Iowa Labor Law Guide

A comprehensive guide to Iowa labor laws: Covering key topics, including minimum wage regulations, overtime provisions, mandated breaks, hiring and termination procedures and other miscellaneous employment laws.

Key Takeaways of Iowa Labor Laws

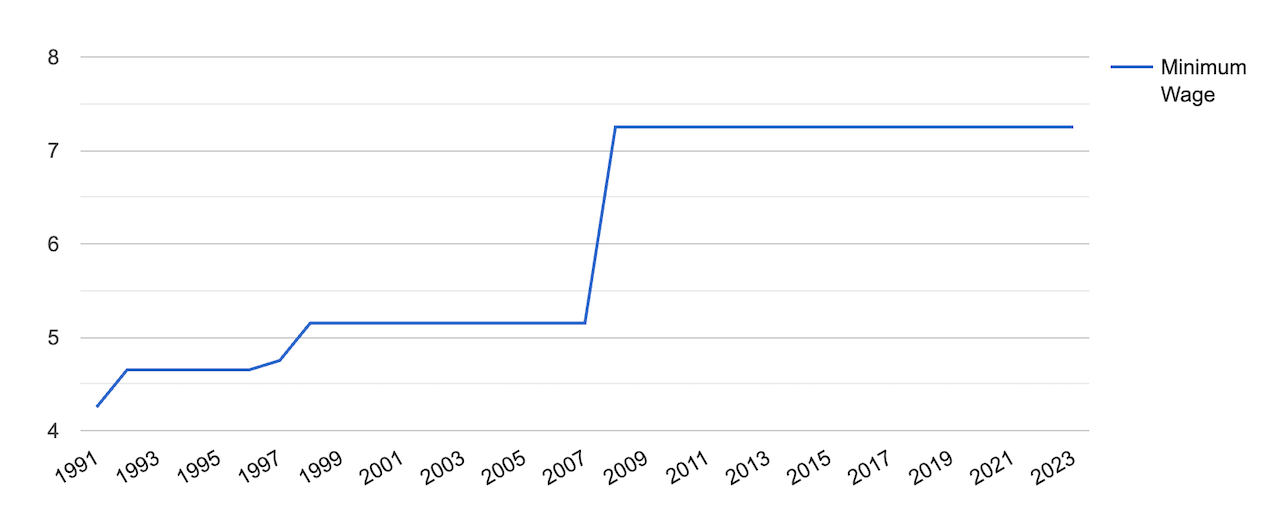

- Iowa’s minimum wage has been $7.25 per hour since 2008.

- Employers in Iowa do not have to provide paid breaks to employees.

- Eligible employees in Iowa should be 1.5 times their regular pay (time and a half) for overtime pay at a minimum of $10.88 per hour for work hours exceeding 40 in 1 workweek.

- Iowa is an at-will employment state, and employers and employees could terminate a working relationship without cause.

- Iowa is a right-to-work state.

Minimum Wage Regulations in Iowa

Similar to the federal minimum wage, Iowa’s minimum wage is $7.25 per hour. The state minimum wage is not indexed for inflation, making Iowa one of 16 states that adhere to the federal minimum wage rate.

