Arkansas Labor Law Guide

A comprehensive guide to Arkansas labor laws: Covering key topics, including minimum wage regulations, overtime provisions, mandated breaks, hiring and termination procedures and other miscellaneous employment laws.

Key Takeaways

- The minimum wage in Arkansas is $11.00 per hour, applying to employers with four or more employees.

- Tipped employees in Arkansas must be paid a minimum of $2.63 per hour, with tips expected to bring their total compensation to the applicable minimum wage per hour.

- Overtime regulations require employers to pay nonexempt employees 1.5 times their regular rate of pay for hours worked beyond 40 in a workweek. Exempt employees do not qualify for overtime pay, provided they meet specific criteria.

- Arkansas labor laws do not mandate specific break or meal periods, but short rest breaks are common and must be compensated as hours worked.

- Family and medical leave laws in Arkansas largely align with the federal Family and Medical Leave Act (FMLA), allowing eligible employees to take up to 12 weeks of unpaid, job-protected leave for specific family and medical situations.

- State employees get 12 weeks of paid pregnancy leave.

- Arkansas is an employment-at-will state, allowing both employers and employees to terminate employment without specific reasons, with exceptions to protect against unlawful terminations.

- Final paychecks are typically due on the next regular payday, with penalties handed out to employers for delays.

Minimum Wage Regulations in Arkansas

Arkansas minimum wage regulations ensure that employers follow fair and equitable compensation requirements, maintaining economic stability for workers throughout the state.

The Arkansas Minimum Wage Act places restrictions on deductions from an employee's minimum wage. Non-standard deductions are generally not permitted if they would bring an employee's pay below the minimum wage rate per hour for the entire workweek.

These deductions may include:

- Spoilage or breakage

- Cash or inventory shortages or losses

- Fines or penalties related to lateness, misconduct or quitting without notice

Arkansas has specific minimum wage regulations that establish different minimum hourly rates for regular and tipped employees.

| State/District | Minimum wage |

| Alabama | $7.25 |

| Alaska | $11.73 |

| Arizona | $14.35 |

| Arkansas | $11 |

| California | $16 |

| Colorado | $14.42 |

| Connecticut | $15.69 |

| Delaware | $13.25 |

| Florida | $13 |

| Georgia | $7.25 |

| Hawaii | $14 |

| Idaho | $7.25 |

| Illinois | $14 |

| Indiana | $7.25 |

| Iowa | $7.25 |

| Kansas | $7.25 |

| Kentucky | $7.25 |

| Louisiana | $7.25 |

| Maine | $14.15 |

| Maryland | $15 |

| Massachusetts | $15 |

| Michigan | $10.33 |

| Minnesota | $10.85 |

| Mississippi | $7.25 |

| Missouri | $12.3 |

| Montana | $10.3 |

| Nebraska | $12 |

| Nevada | $12 |

| New Hampshire | $7.25 |

| New Jersey | $15.13 |

| New Mexico | $12 |

| New York | $15 |

| North Carolina | $7.25 |

| North Dakota | $7.25 |

| Ohio | $10.45 |

| Oklahoma | $7.25 |

| Oregon | $14.2 |

| Pennsylvania | $7.25 |

| Rhode Island | $14 |

| South Carolina | $7.25 |

| South Dakota | $11.2 |

| Tennessee | $7.25 |

| Texas | $7.25 |

| Utah | $7.25 |

| Vermont | $13.67 |

| Virginia | $12 |

| Washington | $16.28 |

| West Virginia | $8.75 |

| Wisconsin | $7.25 |

| Wyoming | $7.25 |

| District of Columbia | $16.5 |

[Source: FRED]

Regular Employees

The state minimum wage in Arkansas is $11.00 per hour. The Arkansas Minimum Wage Act applies to employers with four or more employees.

Employers covered by the federal Fair Labor Standards Act (FLSA) are also covered by the Arkansas law if they have four or more employees. Employers subject to both regulations must pay the highest minimum wage.

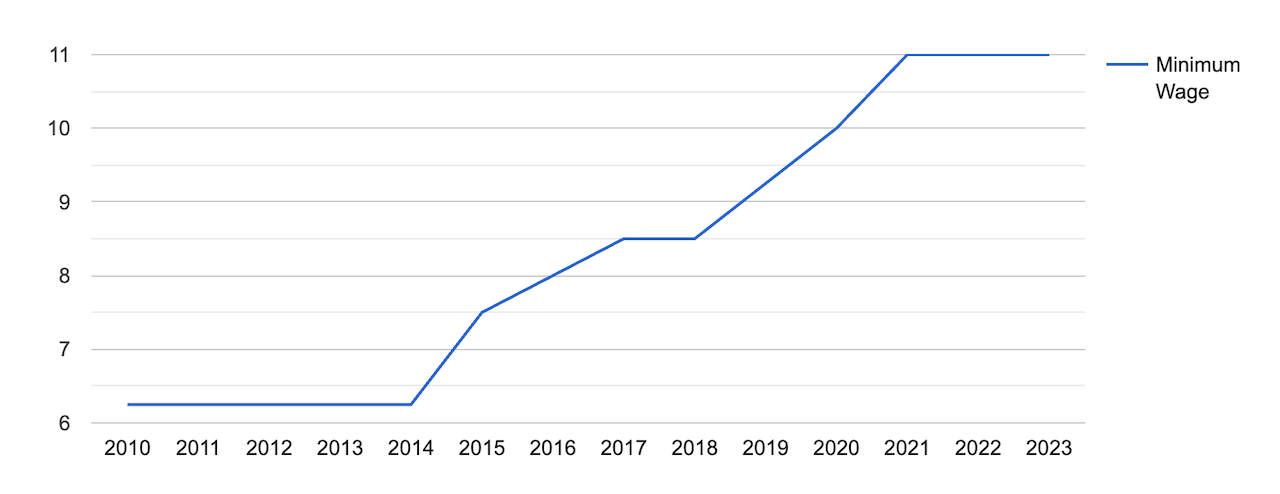

Here's how the minimum wage for regular employees in Arkansas changed over the years:

[Source: FRED]

Tipped Employees

Tipped employees in Arkansas must be paid a minimum of $2.63 per hour. Still, the tips they earn should bring their total compensation up to the applicable minimum wage per hour.

If the tips do not reach the minimum wage rate, the employer is responsible for making up the difference to ensure the employee receives at least the minimum wage.

It is crucial for both employers and employees to maintain accurate records of the tips received by their tipped employees to ensure compliance with these regulations.

Overtime Rules and Regulations in Arkansas

Overtime regulations in Arkansas aim to ensure that nonexempt employees are fairly compensated for their extra hours of work, while also providing certain exemptions. These regulations are in accordance with both state and federal laws.

Nonexempt Employees

Employers in Arkansas are required to pay overtime compensation to nonexempt employees who work more than 40 hours within a workweek. Overtime pay is set at 1.5 times the regular rate of pay.

Only actual hours worked count towards overtime calculations. If an employer pays an employee for hours that were not actually worked, such as for a holiday or a sick day, these hours are not considered when determining overtime eligibility under both state and federal overtime law.

Exempt Employees

Exempt employees in Arkansas are a specific category of workers who are not entitled to overtime pay.

Below is an overview of the key exemptions and criteria that apply to exempt employees in Arkansas:

Executive Exemption

Employees eligible for the executive exemption must:

- Be compensated on a salary basis at a rate not less than $684 per week

- Have their primary duty as managing the enterprise or a recognized department or subdivision

- Customarily and regularly direct the work of at least two or more full-time employees

- Possess the authority to hire or fire other employees, or have their recommendations regarding employment changes carry significant weight

Administrative Exemption

The administrative exemption applies to employees who:

- Are compensated on a salary or fee basis at a rate not less than $684 per week

- Have their primary duty involve non-manual work directly related to the management or general business operations of the employer or the employer's customers

- Exercise discretion and independent judgment on significant matters as part of their primary duties

Professional Exemptions

There are two subcategories for professional exemptions: learned professionals and creative professionals. To qualify for either of these exceptions, an employee must:

- Be compensated at a rate not less than $684 per week

- Have a primary duty consistent with their respective field of expertise

- Have knowledge acquired through specialized intellectual instruction (applicable for learned professionals)

