Rhode Island Paycheck Calculator: Calculate Your Net Pay

If you’re wondering, “How do I figure out how much money I take home in Rhode Island” we’ve got you covered.

Use our simple paycheck tax computation tool to estimate your net or “take home” pay after taxes, as an hourly or salaried employee in Rhode Island.

Paycheck Calculator

Meanwhile, get ahead with our free resources:

How Does the Paycheck Calculator Work?

Input your salary information, such as wage and pay frequency, and our tool will handle the tax calculations for you. Once you’ve filled in all the information, click the “Calculate Tax” button, and the calculator will provide an estimate of your net or “take home” pay for the specified pay period.

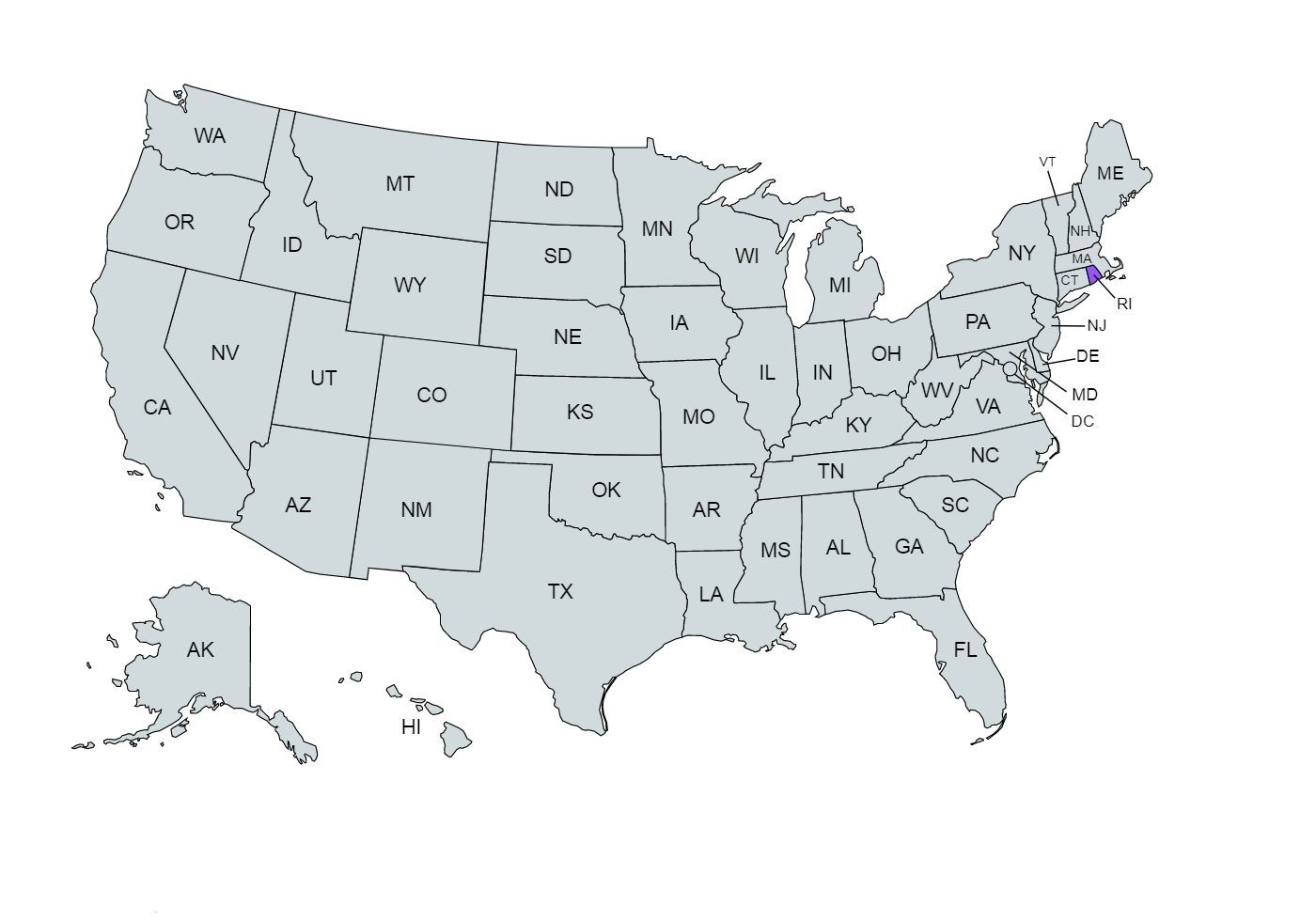

Overview of Rhode Island Taxes

The Rhode Island economy historically had a foundation in fishing and played a significant role in the American Industrial Revolution, with Slater Mill in Pawtucket considered its birthplace in 1793.

Today, Rhode Island's economy is primarily service-based, particularly in healthcare and education, alongside some manufacturing activities like nuclear submarine construction.

In 2019, Rhode Island's unemployment rate stood at 3.5%, but it spiked to 18.1% during the COVID-19 pandemic in April 2020.

If you decide to start a new job in the "Ocean State", here's what to expect tax-wise.

Rhode Island utilizes a progressive state income tax system with three tax brackets, and the tax rates vary by income level, ranging from 3.75% to 5.99%.

These brackets apply uniformly to all taxpayers, regardless of their filing status. Employees have 6.2% of their wages withheld for Social Security tax and 1.45% for Medicare tax, with employers matching these contributions.

However, if you are a self-employed individual, you will be responsible for paying the full FICA contribution.

If earning over $200,000, there is an additional 0.9% Medicare surtax, not matched by employers.

Rhode Island's tax situation, with its progressive income tax system and no local income taxes, can be seen as moderately favorable, but the specific favorability depends on individual income levels and financial circumstances.

Median Household Income in Rhode Island

Salary in each state is typically based on the cost of living. While salaries vary widely based on position, the median household income in your state can give you a glimpse at the average salary a household is earning in your region.

In 2021, the median household income reached its highest point at $74,008, marking a significant increase from the previous year, which saw a median income of $70,305.

However, in 2020, there was a slight dip, possibly due to the economic impact of the COVID-19 pandemic, before the notable surge in 2021.

As you can see, the data reveals a positive trend in median household income over the decade, with a substantial increase in 2021.

Tips for Maximizing Your Paycheck

Here are some tips to help you maximize your paycheck:

- Become familiar with your payroll deductions

- Understand techniques for reducing your tax

- Fully utilize your work-related perks

- Develop a financial plan and define financial goal

- Look into additional income through extra hours or performance incentives

- Regularly check your pay stubs for inaccuracies