Head Chef Salary in the United States

The average Head Chef salary in the United States is $73,632 per year. Want to learn about the factors affecting your income and other key information?

Keep reading this guide that will help you maximize your earning potential.

How Much Does a Head Chef Make in the United States?

As mentioned, Head Chefs make $73,632 a year. This translates to a monthly salary of $6,136.

How Much Does a Head Chef Make Weekly?

The average weekly pay for Head Chefs in the U.S. is $1,416.

Given this, many Head Chefs fall under the "learned professionals" category of the Fair Labor Standards Act (FLSA).

The FLSA defines learned professionals as those who make at least $684 a week and whose primary duties require one to have advanced knowledge.

Employees under this category are often exempt from overtime pay and minimum wage regulations.

How Much Does a Head Chef Make Per Hour?

The average hourly wage for a Head Chef is $35.4.

Head Chef Salary by State or District

The average salaries for Head Chefs vary across different states and districts.

For example, in locations like the District of Columbia and Washington with higher living costs Head Chefs may receive higher pay to keep up with those costs.

In contrast, Head Chefs in states like Kansas and Oklahoma earn relatively lower salaries in states due to lower costs of living.

Head Chefs are also likely to receive more competitive salaries in states with bustling tourism industries, such as New York and California.

Explore the table below for the average Head Chef salaries in all 50 states plus the District of Columbia:

Head Chef Salary in Major US Cities

Among the four cities below, New York City is the top-paying city for Head Chefs followed by Los Angeles, Miami and Chicago.

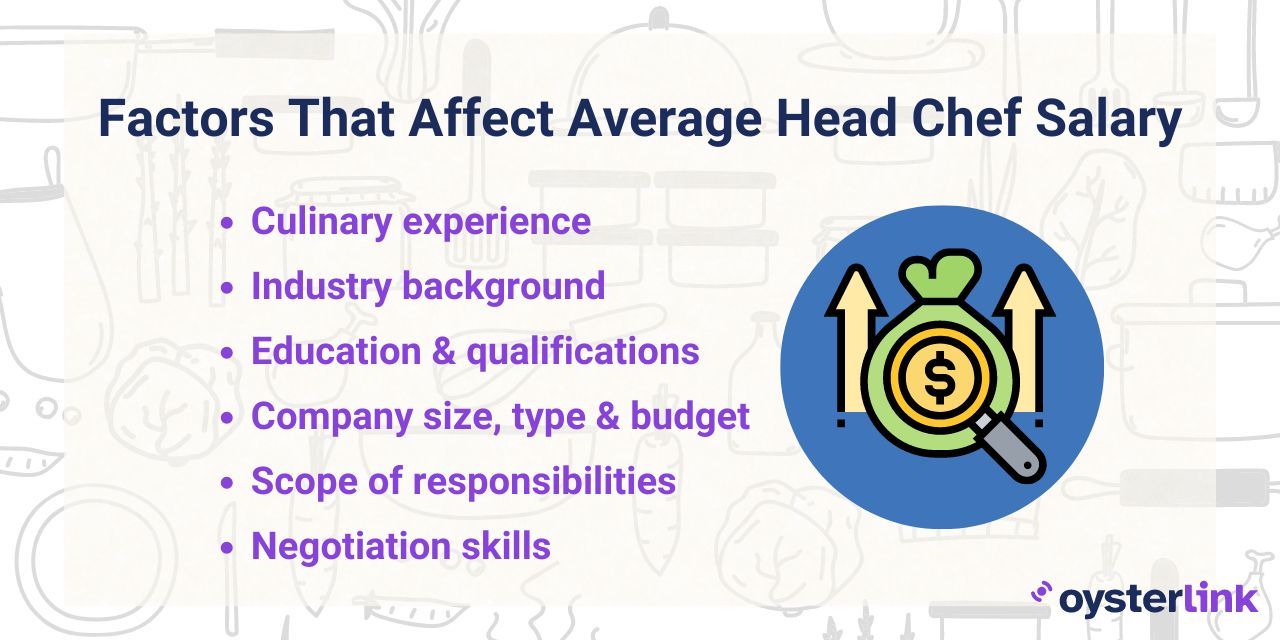

6 Factors That Affect the Salary of a Head Chef

Aside from geographic location and cost of living, there are several other factors that could influence how much a Head Chef makes.

