Social Security for Gen-Z Key Takeaways:

- Social Security isn’t just for retirees — it protects you now

- Every dollar you report builds your future safety net

- You earn credits toward Social Security by working and reporting income

- Honest tip reporting boosts both your future and your financial options now

You’re in your 20s, working hard as a Barista, Line Cook, or Server. Retirement feels like a lifetime away, and Social Security might sound like something only grandparents worry about. In fact, nearly half of Gen Z members say they don’t think they’ll get any Social Security benefits.

It’s easy to see why young workers are skeptical. However, even if retirement is decades down the road, Social Security already matters for you today. It’s more than just a payroll deduction – it’s a safety net you’re gradually building for yourself.

This article explains what Social Security is, how it works, and why reporting every dollar you earn (yes, even cash tips!) can make a big difference in your future. We’ll also go over some simple steps you can take now to set yourself up for a more secure retirement.

Why Social Security Matters (Even in Your 20s)

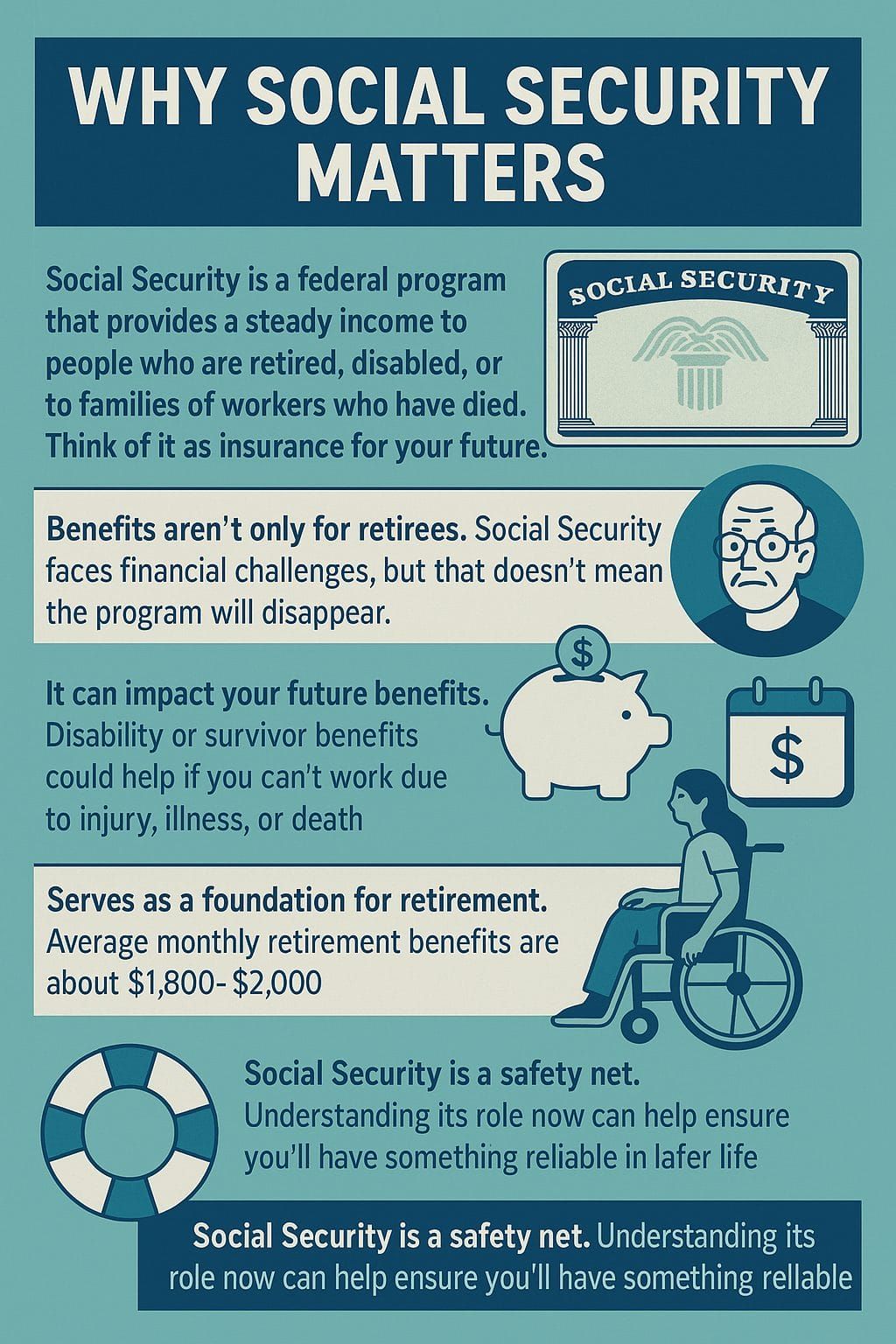

Social Security is a federal program that provides a steady income to people who are retired, disabled, or to families of workers who have died. Think of it as insurance for your future. Every time you get a paycheck and see taxes taken out, you’re already contributing to Social Security’s fund for future benefits.

It might feel painful to lose part of your paycheck now, but that money is helping current retirees and earning you credit for your own benefits later on. In other words, you’re not just working for today’s bills – you’re also investing in a small slice of tomorrow’s security.

Even though many young folks assume Social Security won’t be around when they retire, the reality is the program isn’t going to vanish overnight. Yes, Social Security faces financial challenges; the trust funds are projected to run low by the mid-2030s, which could lead to about a 17% cut in benefits if nothing is done.

