How To Calculate Pay Raises: Quick Guide

- To find your pay raise percentage, subtract your old salary from your current salary.

- Divide the difference by your old salary and multiply by 100 to convert it into a percentage.

- To determine your new salary, convert the raise percentage to a decimal, multiply it by your old salary and add that amount to your original pay.

You've been putting in the hours, exceeding expectations and making valuable contributions to your workplace. Now, it's time to reap the rewards of your hard work — a well-deserved pay raise.

In this article, we'll break down the pay raise calculation process into simple steps and provide straightforward examples that illustrate each calculation.

Without further ado, let's kick things off.

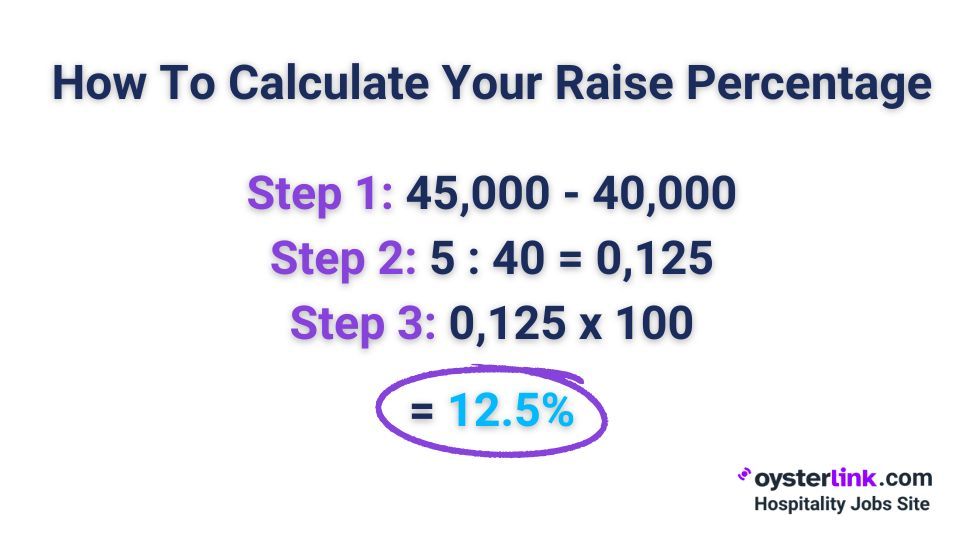

How To Calculate Pay Raise Percentage

Understanding the percentage increase in your salary is the first step in calculating a pay raise. To calculate your raise percentage, follow these straightforward steps:

Step 1: Calculate the difference between your current salary and your previous salary

The first step involves subtracting your previous salary from your current one. This initial calculation quantifies the actual increase in your earnings.

For instance, if your previous salary amounted to $40,000, and your new salary stands at $45,000, the difference between the two is $5,000.

Step 2: Divide the salary increase by your previous salary

Next, we'll calculate the percentage increase by dividing the salary increase (which, as we found, is $5,000) by your previous salary (in this example, $40,000).

This division yields a decimal representation of the percentage increase (0,125).

Step 3: Convert the resulting decimal value into a percentage

Lastly, to express your salary increase as a percentage, you'll need to multiply the decimal value from Step 2 (0,125) by 100.

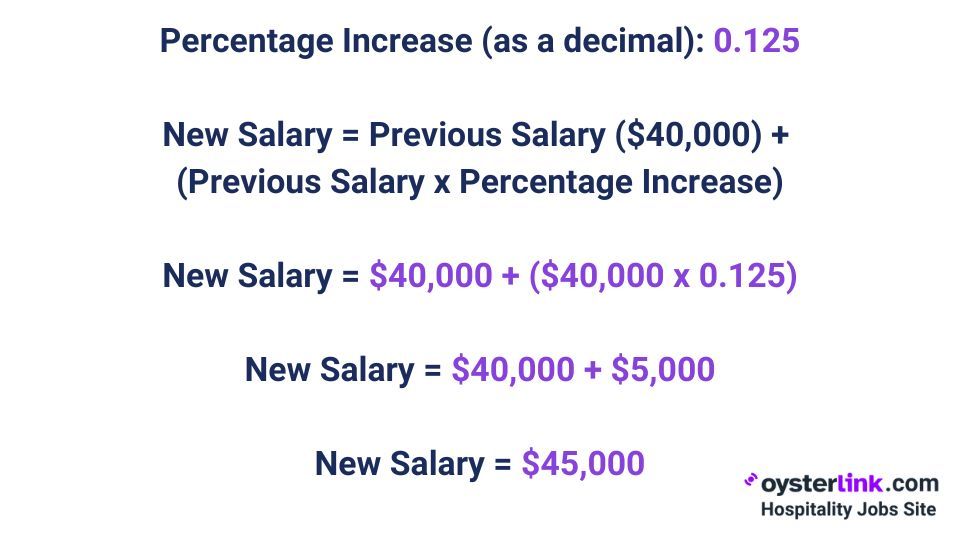

How To Calculate Your Salary Based on Percentage Increase

Let's say you’re a high-performing restaurant Host or Hostess, and the Restaurant General Manager has informed you that your raise percentage is 12.5% as calculated in the previous section.

Now, you want to determine your new salary based on this percentage increase and your previous salary of $40,000.

Let’s see how to calculate pay raises in this case:

Step 1: Convert your percentage raise to a decimal

To do this, divide your raise percentage (12.5%) by 100 to convert it to a decimal.

