Florida Labor Law Guide

A comprehensive guide to Florida labor laws: Covering key topics, including minimum wage regulations, overtime provisions, mandated breaks, hiring and termination procedures and other miscellaneous employment laws.

Key Takeaways

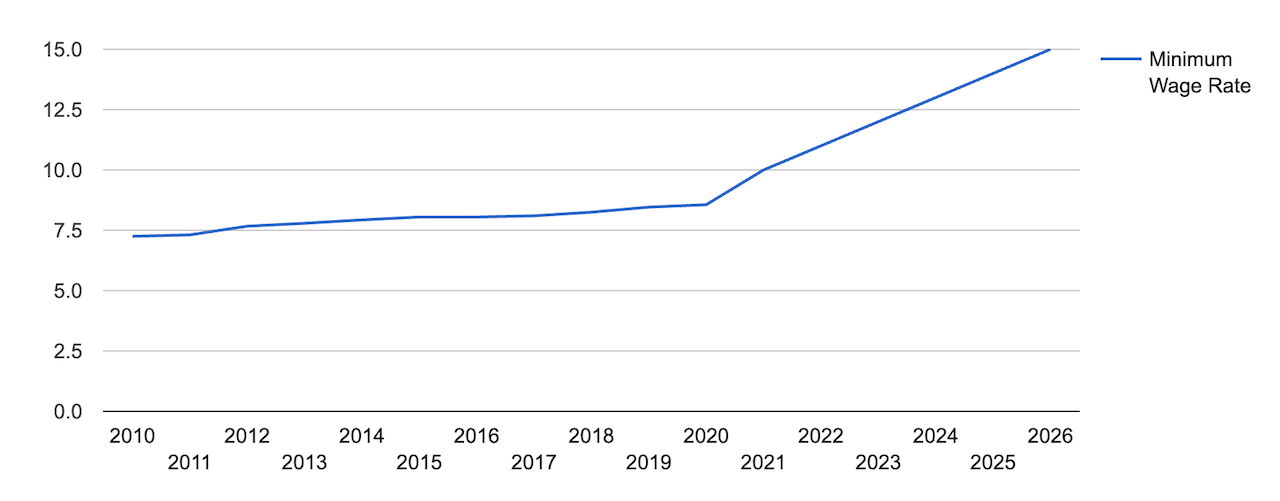

- Florida's minimum wage is $13.00 per hour, with scheduled increases of $1.00 annually until reaching $15.00 in 2026.

- Tipped employees receive a minimum direct cash wage of $8.98 per hour.

- Overtime compensation for nonexempt employees is 1.5 times the standard hourly wage.

- No specific state laws mandate meal or rest breaks for employees over 18.

- FMLA eligibility requires 12 months of service and 1,250 hours worked in the last year.

- Current child labor laws limit 16- and 17-year-olds to eight hours per day on school nights.

- Strict laws protect Florida employees against discrimination based on race, color, religion and more.

- Florida, being an at-will employment state, allows termination with or without cause and notice.

Minimum Wage Regulations in Florida

In Florida, the minimum wage for both regular and tipped employees undergoes an annual adjustment based on a predefined formula. As of January 1, 2024, the basic minimum wage per hour is set at $13.00.

However, this figure is scheduled to incrementally rise by $1.00 every September 30th until it reaches $15.00 on September 30, 2026.

[Source: Florida Department of Economic Opportunity]

Tipped employees, defined as individuals who customarily receive over $30 per month in tips, follow a specific set of regulations under both federal and Florida labor standards.

Florida employers are mandated to pay tipped employees a minimum direct cash wage, which must not fall below $8.98 per hour. This figure is complemented by a tip credit of $3.02 as allowed by state law.

This system ensures that tipped employees, whose income often relies heavily on gratuities, receive a minimum compensation that is in line with the state's labor regulations.

Check out the table below to compare Florida’s minimum wage with minimum wages in other U.S. states.

