Alaska Labor Law Guide

A comprehensive guide to Alaska labor laws: Covering key topics, including minimum wage regulations, overtime provisions, mandated breaks, hiring and termination procedures and other miscellaneous employment laws.

Key Takeaways of Alaska Labor Laws

- Alaska’s minimum wage is $11.73 per hour and is adjusted every year.

- Employers in Alaska are not required to provide breaks for adult employees.

- Minors aged 14–17 should have a break of at least 30 minutes for shifts exceeding 5 hours.

- Eligible employees should be paid time and a half, or 5 times their regular pay, for overtime at a minimum of $17.59 per hour for work hours exceeding 8 per day or 40 in 1 workweek.

- Alaska is an at-will employment state where employers and employees could end their employment relationship at any time without cause.

- Alaska is not a right-to-work state.

Minimum Wage Regulations in Alaska

Alaska’s minimum wage is adjusted annually and is currently at $11.73 per hour.

Should a recent ballot measure be passed, the minimum wage for Alaskans will be raised to $13 per hour effective July 1, 2025, $14 per hour effective July 1, 2026, $15 per hour effective July 1, 2027, and adjusted annually for inflation thereafter.

| State/District | Minimum wage |

| Alabama | $7.25 |

| Alaska | $11.73 |

| Arizona | $14.35 |

| Arkansas | $11 |

| California | $16 |

| Colorado | $14.42 |

| Connecticut | $15.69 |

| Delaware | $13.25 |

| Florida | $13 |

| Georgia | $7.25 |

| Hawaii | $14 |

| Idaho | $7.25 |

| Illinois | $14 |

| Indiana | $7.25 |

| Iowa | $7.25 |

| Kansas | $7.25 |

| Kentucky | $7.25 |

| Louisiana | $7.25 |

| Maine | $14.15 |

| Maryland | $15 |

| Massachusetts | $15 |

| Michigan | $10.33 |

| Minnesota | $10.85 |

| Mississippi | $7.25 |

| Missouri | $12.3 |

| Montana | $10.3 |

| Nebraska | $12 |

