California’s Overtime Law: 3 Key Takeaways

- Employees must be paid 1.5x their regular rate after 8 hours and 2x after 12 hours in a single day.

- If a manager spends over 50% of their time on non-exempt duties (like serving or cleaning), they must receive overtime.

- Employees earning different hourly, commission, or piece rates must calculate overtime based on total weekly earnings ÷ total hours worked.

California Overtime Law is one of the most employee-friendly in the U.S., going beyond federal standards to ensure workers are fairly paid for extra hours.

Whether you're hourly, salaried, or commission-based, knowing how overtime is calculated—and when you're entitled to it—is crucial.

What Is California’s Overtime Law?

California’s Overtime Law is all about fairness—designed to protect the rights of employees and ensure they are fairly compensated for working extra hours.

Whether you’re punching in or signing paychecks, knowing these rules is a must to keep things running smoothly.

Daily overtime

As per California Labor Code 510, most nonexempt employees aged 18 or older—and certain eligible minors aged 16 or 17—are limited to a standard workday of eight hours.

Any work beyond eight hours in a day or 40 hours in a week generally requires overtime pay.

If you work more than eight hours in a single day, California law entitles you to overtime pay at 1.5 times your regular rate for all hours over eight, up to 12 hours.

This rule ensures extra compensation for extended workdays.

Weekly overtime

If you find yourself working on the 7th consecutive day of the workweek, the first eight hours of that day are also subject to one and one-half times your regular rate of pay.

Double time

California’s Overtime Law mandates double the employee’s regular rate of pay for all hours worked in excess of 12 hours in any workday.

Double time also applies when you work more than eight hours on the seventh consecutive day of your workweek.

California Overtime Laws for Hospitality Workers

Managers and supervisors in hospitality are often classified as exempt employees, but this exemption comes with specific requirements under California law.

To qualify as exempt:

- The manager must earn at least twice the state minimum wage for full-time employment.

- The primary duties must involve management, such as hiring, training, or supervising employees.

- The employee must regularly exercise discretion and independent judgment.

In California, if a manager spends over 50% of their time on non-exempt tasks like serving customers or cleaning, they may lose their exempt status.

This means they could be eligible for overtime pay despite their managerial title.

This is particularly relevant in small hotels or restaurants where managers often perform mixed duties.

How Is California Overtime Pay Calculated?

For hospitality workers, calculating the regular rate of pay can include tips, service charges, or commission-based earnings, depending on the circumstances.

Employers must ensure that:

- Tip credit: California does not allow tip credit toward minimum wage, but tips and service charges can factor into the employee's regular pay rate for overtime purposes.

- Multiple pay rates: For employees working multiple roles overtime must be calculated based on a weighted average of all pay rates.

For instance, if a banquet server earns service charges while working overtime, those charges must be factored into the overtime rate.

California law requires that all nondiscretionary compensation, like service charges, be included in calculating overtime pay.

Essentially, depending on your work arrangement, you can calculate your regular rate of pay in the following ways:

Hourly Workers

Your regular rate of pay includes not just your base hourly wage but also any extras like shift differentials or additional compensation you get per hour.

So, if your base hourly wage is $15 and you earn a $2 shift differential, your regular rate of pay becomes $17 per hour.

Overtime pay would then be calculated based on that $17 rate, not just the base wage.

