South Dakota Paycheck Calculator: Calculate Your Net Pay

If you’re wondering, “How do I figure out how much money I take home in South Dakota” we’ve got you covered.

Use our simple paycheck calculator to estimate your net or “take home” pay after taxes, as an hourly or salaried employee in South Dakota.

Paycheck Calculator

Meanwhile, get ahead with our free resources:

How Does the Paycheck Calculator Work?

Input your salary information, such as wage and pay frequency, and our tool will handle the tax calculations for you. Once you’ve filled in all the information, click the “Calculate Tax” button, and the calculator will provide an estimate of your net or “take home” pay for the specified pay period.

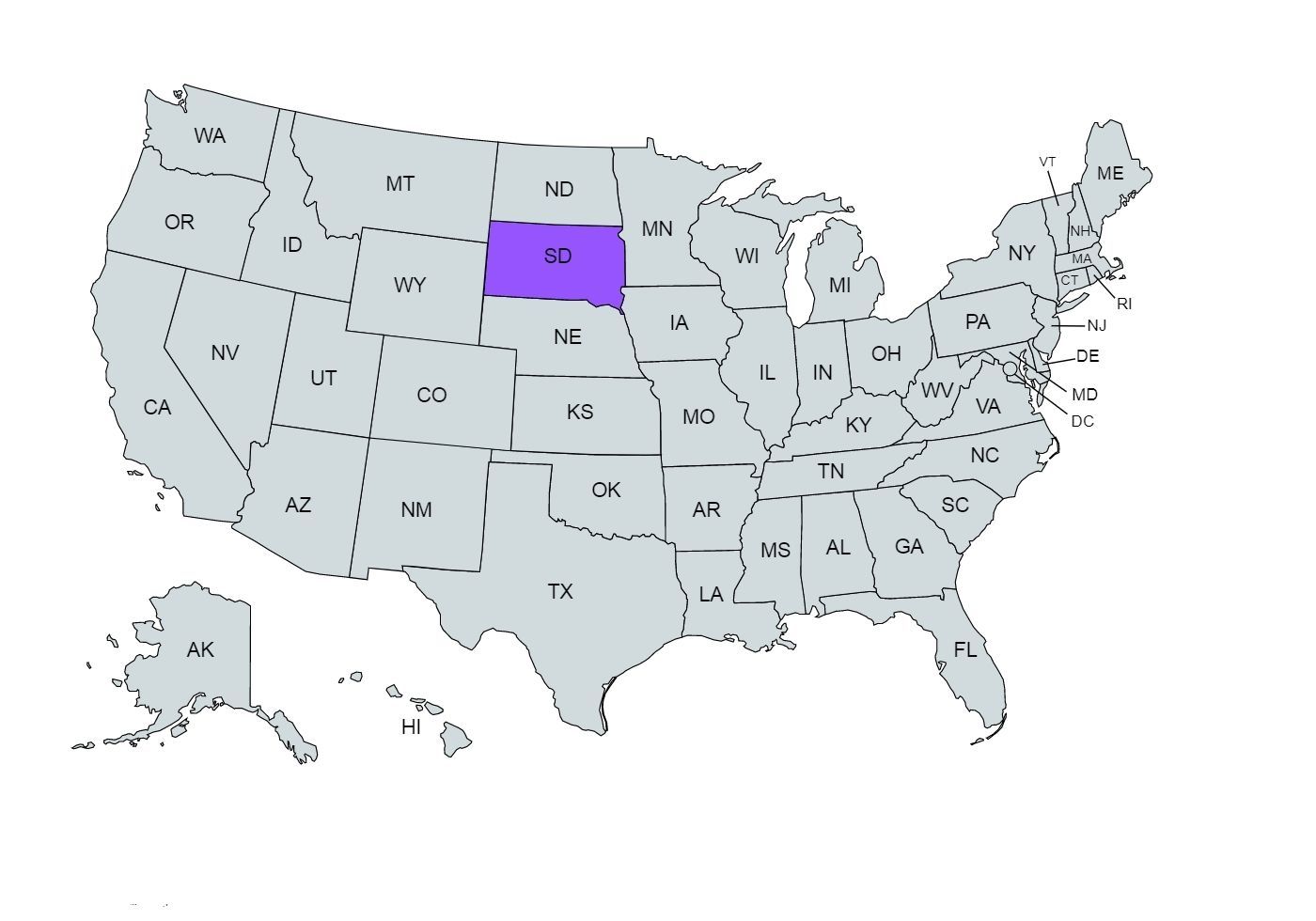

Overview of South Dakota Taxes

In 2010, South Dakota had a gross state product of $39.8 billion, with a per capita personal income of $38,865 (ranking 25th in the U.S.), and a 12.5% poverty rate in 2008.

The state was recognized as the seventh best in the nation for business by CNBC in 2010, and in July 2011, the unemployment rate stood at 4.7%.

The service industry, including retail, finance, and healthcare, is the largest contributor to the state's economy, with Citibank establishing operations there in 1981.

The Mount Rushmore state stands out as a tax-friendly state, imposing neither state nor local income taxes.

This means as its resident, you won't have to worry about state income tax deductions, resulting in more money in your pockets.

The primary tax concerns in South Dakota are federal income tax and FICA taxes, which include Social Security and Medicare contributions. For most employees, this means a 6.2% deduction for Social Security and a 1.45% deduction for Medicare, with employers matching these contributions.

However, if you are a self-employed individual, you must cover the full FICA tax themselves.

Median Household Income in South Dakota

Salary in each state is typically based on the cost of living. While salaries vary widely based on position, the median household income in your state can give you a glimpse at the average salary a household is earning in your region.

In 2021, the median household income notably increased to $66,143 from the previous year's $59,896, indicating a substantial leap.

Examining the preceding years, a consistent upward trajectory can be observed, with median incomes steadily rising over time.

Notably, the most substantial increase in median income occurred between 2020 and 2021, potentially reflecting economic recovery or stimulus measures that positively impacted household earnings.

Tips for Maximizing Your Paycheck

Here are some tips to help you maximize your paycheck:

- Become familiar with your payroll deductions

- Understand techniques for reducing your tax

- Fully utilize your work-related perks

- Develop a financial plan and define financial goal

- Look into additional income through extra hours or performance incentives

- Regularly check your pay stubs for inaccuracies