Kansas Labor Law Guide

A comprehensive guide to Kansas labor laws: Covering key topics, including minimum wage regulations, overtime provisions, mandated breaks, hiring and termination procedures and other miscellaneous employment laws.

Key Takeaways

- Kansas sets the minimum wage for regular employees at $7.25 per hour, aligning with the federal minimum wage.

- Tipped employees in Kansas have a minimum wage of $2.13 per hour, with employers responsible for making up the difference if the employee's total earnings, including tips, do not meet the standard minimum wage.

- Kansas state law mandates overtime pay after 46 hours of work within a week, while federal law requires it after 40 hours within a week.

- The state does not have laws mandating breaks but allows employers to schedule breaks to enhance employee morale and productivity.

- Kansas employers follow the federal Family and Medical Leave Act (FMLA), granting eligible employees up to 12 work weeks of unpaid leave for various family and medical reasons.

- Working hours for children depend on their age and whether the employer is covered by the Fair Labor Standards Act.

- The state follows federal Occupational Safety and Health Administration (OSHA) regulations.

- The Kansas Act Against Discrimination (KAAD) prohibits employment discrimination based on factors such as race, color, religion, sex, national origin, disability, age and more.

- Kansas follows the "employment at will" doctrine, allowing employers and employees to terminate employment at any time and for non-discriminatory reasons.

- Final paychecks must be provided promptly upon termination or resignation.

Minimum Wage Regulations in Kansas

The minimum wage regulations in Kansas uphold equitable compensation, promoting economic stability for workers across the state. These rules establish specific minimum hourly rates for both regular and tipped employees.

| State/District | Minimum wage |

| Alabama | $7.25 |

| Alaska | $11.73 |

| Arizona | $14.35 |

| Arkansas | $11 |

| California | $16 |

| Colorado | $14.42 |

| Connecticut | $15.69 |

| Delaware | $13.25 |

| Florida | $13 |

| Georgia | $7.25 |

| Hawaii | $14 |

| Idaho | $7.25 |

| Illinois | $14 |

| Indiana | $7.25 |

| Iowa | $7.25 |

| Kansas | $7.25 |

| Kentucky | $7.25 |

| Louisiana | $7.25 |

| Maine | $14.15 |

| Maryland | $15 |

| Massachusetts | $15 |

| Michigan | $10.33 |

| Minnesota | $10.85 |

| Mississippi | $7.25 |

| Missouri | $12.3 |

| Montana | $10.3 |

| Nebraska | $12 |

| Nevada | $12 |

| New Hampshire | $7.25 |

| New Jersey | $15.13 |

| New Mexico | $12 |

| New York | $15 |

| North Carolina | $7.25 |

| North Dakota | $7.25 |

| Ohio | $10.45 |

| Oklahoma | $7.25 |

| Oregon | $14.2 |

| Pennsylvania | $7.25 |

| Rhode Island | $14 |

| South Carolina | $7.25 |

| South Dakota | $11.2 |

| Tennessee | $7.25 |

| Texas | $7.25 |

| Utah | $7.25 |

| Vermont | $13.67 |

| Virginia | $12 |

| Washington | $16.28 |

| West Virginia | $8.75 |

| Wisconsin | $7.25 |

| Wyoming | $7.25 |

| District of Columbia | $16.5 |

[Source: FRED]

Regular Employees

In Kansas, the minimum wage for regular employees is $7.25 per hour, which aligns with the federal minimum wage.

Tipped Employees

The minimum wage for tipped employees in Kansas is $2.13 per hour.

If a tipped employee's total earnings, including tips, do not add up to at least the standard minimum wage of $7.25 per hour, the employer is responsible for making up the difference to ensure that the employee earns at least the standard minimum wage.

Kansas labor laws allow tip pooling, which is the practice of sharing tips among employees. It is allowed under certain conditions, and only among employees who customarily and regularly receive tips.

This includes positions like waiters and waitresses, bellhops, counter personnel serving customers, bussers and service bartenders. Dishwashers, cooks, chefs and janitors, who do not typically receive tips, cannot be included in a tip pool.

Overtime Rules and Regulations in Kansas

The rules and regulations governing overtime play a vital role in safeguarding workers' rights and guaranteeing just compensation for additional hours put in.

In Kansas, state law dictates that overtime pay is required once an employee has worked 46 hours within a week. Federal law, on the other hand, mandates overtime pay once an employee has worked 40 hours within a week.

Whether state or federal overtime requirements apply depends on the nature of the business. Key factors include the amount of annual revenue and the extent of interstate commerce conducted by the business.

