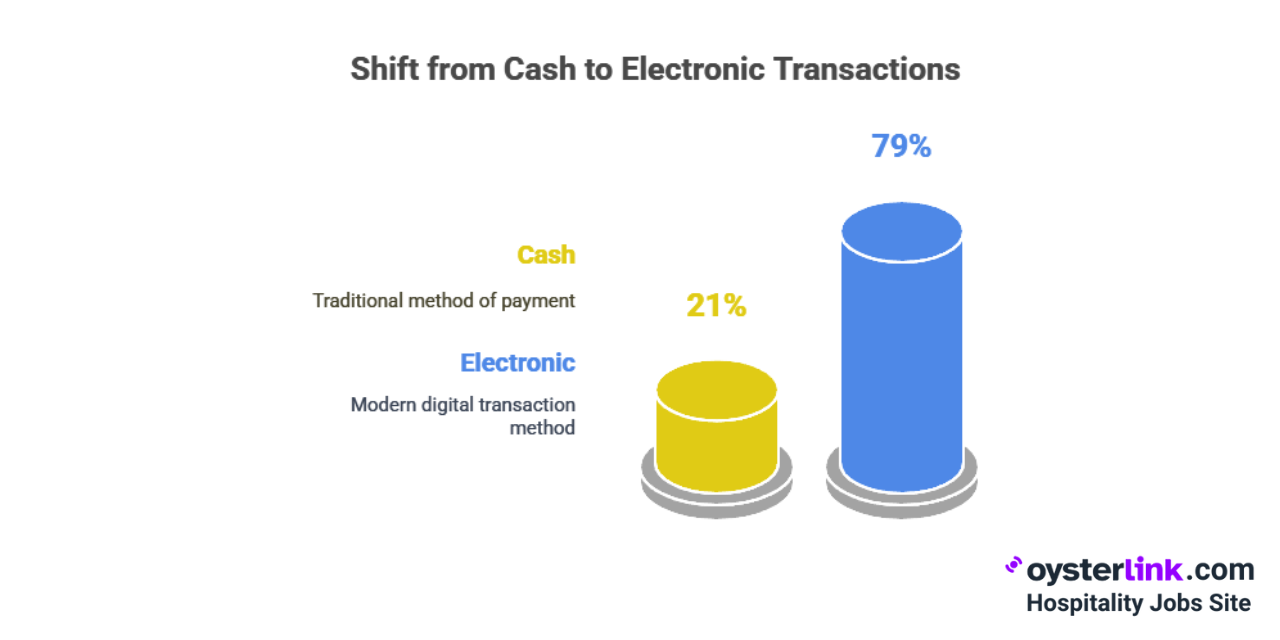

Nowadays, 79% of transactions are made electronically, making cash tips pretty much a thing of the past.

Cashless tipping is growing rapidly, mainly because fewer people are carrying cash and prefer quick, contactless payments.

For restaurant owners and service providers, understanding this shift is essential.

How Cashless Tipping Works

Cashless tipping allows customers to give gratuity digitally, often using smartphones or contactless cards. Instead of pulling out cash, they just tap or scan to tip.

Businesses often use specific apps, QR codes or integrate tipping into their POS systems — like Square, Toast or Clover — that prompt customers at checkout.

These systems generate detailed reports, simplifying tip distribution and record-keeping for managers.

Customers can simply select a predetermined tip percentage or enter a custom amount during checkout — whether paying with a card, mobile wallet or scanning a QR code.

The tip then goes directly to the worker’s account or is pooled by the business according to their payroll policies.

Popular Cashless Tipping Methods

Here are some common and emerging ways to tip without cash:

- Payment apps: Venmo, PayPal, Cash App — customers can tip directly, sometimes through dedicated “tip jar” profiles.

- QR codes: Placed on tables or receipts, allowing guests to scan and tip quickly, especially during takeout and delivery.

- Contactless cards: Many terminals now prompt for tips at checkout—easy to add when using a contactless card or mobile wallet.

- Integrated POS: Systems like Square or Toast ask customers if they'd like to tip during payment, with options for pooling and management.

- New tech: Smartwatches, digital kiosks, and AI-powered chatbots are testing innovative ways to streamline electronic tipping — some of these tech-forward options can boost tips and set your place apart, though they may need staff training.

Cashless Tipping Made Easy: A Step-by-Step Breakdown

Here’s how a typical cashless tip works, from start to finish.

