

- Nursing homes

- Children's camps

- Domestic work in or about private homes

- Construction

- Municipalities

- Agriculture

They can also work outdoors on the grounds of hotels, motels and non-hazardous tasks outside of manufacturing/mechanical establishments.

Moreover, they may engage in non-hazardous customer service/sales and office work, provided it takes place in a separate room from any processing area.

These minors may also work in non-hazardous roles at commercial places of amusement, but they are prohibited from participating in games of chance or activities related to betting.

Minors under 14 can legally work in:

- Children's camps

- Hospitals

- Nursing homes

- Municipalities

- Domestic work in or around private homes

They can also be employed by, with or under the direct supervision of a parent in various industries, including restaurants, auto-related businesses, laundries, stores, sporting camps or on the grounds of hotels or motels.

Minors also have working hour restrictions in Maine based on their age as follows:

Minors Under 16 Years of Age:

- No more than 18 hours per week when school is in session for one or more days

- No more than 3 hours on a school day

- No more than 40 hours per week when school is not in session (must be out of session for the entire week)

- No more than 8 hours on non-school days, such as weekends, holidays and storm days

- They cannot work for more than six days in a row

- Minors under 16 can not work during the hours when their school is in session

- They cannot work before 7 a.m. or after 7 p.m., except during summer vacation when they may work until 9 p.m.

16 and 17-Year-Old Students:

- No more than 20 hours during a week when the approved school calendar has three or more school days; or up to 8 hours on each day of the closure, for a total of 28 hours per week if there is an unscheduled school closure

- No more than 4 hours on a school day, except they can work 8 hours on the last school day of the week

- No more than 50 hours in a week when the approved school calendar has less than three school days, or during the first or last week of the school calendar

- No more than 10 hours on scheduled non-school days, including weekends, holidays and workshops

- They cannot work before 7 a.m. on a school day or before 5 a.m. on a non-school day

- They cannot work after 10 p.m. the night before a school day or after midnight when there is no school the next day

Work permits are mandatory for minors under the age of 16.

Anti-Discrimination and Fair Employment Practices in Maine

The Maine Human Rights Act safeguards employees from discrimination by prohibiting unfair treatment based on various personal characteristics.

These characteristics include:

- Race: Discrimination based on a person's race, color or ethnic background is prohibited.

- Sex: Gender-based discrimination, whether against men or women, is not allowed.

- Religion: Employees are protected from discrimination based on their religious beliefs or practices.

- National origin: Discrimination due to a person's country of origin or nationality is prohibited.

- Age: Age discrimination protections apply to individuals who are 40 years of age or older.

- Disability: The law protects individuals with disabilities from discrimination, ensuring that they have equal employment opportunities and access to reasonable accommodations.

- Sexual orientation: Discrimination based on an individual's sexual orientation, whether they identify as heterosexual, homosexual, bisexual or any other orientation, is not allowed in many jurisdictions.

- Physical or mental disability: Discrimination based on physical or mental disabilities is prohibited.

- Ancestry: Discrimination based on a person's ancestry or familial background is not allowed.

- Marital status: Discrimination related to a person's marital status, whether married, single, divorced or separated, is also prohibited in some jurisdictions.

Independent Contractor Classification in Maine

Determining whether an individual in Maine is classified as an independent contractor or an employee depends on several key factors.

Control over how the job is performed:

- When the employer exercises significant control over how the tasks are carried out, including specifying work hours, location and detailed instructions, it generally indicates an employee classification.

- Conversely, if the worker enjoys substantial autonomy and flexibility in their work, allowing them to determine their own work schedule and methods, it leans toward an independent contractor status.

Control over financial aspects:

- When the employer provides tools and equipment, covers work-related expenses and pays an hourly rate or offers reimbursement, this suggests an employee classification.

- In contrast, if the worker is responsible for procuring their tools, equipment and covering their expenses and is compensated with a flat rate or project-based payment, it tends to indicate an independent contractor status.

- Additionally, the freedom to advertise services to other companies reinforces the notion of being an independent contractor.

Relationship between the worker and the employer:

- If the worker can simultaneously work for multiple businesses, has the option to hire additional personnel to aid in tasks, and their work diverges from the core focus of the hiring business, they are more likely to be an independent contractor.

- Conversely, if the worker exclusively serves one business, cannot hire additional assistance, and performs tasks similar to other employees of that business, their classification is more likely to be an employee.