| Nevada | $12 |

| New Hampshire | $7.25 |

| New Jersey | $15.13 |

| New Mexico | $12 |

| New York | $15 |

| North Carolina | $7.25 |

| North Dakota | $7.25 |

| Ohio | $10.45 |

| Oklahoma | $7.25 |

| Oregon | $14.2 |

| Pennsylvania | $7.25 |

| Rhode Island | $14 |

| South Carolina | $7.25 |

| South Dakota | $11.2 |

| Tennessee | $7.25 |

| Texas | $7.25 |

| Utah | $7.25 |

| Vermont | $13.67 |

| Virginia | $12 |

| Washington | $16.28 |

| West Virginia | $8.75 |

| Wisconsin | $7.25 |

| Wyoming | $7.25 |

| District of Columbia | $16.5 |

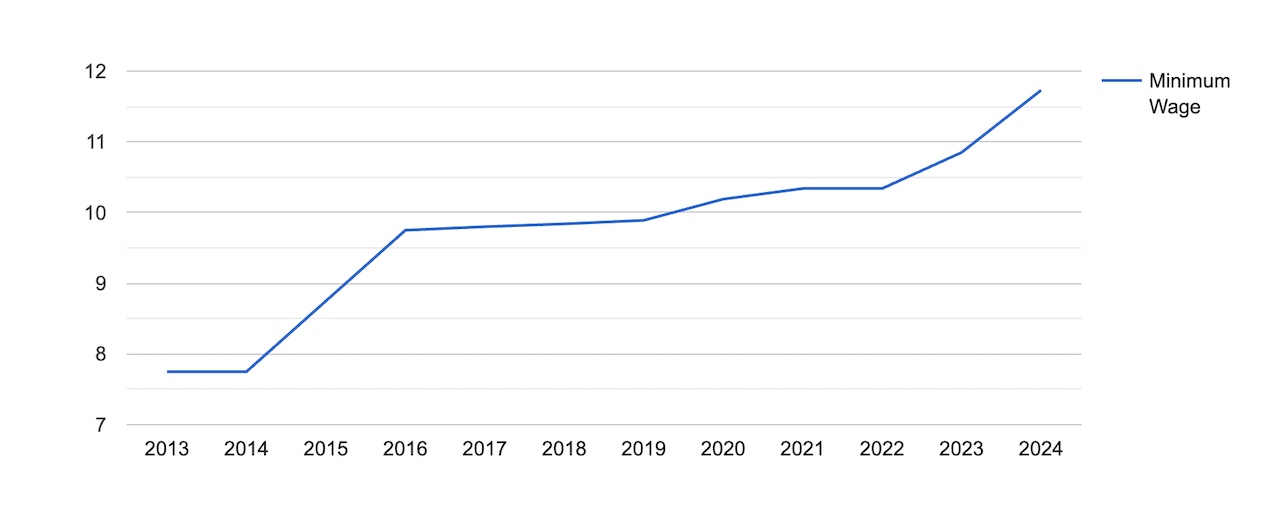

[Source: FRED]

Regular Employees

The current state minimum wage in Alaska is $11.73 per hour, which is higher than the federal wage rate.

[Source: FRED]

Alaska’s minimum wage has been on an increasing trend since 2015 after staying at $7.75 for five years from 2010 to 2014.

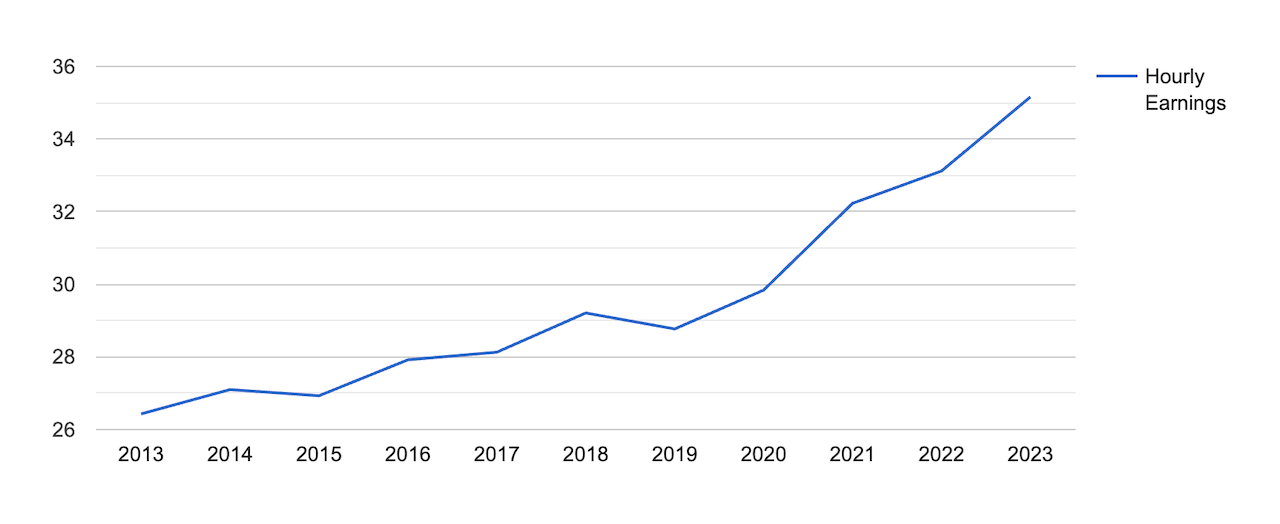

Notably, the average hourly earnings of all employees in Alaska is $35.31.

[Source: FRED]

Tipped Employees

Unlike federal law and in most states, Alaska does not allow a tip credit, which means that tipped employees must also be paid the full minimum wage of $11.73 per hour.

This means that any tips or gratuities received by tipped employees during their shift will not be used to offset their hourly wage.

This means that tipped employees in Alaska can be more assured of earning a consistent and fair wage, regardless of fluctuations in tip income.

Keep in mind that Alaska does not have a state income tax and state sales tax, making Alaska one of the most tax-friendly states in the United States (U.S.). Keep in mind, however, that other taxes and deductibles, such as federal taxes, do apply.

For a fast, simple way to calculate your earnings after other taxes and deductions, you can check out OysterLink’s Paycheck Calculator.

