Delaware Labor Law Guide

A comprehensive guide to Delaware labor laws: Covering key topics including minimum wage regulations, overtime provisions, mandated breaks, hiring and termination procedures and other miscellaneous employment laws.

Key Takeaways of Delaware Labor Laws

- Delaware’s minimum wage is $13.25 per hour, which is greater than the federal rate.

- Delaware employers should provide a 30-minute meal break for employees working for 7.5 hours or more per day.

- Nonexempt employees are entitled to overtime pay at $19.87 per hour (1.5x$13.25) for hours worked after the first 40 in 1 workweek.

- Both employers and employees in Delaware can terminate their employment relationship without cause, following Delaware's at-will employment doctrine.

- Delaware is not a right-to-work state.

Minimum Wage Regulations in Delaware

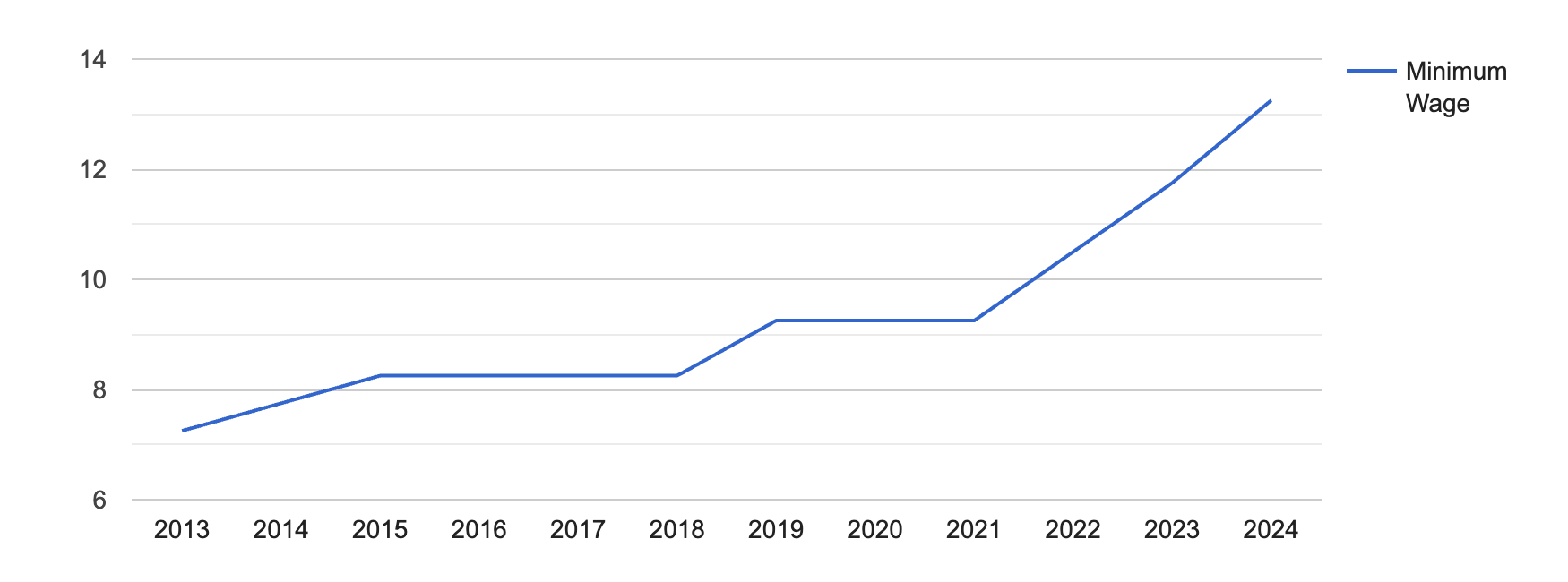

The minimum wage in Delaware is $13.25 per hour, which is $6 higher than the federal minimum wage.