Now, let’s take a closer look at these additional factors.

1. Culinary experience

Head Chefs with more years of culinary experience may command higher salaries due to their track record.

They may also receive higher pay if they have notable experience with specific types of cuisines or food that require more meticulous preparation.

For instance, a Head Chef who has worked in multiple fine-dining restaurants can negotiate higher pay when applying for a job in a similar establishment.

2. Industry background

Head Chefs who work or have worked in prestigious establishments typically have higher chances of earning competitive salaries. This is due to the reputation and clientele associated with such establishments.

For example, a Head Chef previously employed in a famous Michelin-starred restaurant might receive a higher offer from prospective employers.

Additionally, Head Chefs who have received awards or won competitions — such as a James Beard Award or the S.Pellegrino Young Chef Academy Competition — may have more room for negotiating their salary, given the recognition of their talents and expertise.

3. Culinary education and qualifications

Some employers may be willing to give higher salaries to Head Chefs with formal education or training in culinary arts. The same applies to those who have obtained certifications or completed continuing education courses.

Not sure which certifications or courses to take? Head over to our Head Chef Career Overview for our top recommendations.

4. Company size, type and budget

The scale and type of a company or establishment can also affect a Head Chef's salary.

For instance, a Head Chef working for a restaurant group with multiple stores nationwide is likely to earn more than one who works for a small, single-unit establishment.

Moreover, companies or establishments with better financial health often have bigger budgets for salaries of managerial employees like Head Chefs.

5. Scope of responsibilities

A Head Chef in charge of a larger kitchen staff may also earn a higher salary.

This is because employers typically place more value on Head Chefs who can effectively manage a heavier workload, particularly in restaurants with more complex menu items.

6. Negotiation skills

Those applying to be a Head Chef can secure higher salaries through negotiations during the interviewing process, where they can leverage their skills and experience.

Head Chefs can also negotiate with their employers during performance reviews, especially if they have effectively proven their contributions to the kitchen team.

Benefits and Perks That Head Chefs Often Receive

Apart from salary, employers and candidates also factor benefits and perks into the overall compensation package.

The most common non-monetary compensations for full-time employees within the U.S. restaurant industry are healthcare insurance, 401(k) plans, paid time off and employee assistance programs.

However, those in management-level positions like Head Chefs may also be offered these extra benefits and perks:

- Performance incentives: Employers offer bonus plans and profit sharing to incentivize Head Chefs to perform excellently and contribute to the restaurant’s overall success. Head Chefs typically need to achieve metrics such as food cost percentage, menu profitability and customer satisfaction scores.

- Employee discounts or free products: Head Chefs may enjoy high discount percentages or free company products and services. For instance, a Head Chef working for a major hotel chain might be offered free accommodation once a year in one of the company’s properties.

- Travel opportunities: Restaurants participating in culinary competitions, conventions or expos may send their Head Chefs as a representative. Alternatively, Head Chefs working for global restaurant or hotel groups may have the opportunity to travel to the company’s headquarters for further training.

- Flexible scheduling: Head Chefs may be allowed flexible work hours or customized schedules to accommodate their needs, preferences or personal priorities.

- Professional development opportunities: Companies or establishments may cover the costs of culinary courses, training programs, workshops or certifications for Head Chefs.

- Relocation assistance: Some employers may offer this to a newly hired Head Chef originally based elsewhere. Alternatively, employers may also facilitate the relocation of a current Head Chef to a different area.

Since Head Chefs are often exempt from minimum wage regulations, the benefits and perks they receive might also affect the base salary set by their employer.

How Much Do Head Chefs Earn Compared to Other Managerial Roles?

How To Estimate Your Take-Home Pay as a Head Chef

To easily calculate federal, state and local taxes in your state, use our free Paycheck Calculator below.

Labor Laws and Taxes for Head Chefs

As a Head Chef who oversees multiple back-of-house staff members, you need to be aware of the minimum wage, overtime pay and leave policies in your state. Check out the guides below or view more labor laws: