Alabama Labor Law Guide

In this comprehensive exploration of Alabama labor laws, we cover essential topics like minimum wage guidelines, overtime regulations, mandatory rest breaks and other key employment provisions specific to the Yellowhammer State.

Key Takeaways

- Alabama follows the federal minimum wage of $7.25 per hour

- Tipped employees in Alabama can earn as little as $2.13 per hour before tips, under certain conditions, relying on federal law

- Overtime in Alabama is governed by the Fair Labor Standards Act (FLSA), requiring 1.5 times the regular rate for hours worked beyond 40 hours per week

- Alabama does not have state-specific laws regarding rest and meal breaks, so employers follow federal regulations

- Employers must compensate employees for working during breaks

Minimum Wage Regulations in Alabama

Unlike many other states, Alabama has not adopted a state minimum wage law, and therefore, it adheres to the federal minimum wage of $7.25 per hour.

What's interesting is that this federal minimum wage hasn't changed since 2009, making Alabama one of the five states that have maintained this rate.

| State/District | Minimum wage |

| Alabama | $7.25 |

| Alaska | $11.73 |

| Arizona | $14.35 |

| Arkansas | $11 |

| California | $16 |

| Colorado | $14.42 |

| Connecticut | $15.69 |

| Delaware | $13.25 |

| Florida | $13 |

| Georgia | $7.25 |

| Hawaii | $14 |

| Idaho | $7.25 |

| Illinois | $14 |

| Indiana | $7.25 |

| Iowa | $7.25 |

| Kansas | $7.25 |

| Kentucky | $7.25 |

| Louisiana | $7.25 |

| Maine | $14.15 |

| Maryland | $15 |

| Massachusetts | $15 |

| Michigan | $10.33 |

| Minnesota | $10.85 |

| Mississippi | $7.25 |

| Missouri | $12.3 |

| Montana | $10.3 |

| Nebraska | $12 |

| Nevada | $12 |

| New Hampshire | $7.25 |

| New Jersey | $15.13 |

| New Mexico | $12 |

| New York | $15 |

| North Carolina | $7.25 |

| North Dakota | $7.25 |

| Ohio | $10.45 |

| Oklahoma | $7.25 |

| Oregon | $14.2 |

| Pennsylvania | $7.25 |

| Rhode Island | $14 |

| South Carolina | $7.25 |

| South Dakota | $11.2 |

| Tennessee | $7.25 |

| Texas | $7.25 |

| Utah | $7.25 |

| Vermont | $13.67 |

| Virginia | $12 |

| Washington | $16.28 |

| West Virginia | $8.75 |

| Wisconsin | $7.25 |

| Wyoming | $7.25 |

| District of Columbia | $16.5 |

[Source: FRED]

Tipped Minimum Wage

As mentioned, Alabama does not have specific state regulations for tipped employees, so employers must follow federal law.

Under federal law, employers can use a "tip credit," allowing them to pay their employees as little as $2.13 per hour, provided that the employee's tips make up the difference to reach the federal minimum wage of $7.25 per hour.

To qualify for the tip credit, employees must earn at least $30 per month in tips.

What counts as a tip in Alabama can be tricky. In cash and voluntary tips, extra money beyond the bill is a tip.

But it's different for mandatory service charges or credit card payments. Federal law does not see a mandatory service charge as a tip, so the employers can legally keep it.

When customers pay by credit card, by law, employers can make employees cover part of the credit card fee related to their tips.

