Louisiana Labor Law Guide

In this comprehensive exploration of Louisiana labor laws, we cover essential topics like minimum wage guidelines, overtime regulations, mandatory rest breaks and other key employment provisions specific to the Bayou State.

Key Takeaways

- Louisiana adheres to the Federal Minimum Wage of $7.25 per hour

- The minimum overtime wage in the state is $10.88 per hour

- Employees working five hours or more are entitled to a 30-minute unpaid meal break

Minimum Wage Regulations in Louisiana

Unlike many other states in the United States, Louisiana doesn’t have a state-specific minimum wage law and thus adheres to the federal minimum wage of $7.25 per hour.

| State/District | Minimum wage |

| Alabama | $7.25 |

| Alaska | $11.73 |

| Arizona | $14.35 |

| Arkansas | $11 |

| California | $16 |

| Colorado | $14.42 |

| Connecticut | $15.69 |

| Delaware | $13.25 |

| Florida | $13 |

| Georgia | $7.25 |

| Hawaii | $14 |

| Idaho | $7.25 |

| Illinois | $14 |

| Indiana | $7.25 |

| Iowa | $7.25 |

| Kansas | $7.25 |

| Kentucky | $7.25 |

| Louisiana | $7.25 |

| Maine | $14.15 |

| Maryland | $15 |

| Massachusetts | $15 |

| Michigan | $10.33 |

| Minnesota | $10.85 |

| Mississippi | $7.25 |

| Missouri | $12.3 |

| Montana | $10.3 |

| Nebraska | $12 |

| Nevada | $12 |

| New Hampshire | $7.25 |

| New Jersey | $15.13 |

| New Mexico | $12 |

| New York | $15 |

| North Carolina | $7.25 |

| North Dakota | $7.25 |

| Ohio | $10.45 |

| Oklahoma | $7.25 |

| Oregon | $14.2 |

| Pennsylvania | $7.25 |

| Rhode Island | $14 |

| South Carolina | $7.25 |

| South Dakota | $11.2 |

| Tennessee | $7.25 |

| Texas | $7.25 |

| Utah | $7.25 |

| Vermont | $13.67 |

| Virginia | $12 |

| Washington | $16.28 |

| West Virginia | $8.75 |

| Wisconsin | $7.25 |

| Wyoming | $7.25 |

| District of Columbia | $16.5 |

[Source: FRED]

What's even more surprising is that this federal minimum wage has remained constant since 2009, placing Louisiana among the five states including Alabama, Mississippi, South Carolina and Tennessee that have upheld this rate to the present day.

Tipped Minimum Wage

According to federal regulations, employers can apply a "tip credit" system, enabling them to compensate their employees with as little as $2.13 per hour.

This is within the law as long as the employees' tips bridge the gap to reach the federal minimum wage of $7.25 per hour.

To qualify for the tip credit, employees are required to earn a minimum of $30 in tips per month.

Defining what constitutes a tip in Louisiana can be intricate. Cash tips and voluntary gratuities, that exceed the bill amount, are recognized as tips.

However, the scenario differs when dealing with mandatory service charges or credit card payments. Federal law categorizes mandatory service charges as non-tip income, allowing employers to legally retain them.

Additionally, when customers opt for credit card payments, employers are within their rights to pass on a portion of the credit card processing fee to their employees, as per the law.

Exceptions to Minimum Wage Requirements

Louisiana's stance on minimum wage and exemptions closely aligns with federal regulations stipulated in the Fair Labor Standards Act (FLSA).

Here's a breakdown of specific categories of employees exempt from minimum wage regulations in the state:

- Executive, administrative and professional employees

- Outside sales employees

- Computer professionals

- Employees of seasonal amusement or recreational establishments

- Employees of small newspapers and switchboard operators

- Seamen on foreign vessels

- Employees engaged in fishing operations

- Newspaper delivery employees

- Farm workers on small farms

- Casual babysitters

- Individual service providers

Subminimum Wage

Louisiana also adheres to federal regulations regarding subminimum wage rates for specific groups of employees.

