Arizona Labor Law Guide

A comprehensive guide to Arizona labor laws: Covering key topics including minimum wage regulations, overtime provisions, mandated breaks, hiring and termination procedures and other miscellaneous employment laws.

Key Takeaways of Arizona Labor Laws

- Arizona’s minimum wage is $14.35 per hour—around 98% higher than the federal wage rate of $7.25.

- Arizona employers are not required to provide lunch breaks or rest periods to their employees.

- Non-exempt employees are entitled to time and a half pay, or 1.5 times their regular rate of pay, for overtime at a minimum of $21.52 per hour for work hours exceeding 40 in 1 workweek.

- Arizona is an at-will state where both employers and employees can end their employment relationship without cause.

- Arizona is a right-to-work state.

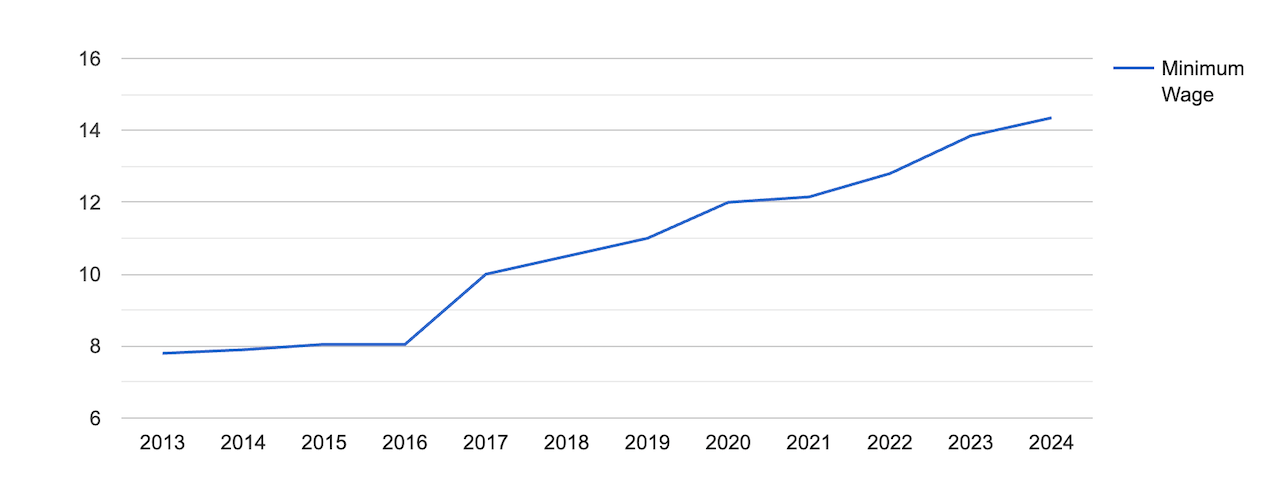

Minimum Wage Regulations in Arizona

Arizona’s minimum wage is $14.35 per hour, and this amount is adjusted every 1st of January based on the current cost of living as part of the Fair Wages and Healthy Families Act.

These minimum wage regulations do not apply to Arizona employers with employees working on tribal lands.