Whether salaried employees in Kansas are entitled to overtime pay depends on their classification as exempt or nonexempt.

Nonexempt Employees

Nonexempt salaried employees are entitled to overtime pay if they work more than the prescribed hours. They must receive overtime compensation at a rate that is at least 1.5 times their standard pay rate.

Exempt Employees

Exempt employees are not entitled to receive overtime pay, and they must be paid a predetermined, fixed amount of compensation that remains consistent regardless of the quantity or quality of work they perform. Exemptions include:

- Executive exemption: Encompasses duties related to managing the business or a recognized department or subdivision of the business.

- Administrative exemption: This exemption necessitates that the primary duty of the position involves office or non-manual work related to the general business or management of the employer or the employer's customers.

- Professional exemption: This exemption applies to employees whose work requires advanced knowledge, discretion and creativity. Examples include doctors, lawyers, scientists, engineers and creative professionals like artists and writers.

- Computer employee exemption: Simply working with computers is not sufficient for qualification. A combination of criteria is considered to determine if an employee meets the requirements for this exemption. Typically, help desk technicians do not qualify for this exemption.

- Outside sales exemption: This exemption covers employees whose primary responsibilities involve sales activities conducted outside the employer's place of business.

The salary for exempt employees must be at least $684 per week.

Break Periods in Kansas

In Kansas, breaks are not mandated by state or federal law. While there is no legal requirement for employers to provide breaks, many employers choose to schedule breaks to enhance employee morale and productivity.

The decision to offer breaks is often driven by the employer's policies and the specific needs of the workplace.

Family and Medical Leave Laws in Kansas

In Kansas, employers are subject to the federal Family and Medical Leave Act (FMLA), which grants eligible employees the right to take unpaid leave with the assurance of reinstatement for specific family and medical reasons. Unlike some states, Kansas does not have its own separate family and medical leave laws. Under the FMLA, eligible employees have the following entitlements:

- Up to 12 work weeks: Eligible employees can take up to 12 work weeks of unpaid leave during a consecutive 12-month period for various reasons, including the birth of their child, the placement of a child for adoption or foster care, dealing with a qualifying serious health condition of the employee or caring for the serious health condition of their child, spouse or parent.

- Up to 26 weeks: In specific circumstances, the FMLA provides up to 26 work weeks of unpaid leave for military qualifying exigencies and for taking care of injured or ill service members.

Child Labor Laws

Child labor laws in Kansas are designed to safeguard the education and well-being of minors, providing clear guidelines on work permits, working hours and the maximum number of hours children can work.

Work Permits

Work permits are mandatory for children under the age of 16 who are not enrolled in or attending secondary school. This requirement ensures that young workers can engage in employment while still meeting their educational obligations.

Working Hours

Working hours for children in Kansas are contingent on the child's age and whether the employer is covered by the Fair Labor Standards Act (FLSA).

The table below shows working hours for children under 16.

*Labor Day is celebrated on the first Monday in September.

For employers not covered by the FLSA, working hours for children under 16 are between 7 a.m. to 10 p.m. when school is in session. However, most employers are covered by the FLSA.

Maximum Number of Hours Children Can Work

The maximum hours children can work depend on their age. Children under 16 can work up to:

- three hours on a school day

- 18 hours in a school week

- 8 hours on a non-school day

- 40 hours on a non-school week.

In cases where the employer is not covered by the FLSA, children under 16 may not work more than eight hours in one day or more than 40 hours in one week.

Workplace Safety and Health Regulations in Kansas

In Kansas, workplace safety and health are overseen by the Industrial Safety and Health Division (ISH) of the Kansas Department of Labor.

The primary responsibilities of the ISH division include the identification and mitigation of safety hazards.

They work diligently to promote programs aimed at helping Kansas workers avoid on-the-job injuries and ensuring the provision of a secure working environment.