Employees under the age of 20 may be paid a minimum wage of not less than $4.25 per hour during the first 90 consecutive calendar days of their employment.

By law, employers are prohibited from displacing any existing employees to hire someone at the youth minimum wage.

The FLSA allows certain individuals to be employed at wage rates lower than the statutory minimum wage through certificates issued by the Department of Labor.

These individuals include:

- Student learners, particularly vocational education students

- Full-time students working in retail or service establishments, agriculture or institutions of higher education

- Individuals whose ability to earn or be productive in their work is affected by physical or mental disabilities, including those related to age or injury

When discussing wages, it’s important to keep in mind the taxes for complete financial clarity. Our Louisiana Paycheck Calculator gives you an estimate of your earnings after accounting for taxes and deductions, in adherence to your state’s tax laws.

Right-To-Work Laws in Louisiana

Louisiana upholds the "right to work" principle, which means employees cannot be compelled to join a union or pay dues as a condition of employment. This law eliminates the requirement for non-union workers to pay an "agency fee."

Key points:

- Policy: All individuals have the right to join or refrain from labor organizations without fear of reprisals

- Prohibited activity: Employers cannot mandate union membership or dues as a condition of employment

- Penalties: Violations result in unlawful agreements, with penalties including fines up to $1,000, imprisonment for up to 90 days, injunctive relief, and damages recovery

Overtime Rules and Regulations in Louisiana

Louisiana doesn’t have state-specific overtime rules and regulations but follows the federal FLSA. Under FLSA laws employers must pay their hourly employees at a rate of 1.5 times their regular hourly wage for any hours worked beyond 40 in a workweek.

Since Louisiana's minimum wage is $7.25 per hour, this means the minimum overtime wage in the state is $10.88 per hour.

For salaried employees, the regular rate is computed by dividing the salary by the intended number of hours it should cover. Overtime is compensated at a rate of 1.5 for hours worked beyond 40.