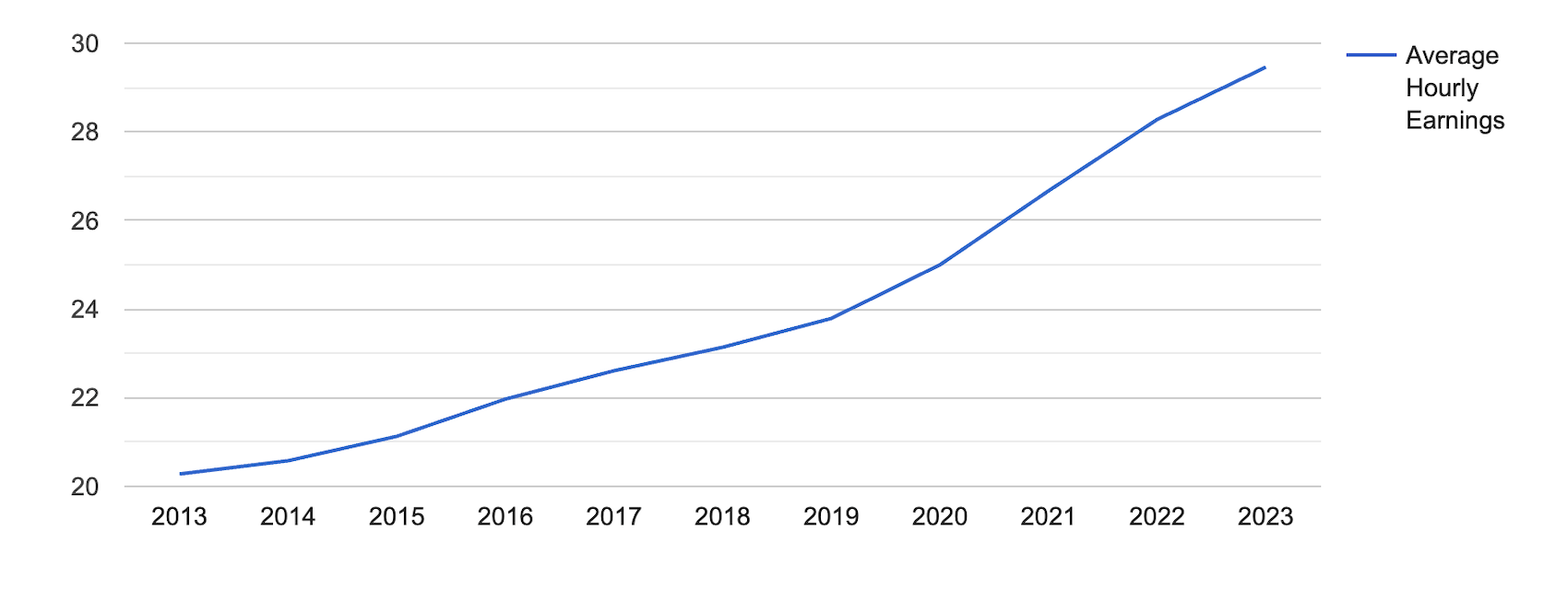

Keep in mind that the minimum wage in Alabama has not changed since 2009. However, it's important to acknowledge that hourly earnings have continued to rise steadily over the years.

[Source: FRED]

Exceptions to Minimum Wage Requirements

Alabama's approach to minimum wage and overtime exemptions is closely tied to the federal regulations outlined in the Fair Labor Standards Act (FLSA).

The categories of employees exempt from minimum wage regulation include:

- Executive, administrative and professional employees: This category encompasses individuals such as managers, administrators, teachers and academic administrative personnel in elementary and secondary schools, among others.

- Outside sales employees: This exemption generally applies to individuals whose primary responsibility involves making sales and conducting business away from the employer's place of business.

- Computer professionals: Computer professionals who meet the Department of Labor's regulations for this exemption are exempt from minimum wage requirements.

- Employees of seasonal amusement or recreational establishments: Employees at certain seasonal amusement or recreational establishments are exempt from minimum wage.

- Employees of small newspapers and switchboard operators: Employees of small newspapers and switchboard operators at small telephone companies may be exempt from these requirements.

- Seamen on foreign vessels: Seamen employed on foreign vessels are often exempt from minimum wage requirements, as their employment is subject to different laws and regulations.

- Employees engaged in fishing operations: Those involved in fishing operations may also be exempt from minimum wage requirements, as their work is subject to distinct regulations.

- Newspaper delivery employees: Individuals engaged in newspaper delivery typically fall under exemption.

