Colorado Labor Law Guide

A comprehensive guide to Colorado labor laws: Covering key topics, including minimum wage regulations, overtime provisions, mandated breaks, hiring and termination procedures and other miscellaneous employment laws.

Key Takeaways

- Colorado’s minimum wage is $14.42 per hour, which is higher than the federal rate

- The minimum wage for tipped employees is $11.44 per hour

- Employees working over five consecutive hours are entitled to a 30-minute break

- Employers are required to provide resigning employees their wages on the next payday

- Young workers aren’t allowed to work more than 40 hours a week

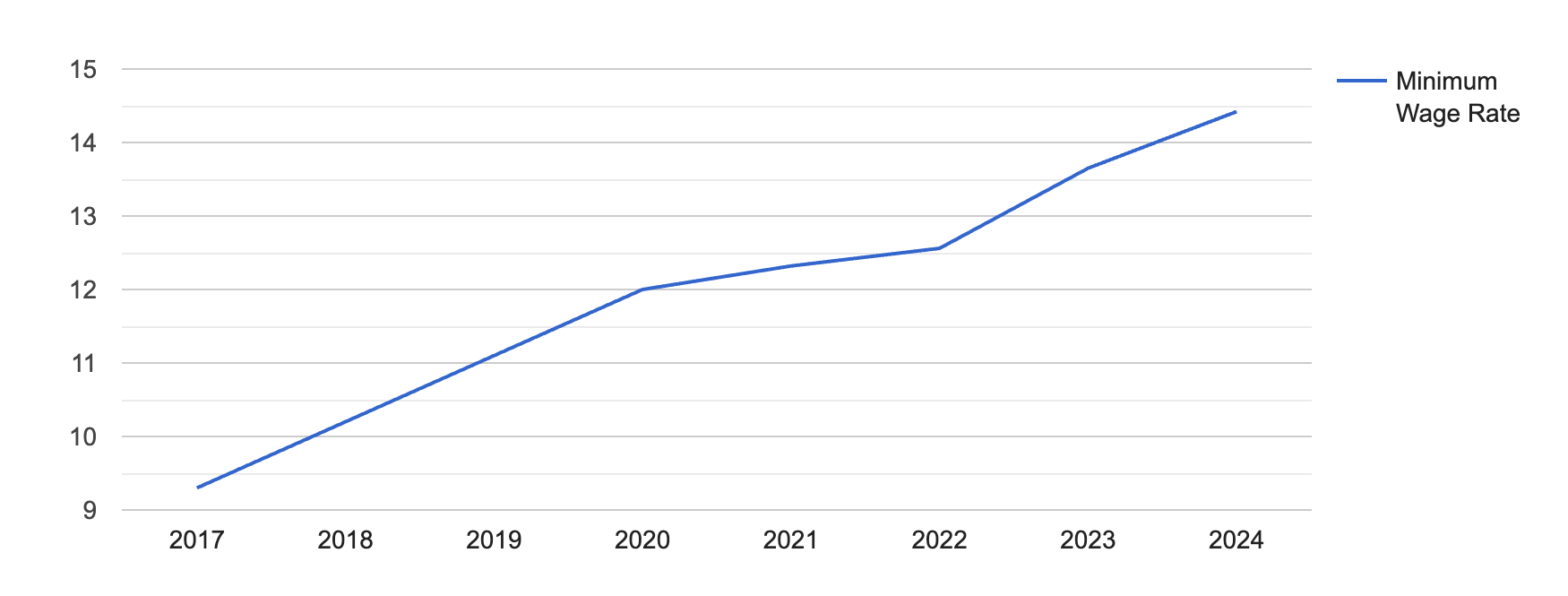

Minimum Wage Regulations in Colorado

The state’s minimum wage rate currently stands at $14.42 per hour, which is higher than the federal minimum wage of $7.25 per hour.