This amount is set to increase as part of a signed bill that progressively raises the state minimum wage from $10.50 in 2022 to $15 in 2025.

| State/District | Minimum wage |

| Alabama | $7.25 |

| Alaska | $11.73 |

| Arizona | $14.35 |

| Arkansas | $11 |

| California | $16 |

| Colorado | $14.42 |

| Connecticut | $15.69 |

| Delaware | $13.25 |

| Florida | $13 |

| Georgia | $7.25 |

| Hawaii | $14 |

| Idaho | $7.25 |

| Illinois | $14 |

| Indiana | $7.25 |

| Iowa | $7.25 |

| Kansas | $7.25 |

| Kentucky | $7.25 |

| Louisiana | $7.25 |

| Maine | $14.15 |

| Maryland | $15 |

| Massachusetts | $15 |

| Michigan | $10.33 |

| Minnesota | $10.85 |

| Mississippi | $7.25 |

| Missouri | $12.3 |

| Montana | $10.3 |

| Nebraska | $12 |

| Nevada | $12 |

| New Hampshire | $7.25 |

| New Jersey | $15.13 |

| New Mexico | $12 |

| New York | $15 |

| North Carolina | $7.25 |

| North Dakota | $7.25 |

| Ohio | $10.45 |

| Oklahoma | $7.25 |

| Oregon | $14.2 |

| Pennsylvania | $7.25 |

| Rhode Island | $14 |

| South Carolina | $7.25 |

| South Dakota | $11.2 |

| Tennessee | $7.25 |

| Texas | $7.25 |

| Utah | $7.25 |

| Vermont | $13.67 |

| Virginia | $12 |

| Washington | $16.28 |

| West Virginia | $8.75 |

| Wisconsin | $7.25 |

| Wyoming | $7.25 |

| District of Columbia | $16.5 |

[Source: FRED]

Regular Employees

Regular employees are entitled to the current state minimum wage rate of $13.25 per hour in Delaware.

Since 2021, eligible youth employees (14–17 years old) should also be paid at least the state minimum wage.

[Source: FRED]

Tipped Employees

Employees who receive tips in Delaware must be paid a minimum wage of $2.23 per hour. Combining this amount with employees’ tips should at least equal the required minimum hourly wage rate of $13.25.

Employers are required to make up the difference if employees’ tips are insufficient to raise their earnings to at least the state minimum wage.

Except if authorized by law, employers are not permitted to take or keep tips. Tip pooling is allowed under certain conditions, although it cannot exceed 15% of the employee’s actual tips.

When navigating wages and Delaware labor laws, ensure you’re equipped with financial clarity. Our Paycheck Calculator allows you to estimate your earnings after accounting for taxes and deductions tailored to your state’s tax laws.

Overtime Rules and Regulations in Delaware

As there are no specific laws in Delaware pertaining to overtime, the state adopts federal overtime laws outlined in the Fair Labor Standards Act (FLSA), wherein employees who work over 40 hours in a single workweek are entitled to overtime pay.

Nonexempt Employees

Delaware law does not have any state-specific provisions for classifying nonexempt employees and follows FLSA regulations instead. Nonexempt employees in Delaware should be paid 1.5 times their regular rate of pay, or time and a half, for hours worked over the first 40 in 1 workweek.

Nonexempt employees typically fall into the category of manual laborers, although there are a few exceptions for administrative or clerical positions.

To check out your time and a half pay, check out OysterLink's time and a half calculator.

Exempt Employees

Exempt employees are usually salaried individuals who receive a fixed weekly salary, which, according to the current federal wage set by the FLSA, is at least $684 per week. Exempt employees are not entitled to overtime pay.

Exempt employees include those in executive, administrative and professional roles.

Employers must exercise caution when classifying employees to ensure compliance with wage regulations and prevent any violations.

At-Will Employment in Delaware

Delaware is an at-will employment state, which means that employers or employees can terminate their working relationship at any time, with or without cause, excluding reasons prohibited by law—breach of contract, discrimination, retaliation, etc.