Salaried Workers

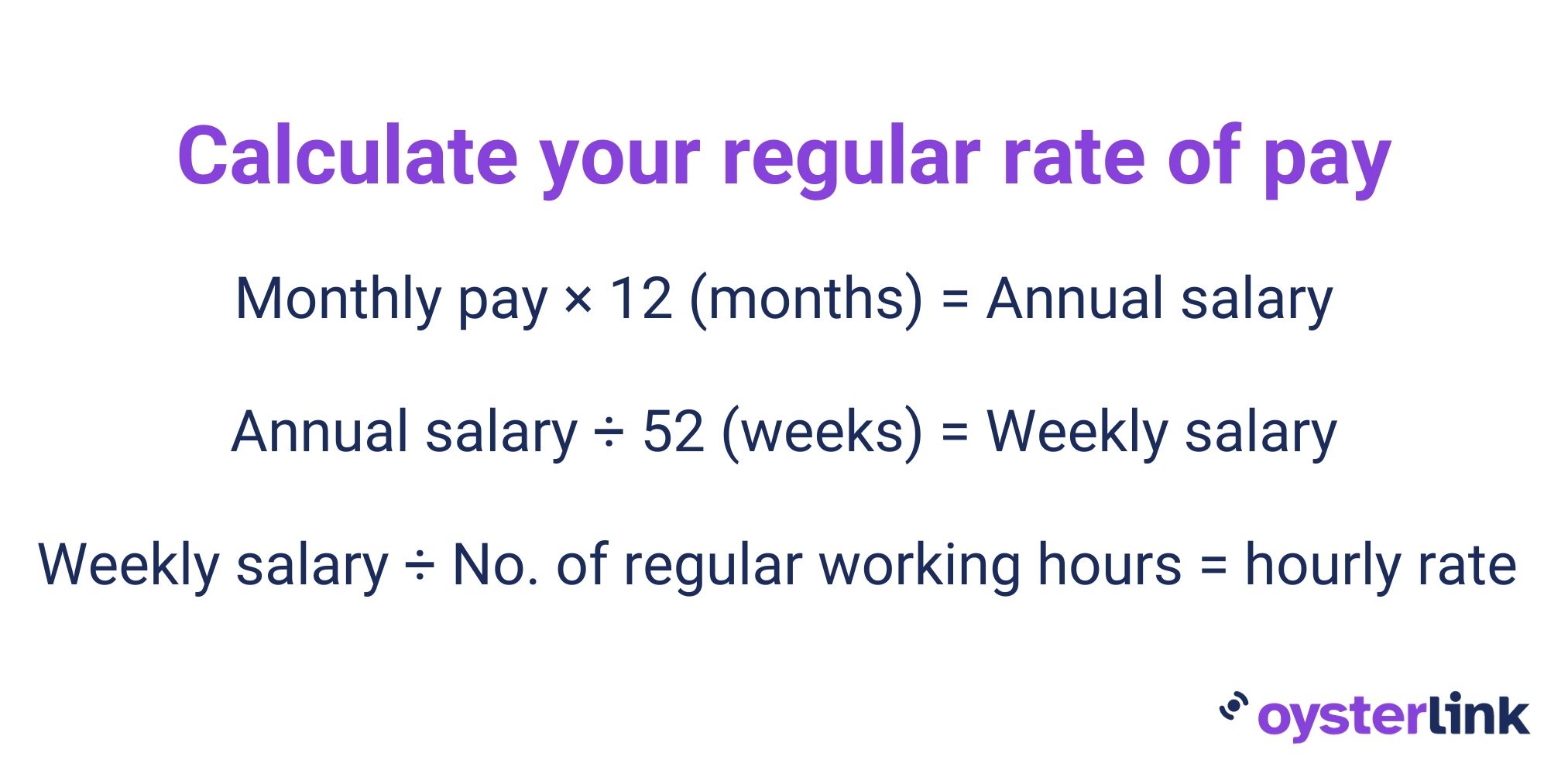

- Multiply your monthly salary by 12 to get your annual salary.

- Divide the value by 52 to find your weekly salary.

- Lastly, divide your weekly salary by the legal maximum regular hours (usually 40) to determine your regular hourly rate.

[Source: California Department of Industrial Relations][/caption]

Piece-Rate or Commission-Based Workers

If you're paid by piece or commission, your regular rate is calculated based on those earnings.

For overtime, you must receive 1.5 times that rate for the first four overtime hours in a day, and double time for any hours worked beyond 12 in a single day.

Or add up all your weekly earnings, including overtime hours. Then, divide that by the total hours worked during the week, including overtime.

For each overtime hour, you get an extra half of your regular rate for hours needing time and a half, and the full rate for double time.

