Idaho Labor Law Guide

A comprehensive guide to Idaho labor laws: Covering key topics, including minimum wage regulations, overtime provisions, mandated breaks, hiring and termination procedures and other miscellaneous employment laws.

Key Takeaways

- Idaho's minimum wage for regular employees is $7.25 per hour, matching the federal minimum wage.

- New hires under the age of 20 have a minimum wage of $4.25 per hour for the first 90 days of employment.

- Tipped employees in Idaho have a minimum wage of $3.35 per hour, with employers required to make up the difference if tips do not reach the regular minimum wage.

- Nonexempt employees in Idaho are entitled to overtime pay at 1.5 times their regular hourly wage for hours worked beyond 40 in a workweek.

- Exempt employees do not receive overtime pay and must meet specific criteria established by the U.S. Department of Labor.

- Idaho labor laws don’t mandate employers to provide breaks or meal periods. The provision of breaks is at the employer's discretion.

- Idaho complies with the federal Family and Medical Leave Act (FMLA), which provides eligible employees with up to 12 weeks of unpaid, job-protected leave for specific family and medical reasons.

- Minors in non-agricultural jobs must be at least 14 years old to work.

- Children under 16 can’t work for more than 54 hours in a week or more than nine hours in a day.

- Idaho law prohibits discrimination based on race, sex, color, national origin, religion, age (over 40) and mental or physical disability.

- Idaho is a "work-at-will" state, allowing either party to terminate employment without notice or reason.

- Final wages must be paid within the next scheduled payday or within 10 days of separation.

Minimum Wage Regulations in Idaho

Idaho's minimum wage regulations are designed to promote fair compensation and enhance economic stability for all employees in the state. These regulations specify minimum hourly rates for both regular and tipped workers.

| State/District | Minimum wage |

| Alabama | $7.25 |

| Alaska | $11.73 |

| Arizona | $14.35 |

| Arkansas | $11 |

| California | $16 |

| Colorado | $14.42 |

| Connecticut | $15.69 |

| Delaware | $13.25 |

| Florida | $13 |

| Georgia | $7.25 |

| Hawaii | $14 |

| Idaho | $7.25 |

| Illinois | $14 |

| Indiana | $7.25 |

| Iowa | $7.25 |

| Kansas | $7.25 |

| Kentucky | $7.25 |

| Louisiana | $7.25 |

| Maine | $14.15 |

| Maryland | $15 |

| Massachusetts | $15 |

| Michigan | $10.33 |

| Minnesota | $10.85 |

| Mississippi | $7.25 |

| Missouri | $12.3 |

| Montana | $10.3 |

| Nebraska | $12 |

| Nevada | $12 |

| New Hampshire | $7.25 |

| New Jersey | $15.13 |

| New Mexico | $12 |

| New York | $15 |

| North Carolina | $7.25 |

| North Dakota | $7.25 |

| Ohio | $10.45 |

| Oklahoma | $7.25 |

| Oregon | $14.2 |

| Pennsylvania | $7.25 |

| Rhode Island | $14 |

| South Carolina | $7.25 |

| South Dakota | $11.2 |

| Tennessee | $7.25 |

| Texas | $7.25 |

| Utah | $7.25 |

| Vermont | $13.67 |

| Virginia | $12 |

| Washington | $16.28 |

| West Virginia | $8.75 |

| Wisconsin | $7.25 |

| Wyoming | $7.25 |

| District of Columbia | $16.5 |

[Source: FRED]

Regular Employees

The minimum wage for regular employees in the state of Idaho is $7.25 per hour, the same as the federal minimum wage. This rate applies to individuals who are not receiving tips as a significant part of their compensation.

Idaho has a specific provision for new hires under the age of 20. For these individuals, the minimum wage is set at $4.25 per hour.

However, this rate only applies for the first 90 consecutive calendar days of employment. After this initial 90-day period, the employee must be paid the regular minimum wage, which is $7.25 per hour.

Tipped Employees

Tipped employees, who commonly work in the service industry, have a different minimum wage rate. In Idaho, the minimum wage for tipped employees is $3.35 per hour.

This wage assumes that the employee will earn the remaining portion of their compensation through tips.

If, however, their tips do not reach or exceed the regular minimum wage of $7.25 per hour when combined with their base wage, the employer is required to make up the difference.

Overtime Rules and Regulations in Idaho

Overtime regulations in Idaho are primarily governed by the federal Fair Labor Standards Act (FLSA). Under the FLSA, the principles regarding overtime apply to both nonexempt and exempt employees.

Nonexempt Employees

For nonexempt employees, overtime must be paid at a rate of 1.5 times their regular hourly wage for all hours worked beyond 40 hours in a workweek.

Each workweek is considered independently when calculating overtime. Averaging of hours over multiple workweeks is not allowed.

To illustrate, if an employee works 48 hours in the first week and 22 hours in the second week, they would be entitled to 40 hours of regular pay for the first week plus eight hours of overtime pay. In the second week, they would be paid their regular wage for the 22 hours worked.

Exempt Employees

Exempt employees are not eligible for overtime pay under the FLSA. To be classified as exempt, the employee's job duties and salary must meet specific criteria established by the U.S. Department of Labor.

Specific categories of employees who are exempt from receiving overtime pay, provided they earn a minimum of $684 per week include:

- Executives, professionals and administrative staff

- Outside salespersons

- Staff at recreation and seasonal amusement establishments

- Specific commissioned employees

- Casual babysitters

- Farm workers

- Taxi drivers

- Employees engaged in certain agricultural operations

- Employees of designated bulk petroleum distributors

- Employees without a high school diploma who are required to dedicate up to 10 hours in a workweek to remedial training

- Hospital and residential care staff

Break Periods in Idaho

Idaho labor laws don’t mandate employers to provide breaks or meal periods to their employees. Instead, the provision of breaks, whether for rest or meals, is entirely at the discretion of the employer.

Family and Medical Leave Laws in Idaho

Idaho, like all U.S. states, complies with the federal Family and Medical Leave Act (FMLA). The FMLA is a federal labor law that provides certain rights and protections to eligible employees when they need to take leave for specific family and medical reasons.

Under the FMLA, eligible employees in Idaho are entitled to up to 12 weeks of unpaid, job-protected leave in a 12-month period for various purposes, including:

- Serious health condition: Employees can take FMLA leave to address their own serious health condition or to care for a family member with a serious health condition.

- Birth or adoption: New parents can take FMLA leave for the birth, adoption or foster placement of a child.

- Military family leave: FMLA also provides leave for certain qualifying military family events, such as when a family member is deployed.

To be eligible for FMLA leave, employees in Idaho must meet certain criteria, including:

- Working for a covered employer

- Having worked a certain number of hours

- Having been employed for at least 12 months

Child Labor Laws in Idaho

Child labor laws in Idaho are designed to safeguard the rights and well-being of young workers. These regulations draw from both state and federal statutes, offering comprehensive guidance for the employment of minors in various industries.

In most non-agricultural settings, minors must be at least 14 years old to work. This age requirement aims to ensure that young employees have reached an appropriate level of physical and intellectual development before entering the workforce.

Regarding working hours for children under 16 years of age, no one in this age group can be engaged in gainful employment for more than 54 hours per week, nor for longer than nine hours in a single day.

Furthermore, they should not start working before six o'clock in the morning or continue beyond nine o'clock in the evening.

Anyone found engaging a child under the age of 16 in harmful activities, whether as a parent, guardian, employer or otherwise, is guilty of a misdemeanor. The penalties include a fine between $50 and $250 or imprisonment in the county jail for up to six months or both.

The enforcement of Idaho's child labor laws falls within the purview of local school boards and probation officers. For businesses in Idaho that are covered by the FLSA, child labor laws are enforced by the U.S. Department of Labor.

Workplace Safety and Health Regulations in Idaho

In Idaho, workplace safety and health regulations are generally enforced by the Idaho Occupational Safety and Health Administration (OSHA), which operates under the Idaho Department of Labor.

Idaho OSHA's primary responsibilities include:

- Enforcement of workplace safety regulations: Idaho OSHA enforces and upholds safety and health regulations in Idaho workplaces. These regulations are designed to protect the well-being of employees by establishing standards for safe working conditions.

