Key Takeaways:

- Incomplete documentation is a leading cause of denied restaurant insurance claims—always gather receipts, estimates, and photos right away (snap with your phone and save to a dedicated cloud folder).

- Delaying claim reporting beyond 24–48 hours can drastically reduce your chances of receiving a full payout. Set a protocol: report incidents quickly, even while details are still coming in.

- A misunderstanding of policy coverage often leads to costly surprises; take time to review your policy with your agent and highlight unclear exclusions. Get changes or clarifications in writing (don’t assume!).

- Failing to mitigate additional damage after an incident—like shutting off water after leaks—can void your claim eligibility. Every action taken should be documented (photos + brief notes, even a quick email to yourself as backup).

- Following a clear step-by-step procedure for filing claims speeds up the process and ensures necessary documentation is included. Train your team with a printed or digital checklist and update it if your policy changes.

Filing an insurance claim can be one of the most stressful aspects of running a restaurant. Even small errors in the process can lead to denied claims or cost you thousands—right when you need support the most.

To keep your business protected, it’s essential to understand the most common mistakes restaurant owners make when filing insurance claims—and how to avoid them. In this guide, we’ll walk you through the top five pitfalls, along with clear, practical strategies to safeguard your restaurant now and in the future.

The Main Restaurant Insurance Claim Mistakes—and Their Solutions

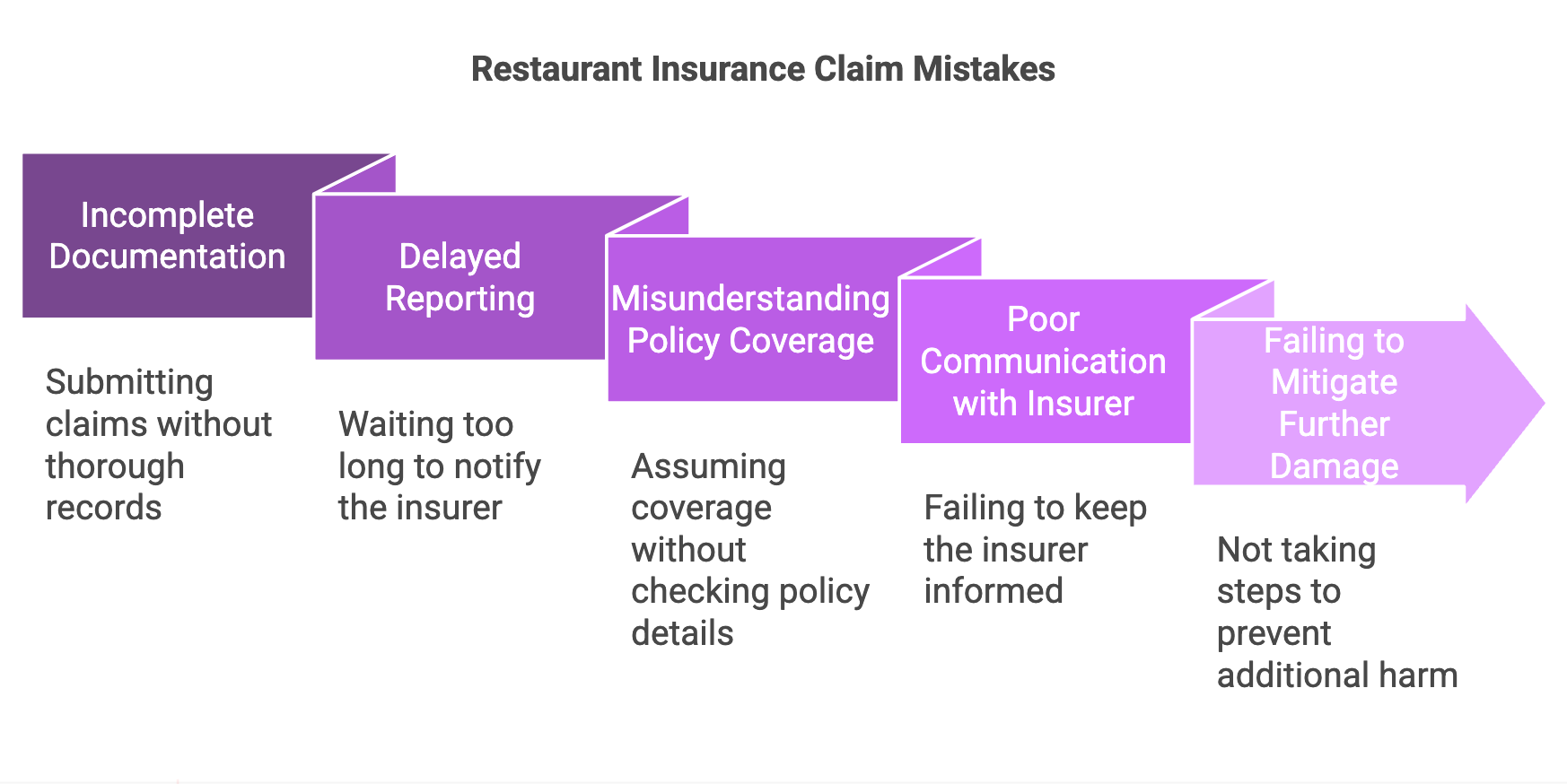

Filing an insurance claim is never fun—but making mistakes during the process can turn a stressful moment into a costly nightmare. Whether it's missing paperwork or waiting too long to notify your provider, even small missteps can lead to delayed or denied payouts.

To help you avoid these headaches, we’ve outlined the five most common restaurant insurance claim mistakes—and how to fix them with clear, actionable steps your team can actually follow.

Mistake #1: Incomplete Documentation

Submitting claims without thorough records is a leading cause of delays or denials. Insurers often require proof of the incident, receipts, inventory lists and repair estimates.