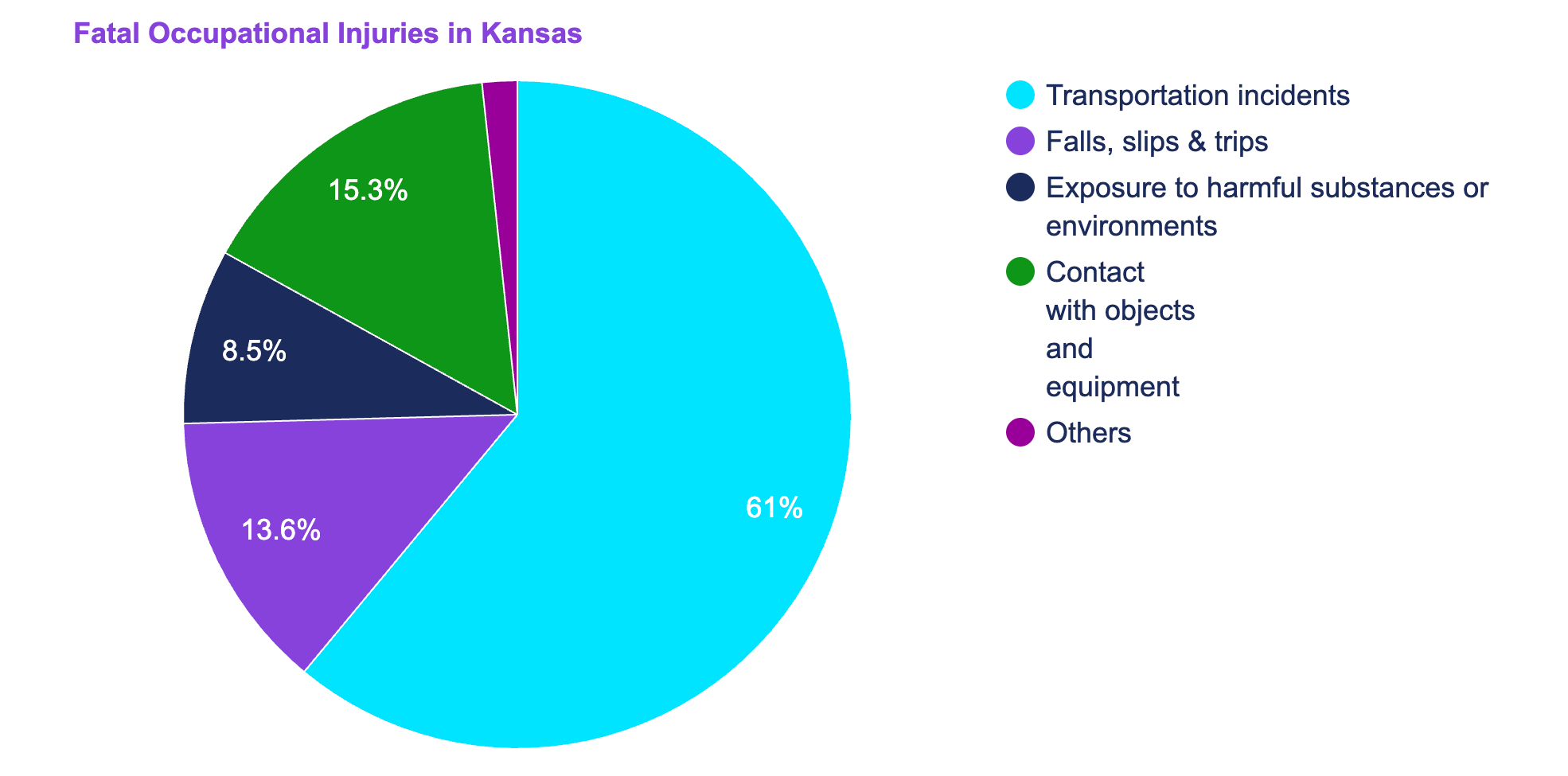

[Source: U.S. Bureau of Labor Statistics]

There were 63 fatal occupational injuries in Kansas in 2021, which is about 14% higher compared to 55 in 2020.

| State/District | No. of Fatal Work Injuries |

| Alabama | 111 |

| Alaska | 20 |

| Arizona | 67 |

| Arkansas | 74 |

| California | 462 |

| Colorado | 96 |

| Connecticut | 23 |

| Delaware | 13 |

| Florida | 315 |

| Georgia | 187 |

| Hawaii | 15 |

| Idaho | 30 |

| Illinois | 176 |

| Indiana | 157 |

| Iowa | 49 |

| Kansas | 63 |

| Kentucky | 97 |

| Louisiana | 141 |

| Maine | 19 |

| Maryland | 80 |

| Massachusetts | 97 |

| Michigan | 140 |

| Minnesota | 80 |

| Mississippi | 41 |

| Missouri | 147 |

| Montana | 40 |

| Nebraska | 39 |

| Nevada | 43 |

| New Hampshire | 21 |

| New Jersey | 110 |

| New Mexico | 53 |

| New York | 247 |

| North Carolina | 179 |

| North Dakota | 34 |

| Ohio | 171 |

| Oklahoma | 86 |

| Oregon | 66 |

| Pennsylvania | 162 |

| Rhode Island | 5 |

| South Carolina | 107 |

| South Dakota | 20 |

| Tennessee | 132 |

| Texas | 533 |

| Utah | 52 |

| Vermont | 10 |

| Virginia | 125 |

| Washington | 73 |

| West Virginia | 36 |

| Wisconsin | 105 |

| Wyoming | 27 |

| District of Columbia | 12 |

[Source: U.S. Bureau of Labor Statistics]

In total, the number of fatal injuries in Kansas is 38% lower than the average number of fatal injuries in all states at 102 fatal work injuries.