| State/District | Minimum wage |

| Alabama | $7.25 |

| Alaska | $11.73 |

| Arizona | $14.35 |

| Arkansas | $11 |

| California | $16 |

| Colorado | $14.42 |

| Connecticut | $15.69 |

| Delaware | $13.25 |

| Florida | $13 |

| Georgia | $7.25 |

| Hawaii | $14 |

| Idaho | $7.25 |

| Illinois | $14 |

| Indiana | $7.25 |

| Iowa | $7.25 |

| Kansas | $7.25 |

| Kentucky | $7.25 |

| Louisiana | $7.25 |

| Maine | $14.15 |

| Maryland | $15 |

| Massachusetts | $15 |

| Michigan | $10.33 |

| Minnesota | $10.85 |

| Mississippi | $7.25 |

| Missouri | $12.3 |

| Montana | $10.3 |

| Nebraska | $12 |

| Nevada | $12 |

| New Hampshire | $7.25 |

| New Jersey | $15.13 |

| New Mexico | $12 |

| New York | $15 |

| North Carolina | $7.25 |

| North Dakota | $7.25 |

| Ohio | $10.45 |

| Oklahoma | $7.25 |

| Oregon | $14.2 |

| Pennsylvania | $7.25 |

| Rhode Island | $14 |

| South Carolina | $7.25 |

| South Dakota | $11.2 |

| Tennessee | $7.25 |

| Texas | $7.25 |

| Utah | $7.25 |

| Vermont | $13.67 |

| Virginia | $12 |

| Washington | $16.28 |

| West Virginia | $8.75 |

| Wisconsin | $7.25 |

| Wyoming | $7.25 |

| District of Columbia | $16.5 |

[Source: FRED]

Overtime Rules and Regulations in Florida

Securing equitable compensation for extra working hours is a crucial element of safeguarding workers' rights. In Florida, whether salaried employees qualify for overtime pay depends on their categorization as exempt or nonexempt.

Nonexempt Employees

Nonexempt employees are entitled to receive overtime pay for any hours worked beyond a specified threshold in a designated workweek, typically set at 40 hours in the United States.

Should nonexempt employees exceed this 40-hour limit, they are required to be compensated at a rate of no less than 1.5 times their standard hourly wage for the extra hours worked.

Check out our time and a half calculator to determine your overtime earnings.

Exempt Employees

Exempt employees in Florida are those who meet specific criteria outlined in the Fair Labor Standards Act (FLSA). These criteria typically involve factors such as:

- The nature of their job duties

- Their salary level

- Adherence to certain employment standards

Unlike nonexempt employees, exempt employees are not eligible for overtime pay, regardless of the number of hours worked beyond the standard 40-hour workweek.

Exempt status often applies to salaried employees holding professional, administrative or executive positions. The salary threshold for exemption is subject to change based on federal regulations.

Break Periods in Florida

The state of Florida doesn’t have specific laws mandating employers to provide meal or rest breaks for employees over the age of 18. The provision of breaks is typically at the employer's discretion.

However, employers are required to comply with federal regulations set forth by the FLSA, which does not mandate specific break times but requires compensation for short breaks (usually 5–20 minutes).

Family and Medical Leave Laws in Florida

In Florida, family and medical leave is primarily governed by the Family and Medical Leave Act (FMLA). To be eligible for FMLA benefits, employees must have completed at least 12 months of service with the state and have worked a minimum of 1,250 hours in the last 12 months.

The FMLA is available for a range of circumstances, including:

- An employee's serious health condition that renders them unable to perform their job

- The birth or adoption of a child

- Addressing the serious health condition of a spouse, children or parents

FMLA also includes provisions for active duty family leave and injured service member leave.

To initiate a leave request under FMLA, employees are required to notify their supervisor in advance, except in cases of medical emergencies or unforeseeable changes in circumstances.

While FMLA leave is generally unpaid, employees have the option to continue health, life or supplemental insurance benefits during their leave by paying their portion of the monthly benefit premium, irrespective of whether they are on unpaid or paid leave status.

Importantly, FMLA emphasizes job security, ensuring that employees returning within the authorized leave period have the right to resume their former position or one of the equivalent benefits, pay and status.

Child Labor Laws in Florida

Presently, the law restricts Florida employers from scheduling 16- and 17-year-olds to work beyond eight hours per day on school nights or more than 30 hours a week while school is in session.

However, newly proposed legislation seeks to eliminate these limitations, allowing employers to schedule teens aged 16 and older for unlimited hours, including overnight shifts, even during the school year.

This proposed shift in legislation has sparked concerns among advocates for youth welfare, as it raises questions about the potential impact on the education, health and overall well-being of young workers.