- Casual babysitters: Casual babysitters hired for occasional childcare services are generally exempt from these requirements.

- Individual service providers: Individuals providing companionship services primarily to seniors and individuals with injuries, illnesses or disabilities, and employed solely by the individuals receiving services, may also be exempt from minimum wage requirements. This exemption does not typically apply to individuals employed by agencies or non-profit organizations.

Subminimum Wage

Alabama also adheres to federal regulations for subminimum wage rates for specific groups of employees.

Youths under the age of 20 must be paid a minimum wage of not less than $4.25 per hour during the first 90 consecutive calendar days of employment. Importantly, employers cannot displace any existing employee to hire someone at the youth minimum wage.

The FLSA allows certain individuals to be employed at wage rates lower than the statutory minimum wage through certificates issued by the Department of Labor.

These individuals include:

- Student learners — particularly vocational education students

- Full-time students working in retail or service establishments, agriculture or institutions of higher education

- Individuals whose ability to earn money or be productive in their work is affected by physical or mental disabilities, including those related to age or injury

When discussing wages, it’s important to keep in mind state and federal taxes for complete financial clarity. Our Alabama Paycheck Calculator gives you an estimate of your earnings after accounting for taxes and deductions, in adherence to your state’s tax laws.

Overtime Rules and Regulations in Alabama

In Alabama, overtime rules and regulations are governed by the FLSA, since the state does not have its own specific overtime laws.

Under the FLSA, employers in Alabama are required to provide "premium pay" for hours worked in excess of 40 hours per week. Premium pay is defined as at least 1.5 times an employee's regular rate of pay.

Employees paid by the hour are entitled to receive 1.5 times their regular hourly rate for each hour worked beyond 40 hours in a workweek.

For salaried employees, the regular rate is calculated as the salary divided by the number of hours it is intended to compensate. Overtime is paid at 1.5 for hours worked over 40.