- Perform work requiring imagination and originality in artistic or creative fields (applicable for creative professionals)

Computer Employee Exemption

Employees eligible for the computer employee exemption must:

- Be compensated on a salary or fee basis at a rate not less than $684 per week or $27.63 per hour, if paid hourly

- Be employed as a computer systems analyst, computer programmer, software engineer or in another similar computer-related role

- Have primary duties that involve activities related to computer systems, including analysis, design, development or modification

Outside Sales Exemption

To qualify for the outside sales exemption, employees must:

- Have a primary duty of making sales (as defined in the FLSA) or obtaining orders away from the employer's place of business

- Be customarily and regularly engaged away from the employer's place of business

Highly Compensated Employees

Highly compensated employees earning $107,432 or more annually, including at least $684 per week, may be exempt if they perform the duties of an exempt executive, administrative or professional employee.

Note: These exemptions are not applicable to blue-collar workers who engage in manual labor or repetitive operations, as they are entitled to minimum wage and overtime protections. They are also not applicable to first responders, such as police officers, firefighters, paramedics and other similar employees, are also not exempt from overtime regulations, regardless of their rank or pay level.

Break Periods in Arkansas

In Arkansas, neither state nor federal wage and hour laws mandate that employers provide specific break or meal periods to their employees. However, there are important considerations when it comes to rest and meal periods in the workplace.

Rest Breaks

Neither state nor federal regulations explicitly require employers to provide rest breaks, but short-duration rest periods, often around 20 minutes or less, are common in many industries as they tend to enhance efficiency.

Under state and federal minimum wage and overtime laws, these short rest periods must be counted as hours worked, and employees must be compensated for this time. In other words, employees are entitled to compensation for these short breaks.

Meal Breaks

Bona fide meal periods, typically lasting 30 minutes or more, are generally not considered work time and do not need to be compensated. However, for a meal period to be unpaid, the employee must be entirely relieved of their work-related duties during this time.

This means that employees must be free to use their meal period for their own purposes, and they should not be required to perform any duties, whether active or inactive, while eating.

If an employee is expected to perform any work-related tasks during their meal period, it must be treated as work time, and the employee should be compensated accordingly.

Family and Medical Leave Laws in Arkansas

In Arkansas, family and medical leave laws are largely governed by the federal Family and Medical Leave Act (FMLA). It allows eligible employees to take necessary leave without the fear of losing their jobs or health benefits.

The FMLA mandates that certain employers must provide up to 12 weeks of unpaid, job-protected leave for employees facing various family and medical situations, such as:

- The birth or adoption of a child

- Caring for a seriously ill family member

- Dealing with one's own serious health condition

To be eligible for FMLA leave, employees must meet specific criteria. They must have worked for a covered employer for at least one year and have logged at least 1,250 hours of work over the previous 12 months.

The employer must also have a workforce of at least 50 employees within 75 miles.

In April 2023, the Arkansas Governor signed a new law providing 12 weeks of paid maternity leave for state employees who have recently given birth or adopted an infant. The leave is funded from the Arkansas catastrophic leave fund.

Workplace Safety and Health Regulations in Arkansas

Compliance with the Occupational Safety and Health Administration (OSHA) regulations is essential for maintaining a safe and healthy work environment. Below is an overview of OSHA requirements and how they contribute to workplace safety:

- Workplace safety standards: Arkansas aligns with federal OSHA standards to ensure a consistent approach to workplace safety. Employers in the state have the responsibility of providing a safe working environment by identifying and mitigating potential hazards.

- Safety training and education: OSHA mandates employers in Arkansas to offer comprehensive safety training and education to their workforce.

- Recordkeeping and reporting: Accurate recordkeeping is a fundamental aspect of OSHA compliance. Employers are required to maintain records of workplace injuries, illnesses and near-miss incidents.

- Hazardous materials handling: Industries dealing with hazardous materials in Arkansas follow OSHA's Hazard Communication Standard. Employers must provide employees with essential information about hazardous substances, safety data sheets (SDS) and proper handling procedures.

- Inspections and enforcement: OSHA conducts inspections in Arkansas to verify compliance with workplace safety regulations. Employers should be prepared for unannounced inspections, which can result from complaints, accidents or random selection. Staying compliant helps businesses avoid penalties and legal consequences.