But experts note that it’s highly unlikely to disappear entirely – the government can adjust things (like raising the retirement age or taxes) to keep it going

In fact, one financial advisor put it plainly: even if the trust fund empties, benefits would still be paid from ongoing taxes, and lawmakers would step in to fix the system rather than let it die

The bottom line is Social Security will probably still exist in some form when you retire. It may not pay for a luxurious lifestyle, but it can provide a critical base income in your older years.

Why should Gen Z hospitality workers care now? Because the choices you make in your early working years directly impact how much you’ll get from Social Security later. It also matters in unexpected situations: if you get seriously injured or sick and can’t work, Social Security isn’t just for retirees – it includes disability benefits that could help you, even at a young age.

And if something were to happen to you, Social Security can provide survivor benefits to your family. In short, Social Security is a safety net. By paying attention to it now, you’re essentially looking out for “future you,” whether that’s decades down the road at retirement or in the event life throws you a curveball sooner.

Finally, consider that Social Security forms a foundation for most Americans’ retirement plans. The average monthly Social Security retirement benefit is around $1,800–$2,000, which isn’t enough to live lavishly, but can cover essential expenses like rent, groceries, or medical bills for seniors.

Without it, millions of older Americans would be in poverty. By caring about Social Security now, you’re helping ensure you’ll have something reliable later on, even as you pursue other savings and investments.

Social Security Basics: Credits, Taxes, and Benefits

So, how does Social Security actually work? Here’s a quick rundown:

Paycheck Contributions (FICA Taxes)