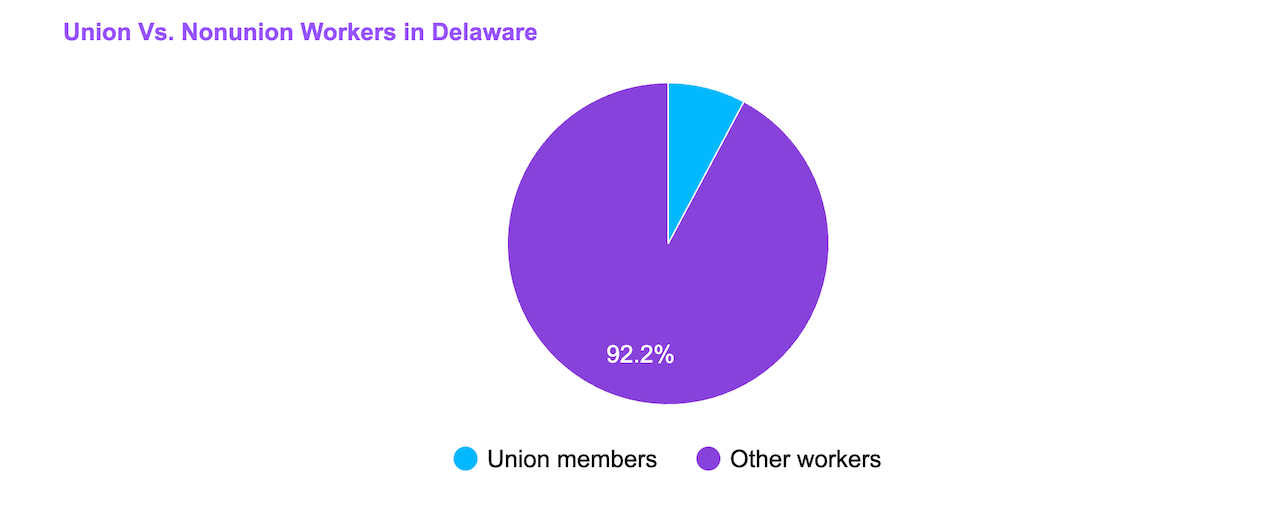

No Right-To-Work Laws in Delaware

Delaware does not observe a right-to-work statute, which entitles employees to organize and join employee organizations.

[Source: Victoria Advocate]

This also means that employees in Delaware have the choice to participate in or form employee organizations without being required to pay union dues or fees.

Rest and Meal Breaks in Delaware

Every employee working a scheduled shift of 7.5 hours or longer is entitled to a minimum 30-minute meal break. This break should occur after the first two hours of work and before the final two hours of the shift.

Exemptions pertain to specific situations, such as when an employee possesses professional certification granted by the State Board of Education and is serving in a role directly involving children.

Additionally, exemptions can be applicable when there is a preexisting collective bargaining agreement or another formal written arrangement between the employer and employee that outlines different terms or conditions.

Family and Medical Leave Laws in Delaware

Employees in Delaware are protected by the Family and Medical Leave Act (FMLA), which aims to strike a balance between work and family needs. It strives to support employees and their families in consideration of the state’s interests.

Family and Medical Leave Act

Employees in Delaware are entitled to time off under the federal FMLA, which provides the following:

- Up to 12 weeks of unpaid leave in a 12-month period for serious health conditions (of their own or of their family members)

- Up to 12 workweeks of unpaid qualifying exigency leave for families of active-duty military members

- Up to 26 workweeks of unpaid Military Caregiver Leave to care for a qualified military member or veteran

- Up to 12 weeks of parental leave for the birth of a child or upon adoption of a child who is six years of age

Employees should provide advance leave notice and documentation whenever applicable.

To be eligible for FMLA leave, you must meet the following conditions:

- Worked for the state for at least 12 months (not necessarily consecutive, with up to a 7-year break allowed)

- Logged a minimum of 1,250 hours in the year just before taking leave, excluding paid or unpaid leave hours. This includes all state employment.

Other Leave Laws

Here’s a quick overview of various types of leaves under Delaware labor laws:

- Jury duty: Employers are required to give you unpaid time off for jury duty. Employers cannot penalize employees for attending jury duty. Yet, if your absence would create significant difficulties for your employer, it might be seen as a valid jury duty excuse.