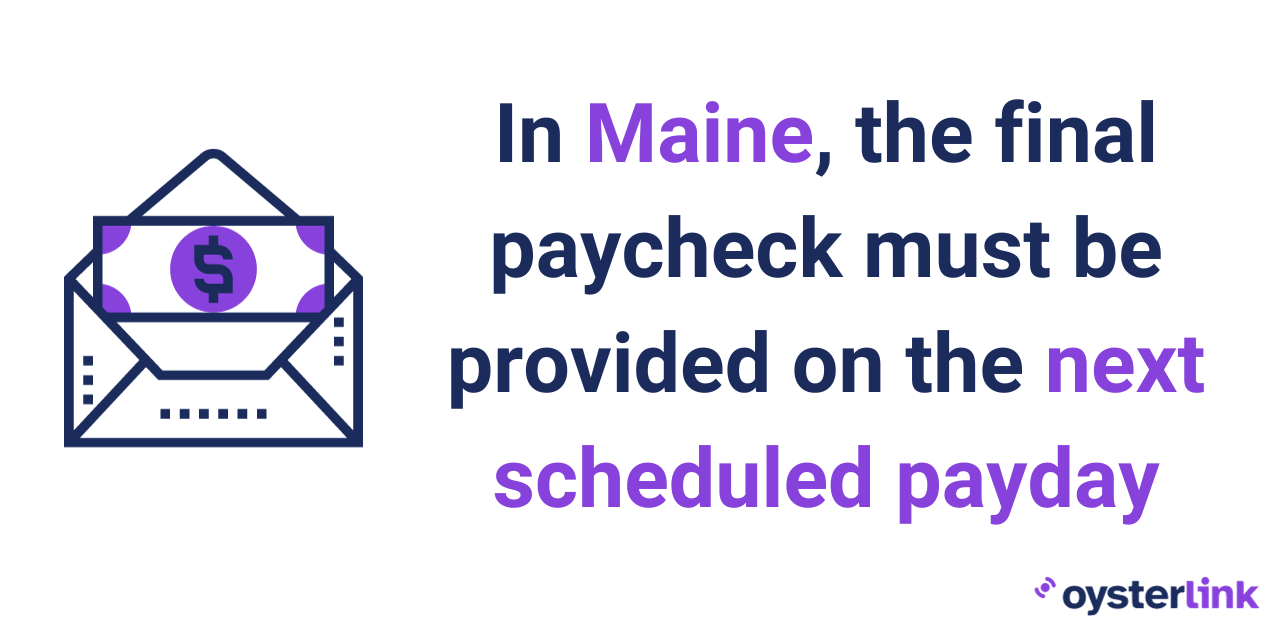

Termination and Final Paycheck Laws in Maine

When an employer terminates an employee, they are required to issue a final paycheck on the next regularly scheduled pay date.

However, if the employee makes a demand for payment earlier, the employer must comply within two weeks of receiving this request, whichever occurs earlier.

If an employee decides to resign from their job voluntarily, they are also entitled to receive their final check on the next regularly scheduled pay date or within two weeks of requesting payment, whichever is earlier.

Summary

As of 2024, the state minimum wage is $14.15. Tipped employees have their own minimum wage, with variations in different locations.

[Source: Maine.gov]

Certain exemptions from the minimum wage regulations exist, such as for agriculture workers and commissioned employees.

Subminimum wage applies to young workers, students and employees with disabilities.

Overtime in Maine is calculated weekly, with specific rates for tipped employees. Family and medical leave laws are applicable under certain conditions. Child labor laws regulate employment for minors, with age-specific restrictions.

Finally, anti-discrimination laws protect employees based on various characteristics, and independent contractor classification is determined by control, finances, and the work relationship.

Termination and final paycheck laws require prompt payment to employees when they are terminated or resign.

FAQs About Maine Labor Laws

For more info, find frequently asked questions about the labor laws in Maine below.

Is Maine a “right-to-fire” state?

Maine follows an "at-will" employment system, allowing both employees and employers the freedom to terminate the employment relationship at any time, with or without a specific reason.

In essence, Maine operates as a "right-to-fire" state.

Can you be forced to work overtime in Maine?

Yes, you can be forced to work overtime in Maine for proper compensation but with certain limitations.

In Maine, employers are prohibited from mandating employees to work more than 80 hours of overtime in any consecutive two-week period.

How many consecutive days can you legally work in Maine?

In Maine, the law specifies that employers cannot require employees to work more than 80 hours of overtime in any consecutive two-week period. However, it does not specify how many days in a row you can legally work.

Is it illegal to discuss wages in Maine?

In Maine, it is not illegal to discuss wages. Employers are prohibited from discriminating against an employee for inquiring about, disclosing, comparing or otherwise discussing their wages with others.

Is holiday pay mandatory in Maine?

In Maine, holiday pay is not mandatory for private employers.

They can require employees to work on holidays, and there is no obligation to pay premium rates, such as 1.5 times the regular rate, for working on holidays unless the hours worked qualify the employee for overtime under standard overtime laws.

This means that private employers have the discretion to determine whether or not they provide additional compensation for holiday work, beyond what is required by standard overtime regulations.

Disclaimer: This information serves as a concise summary and educational reference for Maine state labor laws. It does not constitute legal advice. For personalized legal guidance, it is recommended to consult with an attorney.