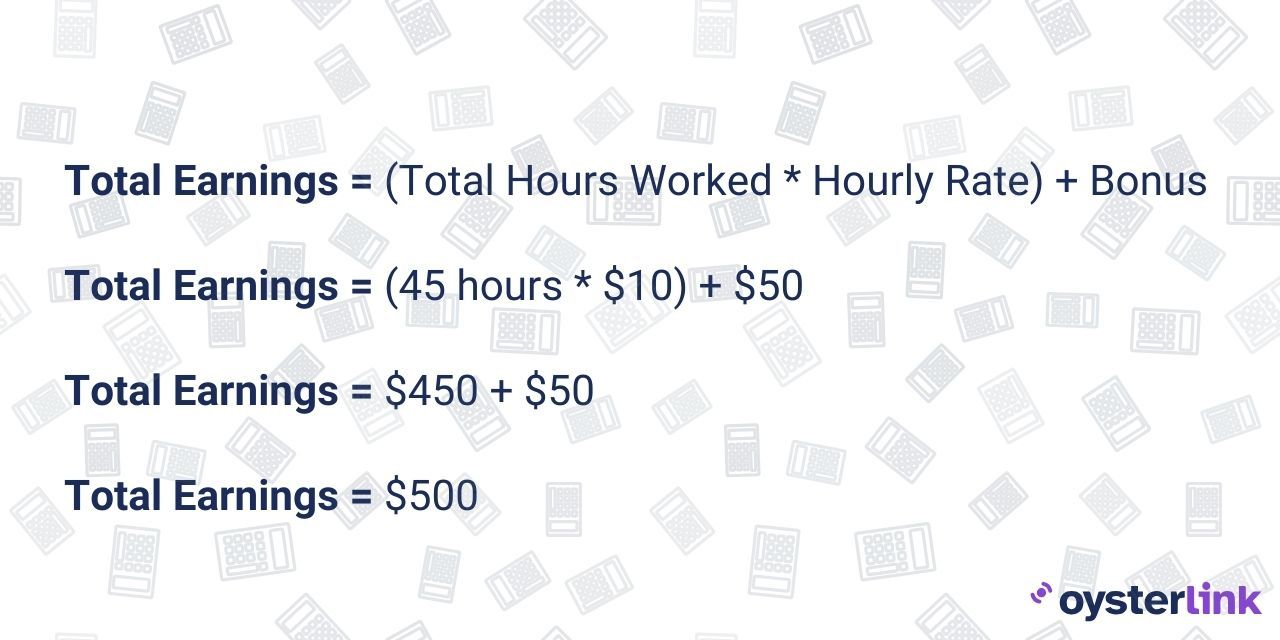

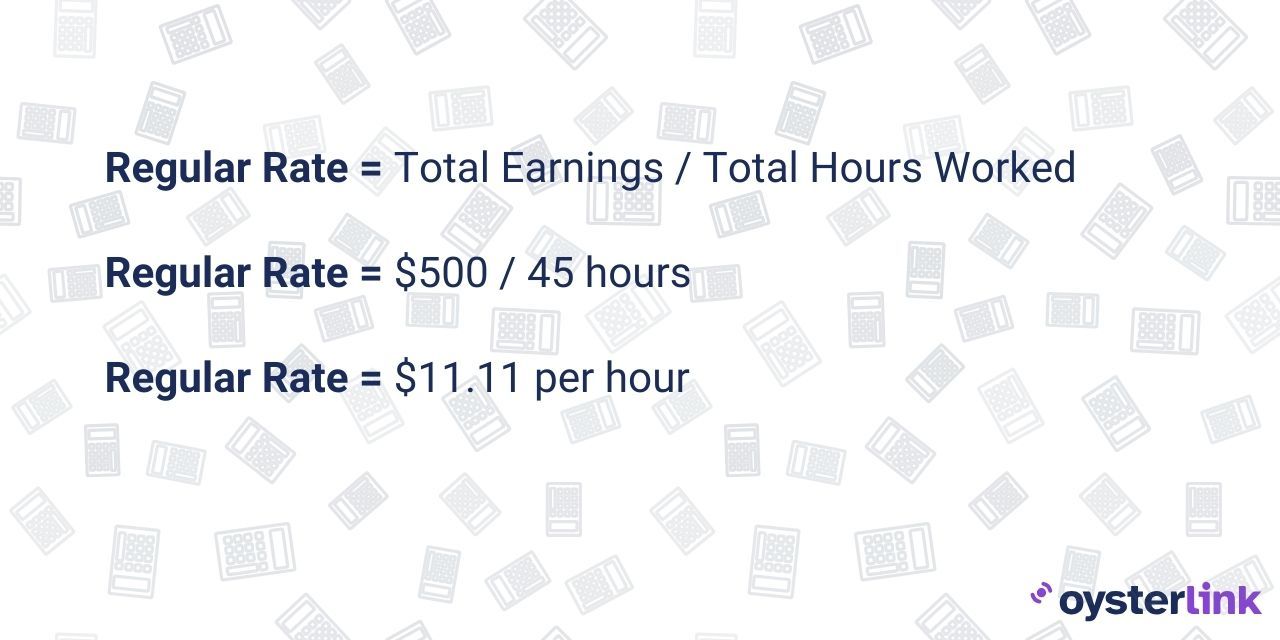

For employees who receive hourly plus bonus and/or commission, the regular rate is calculated as the total hours multiplied by the hourly rate, plus the workweek equivalent of any bonuses or commissions, divided by the total hours in the workweek.