- Voting: Delaware labor laws do not require employers to provide employees time off to vote for their employees.

- Donor: Employees are entitled to up to 7 days of leave as a bone marrow donor and up to 30 days as an organ donor.

- Bereavement: There are no Delaware laws that require private employers to grant time off to attend a memorial service or similar activity. However, state employees are given paid time off in most cases.

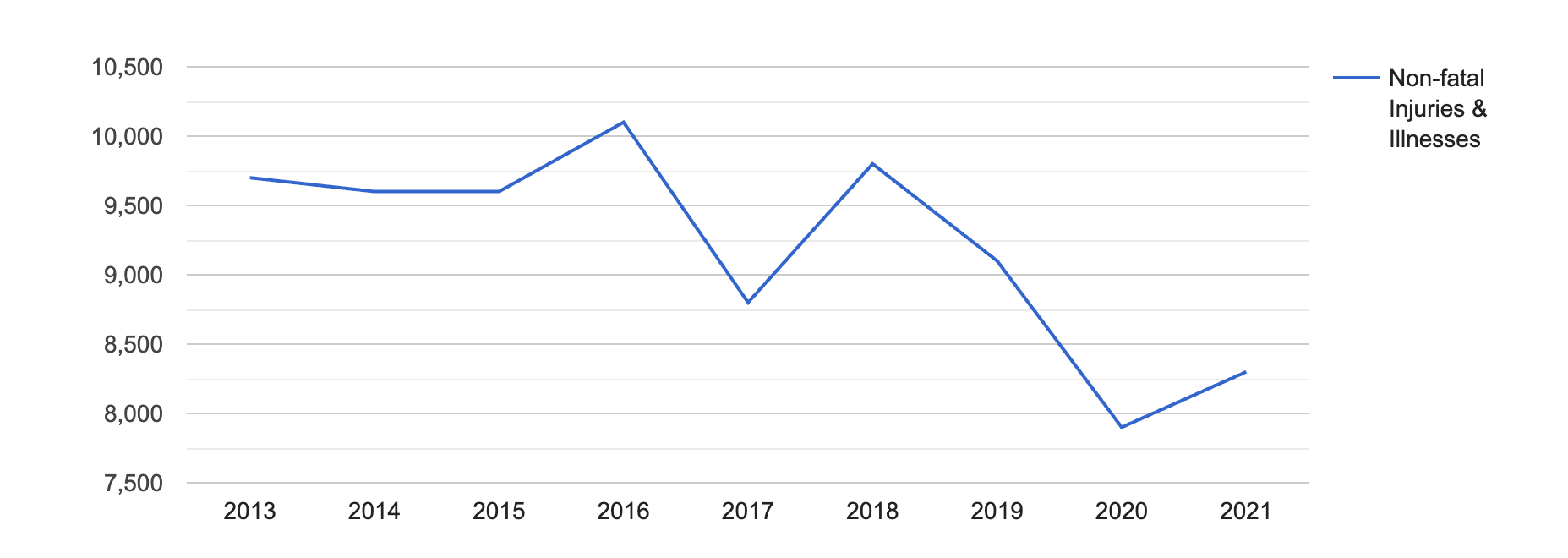

Workplace Safety and Health Regulations in Delaware

Creating a safe work environment is vital, and workplace health and safety should be the foremost concern. Delaware employers must adhere to both federal and state regulations that oversee workplace safety and health.

As per the Delaware Workers’ Compensation Act, employees who experience injuries or occupational diseases related to their jobs may be eligible for different benefits. Reporting a workplace injury to the employer promptly is essential, as a delayed report could lead to benefits being denied.

The Delaware Office of Safety & Health Consultation also plays a primary role in ensuring workplace safety and health within the state of Delaware.

[Source: Delaware.gov]

Child Labor Laws in Delaware

An individual must be at least 14 years old to be allowed to work.

Work Hours

14–15-year-old employees

Minors aged 14-15 cannot work before 7:00 a.m. or after 7:00 p.m., except during the summer from June 1st through Labor Day, when the evening hours extend to 9:00 p.m.