Colorado's minimum wage has consistently increased by $0.90 each year since 2018, reaching $12 in January 2020. Since then, it has been adjusted annually based on the Consumer Price Index.

| State/District | Minimum wage |

| Alabama | $7.25 |

| Alaska | $11.73 |

| Arizona | $14.35 |

| Arkansas | $11 |

| California | $16 |

| Colorado | $14.42 |

| Connecticut | $15.69 |

| Delaware | $13.25 |

| Florida | $13 |

| Georgia | $7.25 |

| Hawaii | $14 |

| Idaho | $7.25 |

| Illinois | $14 |

| Indiana | $7.25 |

| Iowa | $7.25 |

| Kansas | $7.25 |

| Kentucky | $7.25 |

| Louisiana | $7.25 |

| Maine | $14.15 |

| Maryland | $15 |

| Massachusetts | $15 |

| Michigan | $10.33 |

| Minnesota | $10.85 |

| Mississippi | $7.25 |

| Missouri | $12.3 |

| Montana | $10.3 |

| Nebraska | $12 |

| Nevada | $12 |

| New Hampshire | $7.25 |

| New Jersey | $15.13 |

| New Mexico | $12 |

| New York | $15 |

| North Carolina | $7.25 |

| North Dakota | $7.25 |

| Ohio | $10.45 |

| Oklahoma | $7.25 |

| Oregon | $14.2 |

| Pennsylvania | $7.25 |

| Rhode Island | $14 |

| South Carolina | $7.25 |

| South Dakota | $11.2 |

| Tennessee | $7.25 |

| Texas | $7.25 |

| Utah | $7.25 |

| Vermont | $13.67 |

| Virginia | $12 |

| Washington | $16.28 |

| West Virginia | $8.75 |

| Wisconsin | $7.25 |

| Wyoming | $7.25 |

| District of Columbia | $16.5 |

[Source: FRED]

Regular Employees

In Colorado, if an employee is subject to both federal and state minimum wage laws, the employer is required to pay the higher rate, which is the state minimum wage of $14.42.

An employee may fall under both federal and state minimum wage laws if their employer operates in a state like Colorado with its own minimum wage laws and is also subject to federal regulations due to factors such as the type of business, interstate commerce or other federal mandates.

[Source: cdle.colorado.gov]

This graph is interactive. Hover your mouse over different parts of the graph to see detailed data.