| State/District | Minimum wage |

| Alabama | $7.25 |

| Alaska | $11.73 |

| Arizona | $14.35 |

| Arkansas | $11 |

| California | $16 |

| Colorado | $14.42 |

| Connecticut | $15.69 |

| Delaware | $13.25 |

| Florida | $13 |

| Georgia | $7.25 |

| Hawaii | $14 |

| Idaho | $7.25 |

| Illinois | $14 |

| Indiana | $7.25 |

| Iowa | $7.25 |

| Kansas | $7.25 |

| Kentucky | $7.25 |

| Louisiana | $7.25 |

| Maine | $14.15 |

| Maryland | $15 |

| Massachusetts | $15 |

| Michigan | $10.33 |

| Minnesota | $10.85 |

| Mississippi | $7.25 |

| Missouri | $12.3 |

| Montana | $10.3 |

| Nebraska | $12 |

| Nevada | $12 |

| New Hampshire | $7.25 |

| New Jersey | $15.13 |

| New Mexico | $12 |

| New York | $15 |

| North Carolina | $7.25 |

| North Dakota | $7.25 |

| Ohio | $10.45 |

| Oklahoma | $7.25 |

| Oregon | $14.2 |

| Pennsylvania | $7.25 |

| Rhode Island | $14 |

| South Carolina | $7.25 |

| South Dakota | $11.2 |

| Tennessee | $7.25 |

| Texas | $7.25 |

| Utah | $7.25 |

| Vermont | $13.67 |

| Virginia | $12 |

| Washington | $16.28 |

| West Virginia | $8.75 |

| Wisconsin | $7.25 |

| Wyoming | $7.25 |

| District of Columbia | $16.5 |

[Source: FRED]

Regular Employees

Regular employees are entitled to the full current state minimum wage of $14.35 per hour in Arizona.

All employees, whether paid hourly or on a salary basis, must be paid the minimum wage for all the hours they worked.

[Source: FRED]

Keep in mind that some municipalities in Arizona can have their own minimum wage, like Flagstaff, with its own minimum wage of $17.40.

These municipalities cannot impose a minimum wage lower than the state minimum wage.

Tipped Employees

Employees receiving tips in Arizona are entitled to be paid a minimum wage of $10.85 - 11.35 per hour.

This means that the maximum tip credit is $3.00, which can come from the employees’ tips directly from customers or the tip pool. Employers should make up the difference if an employee’s combined wages and tips do not reach the minimum wage of $14.35.

Employees should keep in mind that the minimum wage is not equal to their total earnings at the end of the day, as there are state taxes and other deductions to consider.

To better understand and calculate your net income more accurately, check out our Paycheck Calculator.

Overtime Rules and Regulations in Arizona

Arizona does not have state-specific overtime laws. Employers thereby follow federal regulations outlined in the Fair Labor Standards Act (FLSA), wherein the overtime rate is 1.5 times their regular pay, or time and a half, for work hours exceeding 40 in 1 workweek.

Non-Exempt Employees

Non-exempt employees in Arizona are entitled to overtime pay at a minimum of $21.52 per hour or 1.5 times the regular rate of pay for hours worked over the first 40 in 1 workweek.

Non-exempt employees generally include workers such as restaurant staff, retail associates, administrative assistants, etc.

To help calculate overtime pay for non-exempt employees, check out our time and a half calculator.

Exempt Employees

Exempt employees are often salaried workers, typically in executive, managerial, administrative or other professional positions and are not entitled to overtime pay.

Specific FLSA guidelines and the nature of the job determine the classification of exempt or non-exempt status.

At-Will Employment in Arizona

Arizona is an at-will employment state, which means that either the employer or employee can sever their working relationship at any time with or without cause, except for reasons prohibited by law (e.g., discriminatory).