On school days, they cannot work more than four hours a day, and eight hours on non-school days.

When school is in session for five days, they cannot exceed 18 hours a week, work more than 6 days a week or work over 40 hours a week when school is out.

Additionally, they cannot work continuously for more than 5 hours without a 30-minute non-work period.

16–17-year-old employees

For minors aged 16–17, they should not exceed a total of 12 hours of combined school and work hours in a single day, and there must be an uninterrupted period of 8 hours without work or school within each 24-hour period.

Additionally, they should not work for more than 5 hours without a break of at least 30 consecutive minutes. These rules are designed to balance education, work and well-deserved rest for young employees.

Work Permit

- All minors under the age of 18 are required to get a work permit.

- Employers are required to keep a record of all work permits for each minor employee.

- Should a minor employee change employers, a new work permit is required.

Antidiscrimination and Fair Employment Practices in Delaware

The Delaware Department of Labor’s Office of Anti-discrimination protects employees from being discriminated against with regard to age (40 or older), color, disability, genetic information, marital status, national origin, pregnancy (sex including), race, religion and sexual orientation.

Independent Contractor Classification in Delaware

In Delaware, as in every other state, employers should determine whether a worker should be classified as an employee or an independent contractor to adhere to local tax and wage laws.

An “employee” is generally someone who works under an employer’s direction, follows their set procedures and receives regular compensation (for example, a restaurant cook).

In contrast, an “independent contractor” is compensated per project and operates with more autonomy.

Official Holidays in Delaware

Employers in Delaware are not required to provide leaves for holidays to employees working on those days.

[Source: Delaware.gov]

Termination and Final Paychecks in Delaware

Employers in Delaware must pay all final wages following termination to their employees on the next regularly scheduled payday.

Employers are required to maintain records for each employee, including their pay rates, hours worked and total earnings, for a period of three years.

Miscellaneous Delaware Labor Laws

Here are additional Delaware labor laws regarding specific aspects of employment and labor relations.

Wage Payment

Employers should pay wages to employees at least once per month, with all wages paid within seven days of each payday.

Employers cannot withhold wages for cash or inventory shortages, cash advances or charges for goods and services without a signed agreement specifying the amount and repayment schedule, damaged property or failure to return the employer’s property.

Lastly, employers are required to provide detailed pay stubs, which detail their rate of pay, pay period, deductions and working hours.

Immigration Verification

In Delaware, labor regulations solely mandate compliance with federal I-9 requirements for employment verification, and there is no obligation to use E-Verify.

Drug Testing

Delaware lacks specific regulations governing drug and alcohol testing in the hiring process or during employment. Consequently, employers have the flexibility to establish their own policies concerning substance use in the workplace.

Smoking Laws

As per Delaware’s Clean Indoor Air Act, smoking is prohibited in most indoor public places, such as restaurants, grocery stores, schools, hospitals, etc., as well as workplaces.

Gun Laws

Delaware does not have legislation dictating whether employers can impose bans on weapons in the workplace. This means that employers have the autonomy to set guidelines limiting employees’ rights to carry firearms at their job sites, including in company parking areas.

Frequently Asked Questions About Delaware Labor Laws

Stay updated on Delaware labor laws by reading answers to some commonly asked questions.

What is the legal working age in Delaware?

The minimum working age in Delaware is 14 years old, with limitations in terms of work hours and occupations.

What is the minimum wage in Delaware?

The minimum wage in Delaware is $13.25 per hour.

Can you be fired without cause in Delaware?

Yes. Employers in Delaware can fire employees for any reason and at any time. At the same time, employees also have the right to terminate any working relationship for any reason and at any time.

Are lunch breaks paid in Delaware?

No, in Delaware, meal breaks are not paid. Employees working at least seven and a half consecutive hours are entitled to a 30-minute meal break, but employers are not required to provide paid meal breaks.

Do you need a work permit in Delaware?

If you are a minor, you would need to secure a work permit prior to starting work.

Disclaimer: This information serves as a concise summary and educational reference for Delaware labor laws. It does not constitute legal advice. For personalized legal guidance, it is recommended to consult with an attorney.