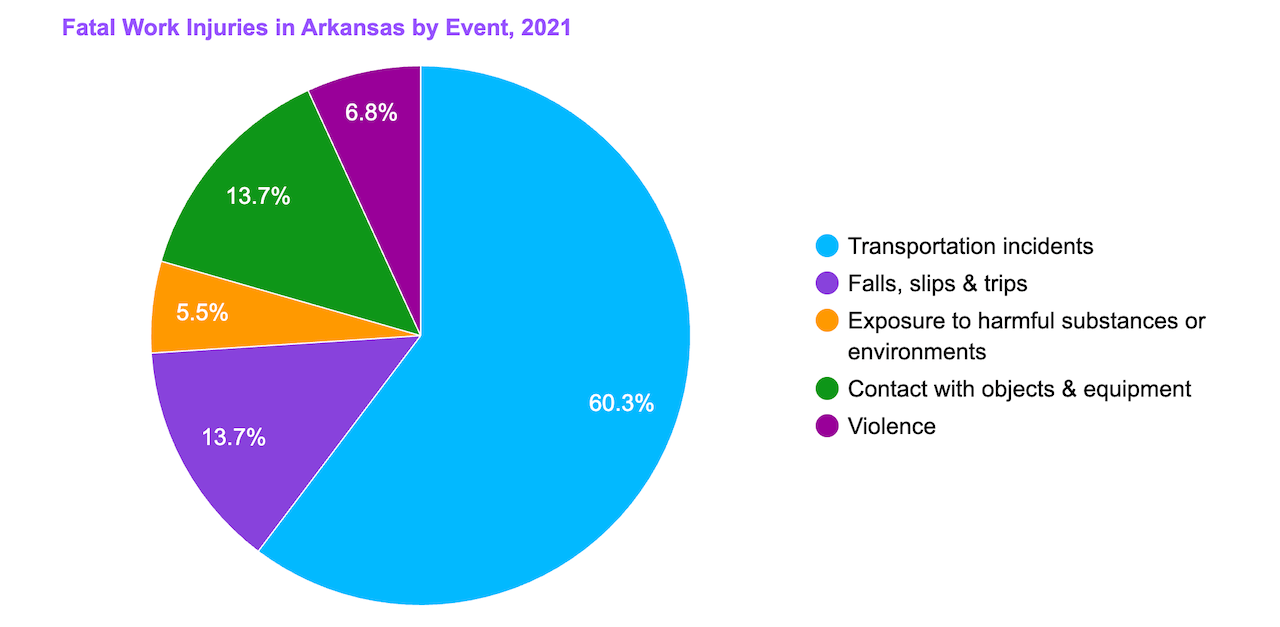

The pie chart below shows fatal occupational injuries by event in Arkansas, shedding light on the importance of workplace safety.

[Source: U.S. Bureau of Labor Statistics]

Arkansas Occupational Safety and Health (AOSH) is responsible for overseeing state safety and health laws, mainly in the public sector. They conduct investigations, respond to complaints and enforce safety regulations in public workplaces.

Additionally, they offer consultation inspections for various public sector entities free of charge, promoting a culture of safety by assisting in the development, implementation and maintenance of safety and health programs.

Anti-Discrimination and Fair Employment Practices in Arkansas

Arkansas enforces comprehensive anti-discrimination and fair employment practices, in line with both state and federal laws. The core principles include:

- Prohibited discrimination: Employers cannot discriminate in any employment aspect, including hiring, compensation, transfers and promotions, based on age, sex, race, religion, national origin, pregnancy or disability.

- Harassment and retaliation: Discriminatory practices encompass harassment and retaliation against individuals who report discrimination.

- Discrimination based on association: This extends to those associated with people facing discrimination due to factors like race, religion, national origin or disability.

Compliance with these laws promotes fairness and equal opportunities, ensuring a workplace free from discrimination and bias.

Independent Contractor Classification in Arkansas

Properly classifying workers as either employees or independent contractors is a crucial consideration for unemployment insurance (UI) tax purposes in Arkansas. To classify a worker as an independent contractor for UI tax purposes, one of the following conditions must be met:

- The service is performed outside the usual course of the business for which it is provided or outside all the places of business of the enterprise requiring the service.