- Make a payment for your service or meal using a card, mobile wallet or digital app.

- At checkout, a prompt appears on the screen (or a QR code is displayed nearby) asking if you’d like to leave a tip.

- Select a preset percentage or enter a custom tip amount.

- Confirm the tip. The amount is added to your total and processed electronically.

- If using a QR code, scan it with your phone, enter the tip, and send payment through the designated app or platform.

- The tip is then sent directly to the service worker’s account or distributed by the business as per their payroll policies (such as pooled tips, distributed via payroll or instant payouts if enabled).

Why Cashless Tipping Is On the Rise

Several factors drive the popularity of cashless tips. For one, four-in-ten Americans (41%) say none of their purchases in a typical week are paid for using cash.

The rise of contactless and mobile payments, paired with shifting hygiene habits since the pandemic, has made digital transactions the new default.

With payment screens prompting for a tip, people often give more — and more often. Businesses also appreciate the streamlined accounting and improved transparency that cashless tips bring to their operations.

For restaurant operators, cashless tipping means less time spent reconciling after each shift and clearer documentation for payroll — which is valuable for compliance and resolving tip pool disputes among staff.

Pros and Cons of Cashless Tipping

Cashless tipping brings fresh opportunities, but also introduces some new hurdles for both customers and those working in hospitality, food service or personal care industries.

Pros for consumers

For customers, cashless tipping makes showing gratitude easier and more convenient. No need to worry about having exact change at the end of a meal — the process is simple during any digital payment.

New tech also keeps tipping transparent, since digital receipts and payment histories record how much was tipped and when.

This ease of use can encourage slightly higher gratuities, as pre-set or rounded amounts are often displayed up front.

Benefits and challenges for service workers

Service workers gain advantages with cashless tipping, such as receiving more tips from cash-free customers and potentially accessing funds instantly, depending on the platform.

However, digital tips are automatically tracked, which may increase tax obligations and reduce the flexibility that cash offers.

Some platforms or employers also deduct processing fees, and workers may need digital access or bank accounts to retrieve their tips.

Considerations for restaurant owners

- Staff satisfaction: Transparent tip reporting can create a fairer workplace and bolster trust, but make sure to communicate changes clearly and gather team feedback before launch.

- Tip pooling: Digital records simplify tip pooling among Servers, Bartenders and kitchen staff — just make sure your POS system can categorize and distribute tips as required by law and company rules.

- Customer transition: Add signage at the register or table to remind guests that cash tips are still welcome. Some diners are old-school and might hesitate about digital payments.

- Training: Spend time on staff training for both the tech and guest-facing conversations. Assign a “tech ambassador” (a friendly face from your crew) to help others learn the ropes.

- Reporting and compliance: Use digital tip data for payroll accuracy, year-end reporting, and in case of audits — reducing compliance headaches.