Group Piece-Rate Workers

Divide the total pieces produced by the group by the number of workers.

Different-Rate Workers

If you work multiple jobs or tasks at different pay rates, your regular rate is calculated using a weighted average.

To find it, divide your total weekly earnings by the total hours worked that week—including overtime hours.

California Overtime Pay Calculation Examples

Now, to understand things better, let’s take a look at how you would calculate 10 hours’ worth of overtime pay for each work arrangement.

- Hourly workers:

- Regular rate: $15 per hour

- Overtime rate (time and a half): $15 x 1.5 = $22.50 per hour

- Total overtime pay for 10 hours: $22.50 x 10 hours = $225

- Salaried workers:

- Regular rate: If your monthly salary is $3,000, your regular hourly rate would be calculated as ($3,000 x 12) / (52 weeks x 40 hours) = $17.31 per hour.

- Overtime rate (time and a half): $17.31 x 1.5 = $25.96 per hour

- Total overtime pay for 10 hours: $25.96 x 10 hours = $259.60

- Piece-rate or commission-based workers (with the piece rate as the regular rate):

- Regular rate: Suppose your commission rate is 10% per sale, and you make $100 in commissions on a regular workday. Your regular rate is $10 per hour.

- Overtime rate (time and a half): $10 x 1.5 = $15 per hour

- Total overtime pay for 10 hours: $15 x 10 hours = $150

- Piece-rate or commission-based workers (with total earnings as the regular rate):

- Regular rate: $1,000 / (40 regular hours + 10 overtime hours) = $20 per hour

- Overtime rate (time and a half): $20 x 1.5 = $30 per hour

- Total overtime pay for 10 hours: $30 x 10 hours = $300

- Group piece-rate workers:

- If the group produced a total of 1,000 pieces and there are 5 workers in the group, each worker’s regular rate would be based on their share of the total pieces:

- Regular rate: 1,000 pieces / 5 workers = 200 pieces per worker (Let’s assume each piece is valued at $2.)

- Overtime rate (time and a half) for each worker: 200 pieces x 1.5 = 300 pieces

- Overtime pay for each worker for 10 hours: 300 pieces x $2/piece = $600.

- Different-rate workers (using weighted average):

Let’s say you worked 32 hours at $11.00 an hour and 10 hours during the same workweek at $9.00 an hour:

Remember, overtime pay is just one aspect of your overall take-home pay. To determine your take-home pay, you must consider taxes, deductions and exemptions.

OysterLink has available paycheck calculators for every state in the U.S., so you can estimate your earnings accurately.

Overtime Pay Calculator

If you’re looking to calculate your overtime pay quickly and accurately, our Overtime Pay Calculator is here to help.

This user-friendly tool takes the hassle out of manual calculations and provides you with precise results in no time.

Here’s how it works:

- Create your own copy of the document.

- Choose which sheet applies to you depending on your work arrangement (hourly, salaried or piece-rate or commissioned).

- Enter your name or the workers’ name.

- Specify the number of hours you worked during your regular workweek.

- Indicate the number of hours you worked in excess of your regular workweek (overtime hours).

- Input other information as needed. Please only fill in the white cells only.

Once you’ve filled in these details, the calculator will automatically generate your overtime pay for the given period.

It’s a straightforward and efficient way to ensure you’re compensated accurately for your extra hours on the job.

Make sure to enter your information in the designated fields for accurate results.

Calculate your overtime pay with ease using our Overtime Pay Calculator today!

Who Qualifies for Overtime Pay in California?

California’s Overtime Law is designed to protect employees’ rights and ensure fair compensation for extra hours worked.

These wage and hour laws apply to most nonexempt employees who are 18 or older.

They also cover eligible 16- or 17-year-old minors who aren’t required to attend school and aren’t otherwise restricted from working by law.

Minimum wage is fundamental under California’s Overtime Law because it sets the baseline for an employee’s regular rate of pay.

This regular rate is essential for accurately calculating overtime compensation.

California’s minimum wage is $15.50 for employees. This does not vary whether you are an adult or a minor.