- Inspections: Idaho OSHA conducts routine inspections of workplaces to assess compliance with safety and health standards. These inspections are carried out to identify potential hazards, evaluate the effectiveness of safety programs and ensure that employers are following the established regulations. Inspections can be scheduled or initiated in response to employee complaints or workplace accidents.

- Compliance assistance: Idaho OSHA provides guidance, training and educational programs to help employers and employees understand and adhere to safety and health regulations. This assistance is aimed at promoting a culture of safety in the workplace and helping employers implement best practices for hazard prevention.

- Investigation of workplace accidents and complaints: When workplace accidents occur or when complaints are filed regarding safety and health violations, Idaho OSHA conducts thorough investigations. These investigations are essential for identifying the root causes of accidents, assessing potential regulatory violations and working to prevent similar incidents in the future.

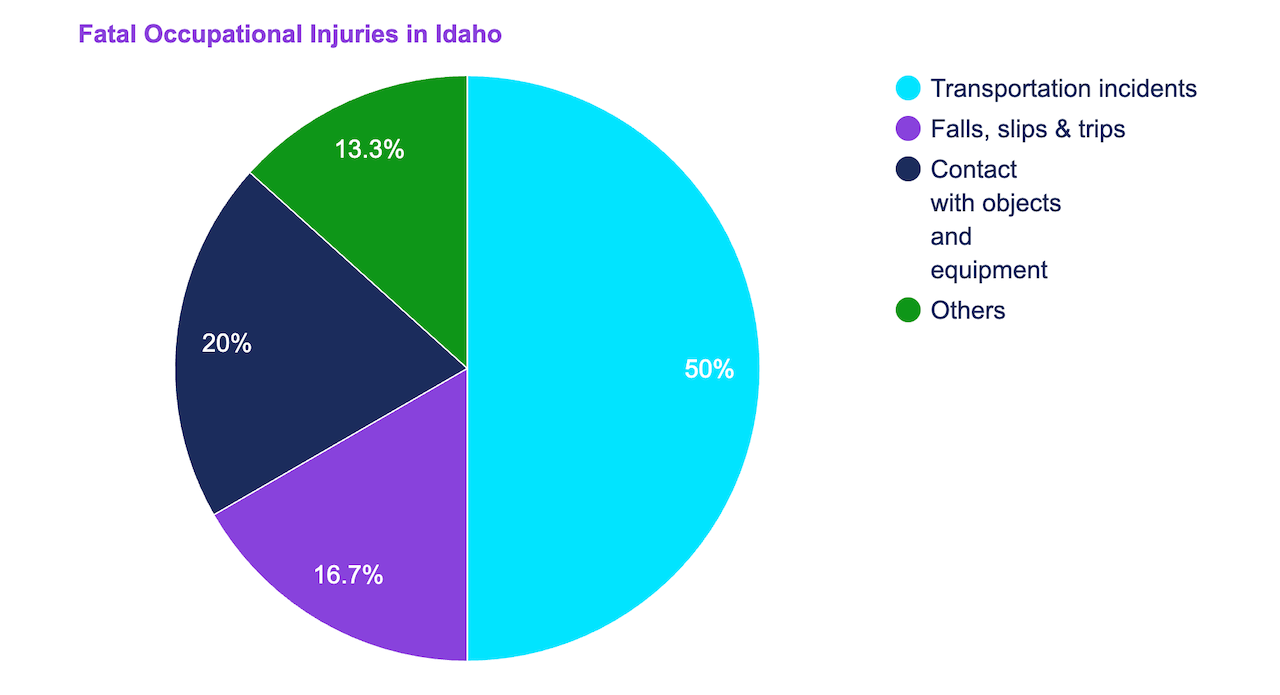

[Source: U.S. Bureau of Labor Statistics]

There were 30 fatal occupational injuries in Idaho in 2021, which is about 6% lower compared to 32 in 2020.