Costs and Fees Associated With Cashless Tipping

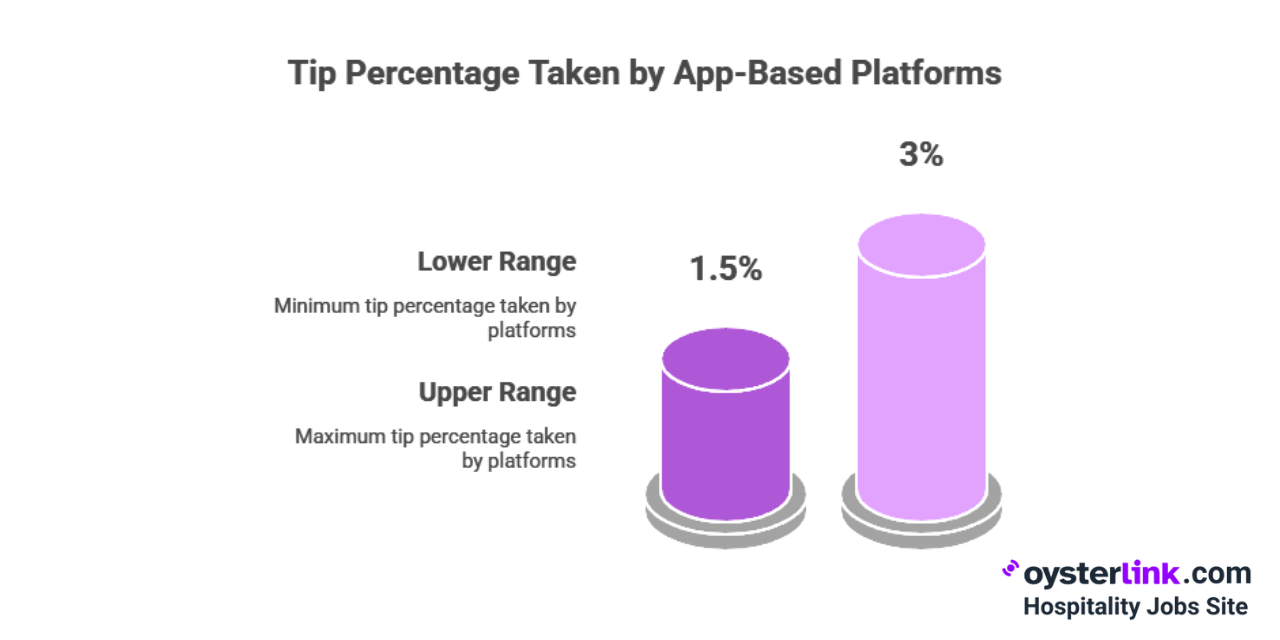

Most cashless tipping methods have fees attached. These range from small processing charges by payment apps to credit card transaction fees through POS systems.

Sometimes, these fees are passed to the business or deducted directly from the tip amount, reducing what workers receive.

Some common scenarios:

- App-based platforms taking a percentage from each tip (anywhere from 1.5 to 3%)

- Additional service charges if tips are transferred instantly to a bank account

- Employers charging setup or monthly fees for using tipping integrations

Over time, these fees can chip away at take-home pay for workers, though some employers cover the cost to keep tips whole.

For helpful tools to attract and retain your best people despite fee-related friction, see our guide on best restaurant staff retention strategies.

What Restaurant Owners Should Watch For:

- Check if your POS provider charges “hidden” fees per tip or monthly usage costs for tipping features.

- Decide whether to cover transaction fees yourself as a retention perk or pass them along to staff or guests.

- Factor in how these micro-fees affect pooled tip distributions — be clear about your policy.

- Compare integration costs across POS systems — some bundle transaction rates for high-volume or multi-location spots.

Security, Privacy and Legal Considerations

Cashless tipping requires sharing personal or financial data, so security is crucial. Most reputable apps use encryption and follow strict security protocols.

Still, users should stick to secure Wi-Fi and reputable platforms.

For staff, digital tips create an electronic record, removing privacy but making record-keeping and tax reporting clearer.

Legally, tips reported digitally must be declared as income — recipients need to keep accurate records for tax purposes.

Be sure your chosen platforms generate reports suitable for tax prep and payroll submissions. It’s worth avoiding any system with unclear privacy settings or sketchy data retention.

The Future of Tipping: What To Expect

Digital payments are still on the rise, so cashless tipping is likely to be the new normal across most service industries.

Tighter payroll integration, automated tip pooling and broader use beyond restaurants — think hotels, rideshares and beauty salons — are already happening.

Advanced POS systems (with help from AI) might someday offer smart tip suggestions based on guest history or send performance-based nudges to your team.

Whichever way the wind blows, the push for transparency and consistency will only grow.

For more forward-looking advice about running modern hospitality businesses, explore best practices in restaurant operations.

Adapting Your Restaurant for Cashless Tipping

Transitioning doesn’t have to be overwhelming. Try this basic roadmap:

- Step 1: Survey your staff and regulars about their preferences and concerns.

- Step 2: Compare POS or app-based tipping solutions — be sure to ask for up-front pricing and compatibility with your current setup.

- Step 3: Run a small pilot during a slow week, then collect feedback and tweak policies before going all in.

- Step 4: Put up clear signs so guests know about cashless tipping — and that cash is still just fine if they prefer.

- Step 5: Use your POS’s tip tracking tools to speed up end-of-day reconciliation, payroll and compliance reporting.

- Step 6: Keep checking in with your team; update them on any tweaks or new features as you go.

About OysterLink – The Fastest Growing Hospitality Platform

OysterLink is a dedicated platform connecting restaurant professionals and employers, making it easy to find top hospitality jobs or hire the right talent quickly and efficiently.

We provide job seekers with salary insights, career guidance and top listings, while offering employers tools for creating compelling job ads, identifying suitable candidates and accessing essential business resources.

Committed to bridging opportunity and talent, OysterLink aims to streamline hiring and career growth within the restaurant and hospitality industry.

Loading comments...