Without these, they can question your claim's validity and drag out payment for weeks. If you’re managing staff during the process, consider reviewing Restaurant Manager responsibilities to ensure everyone understands their role in proper documentation.

How to fix: Immediately after any incident, snap multiple photos (wide and close-up), collect staff and witness statements, and gather receipts or cost estimates. Store in a “Claims” folder (Google Drive or a physical binder).

Mistake #2: Delayed Reporting

Waiting too long to notify your insurer can leave your claim unapproved or reduce the payout. Most insurance policies require prompt reporting, sometimes within 24-48 hours of the incident—so don’t wait.

How to fix: Set up a simple incident protocol (taped inside your back office door and sent to all managers): report to your insurer ASAP, even before all info is gathered. Email or use the insurer’s portal if you dislike making calls.

Log the time and date you reported for your records—on paper, in the app, or both, whatever works for you.

Mistake #3: Misunderstanding Policy Coverage

Many restaurant owners assume their policy covers certain incidents, only to find out exclusions or gaps after a loss occurs. This often leads to surprises and financial hits (it’s more common than you’d think, especially with water damage not always being included).

If you need help "decoding" your coverage, check out how to prepare your restaurant for specific risks that your policy might exclude.

How to fix: Once a year, schedule a policy review—even 30 minutes makes a difference. Mark unclear sections with sticky notes or highlights. Ask your agent for a one-paragraph summary (in plain English) of tricky exclusions.

Keep a “policy summary” page in your insurance binder and digital folder. Don’t sign updates without reading—get answers to your questions first. And don’t be shy about asking even “obvious” questions—agents have heard it all.

Mistake #4: Poor Communication with the Insurer

If you don’t keep your insurer informed or provide unclear information, your claim may be delayed or denied. Unresponsiveness during the process can also signal problems to your provider. For teams, learning the keys to hiring and communicating with restaurant staff can enhance your process here as well.