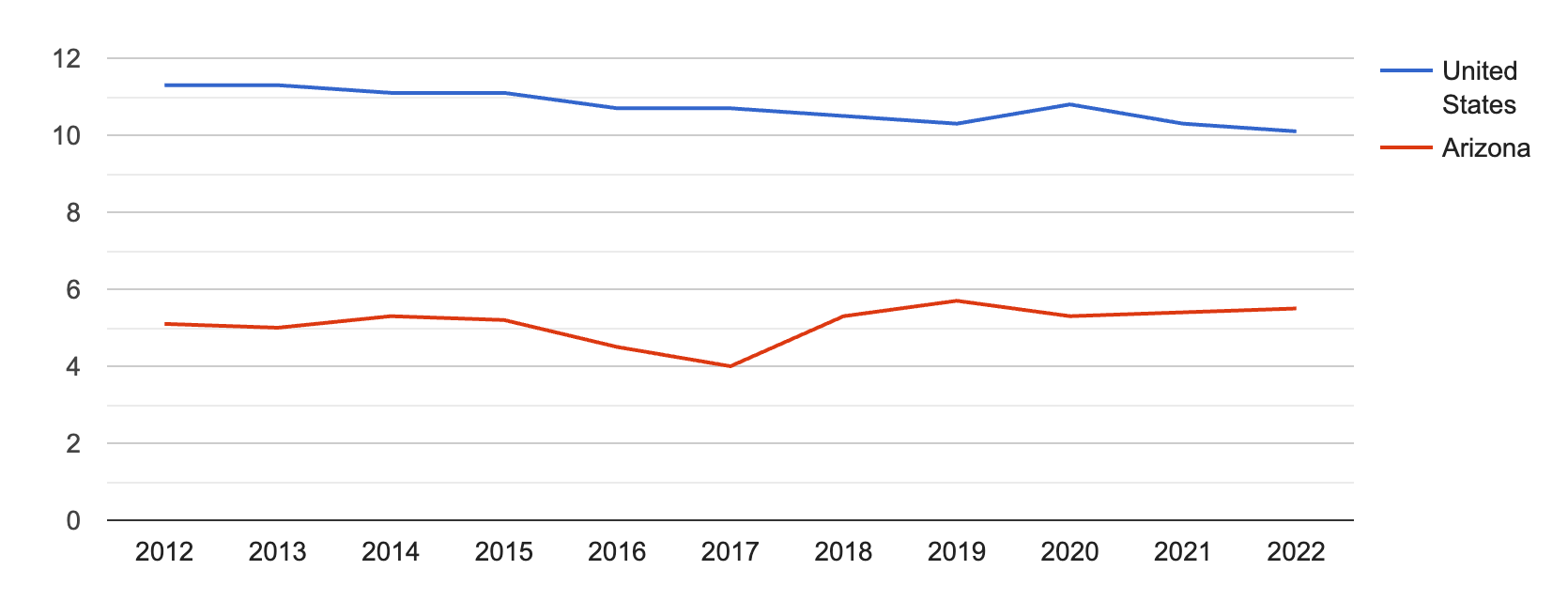

Right-To-Work Laws in Arizona

Arizona is a right-to-work state, which guarantees that employers cannot discriminate against individuals in hiring or retaining employment based on their union membership status.

[Source: U.S. Bureau of Labor Statistics]

Approximately 5.5% of all wage and salary workers in Arizona are union members, and this figure remained fairly consistent compared to 5.4% in 2021.

Rest and Meal Breaks in Arizona

There are no state or federal laws that require Arizona employers to provide rest or meal breaks.

However, following federal law, breaks lasting less than 20 minutes are considered part of the employee’s workday and must be compensated.

Breaks exceeding this duration, however, need not be paid as long as the employee is not engaged in any work-related tasks during that time.

Family and Medical Leave Laws in Arizona

Employees in Arizona are protected by the Family and Medical Leave Act (FMLA), which provides them job-protected time off for family and medical purposes, with the ability to return to work with similar pay, benefits, etc.

Family and Medical Leave Act

Under the FMLA, employees in Arizona are entitled to time off for different reasons.

To qualify for FMLA leave, you must satisfy these requirements:

- Have been employed by the company for a minimum of 12 months (1 year)

- Have had 1,250 hours in the previous year

- Work at a site with at least employees within 75 miles

Employers should adhere to the FMLA if they have a workforce of 50 employees or more for a minimum of 20 weeks.

State government employees have recently received an extension of FMLA benefits, allowing them up to 12 weeks of paid leave to care for a new baby or adoptive or foster child.

Additionally, they can accrue 480 hours or 12 weeks of paid sick leave annually, with a 40-hour cap they can use for personal or family-related reasons.

Other Leave Laws

Here is a summary of various types of leaves as outlined by Arizona labor laws:

- Jury duty: Employers should provide time off to employees for jury duty, but they are not obligated to pay the employee for this period. Employers also cannot insist that employees use their annual, vacation or sick leave for this purpose.

