Delaware Paycheck Calculator: Calculate Your Net Pay

If you’re wondering, “How do I figure out how much money I take home in Delaware?” we’ve got you covered.

Use our simple calculator for paycheck to estimate your net or “take home” pay after taxes, as an hourly or salaried employee in Delaware.

Paycheck Calculator

Meanwhile, get ahead with our free resources:

How Does the Paycheck Calculator Work?

Input your salary information, such as wage and pay frequency, and our tool will handle the tax calculations for you. Once you’ve filled in all the information, click the “Calculate Tax” button, and the calculator will provide an estimate of your net or “take home” pay for the specified pay period. You can also check out our gross income to hourly wage and wage to salary calculator.

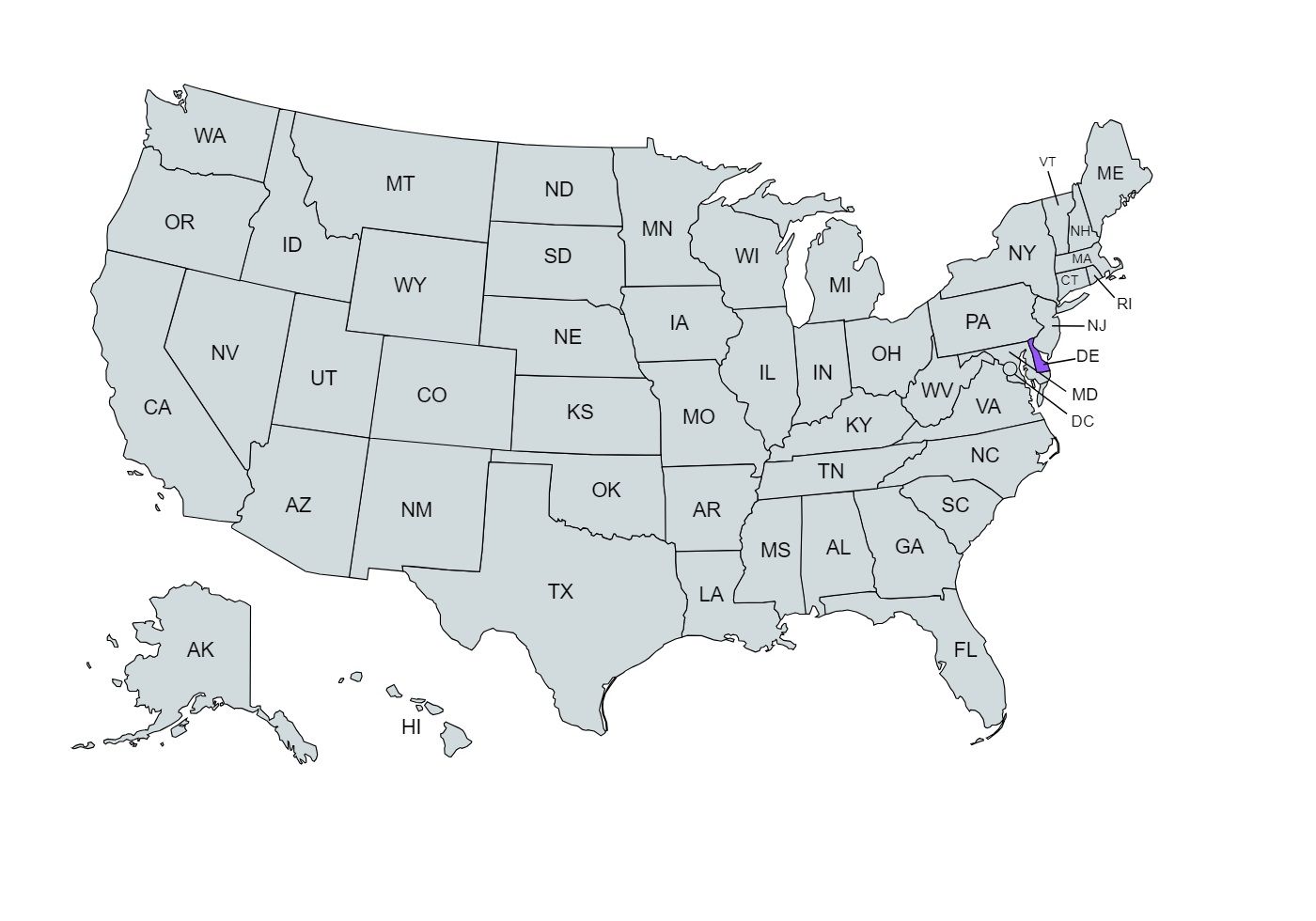

Overview of Delaware Taxes

If you're deciding to start a new job in "The First State," here's what to expect tax-wise.

Delaware has a graduated or progressive personal income tax rate that ranges from 2.2% to 5.55% for income under $60,000, and then 6.6% for income at $60,000 or higher.

Delaware residents must contribute 6.2% of their wages up to $2,600 for the Social Security tax, and then an additional 1.45% for Medicare, all under the Federal Insurance Contributions Act (FICA) tax.

Delaware also offers an Earned Income Tax Credit (EITC), similar to the federal EITC, which can provide significant tax relief for low-to-moderate-income individuals and families.

Delaware’s taxes are generally considered lower than most states, given that there is no statewide sales tax and other state-level taxes with comparably lower property taxes. There is also a higher degree of certainty on tax obligations.

Median Household Income in Delaware

Salary in each state is typically based on the cost of living. While salaries vary widely based on position, the median household income in your state can give you a glimpse at the average salary a household is earning in your region.

Median household income indicates whether people are earning more or less. An increase typically means improved financial conditions for many residents.

Delaware’s median household income has experienced fluctuations during the past decade. The highest median income was recorded in 2019 at $78,628, while the lowest was in 2012 at $57,896. The decline after 2019 may be linked to the economic impact of the COVID-19 pandemic.

Delawarean’s average incomes vary across its cities and towns. According to the five-year American Community Survey Median of the U.S. Census, median incomes in the city ranged from $34,615 to $158,036—with 8.5% of residents earning $200,000 per year.

Tips for Maximizing Your Paycheck

To make sure you have enough money to cover expenses, save for the future and enjoy a better quality of life, it’s important to know how to maximize your paycheck. Below are some steps to do just that:

- Understand your paycheck deductions to track where your money goes

- Optimize your tax situation by taking advantage of tax-saving options

- Maximize workplace benefits like insurance, tuition assistance and more

- Develop a financial plan and set clear financial goals for yourself

- Explore additional income sources through extra work or incentives

- Regularly review your pay stubs for accuracy to catch any errors promptly