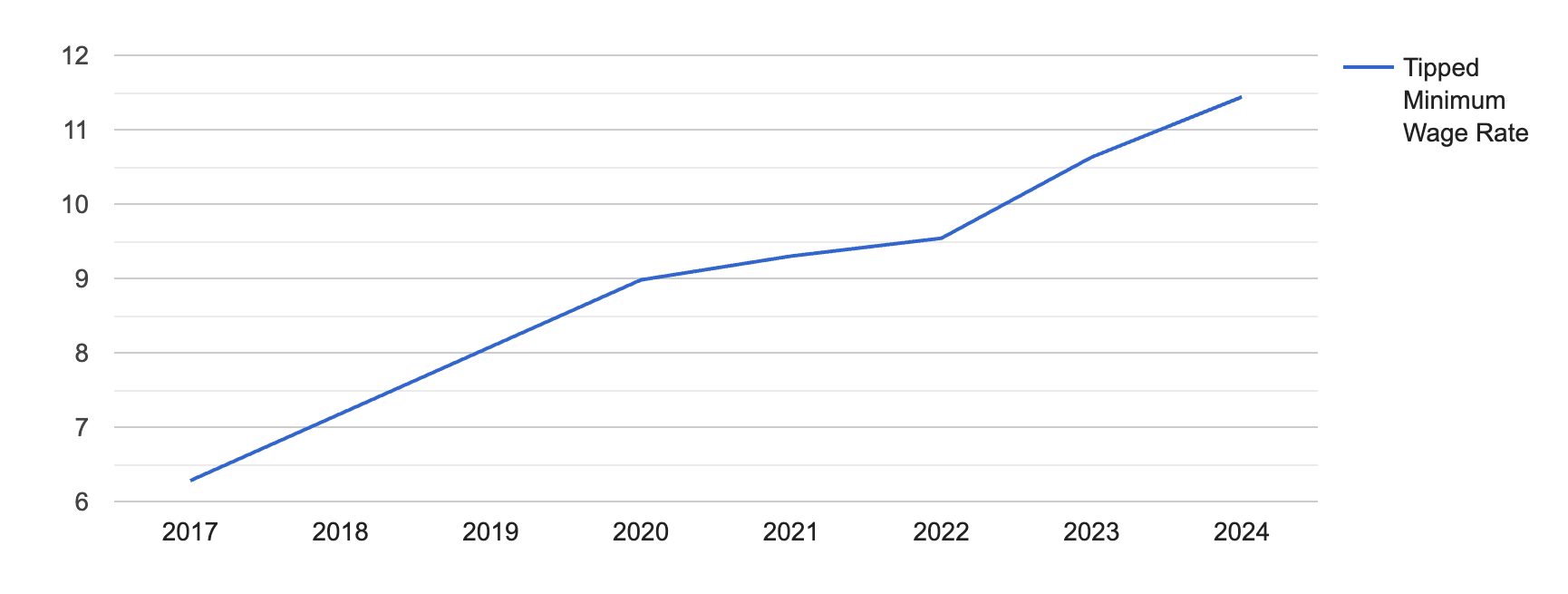

Tipped Employees

The federal tipped minimum wage is $2.13 per hour, which is significantly lower than the state's tipped minimum wage at $11.44 per hour.

If the tips and the employer's cash wage fall short of the minimum hourly wage, the employer must provide additional cash to make up the difference.

[Source: cdle.colorado.gov]

This graph is interactive. Hover your mouse over different parts of the graph to see detailed data.

Overtime Rules and Regulations in Colorado

In Colorado, overtime rules are governed by both the Colorado Overtime and Minimum Pay Standards Order (COMPS Order) and the federal Fair Labor Standards Act (FLSA).

Employers must correctly classify employees as exempt or non-exempt and comply with both state and federal overtime pay regulations to avoid legal and financial implications.

Non-Exempt Employees

Nonexempt employees in Colorado include hourly workers and certain salaried employees. Nonexempt employees are entitled to receive 1.5 times their normal rate of pay for work performed in excess of:

- 40 hours per workweek

- 12 hours per workday

- 12 consecutive hours of work, regardless of the employee's starting and ending times in a workday (excluding duty-free meal break periods)

Exempt Employees

The exempt status is determined based on their job duties and salary. Exempt employees in Colorado include:

- Administrative employees

- Executives or supervisors

- Professional employees

- Outside salespersons

- Taxi cab drivers

- In-residence workers: Casual babysitters, property managers, laundry workers, student residence workers, field staff of seasonal camps or seasonal outdoor education programs

- Elected officials and their staff

- Bona fide volunteers and work-study students

- Employees in highly technical computer-related occupations

- Employees of the medical transportation industry who work 24-hour shifts

- Employees of the ski industry

- Drivers and driver’s helpers

- Range workers

- Temporary employees employed directly by the Western Stock Show

- Companions designated as direct support professionals/direct care workers

- Decision-Making Managers at livestock employers

When navigating Colorado labor laws, ensure you’re equipped with financial clarity.

Our Paycheck Calculator allows you to estimate your earnings after accounting for taxes and deductions tailored to your state’s tax laws.

Rest and Meal Breaks

Employees in Colorado are entitled to a minimum 30-minute uninterrupted meal break when their shift exceeds five consecutive hours. Additionally, employers must provide a 10-minute paid rest break for every 4 hours of work. You may refer to the table below for rest periods required for hours worked:

Family and Medical Leave Laws in Colorado

Colorado labor laws follow the Family and Medical Leave Act (FMLA), a federal law that provides eligible employees with up to 12 weeks of unpaid leave in a 12-month period for specific family and medical reasons. The FMLA can be used for several distinct purposes including:

- Birth of a child

- Adoption or foster care

- Serious health condition

- Employee's own serious health condition

- Active duty (military) family leave

- Military caregiver leave

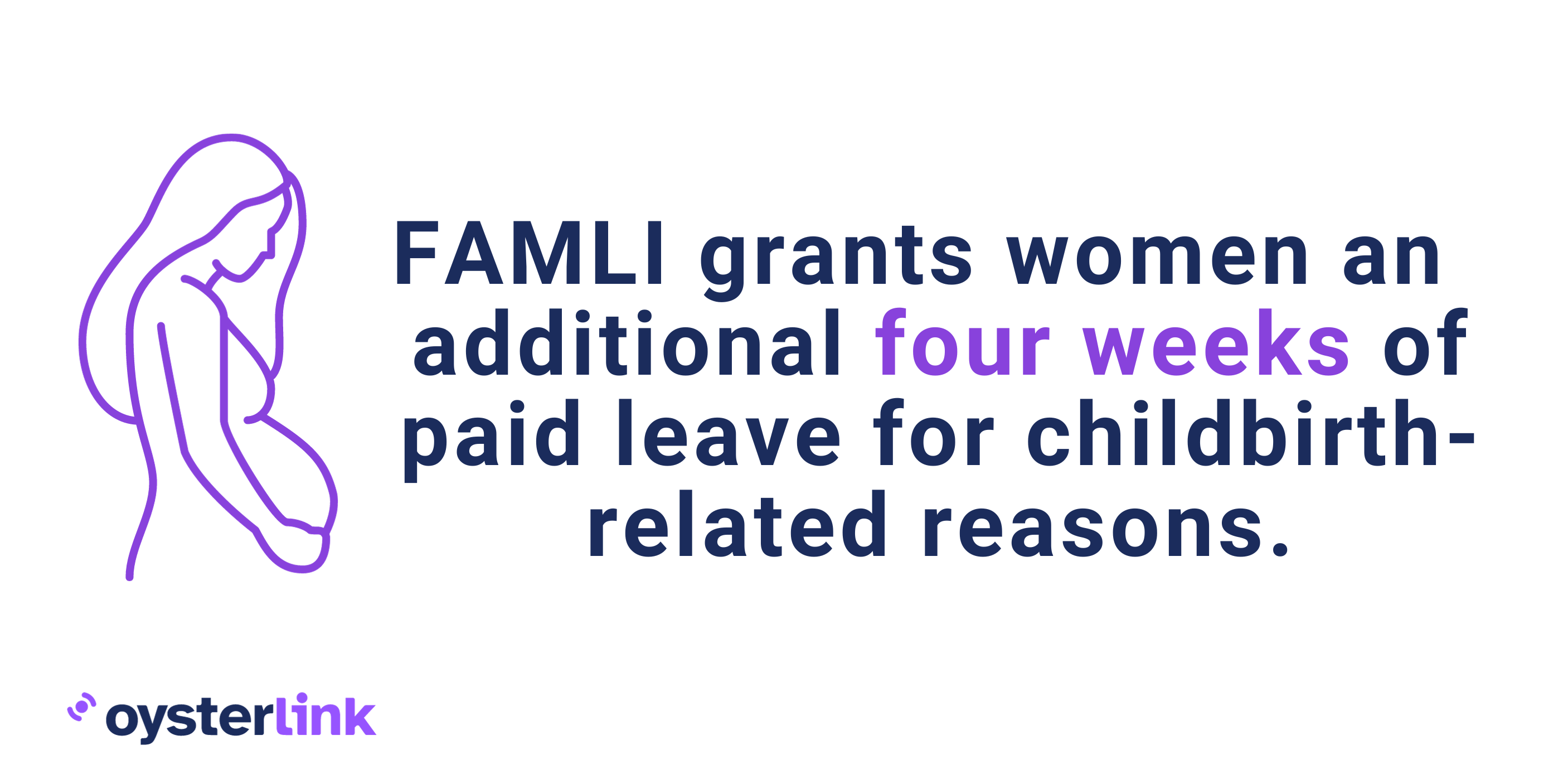

Recently, Colorado voters passed the Paid Family and Medical Leave Insurance program (FAMLI). FAMLI is a state law that offers more benefits compared to FMLA.