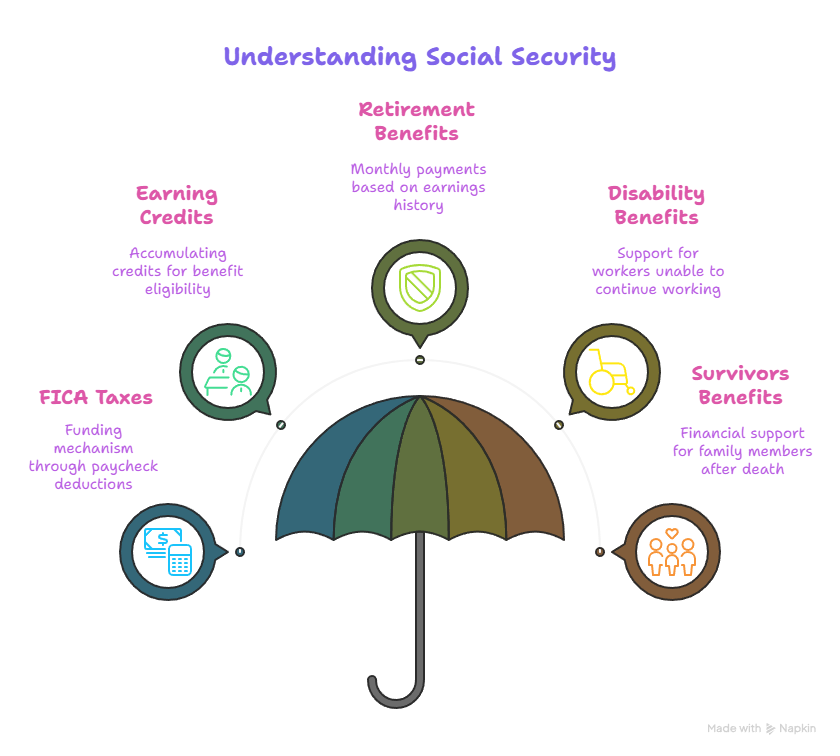

Social Security is funded through the Federal Insurance Contributions Act (FICA) taxes. For most workers, 6.2% of your paycheck is taken out for Social Security, and your employer contributes another 6.2% on their side.

If you’re self-employed or getting paid under the table, you’re supposed to pay the combined 12.4% yourself as self-employment tax.

This money doesn’t go into a personal account for you; it primarily goes to pay current retirees’ benefits. In turn, when you retire, the workers of that time will be funding your benefits – it’s a generational promise.

Earning “Credits”

As you work and pay into Social Security, you earn credits toward future benefits. In 2025, for example, you get 1 Social Security credit for roughly every $1,810 you earn, up to a maximum of 4 credits per year. (The dollar amount for a credit goes up slightly most years with inflation.) Whether you earn $7,000 or $70,000 in a year, you can only get 4 credits max per year.

Typically, you need 40 credits (about 10 years of work) to qualify for Social Security retirement benefits. Think of credits as the ticket to be eligible: if you don’t accumulate enough credits over your career, you can’t claim benefits at all.

The good news is that most people who work full-time for a decade will get their 40 credits. But if you spend years not on the books (unreported work) or in very low-paying jobs without paying into Social Security, you might come up short. Credits are also used to determine eligibility for disability benefits and for your family’s survivor benefits if you pass away.

Retirement Benefits

When you reach retirement age (for Gen Z, full retirement age will be 67 under current law), you can start receiving monthly Social Security checks. You can choose to start as early as age 62, but then you’ll get smaller checks; or wait until 70 and get bigger checks – but that’s a decision for later.

The key point is the size of your benefit depends on your earnings history. Social Security calculates your monthly benefit based on your average earnings over your highest 35 earning years. Essentially, the more you earned (and paid Social Security tax on) during your working years, the larger your check will be.

It’s designed to replace a percentage of your pre-retirement income, with lower earners getting a higher percentage of their wages replaced than higher earners. This is why every dollar you officially earn and report can matter – it can boost that future monthly average.

Conversely, if you have years of low or unreported earnings, those count as zeros in your record and pull down your average.

Disability Benefits

Social Security isn’t just for the golden years. It also includes Social Security Disability Insurance (SSDI) for workers who become too severely disabled to continue working. Young workers can qualify for disability benefits with fewer credits (since you haven’t had as much time to work).

For example, someone in their 20s may only need about 6 to 12 credits (a few years of work) to qualify for disability, whereas older folks need more. But the catch is you have to have those credits. If you’ve mostly worked jobs off the books or haven’t reported your income, you might not be eligible for disability help even if something serious happens.

By working and paying into Social Security now, you essentially have an insurance policy if an accident or illness strikes in your youth. Social Security disability benefits can provide you with monthly income and medical coverage (through Medicare after a waiting period) if you can’t work due to a qualifying disability.

Survivors Benefits

Social Security also provides a form of life insurance. If you die, certain family members (like your spouse, kids, or even dependent parents) might be able to receive survivors benefits based on your work record. Again, the amount and eligibility depend on how much you worked and contributed.

No one likes to think about worst-case scenarios, but it’s good to know that by paying into Social Security, you’re not only protecting yourself but also potentially your loved ones.

For instance, the child of a deceased worker could receive monthly checks to help with living costs, which can be a lifeline for families in tragedy.