Overtime Rules and Regulations in Alaska

Alaska is aligned with federal overtime regulations outlined in the Fair Labor Standards Act (FLSA) when it comes to employees being paid their overtime rate for work exceeding 40 hours in 1 workweek.

Nonexempt Employees

Nonexempt employees in Alaska should be paid time and a half pay or 1.5 times their regular hourly rate for overtime work at a minimum of $17.59 per hour.

Employers in Alaska cannot use a fluctuating workweek method when they calculate overtime pay.

What distinguishes Alaska from most other states is its unique provision for daily overtime pay, where employees are entitled to receive time and a half after working for more than eight hours in a single day.

To easily calculate your overtime earnings, check out our time and a half calculator.

Keep in mind that only employers with at least four employees are required to pay overtime.

Exempt Employees

Under the Alaska Wage and Hour Act, here are some examples of employees who are exempt, or are not entitled to overtime pay:

- Student learners (departmental application/approval required)

- Employees in agriculture

- Employees involved in the taking of aquatic life

- Employees engaged in hand-picking shrimp

- Domestic service workers (including babysitters) in private homes

- Employees delivering newspapers to consumers

- Watchmen or caretakers on non-operational premises, property or plants for four months or more

- Bona fide executive, professional or administrative employees as defined by FLSA

- Employees in forestry or lumber operations with a total workforce of 12 or fewer

- Community health aides in local or regional health organizations

For a full list of exempt employees, consult Alaska’s Department of Labor and Workforce Development.

At-Will Employment in Alaska

Alaska observes an employment-at-will doctrine, which means that, unless there is a specific contract in place, either the employer or employee can terminate their working relationship without cause or notice—provided that there are no legitimate allegations associated with discrimination, retaliation, contraventions of public policy or other unlawful justifications.

No Right-To-Work Laws in Alaska

Alaska has not enacted any right-to-work law, which means workers are not legally required to join or financially support a labor union as a condition of their employment.