Under FAMLI, employees can receive up to 12 weeks of paid leave with an additional four weeks for pregnancy or childbirth-related situations.

The program is designed to benefit a wide range of workers, including the self-employed, independent contractors and employees of local government employers that have opted out.

To qualify for FAMLI benefits, workers need to have earned $2,500 in Colorado within the past year.

FAMLI leave can be used continuously, intermittently or with a reduced work schedule.

Other Leave Laws

Here’s a quick overview of various types of leaves under Colorado labor laws:

- Jury Duty: Regularly employed trial or grand jurors are entitled to receive regular wages, not exceeding fifty dollars per day, for the first three days of juror service or any part thereof. This is subject to mutual agreement between the employee and employer.

- Bereavement Leave: Colorado wage law neither mandates nor prohibits bereavement pay or bereavement leave, leaving it to the discretion of employers.

- Domestic Abuse Leave Law: Employees can request or take up to three working days of leave within a twelve-month period, with or without pay, if they are victims of domestic abuse, stalking, sexual assault, or any other crime related to domestic abuse.

Official Holidays in Colorado

In Colorado, wage laws do not mandate or prohibit employers from offering paid holidays or additional pay for holiday work.

If an employee receives holiday pay without working, those hours do not contribute to overtime unless they worked on the holiday Holidays recognized in Colorado include:

Workplace Safety and Health Regulations

Colorado is under federal Occupational Safety and Health Act (OSHA) jurisdiction which covers the majority of private-sector employees in the state. However, state and local government employees are not subject to federal OSHA regulations. OSHA plays a pivotal role in promoting workplace safety and health in Colorado, incorporating several key elements:

- Regulations: OSHA establishes and enforces safety and health regulations across diverse industries within the private sector, ensuring a comprehensive approach to workplace safety.

- Inspections: Conducting routine inspections in response to complaints or incidents, OSHA diligently evaluates compliance with safety and health regulations to maintain a secure work environment.

- Penalties: Non-compliance with OSHA regulations carries potential penalties, including fines, citations, and mandates to address safety hazards, underlining the importance of adherence to established standards.

- Training and Outreach: OSHA is committed to educating employers and employees through training and outreach programs, fostering awareness and understanding of safety and health matters within the workplace.

- Whistleblower Protection: In its dedication to promoting a culture of accountability, OSHA ensures whistleblower protection for employees reporting safety or health violations by their employers.

- Emergency Response: Providing vital guidance on emergency response and preparedness, OSHA ensures that workplaces are well-equipped to handle diverse emergency situations, ranging from fires and chemical spills to natural disasters.

- Small Business Assistance: Recognizing the unique challenges faced by small businesses, OSHA extends specialized assistance and consultation services, aiding them in meeting safety and health requirements effectively.

- Partnerships: OSHA actively collaborates with a spectrum of organizations, industries, and labor groups, fostering partnerships and alliances. This collaborative approach enhances workplace safety through the shared exchange of knowledge and resources, contributing to a safer working environment for all.