However, this amount can be higher depending on the city or county you are based in.

Some workers are exempt from California’s minimum wage, including the employer’s family, registered apprentices, and outside salespersons.

These exemptions mean they are not entitled to the standard minimum wage or overtime protections.

For a list of California’s minimum wages per city and county, check out this list by UC Berkeley.

Who Is Exempt from California’s Overtime Law?

California Labor Code Section 511 encompasses both exemptions from standard overtime rules and the provisions related to alternative workweek schedules.

Under California’s Overtime Law, some employees are exempt from the standard overtime pay rules.

These rules require additional compensation for working beyond a certain number of hours per day or week.

These exemptions are typically based on an employee’s job duties, salary level and other factors.

Common exemptions include:

- Executive Exemption: Employees who primarily manage the business, supervise employees and exercise discretion and independent judgment.

- Administrative Exemption: Employees engaged in administrative or office work that involves the exercise of discretion and independent judgment.

- Professional Exemption: Employees in certain professional roles, such as doctors, lawyers and architects.

- Outside Sales Exemption: Employees who spend the majority of their time outside the office making sales or servicing clients.

- Computer Professional Exemption: Certain computer professionals meeting specific criteria.

These exemptions have specific criteria that must be met to qualify.

Employers must ensure they follow these rules correctly when classifying employees as exempt from overtime.

Alternative Workweek Schedules

California Labor Code Section 511 also addresses the implementation of alternative workweek schedules.

These schedules allow employers and employees to arrange work hours differently from the traditional five-day, eight-hour workweek.

Common alternative workweek schedules include four-day workweeks with extended daily hours.

Key points regarding alternative workweek schedules include:

- Election and Approval: To adopt an alternative workweek schedule, employers must hold a secret ballot election.

At least two-thirds of the affected employees must vote in favor for it to be approved.

- Overtime Pay: Employees who work beyond the set daily or weekly hours under an alternative workweek schedule are still entitled to overtime pay.

This is in accordance with California’s Overtime Law.

- Meal and Rest Breaks: Employers must continue to provide employees with required meal and rest breaks during extended workdays.

- Regular Rate of Pay: The law specifies how to calculate the regular rate of pay for employees on alternative workweek schedules for overtime pay purposes.

- Revocation and Repeal: Employees can request the repeal of an alternative workweek schedule through a secret ballot election.

However, this vote can only take place at least one year after the schedule was adopted.

What Are the Penalties for Violating California’s Overtime Law?

Employers who violate wage and hour laws should be aware of the penalties stipulated in Labor Code 558.

Initially, the penalty amounts to $50 for the first violation, and for subsequent violations, it increases to $100.

It is imperative to emphasize that these penalties are entirely separate from any outstanding wages that employers are obligated to remunerate their affected employees.

If you’re an employee experiencing nonpayment of overtime wages, you can either file a wage claim or a lawsuit in court against your employer.

Don’t hesitate to report any violation and get the pay you deserve.

[Source: CBS News][/caption]

Common Hospitality Overtime Violations in California

Hospitality businesses frequently encounter compliance challenges with overtime laws.

Common violations include:

- Failing to Track Hours: Some employers improperly track "off-the-clock" work, such as side duties (rolling silverware or cleaning after closing).

- Illegal Tip Pools: When tip pooling policies are mismanaged, and tips are used to offset overtime pay, this violates state law.

- Misclassification: Classifying line cooks or shift supervisors as exempt employees to avoid paying overtime.

- Missed Breaks: With fast-paced environments, hospitality workers often miss legally mandated breaks, resulting in additional penalties.

Employers must remain vigilant to avoid hefty fines and lawsuits stemming from these violations.

Take Control of Your Overtime Pay in California

California’s Overtime Law protects your rights and ensures fair compensation for your hard work.

With OysterLink’s Overtime Pay Calculator, navigating complex overtime rules is effortless.

Take charge of your earnings, stay compliant, and unlock financial clarity today.

Visit OysterLink for expert tools, insights, and resources tailored to your success!

Loading comments...