| State/District | No. of Fatal Work Injuries |

| Alabama | 111 |

| Alaska | 20 |

| Arizona | 67 |

| Arkansas | 74 |

| California | 462 |

| Colorado | 96 |

| Connecticut | 23 |

| Delaware | 13 |

| Florida | 315 |

| Georgia | 187 |

| Hawaii | 15 |

| Idaho | 30 |

| Illinois | 176 |

| Indiana | 157 |

| Iowa | 49 |

| Kansas | 63 |

| Kentucky | 97 |

| Louisiana | 141 |

| Maine | 19 |

| Maryland | 80 |

| Massachusetts | 97 |

| Michigan | 140 |

| Minnesota | 80 |

| Mississippi | 41 |

| Missouri | 147 |

| Montana | 40 |

| Nebraska | 39 |

| Nevada | 43 |

| New Hampshire | 21 |

| New Jersey | 110 |

| New Mexico | 53 |

| New York | 247 |

| North Carolina | 179 |

| North Dakota | 34 |

| Ohio | 171 |

| Oklahoma | 86 |

| Oregon | 66 |

| Pennsylvania | 162 |

| Rhode Island | 5 |

| South Carolina | 107 |

| South Dakota | 20 |

| Tennessee | 132 |

| Texas | 533 |

| Utah | 52 |

| Vermont | 10 |

| Virginia | 125 |

| Washington | 73 |

| West Virginia | 36 |

| Wisconsin | 105 |

| Wyoming | 27 |

| District of Columbia | 12 |

[Source: U.S. Bureau of Labor Statistics]

In total, the number of fatal injuries in Arizona is 70% lower than the average number of fatal injuries in all states at 102 fatal work injuries.

- Recordkeeping: Idaho OSHA oversees recordkeeping requirements for workplace injuries and illnesses. Employers in Idaho are required to maintain records of such incidents, which are valuable for tracking trends, analyzing safety performance and implementing preventive measures.

- Whistleblower protections: Idaho OSHA ensures that employees who report workplace safety violations or concerns are protected from retaliation by their employers. This protection encourages employees to come forward with safety-related issues without fear of adverse consequences.

- Consultation services: The Idaho Department of Labor, working in coordination with Idaho OSHA, offers consultation services to employers. These services are designed to help employers identify and address workplace safety and health hazards. They are provided at no cost and assist employers in creating safer working environments while complying with safety regulations.

- Training and education: Idaho OSHA often conducts or facilitates training and educational programs for both employers and employees to improve safety awareness and promote compliance with regulations.

Anti-Discrimination and Fair Employment Practices in Idaho

In Idaho, there are comprehensive anti-discrimination and fair employment regulations that protect individuals from various forms of discrimination in employment. These laws are designed to ensure equal opportunities and treatment for all residents of the state.

Idaho law explicitly prohibits discrimination based on the following factors:

- Race

- Sex

- Color

- National origin

- Religion

- Age (specifically those over 40)

- Mental or physical disability

Discrimination on any of these grounds is considered unlawful and subject to legal penalties.

Idaho law also prohibits retaliation against individuals who have engaged in a protected activity, such as reporting discrimination or participating in an investigation related to discrimination.

Independent Contractor Classification in Idaho

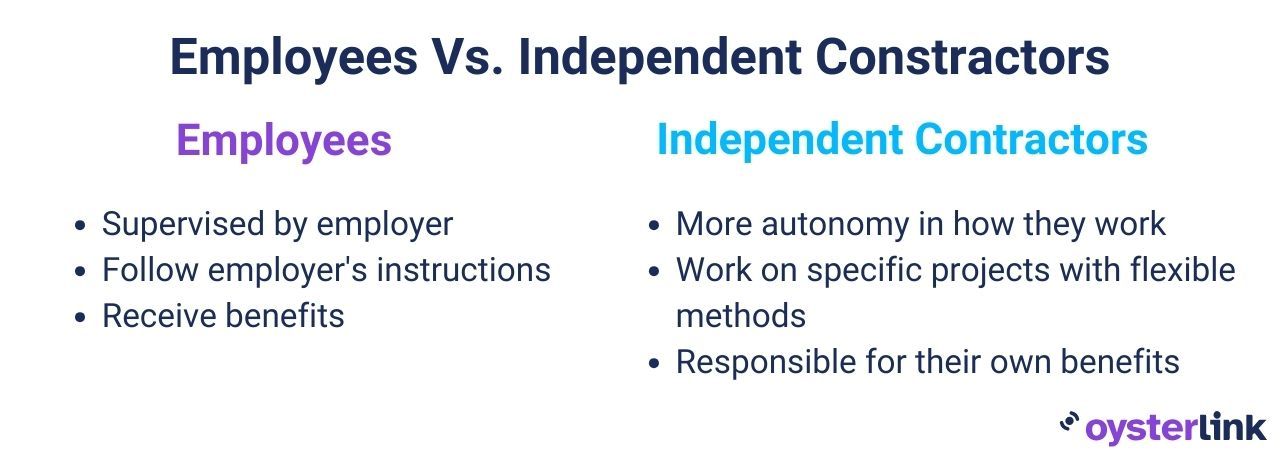

Distinguishing between an employee and an independent contractor is critical since it has important repercussions for both workers and employers in Idaho.