Unlike some states, Kansas does not have its own independent occupational health and safety regulatory program. The state adheres to the federal Occupational Safety and Health Administration (OSHA) regulations.

Key aspects of federal OSHA regulations include:

- Workplace safety standards: These standards cover areas such as fall protection, hazardous materials handling, machine guarding and personal protective equipment.

- Training and education: OSHA mandates that employers provide appropriate training and education to employees to ensure they understand the hazards in their workplace and how to protect themselves.

- Recordkeeping and reporting: Employers are required to maintain records of workplace injuries and illnesses and report severe incidents to OSHA. This information helps OSHA identify trends and prioritize inspections.

- Inspections and enforcement: OSHA conducts inspections to assess compliance with regulations. Non-compliance can result in citations, fines and the requirement to correct safety issues promptly.

- Whistleblower protection: Federal OSHA regulations protect employees who report safety violations or concerns from retaliation by their employers.

- Specific industry standards: OSHA regulations often include specific standards for particular industries, such as construction, healthcare or manufacturing, to address sector-specific hazards.

Anti-Discrimination and Fair Employment Practices in Kansas

Kansas Act Against Discrimination (KAAD) is the primary anti-discrimination law in Kansas. It prohibits discrimination in employment based on factors such as:

- Race

- Color

- Religion

- Sex

- National origin

- Ancestry

- Disability

- Age

Kansas law also includes provisions to protect employees from retaliation when they assert their rights under anti-discrimination laws. This encourages employees to report discriminatory practices without fear of negative consequences.

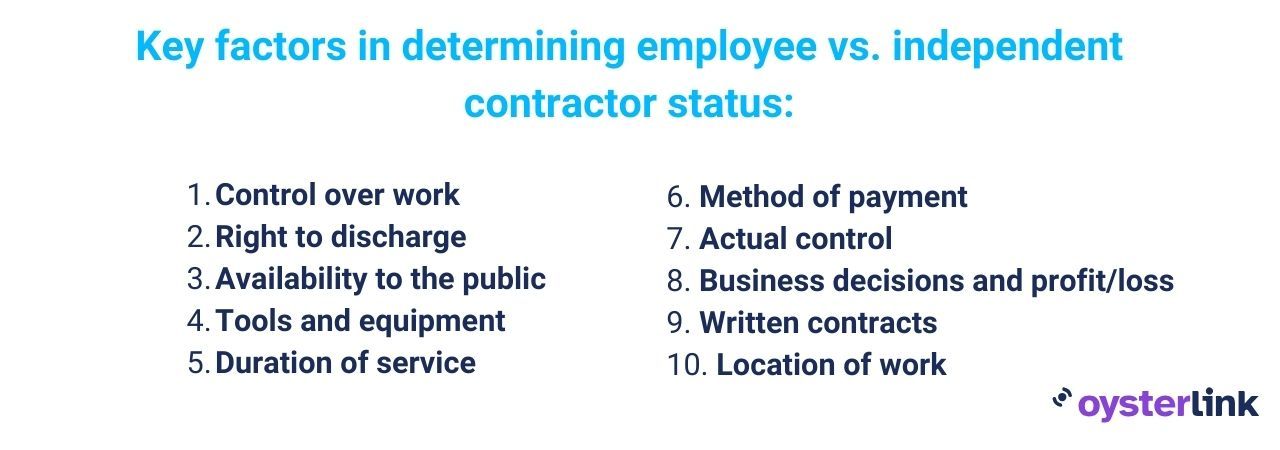

Independent Contractor Classification in Kansas

Determining whether an individual should be classified as an independent contractor or an employee is crucial for businesses in Kansas. The classification can have significant legal and financial implications for both the employer and the worker.

In Kansas, as in many states, the key factors considered in this determination are outlined as follows:

- Control over work: An essential factor in deciding whether someone is an employee or an independent contractor is the level of control the employer has over how the work is performed. If the employer has the right to dictate the manner and means by which the individual carries out their tasks, it generally indicates an employer-employee relationship.