How to fix: Respond promptly to insurer requests. Confirm all communication by email, even after a phone call (e.g., “Per our call today, here’s what I understood…”). Keep an up-to-date logbook of all messages.

Mistake #5: Failing to Mitigate Further Damage

After an incident, restaurant owners are required to take reasonable steps to prevent further harm. Not doing so can result in your claim being denied altogether.

How to fix: Take action right away—shut off water, cover valuables and ensure safety. Take photos BEFORE and AFTER mitigation steps. Make a quick list of everything you do (text it to yourself for record).

Let your insurer know these measures in your claim report. If in doubt, err on the side of over-documenting. See how kitchen fire safety protocols can reduce losses from common incidents.

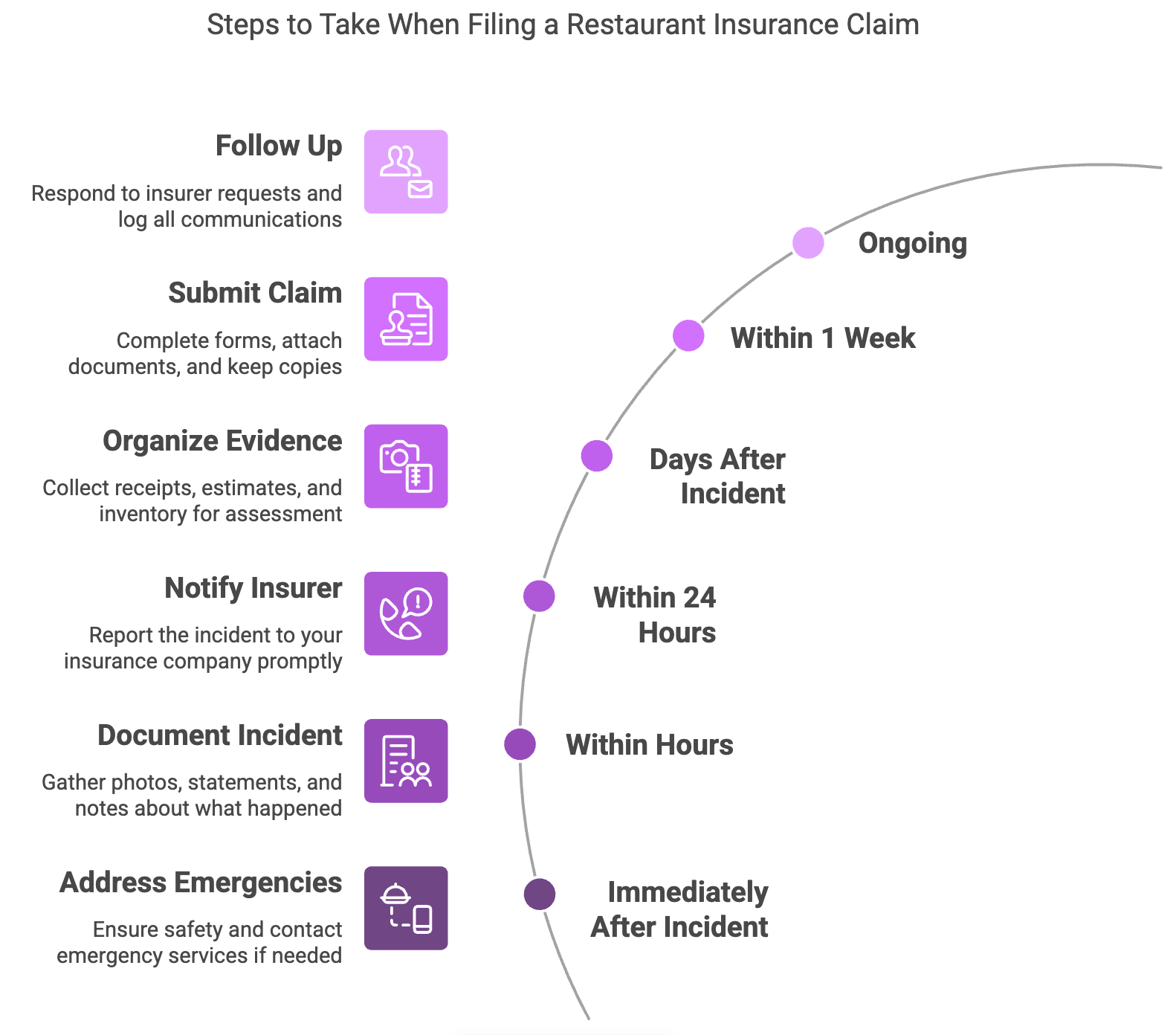

Steps to Take When Filing a Restaurant Insurance Claim

Filing a claim doesn’t have to be overwhelming if you follow these clear, actionable steps:

- Address emergencies first: Make sure everyone is safe and contact emergency services if needed.

Document the incident: Snap photos, gather witness and staff statements, and jot down what happened (voice memo works—transcribe later if short on time).

If you’re interested in leadership best practices during emergencies, the Director of Restaurant Operations role covers key incident response skills.

- Notify your insurer promptly: Call or use your portal/app or email to report right away—save proof of your message.

- Organize evidence: Collect receipts, repair estimates, and inventory for loss assessment—take a phone photo of each for backup (you never know when you'll spill coffee across your paperwork!).

- Submit your claim: Fill out forms accurately, attach all supporting documents, and keep copies for your records (email them to yourself just in case).

- Follow up: Respond quickly to requests from your insurer and stay in touch until the claim is resolved; log all conversations with dates/times.

How to Review and Strengthen Your Restaurant Insurance Policy

Set a recurring time—ideally every year—to review your insurance policy. Make sure existing and new restaurant operations are covered, and look for any gaps or unnecessary overlaps in coverage. Highlight “what’s not covered” in the policy so you're not caught off guard later.