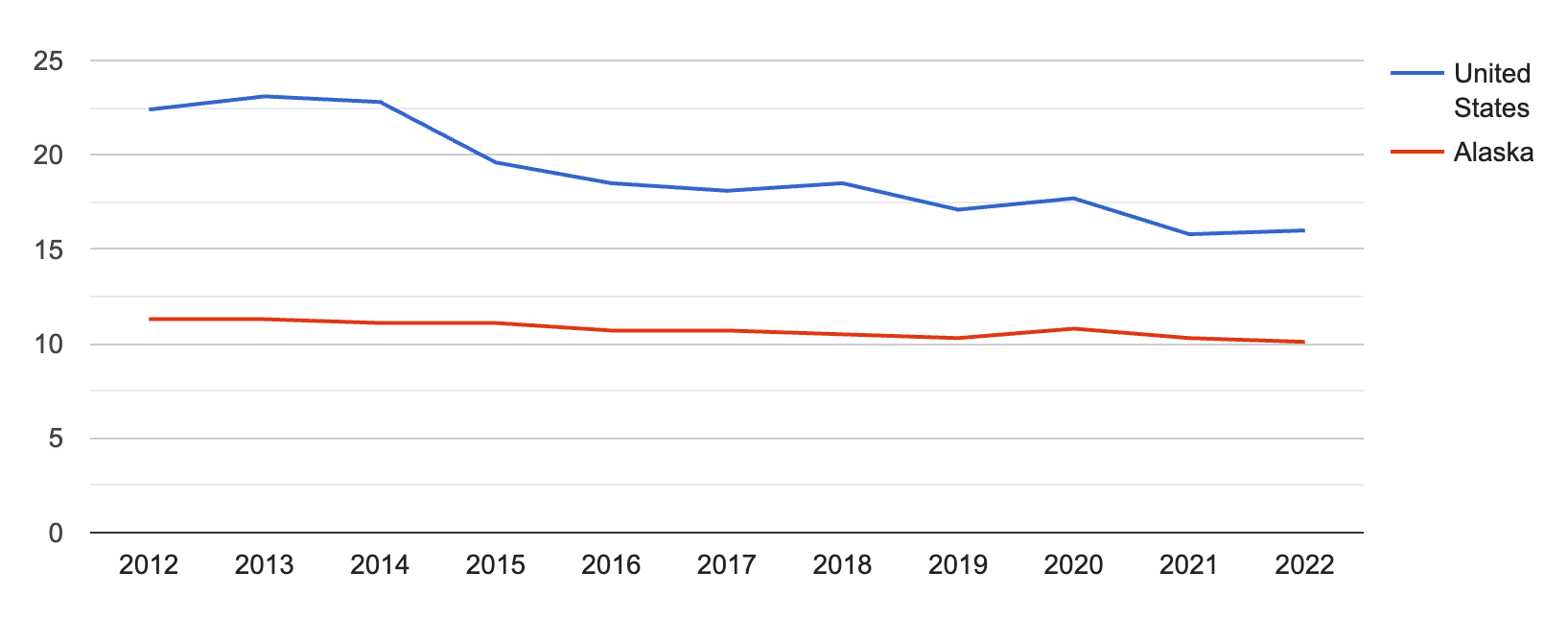

[Source: U.S. Bureau of Labor Statistics]

Alaska’s union membership rate is higher than the country’s average at 10.1%.

Rest and Meal Breaks in Alaska

State law mandates break periods of at least 30 minutes only for minor employees (14–17 years of age). Otherwise, employers are not required to give breaks.

When your employer permits short breaks lasting less than 20 minutes, they must compensate you for these breaks.

However, if your employer allows for longer meal periods exceeding 20 minutes, they are not obligated to pay you for this time, provided you do not perform any work during the meal period.

Family and Medical Leave Laws in Alaska

Employees in Alaska are protected by the Family and Medical Leave Act (FMLA) and the Alaska Family Leave Act (AFLA).

Family and Medical Leave Act

Under the FMLA, employees in Alaska are entitled to take a leave for qualifying family and medical reasons.

You must meet the following requirements to qualify for the FMLA leave:

- Worked for the employer for a year

- Worked in general for at least 1,250 hours in the previous year

- Work for an employer with at least 50 employees in its workforce within 75 miles

Alaska Family Leave Act

According to this Act, eligible employees working for public employers can avail of a maximum of 18 weeks of job-protected leave, whether paid or unpaid, within a 12- or 24-month timeframe for qualifying family and medical reasons.

You must meet the following requirements to qualify for the AFLA leave:

- Worked for a covered employer for at least 35 hours a week for 6 consecutive months

- (Or) worked for a covered employer for at least 17.5 hours a week for 12 consecutive months

- Work for an employer with at least 21 employees within 50 miles during a 20-week period in the previous two calendar years

Other Leave Laws

Here are the conditions for other types of leaves as per Alaska labor laws:

- Jury duty: Employers should provide time off to their employees for jury duty, and employees cannot be fired or harassed for reporting to jury duty (with prior notice).

- Voting: Employers who are qualified voters can take time off work, without pay loss, if there is insufficient time to vote outside working hours. If the voter has two consecutive hours during polling times, they are considered to have enough time to vote outside of work hours.

- Donor: Only state employees can take paid leave of not more than 80 hours and not less than 40 hours for organ or bone marrow donation.

- Bereavement: Employers in Alaska are not required to provide bereavement leave.

Workplace Safety and Health Regulations in Alaska

The Alaska Occupational Safety and Health Division (AKOSH) has adopted all federal regulations upheld by the Occupational Safety and Health Administration (OSHA), with some additions to general industry and construction standards.

AKOSH is responsible for enforcing all of the state’s safety and health standards. Check out the Alaska State Plan for their coverage.