This distinction has a direct impact on various aspects, including payment structures, rights under wage and hour laws, eligibility for benefits and tax responsibilities.

One fundamental difference between employees and independent contractors lies in the degree of control over how the work is performed. Employees are typically under the direct supervision and control of their employers, who dictate when, where and how the work is to be done.

In contrast, independent contractors have a higher level of independence and autonomy in determining how they complete their tasks. They often work on a project basis with more flexibility in their methods.

Idaho's classification of independent contractors may also involve an individual or entity having an established business. This can include aspects such as:

- Having business expenses

- Maintaining their own office or workspace

- Demonstrating a degree of financial independence

If there is uncertainty about whether an individual should be classified as an employee or an independent contractor, it is advisable to seek guidance from the Idaho Department of Labor.

Termination and Final Paychecks in Idaho

Idaho is a “work-at-will” state, which means either the employer or the employee can terminate the working relationship at any time, without notice and without reason.

However, when an employment relationship ends, Idaho labor laws dictate specific requirements regarding the payment of final wages. Separated employees must be paid no later than the next regularly scheduled payday or within 10 days of the separation, excluding weekends and holidays.

If an employee, after the termination of employment, submits a written request to the employer for an earlier payment of their final wages, the employer is legally obligated to fulfill this request.

In such cases, the employer must make the payment within 48 hours of receiving the employee's written request, weekends and holidays excluded.

When navigating Idaho labor laws and termination procedures, make sure you're equipped with financial clarity. Our Paycheck Calculator allows you to estimate your earnings after accounting for taxes and deductions, tailored to your state's tax laws.

Summary of Idaho Labor Laws

In the state of Idaho, regular employees have a $7.25 per hour minimum wage, while new hires under 20 can start at $4.25 for the first 90 days.

Tipped employees’ minimum wage is $3.35 per hour, with employers required to make up the difference if tips do not reach the regular minimum wage.

Nonexempt employees in Idaho receive 1.5 times their regular wage for hours exceeding 40 in a week. Exempt employees are ineligible for overtime pay.

The state doesn't mandate breaks but follows federal FMLA, offering up to 12 weeks of unpaid, job-protected leave.

Idaho is a "work-at-will" state, allowing termination by either the employer or the employee at any time, with or without notice and without the need for a specific cause.

Final wages are due promptly, with earlier payment possible upon request.

Frequently Asked Questions About Idaho Labor Laws

Is Idaho a right-to-work state?

Yes, Idaho is a right-to-work state. This means that employees are not required to join or financially support a labor union as a condition of employment.

It also means that employers and employees have the freedom to engage in or refrain from union activities without facing discrimination or penalties.

How many hours can you legally work in Idaho?

In Idaho, there are no state-specific laws that dictate the maximum number of hours an adult employee can work in a day or week.

Is holiday pay mandatory in Idaho?

Under Idaho labor laws, private employers are not obligated to provide holiday pay. Whether or not an employer provides holiday pay is typically a matter of company policy or collective bargaining agreements.

Is it illegal to discuss wages in Idaho?

No, it is not illegal to discuss wages in Idaho. In fact, federal labor laws protect employees' rights to discuss their wages with one another.

Employers are prohibited from retaliating against employees who engage in such discussions.

Can you be forced to work overtime in Idaho?

In Idaho, employers can require an employee to work overtime. If an employee is unable to fulfill the required overtime, the employer may take disciplinary measures against the employee.

Disclaimer: This information serves as a concise summary and educational reference for Idaho state labor laws. It does not constitute legal advice. For personalized legal guidance, it is recommended to consult with an attorney.