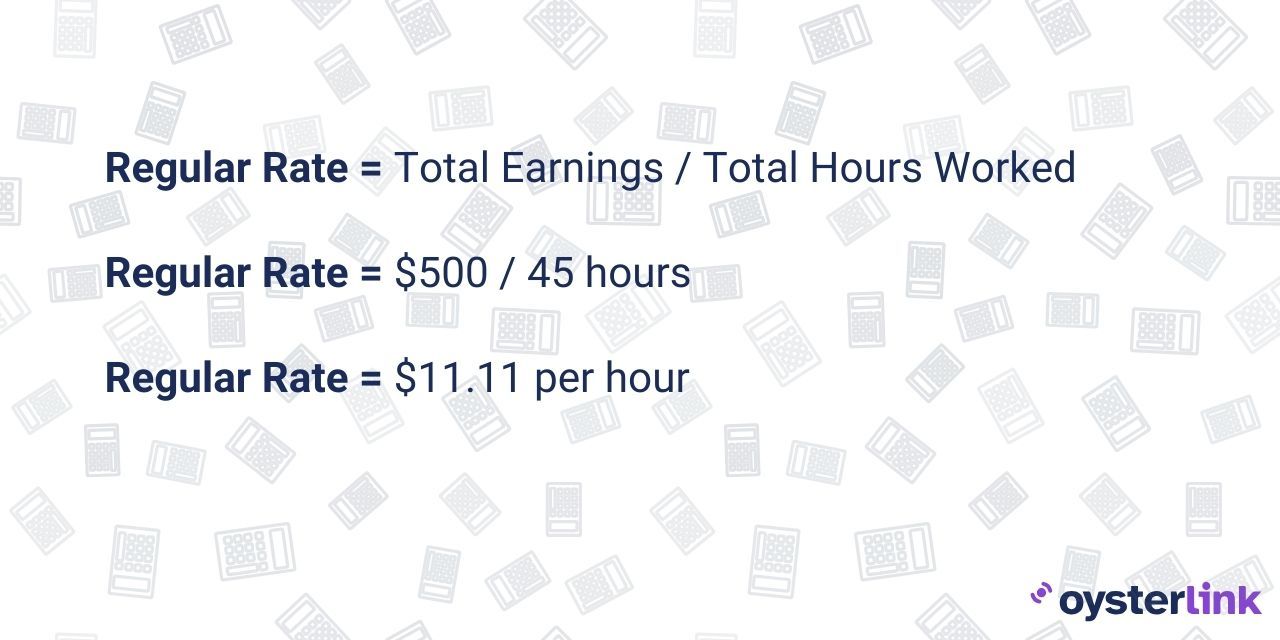

For employees who receive an hourly wage in addition to bonuses and/or commissions, the regular rate is calculated as the total hours worked multiplied by the hourly rate, plus the workweek equivalent of any bonuses or commissions, divided by the total hours in the workweek.

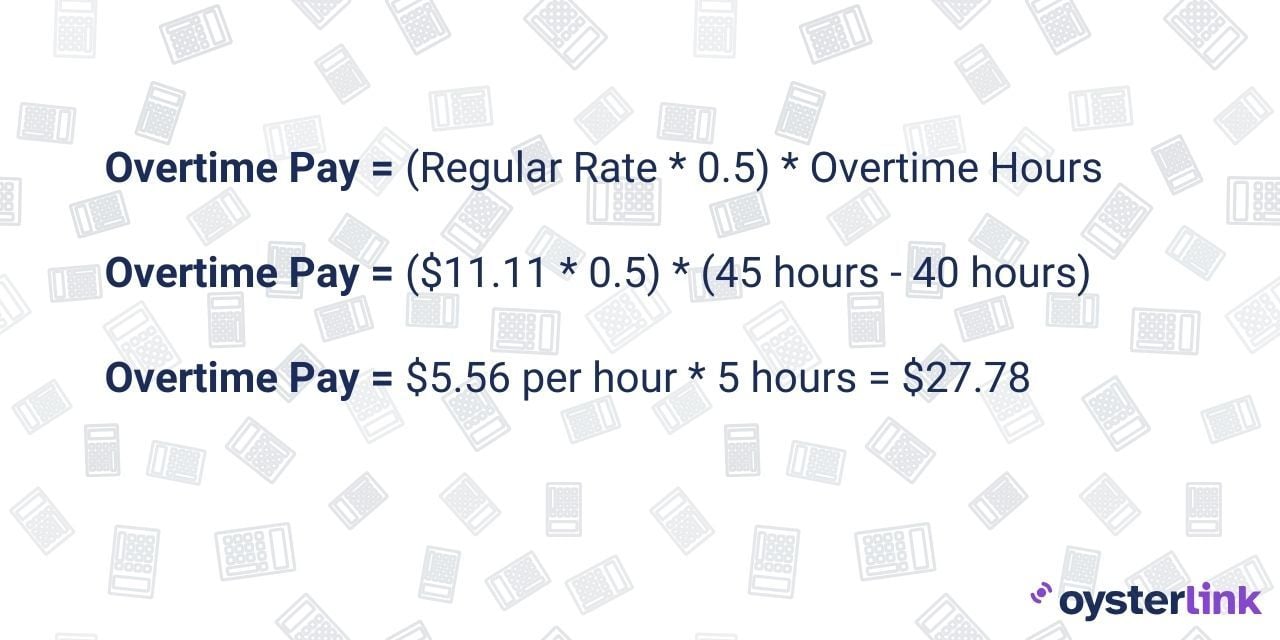

Overtime is then calculated at half of this regular rate for each hour exceeding 40.

