Washington DC Paycheck Calculator: Calculate Your Net Pay

If you’re wondering, “How do I figure out how much money I take home in Washington D.C.?” we’ve got you covered.

Use our simple salary pay calculator to estimate your net or “take home” pay after taxes, as an hourly or salaried employee in Washington, D.C.

Paycheck Calculator

Meanwhile, get ahead with our free resources:

How Does the Paycheck Calculator Work?

Input your salary information, such as wage and pay frequency, and our tool will handle the tax calculations for you. Once you’ve filled in all the information, click the “Calculate Tax” button, and the calculator will provide an estimate of your net or “take home” pay for the specified pay period.

Overview of Washington DC Taxes

If you're deciding to start a new job in "Our Nation's Capital," here's what to expect tax-wise.

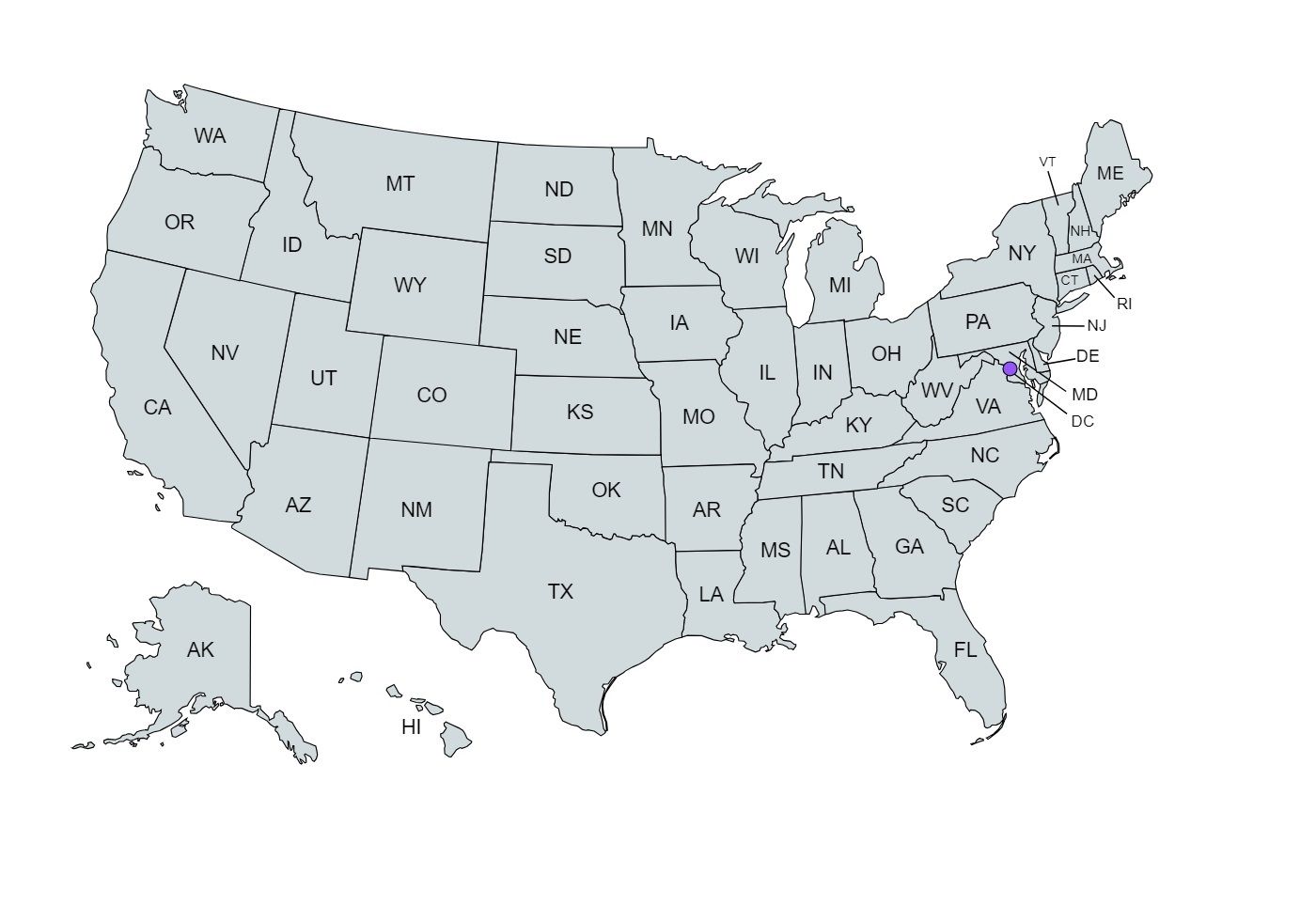

Washington D.C., known formally as the District of Columbia (D.C.), is a unique jurisdiction given its federal district status—in other words, it isn’t a state..

However, residents of the United States capital are still subject to a graduated or progressive individual income tax, ranging from 4.00% to 10.75%, depending on your income level. Check which applies to you from the list below:

- If your taxable income is under $10,000, you’ll pay 4% of your income in taxes.

- If your income is between $10,000 and $40,000, you’ll pay $400 plus 6% of the amount over $10,000.

- For incomes between $40,000 and $60,000, you’ll pay $2,200 plus 6.5% of the amount over $40,000.

- If your income falls between $60,000 and $250,000, you’ll pay $3,500 plus 8.5% of the amount over $60,000.

- For incomes between $250,000 and $500,000, you’ll pay $19,650 plus 9.25% of the amount over $250,000.

- If your income ranges from $500,000 to $1,000,000, you’ll pay $42,775 plus 9.75% of the amount over $500,000.

- If your income exceeds $1,000,000, you’ll pay $91,525 plus 10.75% of the amount over $1 million.

This progressive tax system is designed to collect a larger share of taxes from those with higher incomes while providing some tax relief to those with lower incomes.

Residents also have to pay local taxes, which are separate from federal taxes and may include taxes on sales, property and other local revenue sources.

You will also see an approximate 6.2% Social Security deduction, and, in some cases, an additional 1.45% Medicare reduction in your earnings. There may also be additional deductions for health-care contributions, such as for a Health Savings Account (HSA) or a Flexible Spending Account (FSA).

Lastly, you’d be glad to know that D.C. provides various tax credits to residents, including the Homestead Deduction and Senior Citizen or Disabled Property Owner Tax Relief, which can help lower tax liabilities for eligible individuals and homeowners, as well as the Earned Income Tax Credit (EITC).

Median Household Income in Washington DC

Salary in each state is typically based on the cost of living. While salaries vary widely based on position, the median household income in your state can give you a glimpse at the average salary a household is earning in your region.

The median household income data from 2011 to 2021 shows an almost consistently upward trend—only lowering after 2012 and 2019, with the latter most likely influenced by the COVID-19 pandemic.

Median household income is a crucial indicator of the population’s economic well-being. It reflects the income level separating the upper and lower half of households in the state. When the median income is on the rise, it can be a sign of an improving standard of living for many residents.

D.C. also boasts holding third place across 100 of the largest metros in the U.S. in terms of education, median income and incomes over $100,000.

It also has a median household income among Black residents of $82,045, which is 18.9% higher than the national median household income of $69,021. This demonstrates bright economic opportunities for all residents.

Tips for Maximizing Your Paycheck

Maximizing your paycheck is crucial in ensuring your financial well-being. Here are some ways to start today:

- Review paycheck deductions

- Use tax-saving strategies

- Be informed and maximize workplace benefits (insurance, tuition assistance, etc.)

- Build a financial plan with clear, realistic financial objectives

- Explore additional income sources

- Review pay stubs and watch out for possible errors