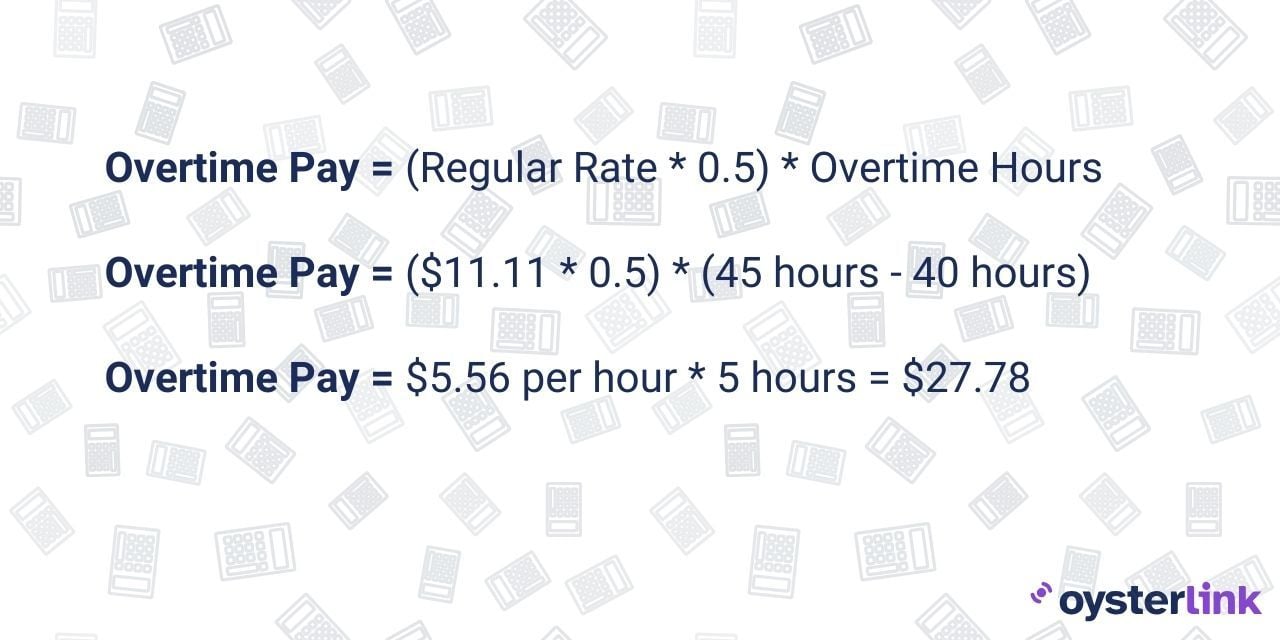

Overtime is then paid at half of this regular rate for each overtime hour.

For instance, let's say an employee works 45 hours a week at an hourly rate of $10 and they receive a bonus of $50.

To calculate the total earnings without overtime:

To find the regular rate (the rate for the first 40 hours):

To calculate overtime pay (for hours worked beyond 40):

So, in this example, the regular earnings are $500, with an hourly rate of approximately $11.11. The additional $27.78 represents the overtime pay for the extra 5 hours worked beyond the standard 40-hour workweek.

Overtime Exceptions and Exemptions

Alabama follows federal overtime laws, and there are both exceptions and exemptions from these regulations, where "exceptions" are special cases where specific criteria might make an employee eligible for overtime, while "exemptions" are categories of employees who are not subject to overtime regulations.

Here's a breakdown of overtime exceptions and exemptions in Alabama:

- Managers of employees: Employees responsible for managing more than one employee may be exempt from overtime requirements.

- Multi-occupation employees: Employees who spend more than 20% of their employment engaged in other occupations may also have exceptions from overtime laws.

- Sales employees: Employees engaged in sales roles are exempt from overtime requirements.

- Salaried professionals: Salaried employees whose jobs require specialized skills and knowledge are exempt from overtime.

Rest and Meal Breaks

In Alabama, rest and meal breaks are not governed by state-specific laws. Instead, they follow federal regulations.

Under federal law, employers are required to compensate employees for hours worked, including designated "breaks."

This means that if an employee has to work during what is typically considered a meal break, they must be paid for that time.

For instance, a receptionist covering phones during lunch or a paralegal having lunch at their desk while working must receive compensation for that working time.

Federal law also mandates payment for short breaks (lasting 5-20 minutes) that employees are permitted to take during the workday. These shorter breaks are considered part of the workday and should be paid.