In short, Social Security is a comprehensive program: you pay now while you’re working, and you and your family can draw on benefits when you retire, if you become disabled, or if you’re no longer around.

It’s a social safety net meant to prevent extreme hardship. Understanding these basics helps you see why making sure your work counts in the system is so important.

Reporting Wages and Tips: Why It Matters

Working in restaurants and cafes often means part of your income comes as cash – those tips stuffed in your jar or added onto a bill. It might be tempting to not report cash tips or off-the-books pay. After all, if your boss hands you $100 in cash at the end of the night, who’s going to know if you pocket it without telling the IRS, right?

But here’s the catch: by not reporting that income, you’re essentially cheating yourself out of future Social Security benefits. Under-reporting your wages might save you a few bucks in taxes today, but it can cost you a lot more in the long run.

Think of every dollar in tips as part of your future earnings. Social Security treats tips just like regular wages as long as you report them. In fact, by law if you earn $20 or more in tips in a month at a single job, you’re required to report those tips to your employer so they can be taxed for Social Security and Medicare.

When you report tips, that money is added to your official earnings record and counts toward your Social Security credits and benefit calculations. It’s literally added to the tally of what you earned in your career. If you don’t report the tip, in the eyes of Social Security it’s like you never earned that money at all.

Over time, failing to report tips or other cash wages can really shrink what you’ll get in benefits later. For example, imagine you only report your $2.13 per hour base server wage and not the additional $150 in cash tips you made during a shift. Social Security will see only that meager wage and “think” you earned almost nothing for that time.

Do that regularly, and when it’s time for you to collect retirement benefits, your checks will be much smaller than they should be – because according to the records, you barely made any money in those years. In other words, you’re trading away future income to keep a bit more cash now. The IRS puts it bluntly: the more you pay into Social Security, the greater your benefits down the road.

This is true for everyone, but it’s especially true for tipped workers who might have a big gap between their official reported pay and their actual income. You don’t want that gap to come back and bite you later.

Reporting all your wages is like investing in your own safety net. Not only does it increase your eventual retirement checks, it also strengthens your other protections. If you suffer an injury or illness that sidelines you from work, having those earnings on record could be the difference in qualifying for disability benefits.

Likewise, if tragedy strikes, your spouse or kids could receive survivors benefits based on your earnings. If you didn’t report a lot of your income, those supports might not be there for your family when they need it.

Simply put, by reporting your full earnings, you ensure you’re properly credited for all the hard work you do – and that you and your loved ones can access the full benefits you’ve earned.

There’s also a more immediate benefit: showing your true income can help you in the here and now. Need a car loan or an apartment lease? Lenders and landlords often ask for pay stubs or W-2 forms to verify income. If you’ve been underreporting, your official income might look too low for that new car or apartment you want.

Similarly, if you ever lose your job and need unemployment benefits, or if you get hurt at work and file for workers’ compensation, those payments are based on your reported earnings. By reporting your tips, you could qualify for better financial opportunities and protections in your working life, not just in retirement.

Lastly, it’s worth noting the legal side: not reporting income (including tips) is illegal. The IRS can audit tip earners, and if they find unreported income, you could face back taxes, penalties, and interest

Employers can get in trouble too for tolerating unreported tips. So while our focus here is on your future benefits, remember that reporting your earnings is also about staying on the right side of the law and avoiding a huge headache down the line.

The takeaway: Don’t shortchange yourself. Every dollar you earn honestly and report is a dollar that works for you twice – once now, and again in the form of Social Security benefits later. It might require a bit of extra effort to track and report your tips, but you’re securing a stronger financial foundation for yourself. Think of it as paying your future self.