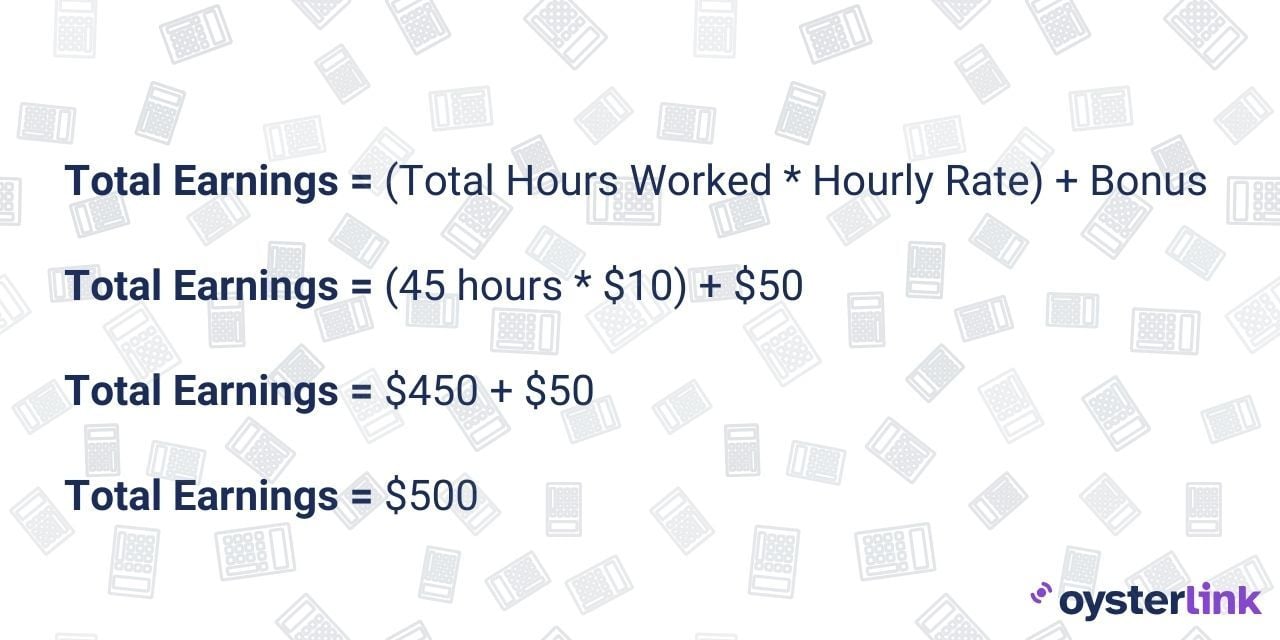

For example, if an employee works 45 hours a week at an hourly rate of $10 and receives a bonus of $50, the calculations in Louisiana would be as follows:

Calculate total earnings without overtime:

Determine the regular rate (the rate for the initial 40 hours):

Calculate overtime pay (for hours worked beyond 40):

In this scenario, the regular earnings amount to $500, with an hourly rate of approximately $11.11. The additional $27.78 represents the overtime compensation for the extra 5 hours worked beyond the standard 40-hour workweek in Louisiana.

Overtime Exceptions and Exemptions

Certain groups and professions are exempt from FLSA regulations due to their lower likelihood of being exploited.

The employee categories exempted from overtime laws include:

- Executive, administrative and professional employees

- Outside sales employees

- Transportation workers

- Agricultural and farm workers

- Live-in employees such as housekeepers

Rest and Meal Breaks

Employees who work for five hours or more in a single shift in Louisiana are entitled to a 30-minute unpaid meal break.

During the meal break, employees must be free to use that time as they see fit, and no work can be required of them during this period.

While employers are encouraged to provide rest breaks, there is no legal requirement for them to do so.

The Louisiana Workforce Commission is responsible for enforcing labor laws in the state, and it can impose penalties on employers found in violation of break laws. Penalties can amount to up to $500 for each employee affected by the violation.

Family and Medical Leave Laws in Louisiana In Louisiana, employers must adhere to the federal Family and Medical Leave Act (FMLA), which provides eligible employees with the right to take unpaid leave and the guarantee of reinstatement for certain qualified reasons.

Under the federal FMLA, eligible employees in Louisiana have the right to take up to 12 weeks of leave within a 12-month for specific reasons.