Work with an experienced insurance agent or broker who understands restaurants. Before your annual renewal, email them a summary of new equipment, facility changes, or business growth.

Also, confirm that your deductible amounts, liability limits, and business interruption coverage are aligned with your actual revenue and risk exposure. Keep a “policy cheat-sheet” with just the essentials for quick access if a claim arises.

For further insights, learn about industry best practices in restaurant operations.

Staff Training and Best Practices for Insurance Claims

Train all managers and staff on how to handle workplace incidents, from immediate reporting to documenting events with photos and written statements. Use an “incident reporting checklist,” and review it at least once a year. Encourage managers to save photos and notes in a central, shared cloud folder titled “Insurance Claims.”

Encourage a culture of transparency and accountability by routinely reviewing insurance procedures. Hold refresher sessions, create digital/paper checklists, and designate a claims point-person (with backup). Consider including a brief insurance update in your monthly managers’ meetings.

New to hiring? See how to onboard and retain restaurant staff to strengthen your whole team’s response and preparedness.

How a Few Simple Steps Can Prevent Denied Claims

.png)

Imagine a small neighborhood bistro experiences a break-in overnight. The owner discovers missing equipment and some property damage. In the rush of reopening and talking to staff, they forget to take photos, save receipts, or report the incident promptly. When they finally file the insurance claim, it's denied due to lack of documentation and delayed reporting—a frustrating and costly outcome.

Now picture a different scenario. This time, the same owner has a simple incident protocol posted in the back office. Within hours, they’ve taken photos, gathered witness statements, and emailed everything to their insurer. They keep a log of communications and store all related documents in a shared folder. Thanks to these proactive steps, their next claim is approved quickly and without hassle.

The difference? A few clear habits, written procedures, and trained staff can make or break your insurance claim experience.

If you're hiring someone to lead these efforts, check out our top Restaurant Manager interview questions to find candidates who are organized, proactive and ready to handle incidents with confidence.

Loading comments...