| State/District | Minimum wage |

| Alabama | $7.25 |

| Alaska | $11.73 |

| Arizona | $14.35 |

| Arkansas | $11 |

| California | $16 |

| Colorado | $14.42 |

| Connecticut | $15.69 |

| Delaware | $13.25 |

| Florida | $13 |

| Georgia | $7.25 |

| Hawaii | $14 |

| Idaho | $7.25 |

| Illinois | $14 |

| Indiana | $7.25 |

| Iowa | $7.25 |

| Kansas | $7.25 |

| Kentucky | $7.25 |

| Louisiana | $7.25 |

| Maine | $14.15 |

| Maryland | $15 |

| Massachusetts | $15 |

| Michigan | $10.33 |

| Minnesota | $10.85 |

| Mississippi | $7.25 |

| Missouri | $12.3 |

| Montana | $10.3 |

| Nebraska | $12 |

| Nevada | $12 |

| New Hampshire | $7.25 |

| New Jersey | $15.13 |

| New Mexico | $12 |

| New York | $15 |

| North Carolina | $7.25 |

| North Dakota | $7.25 |

| Ohio | $10.45 |

| Oklahoma | $7.25 |

| Oregon | $14.2 |

| Pennsylvania | $7.25 |

| Rhode Island | $14 |

| South Carolina | $7.25 |

| South Dakota | $11.2 |

| Tennessee | $7.25 |

| Texas | $7.25 |

| Utah | $7.25 |

| Vermont | $13.67 |

| Virginia | $12 |

| Washington | $16.28 |

| West Virginia | $8.75 |

| Wisconsin | $7.25 |

| Wyoming | $7.25 |

| District of Columbia | $16.5 |

[Source: FRED]

Keep in mind that some counties and municipalities can have their own minimum wage. For example, the Johnson County’s minimum wage is $12.25 per hour.

Regular Employees

Eligible regular employees are entitled to the state minimum wage of $7.25 per hour. Iowa’s minimum wage will match the federal minimum wage rate if it is set lower than the federal rate.

[Source: FRED]

Iowa has maintained a minimum wage of $7.25 since 2008 after staying at $5.15 from 1998 to 2007.

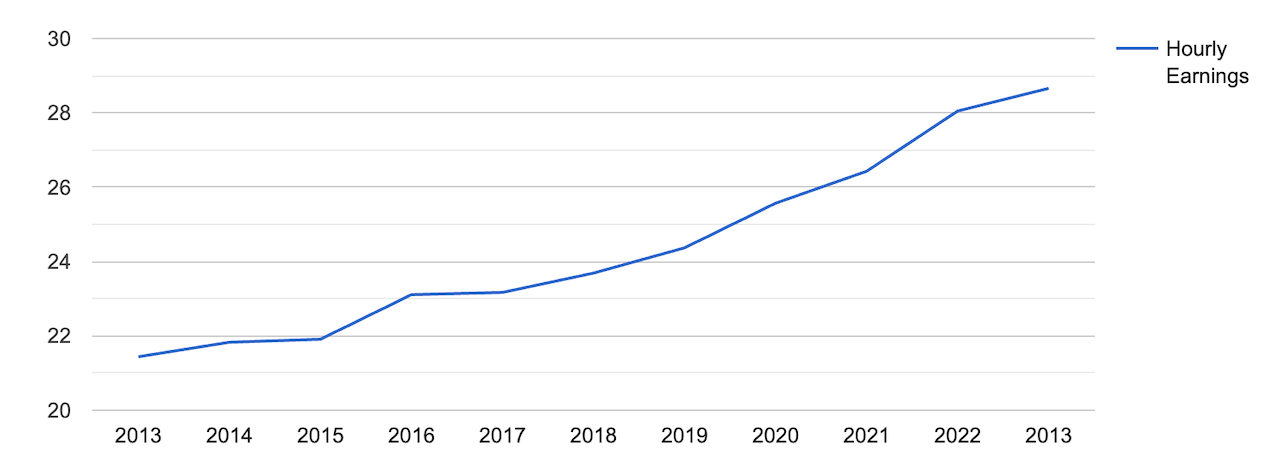

Notably, even though Iowa’s minimum wage has remained stagnant, the average hourly earnings of employees in the state have steadily increased, reaching $28.66 per hour.

[Source: FRED]

Tipped Employees

Tipped employees are entitled to receive a minimum cash wage of $4.35 with a maximum tip credit of $2.90. The tip credit cannot exceed 40% of the minimum wage.

State Income Tax Rates in Iowa

The income tax rates in Iowa, as of 2023, range from 4.40% to 6.00%, depending on the income tax bracket you belong to.

This is part of the state’s plan to eventually have a flat individual income tax rate of 3.9% by 2026.

Check the table below for Iowa’s income tax rates. Keep in mind that the brackets double for married couples filing jointly.

[Source: Iowa Department of Revenue]

Both regular and tipped employees can calculate their earnings faster, factoring in taxes and deductions, with OysterLink’s Paycheck Calculator.