Steps to Set Yourself Up for Retirement Now

You don’t need to wait until middle age to start taking charge of your financial future. As a Gen Z hospitality worker, there are some easy, concrete steps you can start right now to make sure you’re on track with Social Security and beyond. These aren’t huge life overhauls – just smart habits and actions that can pay off big-time later. Here are a few to consider:

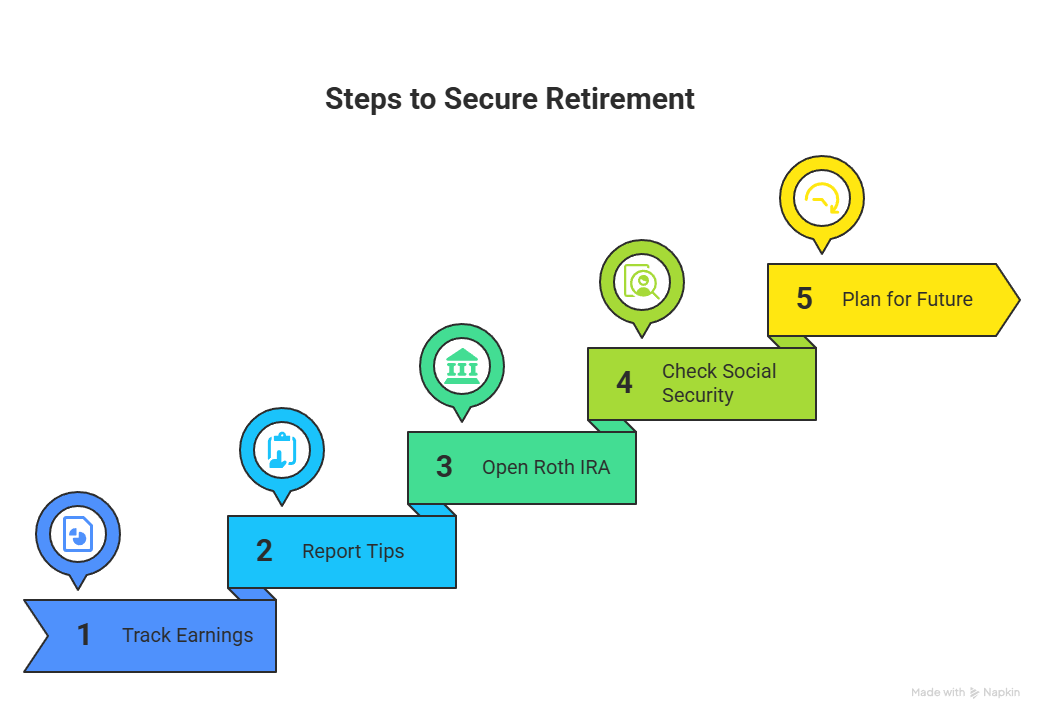

1. Keep Track of Your Earnings (Especially Tips)

It’s hard to report your income accurately if you don’t remember what it is! Get in the habit of tracking all your earnings. Use a notebook or a notes app on your phone to jot down the cash tips you take home each shift, as well as hours worked if they’re not on a pay stub.

The IRS even provides Form 4070A as a daily tip record log, but any method that works for you is fine. The key is to have a record. This will make it much easier to report your tips to your employer each month and to double-check that your W-2 at year-end reflects what you actually earned.

Tracking your income also helps you notice if something’s off (for example, if an employer didn’t report some of your wages to Social Security). Plus, it can inform your budget and savings plans. It takes maybe a minute at the end of your shift to note your tips – a minute that could translate into more money in your pocket later on.

2. Report Your Tips every time

Make it a non-negotiable routine to report all your tips to your employer (generally, you should do this by the 10th of each month for the prior month’s tips, or as your workplace requires). If your restaurant’s payroll system asks for cash tips at the end of each shift, be truthful and thorough.

By reporting, your tips get included on your paycheck records and W-2 form, which means Social Security and Medicare taxes are paid on them. This ensures those tips count toward your future benefits.

If you ever have a month where you forget to report some tips to your boss, you can still make it right when you file your taxes by using Form 4137 to include those unreported tips – that way you pay the tax and get credit for that income in Social Security’s eyes. It might be tempting to hide cash to avoid taxes, but remember: you’re only hurting your own retirement and protections.

Honesty truly is the best policy here, for both legal and financial reasons. Over time, your future self will thank you as those reported tips boost your benefit calculations.

3. Open a Roth IRA (and Save What You Can)

Social Security alone probably won’t be enough for a comfortable retirement, so it’s smart to start your own savings on the side. One of the best tools for young workers without employer retirement plans (which is often the case in hospitality) is a Roth IRA.