These reasons include:

- Recovery from a serious health condition

- Caring for a family member with a serious health condition

- Bonding with a new child (birth, adoption or foster placement)

- Handling qualifying emergencies due to a family member's military service

- Care for a family member who suffered a serious injury during active duty in the military

Under FMLA, Louisiana employees may take leave if they meet the following criteria:

- Have worked for the company for at least one year

- Worked a minimum of 1,250 hours during the prior year

- Work at a location with at least 50 employees within a 75-mile radius

During FMLA leave in Louisiana, employees are permitted to maintain their health insurance at the same cost they are required to pay while working. FMLA leave is unpaid, but employees may use their accrued paid leave during this period.

In addition to the FMLA, Louisiana's labor laws also provide state-specific leave rights. These include:

- Louisiana pregnancy disability leave: Employers with over 25 employees are required to grant eligible employees leave for pregnancy-related disabilities. Employers must offer up to six weeks of leave for normal pregnancies and childbirth, and up to four months for pregnancies with complications.

- Small necessities law: Louisiana mandates that all employers must offer employees up to 16 hours of unpaid leave within a 12-month period for attending, observing or participating in conferences or classroom activities related to their children (in school or daycare).

Family Members Who Qualify for FMLA

The FMLA recognizes specific family members for whom eligible employees can take leave to provide care or support.

These immediate family members include:

- Spouse: An eligible employee in Louisiana can take FMLA leave to care for their spouse, which includes a legally recognized husband or wife.

- Children: Immediate family members also encompass an eligible employee's children, whether they are biological, adopted or foster children.

- Parents: FMLA allows an eligible employee to take leave to care for their parents, which includes biological parents and adoptive parents.

Keep in mind that "parents-in-law" are not considered immediate family members under FMLA.

It's worth knowing that the terms "son" and "daughter" within the context of FMLA do not include individuals aged 18 or older, unless they are "incapable of self-care" due to a mental or physical disability that limits one or more "major life activities."

Salary During Paid Sick Leave In Louisiana, private employers are not mandated by state law to offer employees paid or unpaid sick leave.

Employers have the discretion to provide sick leave benefits to their employees if they choose to do so. However, if an employer opts to offer sick leave, they must ensure compliance with any agreements outlined in employment contracts.