Overtime Rules and Regulations in Iowa

Iowa’s overtime regulations align with the Fair Labor Standards Act (FLSA), which mandates that employees receive overtime pay at a rate of 1.5 times their regular hourly wage for work exceeding 40 hours in a single workweek.

Nonexempt Employees

Nonexempt employees in Iowa are entitled to receive time and a half for their overtime pay, or 1.5 times their regular hourly rate, at a minimum of $10.88 per hour.

To check your overtime earnings, check out our time and a half calculator.

Exempt Employees

Iowa follows the federal FLSA in its classification of exempt employees from overtime pay, with the following exemptions:

- Executives, administrators and other professionals making a minimum of $684 per week

- Independent contractors

- Transportation employees

- External salespersons

- Workers in computer-related roles

- Specific agricultural and farm laborers

- Live-in staff such as housekeepers

Iowa revised its overtime pay rules in 2016, as explained here by the Iowa Department of Administrative Services.

At-Will Employment in Iowa

Iowa is an at-will state, which means either the employer or employee can end their working relationship without cause.

Exceptions include situations where a contract that details the employment duration and circumstances under which termination can occur is at place.

This is permitted as long as the termination does not appear to be rooted in discrimination or any other reason that infringes upon the employee’s rights (e.g., public policy).

Right-To-Work Laws in Iowa

Iowa is a right-to-work state, which means that workers have the option to refrain from joining unions or paying union fees, all while enjoying the advantages of unions being present in their workplace.

Iowa’s union membership rate is higher than the national average at 10.1%.

Rest and Meal Breaks in Iowa

Iowa labor laws do not mandate employers to provide either rest or meal breaks.

According to federal law, employees should be compensated for short breaks not exceeding 20 minutes, as this time is typically considered part of their workday.

Employers are not mandated to provide compensation for “bona fide” breaks, which are breaks during which employees are fully relieved of all work duties and typically last at least 30 minutes.

Keep in mind that private employers can have more generous policies in place, which can be discussed during interviews in the hiring process.

Family and Medical Leave Laws in Iowa

Employees in Iowa are protected by the Family and Medical Leave Act (FMLA), which is administered by the Department of Administrative Services’ Human Resource Enterprise.

Family and Medical Leave Act

The FMLA entitles eligible employees in Iowa to take leaves for family, medical, and military reasons.

You must meet the following requirements to qualify for the FMLA leave:

- Worked for the employer for 12 months

- Worked in general for at least 1,250 hours in the previous year

- Work for an employer with a minimum of 50 employees within 75 miles

Other Leave Laws

Here are the conditions for other types of leaves under Iowa labor laws:

- Jury duty: Employers should allow time off to their employees to serve on a jury. They are not required to provide paid time off.

- Voting: Employers should make sure that employees have a minimum of three consecutive hours, which, when combined with non-working time, covers the period when polls are open. Employees are required to submit a written leave request in advance of the voting day.

- Donor: State employees are eligible for paid leave, with up to five days for bone marrow donation, up to 30 days for organ donation and two hours for blood donation.

- Bereavement: Iowa does not mandate employers to provide bereavement leave.

Workplace Safety and Health Regulations in Iowa

The Iowa Occupational Safety and Health Administration has adopted all standards of the Occupational Safety and Health Administration (OSHA), with some state-specific standards for hazardous chemical risks and sanitation and shelter rules specifically for railroad workers.

The Iowa State Plan applies to state and local government employers, as well as most private employers, with some exemptions. It does not apply to federal government employers.

The Iowa OSHA enforces all safety and health standards in the state. Check out the Iowa State Plan for their coverage.