A Roth IRA is an individual retirement account you can open at a bank or online brokerage. You contribute post-tax money (meaning you’ve already paid tax on it), and then it grows tax-free. When you withdraw from it in retirement, it’s all yours – no taxes on the investment gains.

For young people who might be in a lower tax bracket now than they will be later, a Roth is golden. Even small contributions help. For example, putting aside $20 a week from tip money into a Roth IRA can grow significantly over 40 years.

Another perk: since it’s after-tax money, you can withdraw your contributions from a Roth IRA at any time without penalty if you really need it (though you shouldn’t touch the earnings). That means a Roth can double as an emergency fund in a pinch – a nice safety net for someone with an unpredictable income.

If your employer offers a 401(k) or similar plan with a match, definitely take advantage of that first (never turn down free matching money). But many restaurants don’t offer such plans, so an IRA is your DIY option. Setting up a Roth IRA is usually free; you just need to have earned income (which you do from your job) and you can start with relatively small amounts. The younger you start, the more time your money has to grow. It’s truly a gift to your future self.

4. Check Your Social Security Statement Regularly

You might not realize this, but you can view your own Social Security records online anytime. The Social Security Administration provides a “my Social Security” online account where you can see your Social Security Statement – this shows your earnings history (what your employers reported each year) and estimates of your future benefits.

It’s a good practice to check this at least once a year to make sure everything is accurate. Mistakes do happen: an employer might have reported your name or SSN incorrectly, or some earnings might not have been credited. If you spot an issue, it’s much easier to fix it now (by contacting SSA and providing proof, like W-2s) than 30 years from now.

Monitoring your statement is also motivating – you can literally watch your credited earnings and future benefit estimates grow over time as you work. The SSA encourages workers to do this: “Open a my Social Security account to verify your personal earnings and watch your future benefits grow over time”.

For younger folks, SSA usually doesn’t mail paper statements anymore, so online is the way to go. It only takes a few minutes to sign up on ssa.gov. By staying on top of your Social Security records, you ensure that no year of hard work goes uncounted.

5. Plan for the Long Haul (Think “Future You”)

This last tip is more mindset than action: start thinking of future you as someone you care about. When you’re bussing tables or dealing with a rush at the coffee shop, retirement feels abstract. But every career has an end, and you don’t want to be scrambling at the last minute.

By treating things like reporting income, saving a bit out of each paycheck, and learning about benefits as priorities now, you’re essentially giving your older self a gift. Even if Social Security changes by the time you retire, the habits you build today (like saving and being financially aware) will serve you no matter what.

So take your earnings and retirement planning seriously, even while you’re young. It’s totally fine if you can only save a little or if you’re just learning as you go – the important part is to start.

Final Thoughts

Being a Gen Z worker in the hospitality industry is demanding – the hours can be long, the work is physical, and the pay often comes in unpredictable waves of wages and tips.

Amidst the hustle of today, don’t forget about tomorrow. Social Security may not be the most exciting topic, but it’s a pillar of financial stability that you have the power to strengthen for yourself.

By reporting your income honestly and taking a few smart steps while you’re young, you’re essentially locking in a stronger baseline for your later years. Imagine down the line, getting a monthly check in retirement that’s a little higher because 25-year-old you took the time to do things right – that could mean less stress about bills when you’re older.

Or if life throws you a curveball, knowing you’ve got enough work credits and accurate records so you can access disability benefits or help your family get survivor benefits if needed.

In the end, caring about Social Security now is about respecting the value of your own work. You work hard for your money; make sure that money works hard for you in return. Every coffee you pour, every plate you serve, every tip you earn is building your future. So keep an eye on that future.

Track your earnings, report them, save a bit if you can, and check in on your progress. These habits will set you up for success and security in the long run. You’ve got the apron and the name tag now, but one day you’ll hang them up – and when you do, you’ll be glad you looked out for yourself.

Social Security is one ingredient in your recipe for retirement, and with a little care and attention today, it can help ensure your tomorrow is a little sweeter.

Loading comments...