- Voting: Employers should grant employees a minimum of three consecutive hours off to vote. Employers have the flexibility to designate a specific three-hour window within the workday, and any work hours falling within this period should be paid.

- Donor: Employees have five days of paid leave to serve as a bone marrow donor and 30 days as an organ donor.

- Bereavement: Employers are not required to grant their employees bereavement leave.

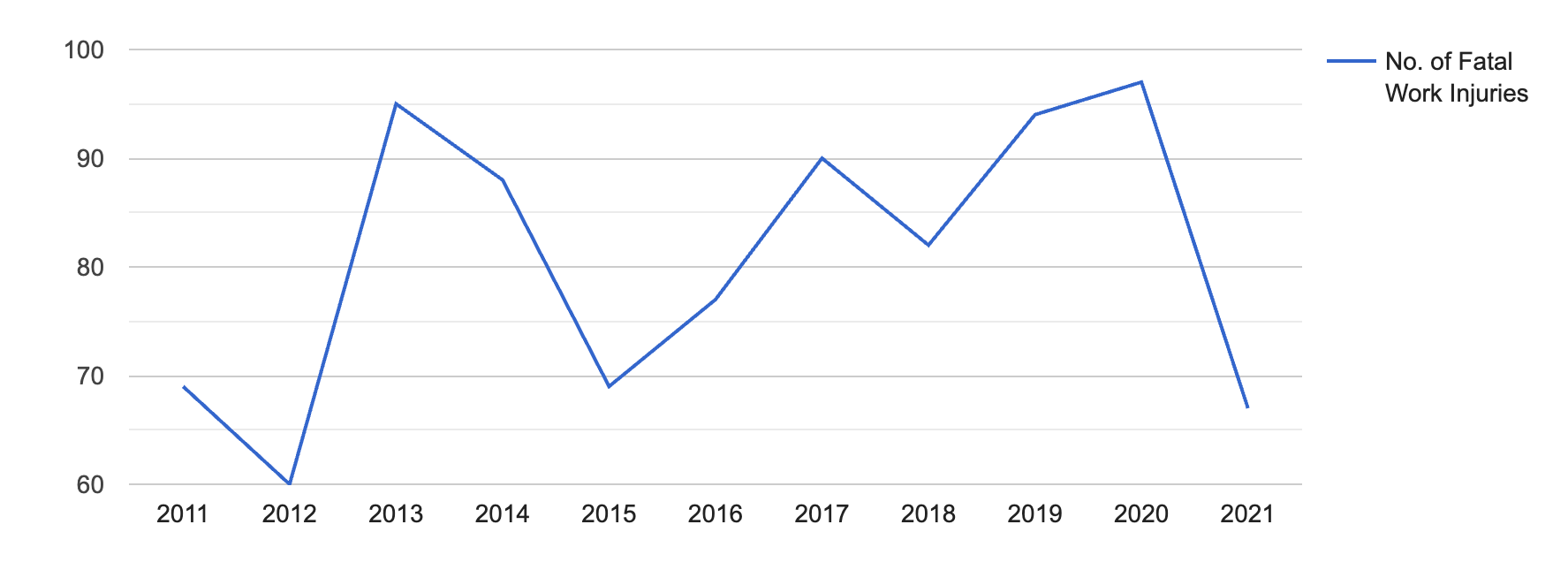

Workplace Safety and Health Regulations in Arizona

The Arizona Division of Occupational Safety and Health (ADOSH) under the Industrial Commission of Arizona (ICA) adopts federal Occupational Safety and Health Administration (OSHA) standards in the enforcement of its regulations and other provisions, which apply to all public and private sector workplaces in Arizona except federal government workers.

These regulations include emergency action plans, training requirements, protective equipment, storage, standards, etc.