A total of 49 fatal occupational injuries in Iowa were recorded in 2021—25 of which were caused by transportation incidents, accounting for 51% of all fatal work injuries in the state.

| State/District | No. of Fatal Work Injuries |

| Alabama | 111 |

| Alaska | 20 |

| Arizona | 67 |

| Arkansas | 74 |

| California | 462 |

| Colorado | 96 |

| Connecticut | 23 |

| Delaware | 13 |

| Florida | 315 |

| Georgia | 187 |

| Hawaii | 15 |

| Idaho | 30 |

| Illinois | 176 |

| Indiana | 157 |

| Iowa | 49 |

| Kansas | 63 |

| Kentucky | 97 |

| Louisiana | 141 |

| Maine | 19 |

| Maryland | 80 |

| Massachusetts | 97 |

| Michigan | 140 |

| Minnesota | 80 |

| Mississippi | 41 |

| Missouri | 147 |

| Montana | 40 |

| Nebraska | 39 |

| Nevada | 43 |

| New Hampshire | 21 |

| New Jersey | 110 |

| New Mexico | 53 |

| New York | 247 |

| North Carolina | 179 |

| North Dakota | 34 |

| Ohio | 171 |

| Oklahoma | 86 |

| Oregon | 66 |

| Pennsylvania | 162 |

| Rhode Island | 5 |

| South Carolina | 107 |

| South Dakota | 20 |

| Tennessee | 132 |

| Texas | 533 |

| Utah | 52 |

| Vermont | 10 |

| Virginia | 125 |

| Washington | 73 |

| West Virginia | 36 |

| Wisconsin | 105 |

| Wyoming | 27 |

| District of Columbia | 12 |

[Source: U.S. Bureau of Labor Statistics]

The number of fatal injuries in Iowa (49) is approximately 51% lower than the national average (102).

Child Labor Laws in Iowa

The minimum age of employment in Iowa is 14, with minors aged 14 and 15 requiring a work permit prior to employment for most jobs.

Minors aged 10–15 should also have street trade permits for street occupations such as newspaper delivery.

Additionally, minors between the ages of 12 and 16 engaged in migrant labor should obtain a work permit.

Working Hours

14–15-year-olds may work:

- Outside school hours

- Between 7:00 a.m. and 7:00 p.m. after Labor Day through May 31

- Between 7:00 a.m. and 9:00 p.m. from June 1 to Labor Day

- Up to 4 hours a day on school days (maximum 28 hours a week during a school week)

- Up to 8 hours a day during vacations, weekends and holidays (maximum 40 hours a week during the summer, June 1 through Labor Day, or during the school year if there is a full week of vacation)

10–15-year-olds in street occupations may work:

- 4:00 a.m. – 7:30 p.m. while school is in session

- 4:00 a.m. – 8:30 p.m. for the rest of the year

12–16-year-olds performing migrant labor may work:

- 5:00 a.m. – 7:30 p.m. from Labor Day to June 1

- 5:00 a.m. – 9:00 p.m. for the rest of the year

16-year-olds and older are generally unrestricted in their working hours, with the exception of roles involving the transmission, distribution or delivery of goods and messages.

Rest or Meal Breaks for Minors

Minors younger than 16 should be provided a 30-minute break if their shift is five hours or longer.

Work Occupations for Minors

Minors aged 16 may work in:

- Manufacturing and construction with restrictions

- Insurance and real estate

- Retail stores

- Hotels and motels

- Restaurants

- Local government

- Retail lumberyards

- Garages and auto repair shops

- Service/gas stations

- Hospitals and nursing homes

- Greenhouses and nurseries

- Printing and publishing firms

Minors aged 14 or older may work in:

- Packing fresh fruits or vegetables (retail or agricultural, not processing)

- Answering phones and taking messages in a telephone answering service

- Caddying on a golf course

- Selling gas and oil, washing and polishing cars at service stations with restrictions

- Office work and clerical work

- Maintaining grounds with restrictions

In retail stores and businesses, minors aged 14 and older may:

- Run errands or make deliveries

- Sell, price, pack and shelve store goods

- Assemble customer orders

- Bag purchases and carry out for customers

- Clean vegetables and fruits

- Perform cleanup work without certain chemicals or personal protective equipment

- Trim windows and create displays without ladders

In food service firms, minors aged 14 and older may:

- Serve food at lunch counters

- Wash dishes

- Do cleanup work without certain chemicals or personal protective equipment

For minors under 16 working as models, specific hours and parental consent rules apply.