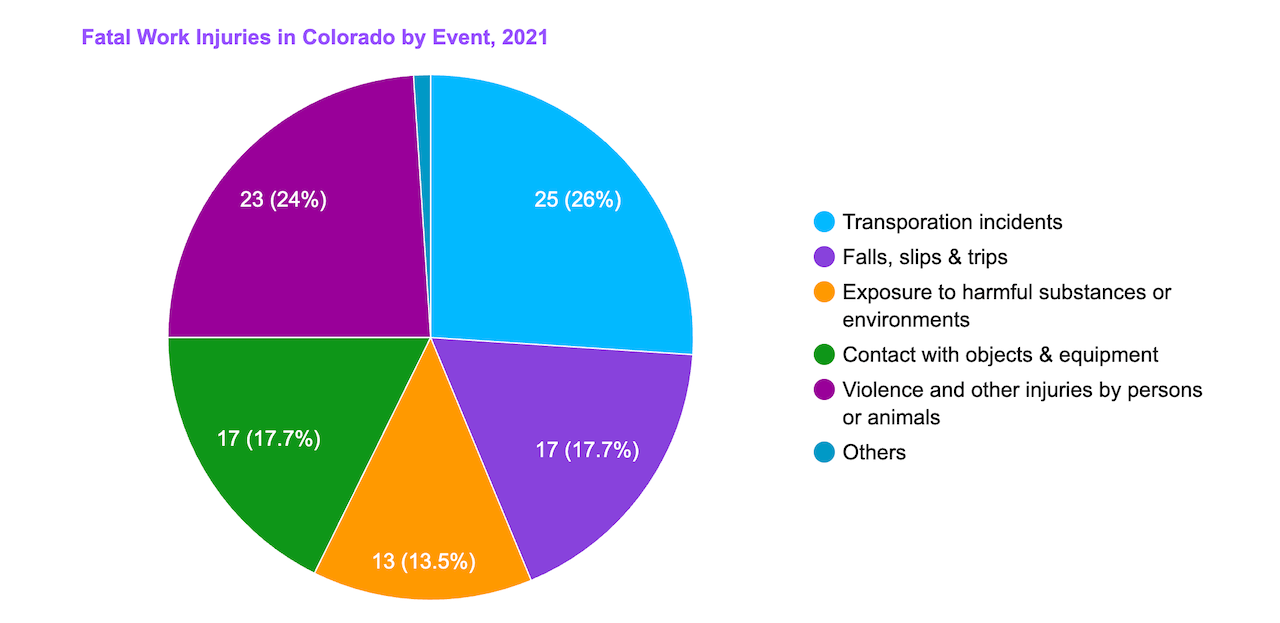

Based on the most recent data, there have been 96 fatal occupational injuries in Colorado State.

[Source: U.S. Bureau of Labor Statistics]

Transportation incidents remained the leading cause of fatalities, although they decreased by 13.8% from the previous year, going from 29 to 25 in 2021.

Violence and other injuries caused by persons or animals saw a significant increase of 155.6% from 2020.

Exposure to harmful substances or environments also rose by 44.4% over 2020, with 13 incidents in 2021 compared to 9 in the previous year.

Lastly, contacts with objects and equipment, as well as falls, slips, and trips, each accounted for 17 deaths in 2021.

Child Labor Laws in Colorado

In Colorado, employment rules for minors aim to create a supportive environment for young workers in consideration of their educational commitments.

Clear guidelines dictate the hours and conditions under which minors under the age of 16 can be employed, both on school days and non-school days.

Let's explore these regulations in detail, emphasizing the distinctions based on school schedules and the time of the year.

Work Limitations for Minors Under 16 on a School Day

- No more than three hours

- On Fridays, the day is considered a school day if the district is in session; however, on a non-traditional schedule, permissible non-school work hours apply on the fifth day

- No work in excess of 18 hours during a school week

- Minors under 16 may work up to 40 hours during non-school weeks

- On school days and during school hours, no employment for minors under 16 without a school release permit issued by the school district superintendent

On a Non-School Day

- A limit of eight hours

General Work Hours (Apply to Minors Under 16)

- Between 7:00 a.m. and 7:00 p.m. during the basic school year

- Between June 1 and Labor Day, evening hours extended to 9:00 p.m.

For minors ages 14-15, their working hours are limited to work experience, career exploration and work-study programs, a federal standard regulated by the U.S. Department of Labor, and followed by the Division of Labor Standards and Statistics.

Anti-Discrimination and Fair Employment Practices in Colorado

The Colorado Anti-Discrimination Act (CADA) serves as the primary law addressing anti-discrimination and fair employment practices in the state.

CADA prohibits discrimination in employment, housing, and public accommodations based on various factors, including:

- Disability

- Race

- Creed

- Color

- Sex

- Sexual orientation

- Gender identity

- Gender expression

- Religion

- Age (40+)

- National origin

- Ancestry

- Marital status

- Marriage to a co-worker

- Pregnancy, childbirth, and related conditions

Colorado recently enacted several legislative changes, including the Protecting Opportunities and Workers’ Rights (POWR) Act and the Job Application Fairness Act. The POWR Act imposes extensive recordkeeping duties on employers concerning discriminatory or unfair labor practices.