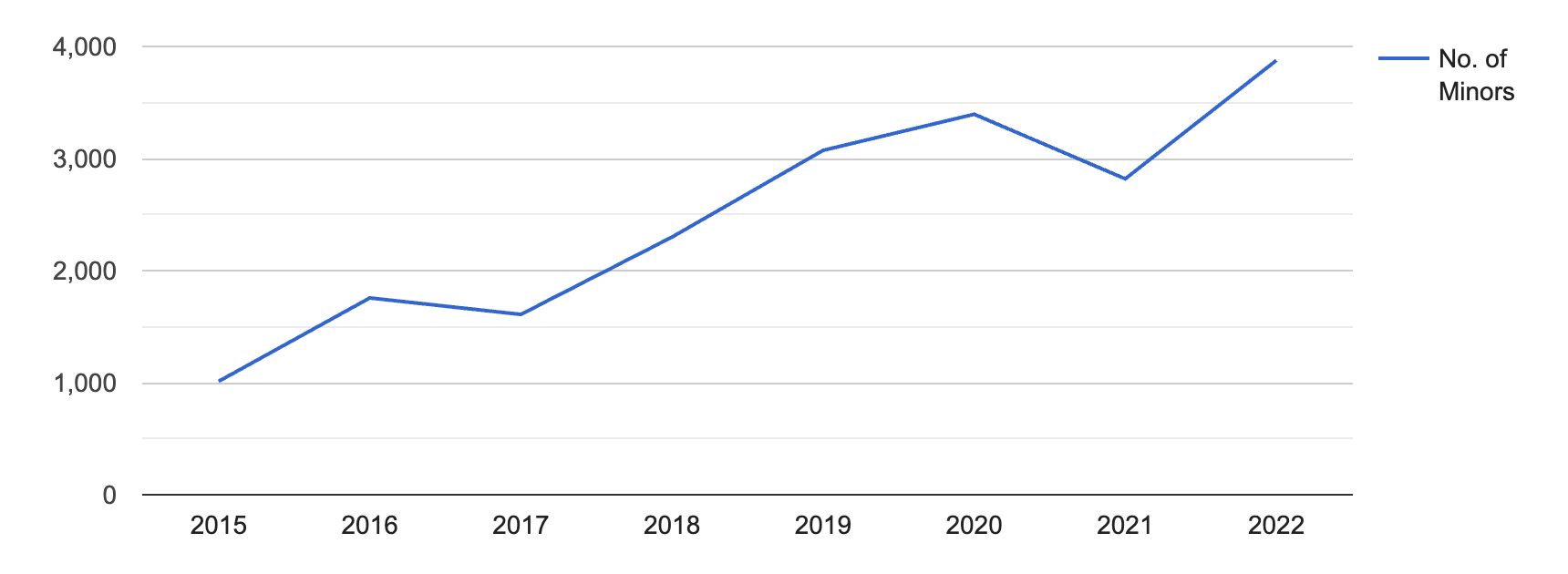

In recent years, a disconcerting trend has emerged, indicating a significant rise in child labor violations in the United States. The chart below shows the number of child labor violations from 2015 to 2022.

[Source: Economic Policy Institute]

Workplace Safety and Health Regulations in Florida

Florida's workplace safety and health regulations are primarily governed by the federal Occupational Safety and Health Act (OSHA), administered by the Occupational Safety and Health Administration, a branch of the U.S. Department of Labor.

Key aspects of workplace safety and health regulations in Florida include:

- General workplace standards: OSHA establishes general standards that apply to almost all industries. These standards cover areas such as hazard communication, machine guarding, electrical safety and fall protection.

- Recordkeeping and reporting: Employers are required to keep records of workplace injuries and illnesses and report serious incidents to OSHA. This information helps OSHA track workplace safety trends and develop targeted enforcement initiatives.

- Safety training: Employers are responsible for providing training to employees on safety and health hazards specific to their workplace. Training programs may cover topics such as emergency procedures, proper equipment usage and hazard recognition.

- Construction industry standards: For the construction industry, specific OSHA standards address scaffolding, excavation, fall protection and other hazards commonly associated with construction activities.

- Inspections and enforcement: OSHA conducts inspections of workplaces to ensure compliance with safety and health standards. Employers found in violation may face penalties, and OSHA may issue citations requiring corrective actions.

- Whistleblower protection: Workers have the right to report unsafe conditions without fear of retaliation. OSHA provides protections for workers who raise concerns about workplace safety and health.

- Health standards: OSHA standards address occupational exposure to hazardous substances, including chemicals, asbestos, and other materials. Employers must implement measures to protect workers from exposure and provide appropriate training and personal protective equipment.

Anti-Discrimination and Fair Employment Practices in Florida

In Florida, stringent anti-discrimination laws are in place to safeguard the rights of employees These laws prohibit discrimination based on several fundamental factors, including:

- Race

- Color

- Religion

- Sex

- Pregnancy

- National origin

- Age

- Disability

- Marital status.

Anyone who believes they have experienced an unlawful employment practice has the right to file a complaint. This complaint can be filed at any time within 365 days of the alleged discriminatory act.