- The individual is customarily engaged in an independently established trade, occupation, profession or business closely related to the service they offer.

Termination and Final Paychecks in Arkansas

Arkansas is an employment-at-will state, meaning both employers and employees can terminate the employment relationship at any time, without the need for specific reasons.

However, it's vital to be aware of exceptions to this rule. Under both state and federal laws, employers are prohibited from terminating employees based on factors such as age, sex, race, religion, national origin, pregnancy, disability or genetic information.

State law may provide protection when an employee is fired in violation of a clear public policy. This can include situations where an employee is discharged for refusing to engage in illegal activities, fulfilling jury duty, complying with a subpoena or reporting suspected violations of state or federal law.

When an employer terminates an employee, the employee's final paycheck is typically due on the next regular payday. If the employer fails to make this payment within seven days of the next regular payday, they will owe the employee double the wages that are due.

When navigating Arkansas labor laws and termination procedures, make sure you're equipped with financial clarity. Our Paycheck Calculator allows you to estimate your earnings after accounting for taxes and deductions, tailored to your state's tax laws.

Summary of Arkansas Labor Laws

In the state of Arkansas, the minimum wage stands at $11.00 per hour. This regulation extends its reach to employers with four or more employees.

Nonexempt employees in Arkansas are entitled to receive overtime pay at a rate of 1.5 times their regular wage if they exceed 40 hours of work within a single workweek. However, exempt employees, who meet specific criteria, are exempt from this provision and do not qualify for overtime pay.

When it comes to break periods, the state does not impose specific requirements for rest or meal breaks under either state or federal wage and hour laws.

Family and medical leave laws in Arkansas closely align with the federal Family and Medical Leave Act (FMLA), and employers in Arkansas must adhere to Occupational Safety and Health Administration (OSHA) state requirements.

Arkansas is steadfast in enforcing anti-discrimination and fair employment practices, thereby prohibiting discrimination based on a variety of factors, such as age, sex, race, religion, national origin, pregnancy or disability.

The state operates as an employment-at-will state, allowing both employers and employees the flexibility to terminate employment relationships at any time. Final paychecks are generally due on the next regular payday.

Frequently Asked Questions About Arkansas Labor Laws

Is the state of Arkansas a right-to-work state?

Yes, Arkansas is a right-to-work state. This means that employees are not required to join or financially support a union as a condition of employment. Unions cannot compel workers to pay union dues or fees.

What is the legal working age in Arkansas?

The legal working age in Arkansas is 14. However, there are restrictions on the number of hours and types of work that both 14-year-olds and 15-year-olds can perform.

Prohibited jobs are those involving hazardous chemicals, machinery operation, manufacturing, transportation, explosives, logging, slaughtering and many agricultural tasks, among others.

How many hours can you work in Arkansas?

Arkansas labor laws do not mandate specific limits on the number of hours an employee can work. Instead, working hours and break policies are typically determined by individual employers or collective bargaining agreements.

What holidays do Arkansas state employees get off work?

Arkansas state employees are typically granted the following holidays off:

- New Year's Day (January 1)

- Dr. Martin Luther King, Jr. Birthday and Robert E. Lee’s Birthday

- George Washington’s Birthday and Daisy Gatson Bates Day (the third Monday in January)

- Memorial Day (the last Monday in May)

- Independence Day (July 4)

- Labor Day (the first Monday in September)

- Veterans Day (November 11 )

- Thanksgiving Day (the fourth Thursday in November )

- Christmas Eve (December 24)

- Christmas Day (December 25)

- An employee’s birthday

How does holiday pay work in Arkansas?

Arkansas state law does not require private employers to provide paid holidays.

To qualify for holiday pay, public employees must have been in a paid status on their last scheduled workday before the holiday and their first scheduled workday after the holiday.

Does Arkansas have a paid leave?

Yes, Arkansas does offer 12 weeks of paid leave for pregnancy since 2023.

Disclaimer: This information serves as a concise summary and educational reference for Arkansas state labor laws. It does not constitute legal advice. For personalized legal guidance, it is recommended to consult with an attorney.