The Job Application Fairness Act, effective from July 1, 2024, prohibits employers from requesting age-related information in initial applications.

Independent Contractor Classification in Colorado

In Colorado, to be classified as an independent contractor, the employee needs to show they work independently and have their own trade or job related to the work they do. Normally, it's the employer's job to prove this, but it can change if there's a proper written contract.

The contract must contain the following clauses that both parties agree to follow:

- The company does not require the individual to work exclusively for the person for whom services are performed, except that the individual may choose to work exclusively for the said person for a finite period of time specified in the document.

- The company does not establish a quality standard for the individual, except that such person can provide plans and specifications regarding the work but cannot oversee the actual work or instruct the individual as to how the work will be performed.

- The company does not pay a salary or hourly rate but rather a fixed or contract rate.

- The company cannot terminate the work during the contract period unless the individual violates the terms of the contract or fails to produce a result that meets the specifications of the contract.

- The company does not provide anything more than minimal training for the individual.

- The company does not provide tools or benefits to the individual, except that materials and equipment may be supplied.

- The company does not dictate the time of performance, except that a completion schedule and a range of mutually agreeable work hours may be established.

- The company does not pay the individual personally but rather makes checks payable to the trade or business name of the individual.

- The company does not combine their business operations in any way with the individual's business, but instead maintains such operations as separate and distinct.

Termination and Final Paycheck Laws in Colorado

When an employer terminates an employee, they are required to issue the final paycheck to the terminated employee immediately, except:

- When the employer's payroll unit is not regularly open, the separated employee should receive their wages within six hours of the unit's next regular workday.

- When the unit is off-site, the employer must deliver the check within 24 hours to one of the following locations: a) the work site, b) the employer's local office, c) the employee's last-known mailing address.

If an employee chooses to quit their job, they must receive their final paycheck on the next regularly scheduled pay date. They may be paid by check, cash, or by direct deposit as on any other payday.

Summary

In Colorado, the minimum wage stands at $14.42 per hour, which is significantly higher than the federal minimum rate of $7.25 per hour.

The federal tipped minimum wage is $2.13 per hour. Employees who work over 40 hours a week, 12 hours per workday or 12 consecutive hours of work are entitled to 1.5 times their regular rate of pay.

They’re also entitled to a minimum 30-minute uninterrupted meal period when their shift exceeds five consecutive hours. Employers are required to issue the final paycheck to the terminated employee immediately.

Colorado falls under the federal Occupational Safety and Health Act (OSHA) for private-sector employees.

Frequently Asked Questions About Colorado Labor Laws

For more info, find frequently asked questions about the labor laws in Colorado below.

Is sick pay mandatory in Colorado?

Colorado mandates that employers provide accrued paid sick leave, up to 48 hours annually, and public health emergency leave, up to 80 hours per public health emergency, to their employees.

Is Colorado a “fire-at-will” state?

Yes, Colorado follows the principle of “at-will” employment wherein employers and employees have a relationship that can be terminated by either party at any time, without prior notice or cause. However, this rule is subject to exceptions including cases involving discrimination, violations of public policy and specific contractual agreements that limit the grounds for termination.

Can you be forced to work overtime in Colorado?

In Colorado, employers can require employees to work overtime, which is often referred to as “mandatory overtime.” While it’s legal, it’s not always recommended for employers as it carries potential repercussions for employee morale, retention rates and the increased risk for employee injury.

How many hours can you legally work a week in Colorado?

In Colorado, there is no set limit on the maximum number of hours a person can legally work in a day. However, eligible employees must receive overtime pay if they worked beyond 12 hours in a day

Disclaimer: This information serves as a concise summary and educational reference for Colorado state labor laws. It does not constitute legal advice. For personalized legal guidance, it is recommended to consult with an attorney.