Employers are not obligated to pay for bona fide meal breaks, during which employees are relieved of all job duties to eat a meal.

These breaks typically last at least 30 minutes, but shorter breaks may also qualify, depending on the circumstances.

Family and Medical Leave Laws in Alabama

Alabama follows federal regulations regarding family and medical leave, primarily governed by the Family and Medical Leave Act (FMLA).

This federal law grants eligible employees the right to take unpaid leave and be reinstated to their position for specific reasons.

Under FMLA, employees may take leave if they meet the following criteria:

- Have worked for the company for at least one year

- Worked a minimum of 1,250 hours during the prior year

- Work at a location with at least 50 employees within a 75-mile radius

FMLA leave is available to Alabama employees for the following reasons:

- Recovery from a serious health condition

- Caring for a family member with a serious health condition

- Bonding with a new child (birth, adoption or foster placement)

- Handling qualifying emergencies due to a family member's military service

- Care for a family member who suffered a serious injury during active duty in the military

Employees can take up to 12 workweeks of leave within a 12-month period for the listed reasons. This entitlement renews every 12 months if the employee continues to meet the eligibility criteria.

The exception is a military caregiver leave, when the employees may take up to 26 weeks of leave in a single 12-month period, but this leave is specific to each injury or service member. Additional leave for the same purpose is not available unless another family member is injured during active duty.

It’s important to know that during FMLA leave, employees can maintain their health insurance at the same cost they would pay while working.

While FMLA leave is unpaid, the decision to use accrued paid leave during this period depends on various factors, including company policies and legal requirements.

In some cases, employees may be permitted to use their accrued paid leave voluntarily, while in other situations, they might be required to use it as mandated by their employer or relevant regulations.

At the end of FMLA leave, employees have the right to be reinstated to their previous position or an equivalent position, with a few exceptions.

Family Members That Qualify for FMLA

Under the FMLA, the definition of "family members" eligible for leave includes the following relationships:

- Spouse: The FMLA defines a spouse as a husband or wife, including legally recognized same-sex marriages.

- Son or daughter: An eligible employee can take FMLA leave to care for a son or daughter with a serious health condition. This includes biological, adopted and foster children, stepchildren and legal wards. The child can be younger than 18 years old or 18 and older if they are incapable of self-care due to a mental or physical disability.

- Parent: The FMLA defines a parent as a biological, adoptive, step or foster father or mother, as well as individuals who stood in loco parentis to the employee when the employee was a son or daughter.

The regulations explicitly state that FMLA leave is not available to care for a mother-in-law or father-in-law with a serious health condition.

It is important to know that employers can ask for documentation to verify these relationships when necessary to ensure compliance with FMLA requirements.

Salary During Paid Sick Leave

In Alabama, whether employees receive a salary during paid leave, such as sick leave, is determined by employer policy. Private employers are not required to provide paid sick leave, while government employees in Alabama do receive paid sick leave, with pay equivalent to their daily rate.

Workplace Safety and Health Regulations in Alabama

Alabama falls under the authority of the federal Occupational Safety and Health Act (OSHA), which covers the majority of private-sector employees in the state. However, federal OSHA regulations do not apply to state and local government employees.

Federal OSHA is an agency in charge of ensuring workplace safety and health.

The key aspects of OSHA operations include:

- Regulations: OSHA establishes and enforces safety and health regulations for most private sector employers, addressing various industries and workplace hazards.

- Inspections: OSHA conducts routine inspections and responds to complaints or accidents to verify compliance with safety and health regulations.

- Penalties: Non-compliance can result in penalties, including fines, citations and requirements to rectify hazards. OSHA has the authority to levy significant fines for serious violations.

- Training and outreach: OSHA provides training and outreach programs to educate employers and employees on safety and health matters, offering resources for training and compliance assistance.

- Whistleblower protection: OSHA safeguards employees who report safety or health violations from employer retaliation.

- Emergency response: OSHA offers guidance on emergency response and preparedness, ensuring workplaces are equipped to handle emergencies like fires, chemical spills and natural disasters.