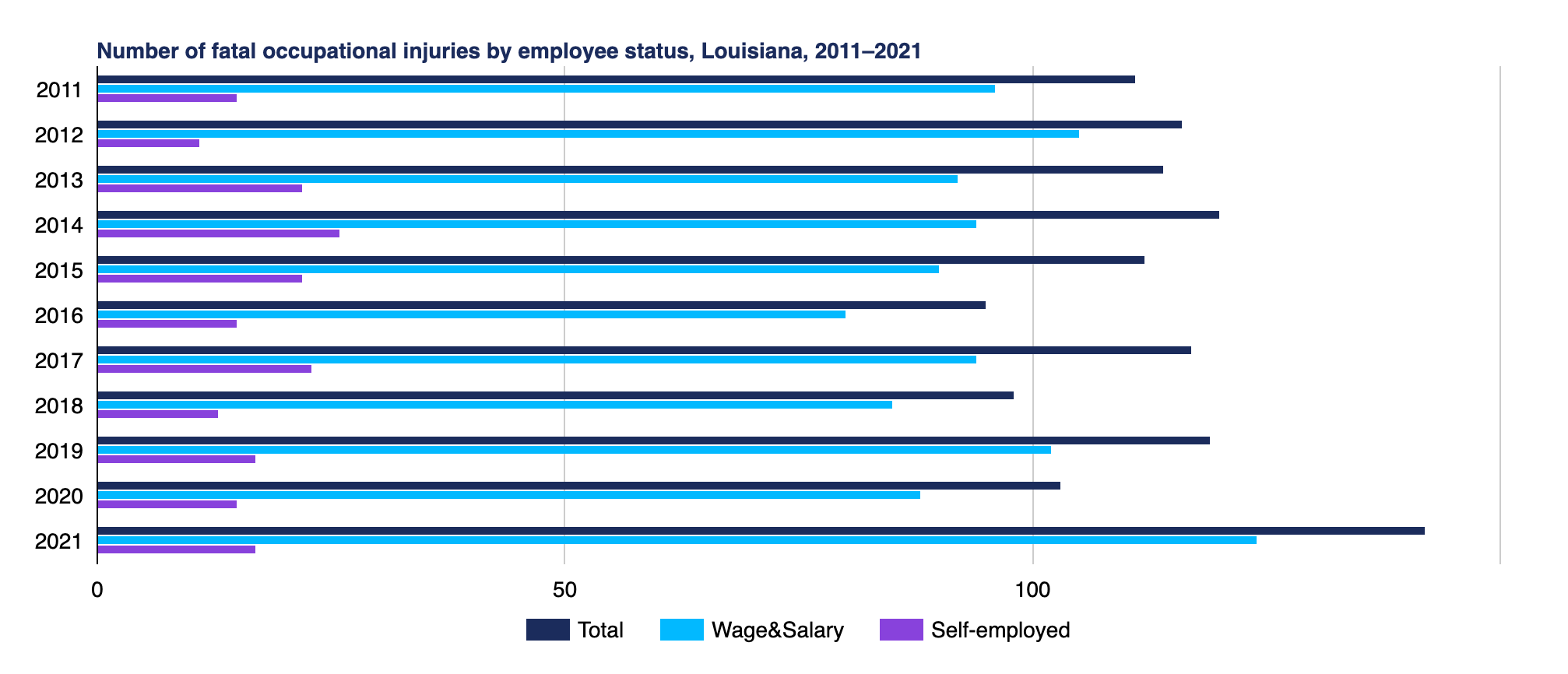

Workplace Safety and Health Regulations in Louisiana

Louisiana is governed by the federal Occupational Safety and Health Act (OSHA), which has jurisdiction over the majority of private-sector employees within the state.

Here are the key aspects of federal OSHA operations:

- Regulations: OSHA establishes and enforces safety and health regulations for most private sector employers, encompassing a wide range of industries and workplace hazards.

- Inspections: OSHA conducts regular inspections and responds to complaints or incidents to ensure compliance with safety and health regulations.

- Penalties: Failure to comply with OSHA regulations can result in penalties, including fines, citations and requirements to address safety hazards.

- Training and outreach: OSHA offers training and outreach programs to educate employers and employees in Louisiana on safety and health matters.

- Whistleblower protection: OSHA is committed to protecting employees who report safety or health violations from facing retaliation by their employers.

- Emergency response: OSHA guides emergency response and preparedness, ensuring that workplaces in Louisiana are adequately equipped to handle various emergencies, such as fires, chemical spills and natural disasters.

- Small business assistance: OSHA extends specialized assistance and consultation services to small businesses in Louisiana, aiding them in meeting safety and health requirements.

- Partnerships: OSHA collaborates with diverse organizations, industries and labor groups to enhance workplace safety through partnerships and alliances, fostering a culture of safety and well-being in the state.

[Source: U.S. Bureau of Labor Statistics]

Child Labor Laws in Louisiana

Louisiana has specific child labor laws in place to protect the well-being of minors in the workforce.

Laws affecting minors who are 14 and 15 years old:

- On a school day, they can work up to three hours

- During a school week, they can work up to 18 hours

- On a non-school day, they can work up to eight hours

- During a non-school week, they can work up to 40 hours

- Work hours cannot begin before 7 a.m. except from June 1 through Labor Day when it's extended to 9 p.m.

16-year-old minors who haven't graduated from high school can't work before 5 a.m. or after 11 p.m. on a school night.

17-year-old minors who haven't graduated from high school can't work before 5 a.m. or after midnight on a school night.

All minors must be given at least a 30-minute meal period for every five hours worked. Minors must have an eight-hour rest break at the end of a workday before starting another workday.

Anti-Discrimination and Fair Employment Practices in Louisiana The Louisiana Commission on Human Rights (LCHR) plays a pivotal role in upholding anti-discrimination and fair employment practices in the state of Louisiana.

The LCHR follows distinct procedures for intake, investigation, mediation and determination to process official complaints of discrimination.

Under the LCHR employees are protected against discrimination based on several characteristics, including:

- Race

- Color

- National origin

- Religion

- Sex

- Disability

- Age

- Sickle cell trait

- Pregnancy, childbirth and related medical conditions

If you feel you’ve been discriminated against based on any of the listed categories, you can file a complaint on the LCHR Employment Discrimination official website.