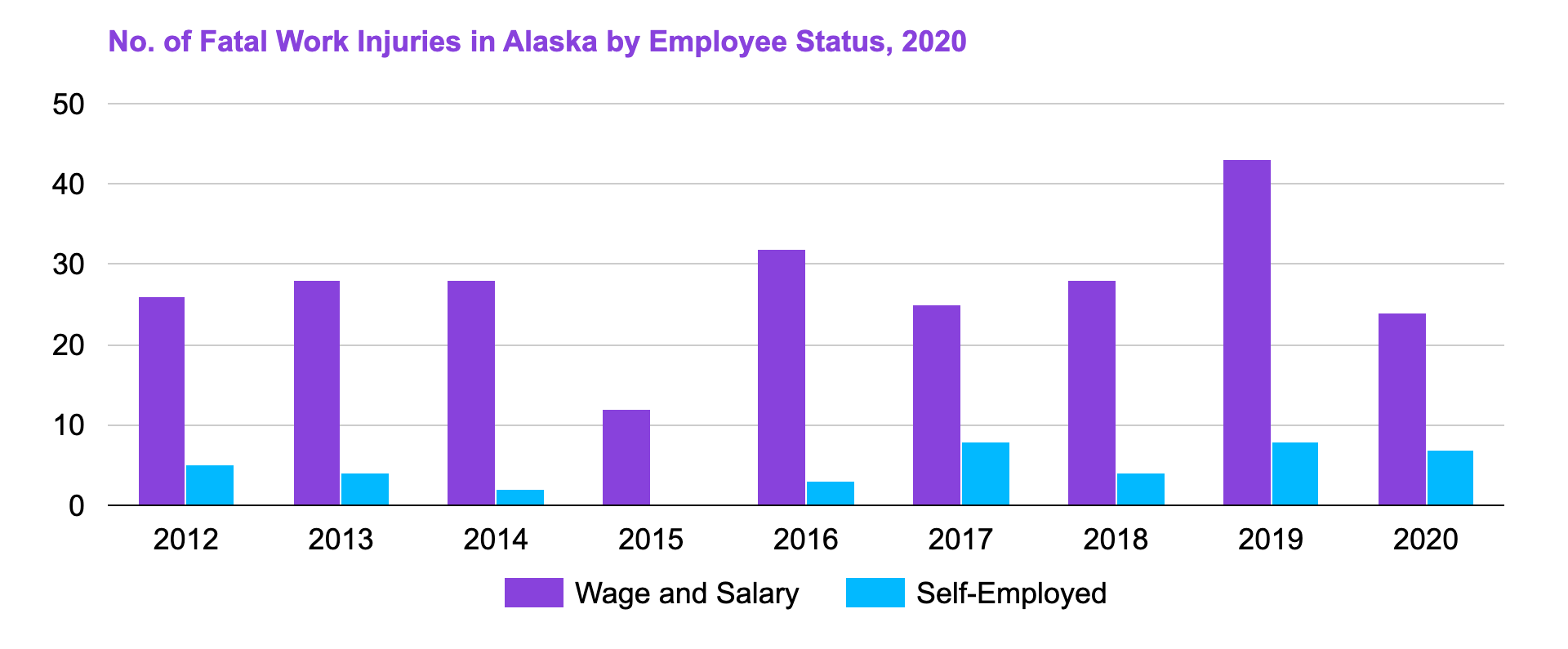

[Source: U.S. Bureau of Labor Statistics]

There were 20 fatal occupational injuries in Alaska in 2021—9 of which were caused by transportation incidents and 5 by contact with objects or equipment, accounting for 70% of all fatal work injuries in the state.

| State/District | No. of Fatal Work Injuries |

| Alabama | 111 |

| Alaska | 20 |

| Arizona | 67 |

| Arkansas | 74 |

| California | 462 |

| Colorado | 96 |

| Connecticut | 23 |

| Delaware | 13 |

| Florida | 315 |

| Georgia | 187 |

| Hawaii | 15 |

| Idaho | 30 |

| Illinois | 176 |

| Indiana | 157 |

| Iowa | 49 |

| Kansas | 63 |

| Kentucky | 97 |

| Louisiana | 141 |

| Maine | 19 |

| Maryland | 80 |

| Massachusetts | 97 |

| Michigan | 140 |

| Minnesota | 80 |

| Mississippi | 41 |

| Missouri | 147 |

| Montana | 40 |

| Nebraska | 39 |

| Nevada | 43 |

| New Hampshire | 21 |

| New Jersey | 110 |

| New Mexico | 53 |

| New York | 247 |

| North Carolina | 179 |

| North Dakota | 34 |

| Ohio | 171 |

| Oklahoma | 86 |

| Oregon | 66 |

| Pennsylvania | 162 |

| Rhode Island | 5 |

| South Carolina | 107 |

| South Dakota | 20 |

| Tennessee | 132 |

| Texas | 533 |

| Utah | 52 |

| Vermont | 10 |

| Virginia | 125 |

| Washington | 73 |

| West Virginia | 36 |

| Wisconsin | 105 |

| Wyoming | 27 |

| District of Columbia | 12 |

[Source: U.S. Bureau of Labor Statistics]

The number of fatal injuries in Alaska (20) is approximately 80% lower than the average number of fatal injuries in all states (102).