- Small business assistance: OSHA provides specialized assistance and consultation services for small businesses, aiding them in meeting safety and health requirements.

- Partnerships: OSHA collaborates with various organizations, industries and labor groups to enhance workplace safety through partnerships and alliances.

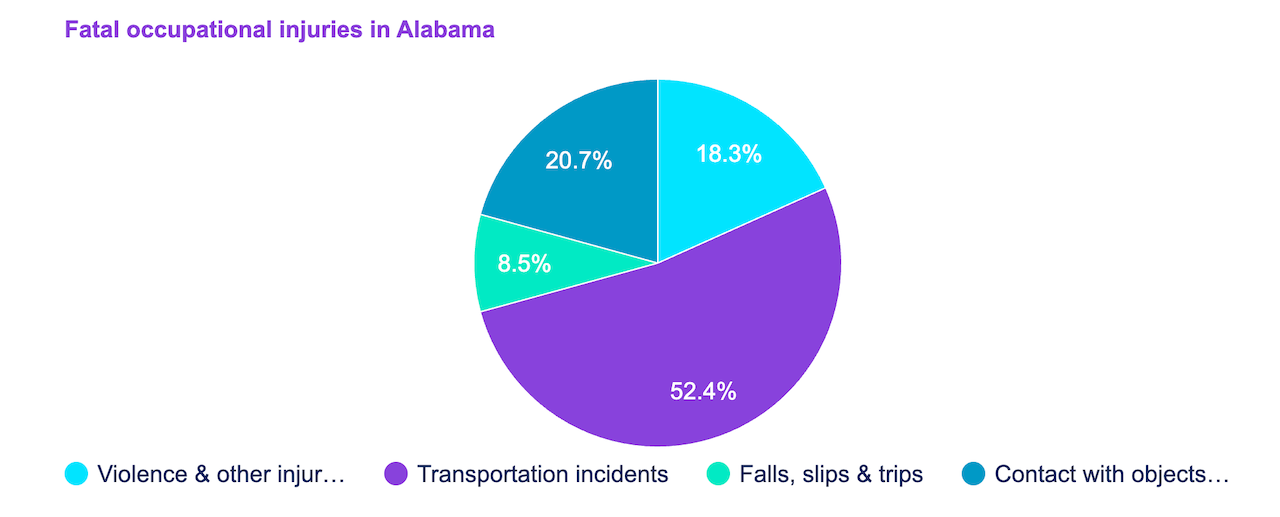

[Source: U.S. Bureau of Labor Statistics]

Anti-Discrimination and Fair Employment Practices in Alabama

Alabama's anti-discrimination law is mostly based on federal Equal Employment Opportunity law (EEO), with limited state and common law causes of action.

The EEO law prohibits discrimination based on a variety of factors, including:

- Race

- Color

- Religion

- Sex

- National origin

- Age

- Disability

- Pregnancy status

- Veteran status

It is also illegal to retaliate against an individual for filing a complaint or participating in an EEO investigation.

Independent Contractor Classification in Alabama

In Alabama, the classification of individuals as either employees or independent contractors is governed by the IRS 20-Factor test.

These factors are used to assess the level of control an employer has over an employee. Employers should consider these factors carefully to determine the proper classification of individuals as employees or independent contractors under Alabama law.

The 20 factors of the IRS 20-Factor test that make up the contractor classification include:

- Instructions: If the employer provides specific instructions regarding when, where and how the work is to be done, it suggests an employer-employee relationship.

- Training: If the employer provides training to the employee, it tends to indicate an employer-employee relationship. Independent contractors typically use their own methods and receive no training.

- Integration: The extent to which the employee's services are integrated into the overall business operation can indicate the nature of the relationship.

- Services rendered personally: If the services must be performed personally, it suggests an employer-employee relationship.

- Hiring, supervising and paying assistants: Control over hiring, supervising, and paying assistants is associated with an employer-employee relationship.