[Source: U.S. Bureau of Labor Statistics]

There were 67 fatal occupational injuries in Arizona in 2021, which is about 31% lower compared to 97 in 2020.

| State/District | No. of Fatal Work Injuries |

| Alabama | 111 |

| Alaska | 20 |

| Arizona | 67 |

| Arkansas | 74 |

| California | 462 |

| Colorado | 96 |

| Connecticut | 23 |

| Delaware | 13 |

| Florida | 315 |

| Georgia | 187 |

| Hawaii | 15 |

| Idaho | 30 |

| Illinois | 176 |

| Indiana | 157 |

| Iowa | 49 |

| Kansas | 63 |

| Kentucky | 97 |

| Louisiana | 141 |

| Maine | 19 |

| Maryland | 80 |

| Massachusetts | 97 |

| Michigan | 140 |

| Minnesota | 80 |

| Mississippi | 41 |

| Missouri | 147 |

| Montana | 40 |

| Nebraska | 39 |

| Nevada | 43 |

| New Hampshire | 21 |

| New Jersey | 110 |

| New Mexico | 53 |

| New York | 247 |

| North Carolina | 179 |

| North Dakota | 34 |

| Ohio | 171 |

| Oklahoma | 86 |

| Oregon | 66 |

| Pennsylvania | 162 |

| Rhode Island | 5 |

| South Carolina | 107 |

| South Dakota | 20 |

| Tennessee | 132 |

| Texas | 533 |

| Utah | 52 |

| Vermont | 10 |

| Virginia | 125 |

| Washington | 73 |

| West Virginia | 36 |

| Wisconsin | 105 |

| Wyoming | 27 |

| District of Columbia | 12 |

[Source: U.S. Bureau of Labor Statistics]

In total, the number of fatal injuries in Arizona is 34% lower than the average number of fatal injuries in all states at 102 fatal work injuries.

Child Labor Laws in Arizona

The legal working age in Arizona is 14, with limitations in occupations, such as those that use heavy machinery, meat processing, mining and logging, manufacturing, food retail, agriculture, etc., and work hours.

Working Hours

Minors under 16 can work up to 3 hours on school days and 8 hours on nonschool days, with weekly limits.

On school nights, work can start at 6:00 a.m. and end by 9:30 p.m., or 11:00 p.m. if the minor has no school the next day.

When school’s out, they can work up to 8 hours a day, not before 6:00 a.m. or after 11:00 p.m.

Work ends at 7:00 p.m. during the school year and 9:00 p.m. in summer, with no work before 7:00 a.m.

Work Permit

The state does not require work permits, but minors should provide proof of age upon employment. Permission from minors’ parents is not required.

Anti-Discrimination Laws in Arizona

As per the Arizona Civil Rights Act (ACRA), discrimination based on age, color, disability, genetics, national origin, parental status, political affiliation, pregnancy, race, religion, retaliation and sex is prohibited by state and federal law.

The ACRA applies to employees with 15 employees or more. However, it also applies to employers with one or more employees in sexual harassment cases.

- Equal Pay Act: Stops employers from paying anyone at a lesser rate than it pays to employees of the opposite sex for the same job in the same place, doing the same work with the same skill. Any deals to pay less are not allowed. This rule applies to all employers—public or private.

- Age Discrimination in Employment Act (ADEA): Protects older employees from age-based discrimination in hiring, promotions, and compensation.

- Americans with Disabilities Act (ADA): Prevents discrimination against job applicants and employees with disabilities, requiring reasonable accommodations.

- Fair Credit Reporting Act (FCRA): Ensures privacy and accuracy in consumer report data used for employment decisions.

- Genetic Information Nondiscrimination Act (GINA): Prevents genetic information–based discrimination. This can include information about an individual's genetic makeup, family medical history, or genetic testing results.

- Immigration Reform and Control Act (IRCA): Prohibits discrimination in hiring, establishes penalties for employment of illegal aliens and requires identity verification using Form I-9.

- Pregnancy Discrimination Act: Prohibits pregnancy-based workplace discrimination.

- Pregnant Workers Fairness Act of 2023: Requires employers to provide reasonable accommodations for pregnant employees, if feasible.