- Right to discharge: The right to discharge a worker at will and without cause is considered strong evidence of control. So, if the right to discharge is vested solely in the hands of the employer, it underscores the level of authority they hold over the working relationship.

- Availability to the public: If the person providing services makes their services available to the general public or multiple clients, it suggests an independent contractor arrangement. In contrast, if the work is exclusively performed for one entity, it leans towards an employer-employee relationship.

- Tools and equipment: The party responsible for supplying the necessary tools, equipment, and workspace can be a determining factor. Independent contractors often use their tools and workspace, while employees may rely on the employer's resources.

- Duration of service: The length of time for which services are provided can indicate the nature of the relationship. Continuous, ongoing work suggests an employment relationship, while short-term or isolated services may align more with independent contracting.

- Method of payment: How the worker is compensated, whether by time, piece rate or job, can be telling. Independent contractors are often paid for the result of their work, while employees typically receive regular wages.

- Actual control: The extent of control exercised by the principal or employer over the worker's methods and means of performing the services plays a significant role in the classification.

- Business decisions and profit/loss: Independent contractors are often expected to make business decisions that impact their profitability or financial risk. A simple investment of time is insufficient to demonstrate a potential financial loss.

- Written contracts: Having a written contract that designates the worker as an independent contractor is not determinative if the actual practice between the parties suggests that the employer retains control under common law principles.

- Location of work: If the work is performed at the employer's place of business, it could indicate an employment relationship. Independent contractors typically have the flexibility to choose where they work.

Termination and Final Paychecks in Kansas

Kansas operates under the doctrine of "employment at will." This means that in most situations, both employers and employees have the freedom to terminate the employment relationship at any time and for any reason that is not discriminatory or retaliatory.

However, there are exceptions to this doctrine that provide certain protections to employees. Employers cannot terminate employees for discriminatory reasons, such as those related to race, gender, age, disability, religion or other protected characteristics.

Additionally, retaliation against employees who report violations of labor laws or engage in protected activities is prohibited.

Whenever an employer discharges an employee or when an employee decides to quit or resign, the employer is obligated to provide the employee's earned wages. This payment must be made not later than the next regular payday on which the employee would have received their wages if still employed.

When navigating Kansas labor laws and termination procedures, make sure you're equipped with financial clarity. Our Paycheck Calculator allows you to estimate your earnings after accounting for taxes and deductions, tailored to your state's tax laws.

Summary of Kansas Labor Laws

Regular employees in Kansas are entitled to a minimum wage of $7.25 per hour, aligning with the federal minimum. Tipped employees, on the other hand, receive a minimum of $2.13 per hour, with employers required to bridge the gap if tips fall short of the standard minimum wage.

Overtime pay kicks in after 46 hours in a week according to state law, while federal regulations mandate it after 40 hours. Exempt employees, meeting specific criteria, are not eligible for overtime pay.

Kansas labor laws do not enforce mandatory breaks, although many employers offer them voluntarily.

The Family and Medical Leave Act (FMLA) provides employees with unpaid leave rights for various reasons, while workplace safety in Kansas adheres to federal OSHA regulations.

Kansas operates under the doctrine of employment at will, allowing employers and employees to terminate employment at any time, with certain exceptions.

Frequently Asked Questions About Kansas Labor Laws

How many hours can you work in Kansas?

In Kansas, the maximum number of working hours depends on your age. If you are under 16, you are restricted to working no more than three hours on a school day and eight hours on a non-school day.

However, individuals aged 16 and older theoretically have no specific daily hour limits.

How many hours is full-time in Kansas?

The definition of full-time employment in Kansas typically varies between employers, but it often involves working around 40 hours per week.

Are lunch breaks required in Kansas?

Neither state nor federal laws mandate the provision of breaks. Nonetheless, many employers choose to schedule breaks to boost employee morale and productivity.

Is it illegal to talk about wages in Kansas?

it is generally not illegal to discuss wages with colleagues, and many employers respect the right of employees to have such discussions. However, it's essential to be aware of potential exceptions in employment contracts or policies.

Is Kansas a right-to-work state?

Yes, Kansas is a right-to-work state. This means that employees are not required to join or financially support a union as a condition of their employment, and unions cannot compel individuals to become union members or pay union dues.

Disclaimer: This information serves as a concise summary and educational reference for Kansas state labor laws. It does not constitute legal advice. For personalized legal guidance, it is recommended to consult with an attorney.