- Continuing relationship: A longer-term relationship is more likely to be seen as employer-employee.

- Set hours of work: More control over work hours leans toward an employer-employee relationship.

- Full time required: If the employee must devote full time to the employer's business, it indicates control over their time.

- Doing work on the employer’s premises: Working on the employer's premises is not necessarily an indicator of control, but it can be, depending on the circumstances.

- Order or sequence set: If the employee must follow a specific order or sequence set by the business, it suggests an employer-employee relationship.

- Oral or written reports: Requiring regular reports to the employer indicates a subservient relationship.

- Payment by hour, week or month: Regular, periodic paychecks are more indicative of an employer-employee relationship, while independent contractors are often paid in lump sums.

- Payment of business and/or travel expenses: Employers paying for business and travel expenses tend to have an employer-employee relationship.

- Furnishing of tools, machinery and materials: When the employer provides tools, equipment and materials, it can suggest an employer-employee relationship.

- Significant investment: Independent contractors often make a significant investment in facilities used to perform services.

- Working for more than one firm: Working for multiple employers simultaneously is a characteristic of independent contractors.

- Realization of profits or losses: Individuals who can realize profits or suffer losses due to their services are typically independent contractors. This can be determined by factors like hiring, equipment, liabilities and bidding on jobs.

- Making services available to the general public: If the worker offers their services to the general public, it is more indicative of independent contractor status.

- Right to hire and fire: The right to hire and fire is a crucial factor in determining the nature of the relationship.

- Right to terminate: Generally, employees have the right to terminate their relationship with an employer at will, while independent contractors often work under written contracts and don't have this right.

Termination and Final Paycheck Laws in Alabama

Alabama does not have state-specific regulations that mandate when a final paycheck must be issued. However, employers in Alabama are obligated to follow the federal FLSA.

Under the FLSA, the final paycheck should be provided on the next scheduled payday, regardless of whether the employee quit or was terminated.

While an employer may have the right to withhold money from the final paycheck if the employee owes the organization (for example, if they have unpaid debts or loans), the employer cannot withhold the entire paycheck for any reason.

Failing to adhere to final paycheck laws can result in fines and penalties.

Summary of Alabama Labor Laws

Alabama follows the federal minimum wage of $7.25 per hour. At the same time, tipped employees can earn as little as $2.13 per hour under certain conditions.

Overtime rules adhere to federal law, requiring 1.5 times the regular rate for hours worked beyond 40 hours per week. Rest and meal breaks are governed by federal regulations.

Family and medical leave in Alabama complies with the FMLA. In Alabama, independent contractor classification is determined using the IRS 20-Factor test.

Alabama lacks specific regulations for final paycheck issuance, following the FLSA guidelines. Non-compliance with final paycheck laws can result in fines and penalties.

FAQs About Alabama Labor Laws

For more info, find frequently asked questions about the labor laws in Alabama below.

What is tip pooling in Alabama?

In Alabama, tip pooling, also known as "tipping out," is a practice where employees who receive tips are required to contribute a portion of their tips, which are then redistributed among a group of employees.

Is Alabama a “right-to-fire” state?

Yes, Alabama is an employment-at-will state, which means that employers have the right to terminate an employee at any time for any reason, provided it is not an unlawful reason.

How many consecutive days can you work in Alabama?

In Alabama, you can work as many consecutive days as your employer requires, as long as you don't exceed 40 hours in a seven-day workweek without receiving overtime pay.

Can you be forced to work overtime in Alabama?

In Alabama, employers can require employees to work overtime, which is often referred to as "mandatory overtime."

It is not a violation of overtime laws as long as the employees are compensated properly at the premium rate required by federal law.

Can an employee refuse to take a break in Alabama?

In Alabama, employees can refuse to take breaks if they wish, as no state law mandates meal or rest breaks.

Disclaimer: This information serves as a concise summary and educational reference for Alabama state labor laws. It does not constitute legal advice. For personalized legal guidance, it is recommended to consult with an attorney.