- PUMP for Nursing Mothers Act: Mandates breaks and private spaces, excluding bathrooms, for nursing mothers to express breast milk at work.

- Rehabilitation Act of 1973: Prevents disability-based employment discrimination for organizations receiving federal funding.

- Uniformed Services Employment and Reemployment Rights Act (USERRA): Mandates employers to grant military leave for up to five years and typically reinstate employees to their previous or equivalent positions post-military service.

Independent Contractor Classification in Arizona

Employers must differentiate employees and independent contractors to comply with local tax and wage rules. Employees are under employer control, while independent contractors have more autonomy in their trade or business.

Employers should contact the Arizona Department of Economic Security in case of questions related to employee and independent contractor classification.

Official Holidays in Arizona

Employers in Arizona are not required to provide vacation days or holiday pay for holidays. For a list of the official state holidays, check the table below.

[Source: Arizona Department of Administration]

Termination and Final Paychecks in Arizona

Arizona law mandates that when an employer terminates an employee, they must pay the owed wages within seven working days or by the end of the next regular pay period, whichever comes first.

For employees who choose to resign, the employer should pay all owed wages by the regular payday for the pay period in which the termination occurred.

Miscellaneous Arizona Labor Laws

Discover other Arizona laws in employment and labor relations.

Wage Payment

Employees must be paid all owed wages at least twice a month, with fixed paydays not more than 16 days apart. If the payday falls on a holiday, payment should be made on or before.

Wages can only be withheld as required by law, with employee consent, or in case of a legitimate dispute.

Employers should keep an accurate record of employee wages, work hours, etc., as outlined in employee pay stubs. Noncompliance can result in disputes or penalties for employers.

Unemployment Insurance

The Arizona Department of Economic Security manages a state unemployment insurance program that offers benefits to individuals who lost their jobs through no fault of their own, which can include reasons like natural disasters.

Drug Testing

Arizona law allows, but not requires, employers to hold a drug test as a condition of employment as per their written policy and confidentiality agreement.

Moreover, Arizona provides medical marijuana registration identification cards to eligible patients, and these individuals should not face penalties for holding such cards or testing positive for marijuana.

Smoking Laws

Arizona law prohibits smoking in all public places and workplaces with very few exceptions.

Gun Laws

Arizona’s Guns-at-Work Laws allow employees to store firearms in their locked and privately owned vehicles or motorcycles as long as they are not visible from the outside.

However, there are exceptions, including when employers offer secured parking areas with designated firearm storage.

Unlike some states, Arizona’s law does not provide immunity for employers who follow these rules.

Frequently Asked Questions About Arizona Labor Laws

Stay updated on Arizona labor laws by reading answers to some commonly asked questions by Arizonans.

What is the legal working age in Arizona?

The minimum age for employment in Arizona is 14 years old, with several limitations in occupations and work hours for employees under the age of 18.

What is the minimum wage in Arizona?

Arizona’s minimum wage is $14.35 per hour. This changes every start of the year in consideration of the cost of living.

What are the termination laws in Arizona?

Both employees and employers can terminate their working relationship for any lawful reason, or even without a specific reason, at any time. This aligns with Arizona’s at-will employment doctrine.

Does Arizona have laws for work breaks?

Arizona does not have any laws that require employers to provide work breaks. This is at the employer’s discretion, and break policies should be clarified during the hiring process.

How much is the income tax rate in Arizona?

Starting in 2023, Arizona has a flat individual income tax rate of 2.50% and a corporate income tax rate of 4.90%.

How is overtime paid in Arizona?

Hours that qualify as overtime should be paid 1.5 times the employee’s regular rate of pay (or time and a half pay).

What is a livable salary in Arizona?

According to a study by MIT, a livable salary for a single person is $31,077 or $17.78 per hour.

Disclaimer: This information serves as a concise summary and educational reference for Arizona labor laws. It does not constitute legal advice. For personalized legal guidance, it is recommended to consult with an attorney.