Independent Contractor Classification in Louisiana

In Louisiana, the nature of the work and the relationship between the worker and the employer play a crucial role in making this determination.

Here are the key factors to consider:

- Selection and engagement of a worker: Independent contractors are typically hired for specific projects or on a temporary basis. If the work arrangement has a defined start and end, it leans towards an independent contractor relationship.

- Payment of wages and benefits: Independent contractors are often paid per project completion or on a commission basis.

- Power of dismissal: Once an independent contractor has agreed to a job, they are not typically terminated at will.

- Power of control: Independent contractors often have more flexibility in determining when and how they complete their work. They commonly use their own tools and supplies and may have minimal supervision.

No single factor is determinative in classifying someone as an employee or an independent contractor.

Instead, all these factors must be considered collectively. The critical question is where the control in the work relationship rests: with the employer or the worker.

Termination and Final Paycheck Laws in Louisiana

Louisiana's Wage Payment Act governs termination and final paycheck laws within the state. Here are the key details that employers and employees should be aware of:

- Payment upon termination: Louisiana employers are legally obligated to provide employees with all wages due when their employment is terminated. This includes any accrued vacation pay, provided the employer offers paid vacation and there's a policy in place for it.

- Timing of payment: According to the Act, all wages owed to an employee must be paid on or before the next regular payday or within 15 days following the date of discharge or resignation, depending on which occurs first.

- Accrued vacation pay: The Act defines accrued vacation pay as a "wage," and it must be disbursed when an employee's employment is terminated. Employers are not mandated to offer paid vacation, but if they do, they are required to pay all accrued, unused vacation pay upon termination.

Employers found in violation of the Louisiana Wage Payment Act may face penalties.

An employer may be liable to the employee for either 90 days' wages at the employee's daily rate of pay or full wages from the time the employee requests payment until the employer fulfills the unpaid wage obligations.

This comes into effect when the employee makes a demand for unpaid wages, and this demand can be oral in person or over the phone.

Summary

Louisiana adheres to the federal minimum wage of $7.25 per hour, with exemptions and a tip credit system for certain employees.

Overtime is regulated following the Fair Labor Standards Act. Moreover, employees working five hours or more are entitled to a 30-minute meal break, while rest breaks are encouraged but not mandatory.

Louisiana follows the federal Family and Medical Leave Act, and the state provides additional leave rights.

Workplace safety adheres to federal Occupational Safety and Health Act regulations, while anti-discrimination laws are enforced by the Louisiana Commission on Human Rights.

The classification of independent contractors versus employees is determined by various factors, and the Wage Payment Act governs termination and final paycheck laws, with penalties for violations.

FAQs About Louisiana Labor Laws

For more info, find frequently asked questions about the labor laws in Louisiana below.

Is working 32 hours a week considered full-time in Louisiana?

To be considered full-time in Louisiana, an employee should work a minimum of 30 hours per week. So, yes, working 32 hours per week would be full-time employment.

Can an employee refuse to take a break in Louisiana?

In Louisiana, employees have the right to refuse to take breaks, as state labor laws do not mandate specific break requirements for adult employees.

Can you work 16 hours a day in Louisiana?

In Louisiana, there are no specific limits on the number of hours that employees can work in a day or a week. The state does not have regulations that restrict the hours of work for employees who are 16 years of age or older.

Is it illegal to discuss wages in Louisiana?

In Louisiana, employees have the right to inquire about, disclose, compare and engage in discussions about their wages with their coworkers.

Does Louisiana require PTO payout?

In Louisiana, when an employee is terminated, they are entitled to receive compensation for any vacation days they have accrued but have not yet taken.

Unused vacation pay could potentially be denied if the termination was deemed to be for a valid or "good" reason.

Disclaimer: This information serves as a concise summary and educational reference for Louisiana state labor laws. It does not constitute legal advice. For personalized legal guidance, it is recommended to consult with an attorney.