12.5% ÷ 100 = 0.125

Step 2: Multiply your previous salary by the decimal raise percentage

Take your previous salary (in this example, $40,000) and multiply it by the decimal raise percentage we calculated in Step 1 (0.125).

$40,000 x 0.125 = $5,000

Step 3: Add the result from step 2 to your previous salary

Finally, add the result from Step 2 ($5,000) to your previous salary ($40,000) to calculate your new salary.

$40,000 + $5,000 = $45,000

So, your new salary after a 12.5% raise would be $45,000.

Pay Raise Calculator

If you don’t have time or prefer not to calculate your pay raise percentage manually, you can use our Pay Raise Calculator above. It's a convenient tool to quickly estimate the impact of a pay raise on your earnings.

Simply enter your previous salary and new salary, and the calculator will provide you with the salary raise percentage.

You can also use our calculator to determine your new salary based on the pay raise percentage.

Simply enter the pay raise percentage and your previous pay, and the calculator will provide you with your new salary amount.

In both cases, make sure to fill in only the white cells.

How Do Employers Calculate Pay Raises?

Employers use a combination of factors and strategies to calculate pay raises.

The specific method and criteria can vary depending on the company's policies, industry norms and the employee's performance.

Here are some common factors and methods that employers may consider when calculating pay raises:

Employee performance evaluations

Employers assess an employee's job performance over a specific period, often annually or semi-annually. Performance evaluations serve as the foundation for determining an employee's performance rating, which, in turn, plays a crucial role in determining the size of their merit-based pay increase.

Cost-of-living adjustments (COLA)

Some employers offer cost-of-living adjustments to ensure that employees' salaries keep pace with inflation. COLAs are typically based on changes in the Consumer Price Index (CPI) or other economic indicators.

Market research

Employers may conduct salary surveys to compare their employees' compensation with industry standards. If employees' salaries are below the market average, employers may consider adjusting pay to remain competitive.

Seniority

In some organizations, employees receive regular raises based on their length of service with the company. These are often referred to as "step increases" and are predetermined based on a structured salary scale.

Promotion or job change

When an employee is promoted or takes on additional responsibilities, they may receive a salary increase to reflect the new role's requirements and market value.

Budget constraints

Employers must also consider budget limitations when determining pay raises. They may allocate a certain percentage of the budget for salary increases and distribute it among employees accordingly.

Employee negotiation

In some cases, employees may negotiate pay raises with their supervisors or HR departments. Effective negotiation skills and a strong case for why a raise is deserved can influence the outcome.

According to a recent survey, 85% of Americans who negotiated a job offer were successful. Conducted in March 2022, this survey polled 1,524 U.S. adults ages 25 to 70 who currently work either full- or part-time.

Source: Fidelity

Company performance

A company's financial health and performance can impact its ability to provide pay raises. When a company is thriving, it may be more generous with salary increases, while economic challenges may result in smaller raises or pay freezes.

Minimum wage and legal requirements

In the U.S., the minimum wage is a critical legal requirement that sets the lowest hourly rate at which employers can compensate their employees. The federal minimum wage is established by federal law and serves as a baseline standard.

As of 2025, it is $7.25 per hour. However, many states and local municipalities have their own minimum wage laws that can be higher than the federal minimum wage.

| City | Minimum Wage |

|---|---|

| United States | $7.25/h |

| New York | $16.50/h |

| California | $16.50 /h |

| Florida | $14.00/h |

| Washington DC | $17.95/h |

Source: U.S. Department of Labor

How Does a Pay Raise Affect Your Taxes?

As your income increases with a federal pay raise, your tax situation can undergo significant changes. These changes can lead to both increased tax obligations and potential benefits.

Let’s look at how a pay raise can affect your taxes:

- Increased taxable income: When you receive a pay raise, your taxable income generally increases because you are earning more money. This means you may owe more in federal and state income taxes.

- Higher tax bracket: Depending on the size of your pay raise, you could move into a higher tax bracket. Higher tax brackets typically have higher tax rates, which means you'll owe a greater percentage of your income in taxes.

- Social Security and Medicare taxes: Pay raises can also lead to an increase in Social Security and Medicare taxes (FICA taxes) because these are typically calculated as a percentage of your income. The Social Security tax has a wage base limit beyond which you don't pay additional tax.

- Impact on tax credits and deductions: A pay raise can affect your eligibility for certain tax credits and deductions. For example, some tax credits, such as the Earned Income Tax Credit (EITC), are income-based and may phase out as your income increases.

- 401(k) contributions: If you contribute a percentage of your income to a 401(k) or other retirement account, a pay raise can result in higher contributions, potentially reducing your taxable income.

- State taxes: State income tax rules vary, so a pay raise may affect your state tax liability differently depending on where you live. Some states have flat tax rates, while others have progressive tax structures.

- Additional tax planning: With a higher income, you may want to consider adjusting your tax withholding to ensure you're not underpaying or overpaying taxes throughout the year.

- Capital gains taxes: If your pay raise allows you to invest more, any capital gains you earn from investments could be subject to capital gains taxes when you sell them.

- Alternative Minimum Tax (AMT): In some cases, a significant pay raise may trigger the AMT, a separate tax system with its own rules and rates.

In your quest to understand how a pay raise can impact your taxes, we provide a powerful tool that simplifies the process: our Paycheck Calculator.

It calculates not only your gross pay but also meticulously breaks down all the relevant deductions and withholdings.

Loading comments...