Child Labor Laws in Alaska

The minimum age of employment in Alaska is 14, with those aged 14 and 15 requiring a work permit prior to employment.

Those aged 17 are required to have a work permit if their employer is a restaurant or an establishment that sells alcohol.

Those under the age of 14 can only work jobs related to newspaper selling and delivery, babysitting and domestic employment in private homes and the entertainment industry.

Working Hours

For minors aged 14 and 15:

- During the school year, work and school attendance should not exceed a combined total of nine hours in a single day.

- Work is permitted only between 5:00 a.m. and 9:00 p.m., and the weekly limit is 23 hours.

- During school vacations, the weekly work hours can extend to 40 hours per week within the 5:00 a.m. to 9:00 p.m. timeframe.

Breaks

Minors under the age of 18 who have a six-hour work shift are entitled to a 30-minute break during their workday. For minors working a five-hour consecutive shift, a 30-minute break is provided before they continue their work.

Anti-Discrimination Laws in Alaska

Aside from federal law, Alaska has the Alaska Human Rights Act (AHRA), which makes it unlawful to discriminate against applicants or employees based on age, color, marital status, mental disability, national origin, parenthood, physical disability, pregnancy, religion, race and sex.

The AHRA covers all employers with at least one employee.

Independent Contractor Classification in Alaska

Employers should adhere to local tax and wage regulations by distinguishing between employees and independent contractors. Employees are individuals who work under the employer, whereas independent contractors have more freedom in managing their trade or business.

For more information on proper compensation for types of employees, consult the Workers’ Compensation Division.

Official Holidays in Alaska

State law does not mandate employers to provide time off, paid or unpaid, to employees for holidays. For a list of the official state holidays in Alaska, check the table below.

[Source: Alaska Department of Administration]

Termination and Final Paychecks in Alaska

Alaska law mandates that employees who were terminated should be issued their final pay within three working days of termination.

For employees who chose to resign, they must be paid within the next regular payday at least three days after the employer receives notice.

Summary of Alaska Labor Laws

Alaska’s minimum wage is $11.73 per hour, which is higher than the federal wage rate of $7.25 per hour.

Moreover, Alaska is an at-will employment state, where both employers and employees can terminate their working relationship without cause and notice—except for reasons such as discrimination or retaliation.

Alaskan employees are only entitled to a break of at least 30 minutes if they are a minor. However, adult employees are not entitled to any breaks. Private employers can have more generous policies in place, so this can be something discussed during the hiring process.

Alaskan employees will also be happy to know that Alaska does not mandate an individual income tax and a state sales tax.

Frequently Asked Questions About Alaska Labor Laws

Check out answers to frequently asked questions regarding Alaska labor laws.

What is the legal working age in Alaska?

The legal working age in Alaska is 14 years old, and minors aged 14–16 should have an approved work permit prior to employment. Some employers may also ask for a work permit for minors aged 17 following federal law.

Is it illegal for minors to work overtime in Alaska?

Minor employees in Alaska have specific work hours depending on whether or not school is in session. Employers should abide by these work hour policies to prevent any potential violations or penalties.

What is considered wrongful termination in Alaska?

Alaska is an at-will employment state, where both employers and employees can terminate their working relationship without cause and notice. However, reasons such as discrimination or retaliation are exceptions to this rule.

Is holiday pay mandatory in Alaska?

State law does not require employers in Alaska to provide time off for holidays to their employees.

What is the average salary in Alaska?

The average hourly pay of employees in Alaska is $35.31, as per the Federal Reserve Bank of St. Louis.

What is a livable salary in Alaska?

Based on a study by MIT, a livable salary for a single-person household in Alaska is at least $17.15 per hour.

How is overtime paid in Alaska?

Overtime is paid at a rate of time and a half or 1.5 times the employee’s regular rate of pay. This is for hours worked in excess of 8 per day or 40 in a workweek.

Disclaimer: This information serves as a concise summary and educational reference for Alaska labor laws. It does not constitute legal advice. For personalized legal guidance, please consult an attorney.