The Florida Commission on Human Relations (FCHR) accepts written complaints at its office, with the filing date considered the actual receipt date by the FCHR. If received after 5:00 p.m. (Eastern time), the document is filed as of 8:00 a.m. on the next regular business day.

The Commission holds the authority to refer complaints to other relevant agencies, including the Governor's office or the Inspector General, as applicable.

Independent Contractor Classification in Florida

The classification of independent contractors in Florida is a noteworthy aspect of employment relationships, setting it apart from conventional employer-employee arrangements.

An independent contractor is an individual or business entity that provides services to another entity under the terms specified in a contract.

In Florida, as in many other states, the classification of workers as independent contractors carries legal and financial implications for both parties involved.

The determination of independent contractor status in Florida involves considering various factors, including:

- The level of control the hiring entity has over the work

- The degree of independence of the worker

- The method of payment

- The provision of tools and equipment

- The existence of a written contract outlining the terms of the engagement

It is crucial for businesses to correctly classify workers to comply with tax laws, labor regulations and other legal requirements.

Independent contractors are typically responsible for their own taxes, insurance and benefits, relieving the hiring entity of certain financial obligations associated with traditional employees.

The Internal Revenue Service (IRS) and the Florida Department of Revenue provide guidelines to help businesses determine the proper classification of workers. These guidelines aim to prevent the misclassification of employees as independent contractors or vice versa.

Companies employing independent contractors should create explicit, written agreements delineating the work scope, payment terms and other relevant details.

Termination and Final Paychecks in Florida

In the state of Florida, the employment landscape operates under the principle of at-will employment.

This principle provides both employers and employees with the flexibility to terminate the employment relationship at their discretion, whether with or without cause, and with or without prior notice.

When it comes to regulations surrounding final paychecks, they are not explicitly outlined by state law, but certain guidelines are suggested by the Department of Labor to ensure fair and timely compensation for employees.

According to these suggestions, employers in Florida are advised to provide final paychecks on the next scheduled payday, which is typically at the end of the next regular pay period.

In some situations, an employer might keep back a part of the final paycheck. This is acceptable if the employee agrees or if the deductions are for reasonable and necessary expenses such as taxes or court-ordered payments.

It's crucial, though, that these deductions do not result in the employee's pay rate falling below the minimum wage.

When navigating Florida labor laws and termination procedures, make sure you're equipped with financial clarity. Our Paycheck Calculator allows you to estimate your earnings after accounting for taxes and deductions, tailored to your state's tax laws.

Summary of Florida Labor Laws

The current minimum wage in Florida is $13.00 per hour, set to increase to $15.00 by 2026. Tipped employees follow specific rules to meet this minimum.

Overtime typically applies after 40 hours a week, depending on the job. Breaks align with national guidelines, and family or health-related time off has protections, though it is generally unpaid.

Younger workers have limits on work hours, with ongoing discussions about potential changes.

Prohibitions against discrimination, including factors such as race or age, enable individuals to file complaints about unfair treatment.

The termination process adheres to the principle of at-will employment, providing flexibility for both employers and employees to conclude the relationship.

Frequently Asked Questions About Florida Labor Laws

Is it illegal to work eight hours without a break in Florida?

No, Florida does not have specific laws mandating breaks for employees over the age of 18. Breaks are generally at the discretion of the employer.

Can I quit my job without notice in Florida?

Yes, Florida follows the principle of at-will employment, allowing both the employer and the employee to terminate the employment relationship at any time, with or without notice.

Is it legal to work seven days in a row in Florida?

There is no specific law in Florida that prohibits working seven days in a row for adults. However, certain industries may have their own regulations, and employees are entitled to overtime pay if they exceed 40 hours in a workweek.

What is considered wrongful termination in Florida?

Wrongful termination in Florida occurs when an employee is fired for reasons that violate state or federal laws. This could include termination based on discrimination, retaliation for exercising legal rights or breach of an employment contract.

Is nepotism illegal in Florida?

Florida’s Anti-Nepotism Law specifically addresses the employment of relatives by public officials. This law prohibits a "public official" with hiring authority from employing or recommending for employment their "relative," which includes spouses.

This law applies to job actions occurring within an "agency," as defined in the statute. While the law covers many state and local entities, it explicitly excludes certain institutions, such as those under the jurisdiction of the Board of Governors of the State University System, district school boards and community college districts.

Disclaimer: This information serves as a concise summary and educational reference for Florida state labor laws. It does not constitute legal advice. For personalized legal guidance, it is recommended to consult with an attorney.