Minors aged 14 and 15 are restricted from working in:

- Hazardous occupations in manufacturing, construction and mining

- Most processing occupations

- As public messengers

- Cleaning, repairing or operating power-driven machinery

Antidiscrimination Laws in Iowa

The Iowa Department of Human Services aims to provide equal treatment in employment that does not discriminate against age, color, disability, gender identity, national origin, race, religion, sex, sexual orientation or veteran status.

You can file a complaint with the Iowa Department of Human Services, Office of Human Resources, by 300 days from the date of the alleged discriminatory incident.

Immigration Verification

Iowa private employers should refer to the federal employment verification rules. Keep in mind that the state does not require the use of the E-Verify system.

However, there is a pending bill that could change this requirement in the future.

Independent Contractor Classification in Iowa

Employers should be able to differentiate between employees and independent contractors to adhere to tax regulations and avoid potential violations.

At the same time, employees should know the difference to have a clear understanding of their rights and tax implications.

For starters, employees have taxes withheld from their paychecks, while independent contractors are responsible for self-employment taxes.

As an employee:

- Your employer covers 7.65% of your Social Security and Medicare taxes.

- Your employer pays unemployment taxes and may provide benefits if you lose your job.

- Your employer withholds income taxes and your share of Social Security and Medicare tax.

- You receive a W-2 form showing your income and tax withholdings by January 31 each year.

As an independent contractor:

- You are responsible for the full 15% of Social Security and Medicare taxes after deducting business expenses.

- Taxes are not withheld from payments made by businesses you work with.

- You may need to make estimated quarterly payments for income, Social Security and Medicare taxes.

Official Holidays in Iowa

Employers in Iowa are not required to provide time off, paid or unpaid, to employees for holiday leaves.

For a list of the official state holidays in Iowa, please take a look at the table below.

[Source: Iowa Department of Administrative Services]

Termination and Final Paychecks in Iowa

When an employee in Iowa is terminated or resigns, the employer must issue the final paycheck by the next scheduled pay date.

This final paycheck can be given via direct deposit, in person, by check or payroll card or by mail.

Summary of Iowa Labor Laws

Iowa’s minimum wage is $7.25 per hour, which aligns with the federal rate.

Moreover, Iowa follows an at-will employment doctrine, allowing both employers and employees to end their working relationship without cause or notice. Exceptions occur when the termination is based on discrimination or infringes on employees’ rights.

Keep in mind that employers in Iowa are not mandated to provide rest or meal breaks.

Lastly, the state requires an individual income tax rate ranging from 4.40% to 6.00%.

Frequently Asked Questions About Iowa Labor Laws

Explore answers to frequently asked questions regarding Iowa labor laws.

What is the legal working age in Iowa?

You need to be at least 14 years old to work in the state. A work permit is required for most jobs for minors aged 14 to 15, with limits on the hours and occupations they can work.

What is the tip law in Iowa?

In Iowa, employers can use a 40% tip credit, allowing them to pay tipped employees a minimum hourly wage of $4.35.

This is provided that the total earnings, including tips, meet the state’s minimum wage of $7.25.

How is overtime paid in Iowa?

Overtime pay is set at a rate of time and a half or 1.5 times the employee’s regular pay. This is for hours worked in 40 hours in 1 workweek.

What is considered wrongful termination in Iowa?

In Iowa, under the at-will employment doctrine, employers and employees can typically terminate the working relationship without providing notice or cause.

However, wrongful termination occurs when there is a clear violation of the employees’ rights or when the termination is based on discriminatory reasons.

Are employers required to provide holiday pay in Iowa?

No. Iowa labor laws do not require employers in the state to provide time off for holidays to their employees.

What are the average earnings of employees in Iowa?

The average hourly earnings of employees in Iowa is $28.66 per hour, as per FRED.

What is a livable salary in Iowa?

The livable salary for a single-person household in Iowa is at least $15.73 per hour based on a study by MIT.

Disclaimer: This information serves as a concise summary and educational reference for Iowa labor laws. It does not constitute legal advice. For personalized legal guidance, you can consult an attorney.