The boom in online food delivery has made ghost kitchens – restaurants with no storefront that serve delivery orders only – a major growth industry. In 2024 the U.S. online food delivery market was about $353.3 billion, and delivery ordering is increasing rapidly.

Industry reports estimate the U.S. ghost‐kitchen market at roughly $2.88 billion in 2024 (projected to $3.87 billion by 2030). These kitchens are widely adopted: about 51% of U.S. restaurants now use a ghost or virtual kitchen model.

By some accounts, major metros like New York, Los Angeles, Chicago, and Miami have the most robust ghost kitchen markets. All this means there are hundreds of new jobs available for Chefs, Line Cooks, packers, delivery logistics and customer support, plus opportunities for entrepreneurs to launch delivery-focused brands.

Below we rank and describe the top cities in 2025 for ghost-kitchen jobs and entrepreneurship, based on:

- Local job demand

- Pay levels

- Business environment (infrastructure, regulations, tax climate)

Key Factors and City Ranking Criteria

- Job Availability: Large, dense metros naturally have more openings. For example, New York, Los Angeles, Chicago and Miami currently lead in ghost‐kitchen activity. We use BLS data for restaurant cooks and chefs to approximate the labor pool in each metro.

- Salary Potential: Culinary wages vary widely by region. Urban centers often pay more: Chefs in Boston and Seattle earn among the most nationally (≈$77,120 and $67,360), while entry-level Cooks in the same markets earn more than in smaller cities.

- Entrepreneurial Environment: Ghost kitchens thrive where delivery infrastructure, investment capital, and permissive policies exist. Tech‐savvy, high-income cities (San Francisco, Seattle) and states with low taxes (Florida, Texas) often provide favorable conditions. We note the presence of major players (e.g. CloudKitchens, REEF, Kitchen United) and relevant regulations in each city.

The table below compares key metros by job count, Chef wages, and business climate. Ghost-kitchen roles also include kitchen staff and delivery logistics.

| City | Approximate Number of Cooks | Approximate Number of Chefs | Avg. Chef Wage | Business/Notes |

|---|---|---|---|---|

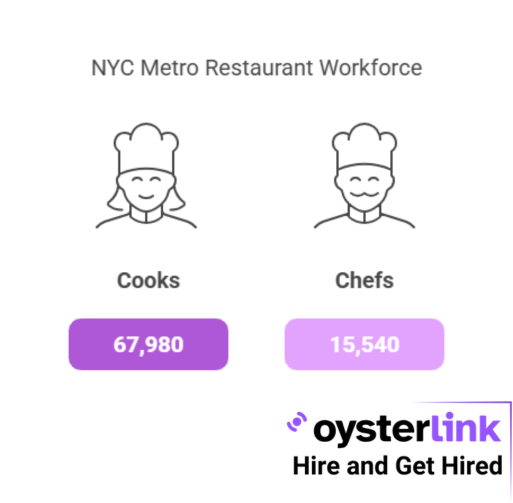

| New York–NJ–PA | 67,980 | 15,540 | $68,410 | Largest market; highest delivery demand; high costs/regulations |

| Los Angeles–CA | 51,320 | 9,480 | $67,150 | Major tech/media hub; high costs; many ghost startups |

| Chicago–IL–WI | 41,870 | 6,500 | $66,610 | Central U.S. hub; diverse cuisine; moderate costs |

| Miami–FL | 35,210 | 5,600 | $61,880 | Tourism-driven growth; no state income tax (FL); REEF’s HQ |

| San Francisco–CA | 20,660 | 4,820 | $67,150 | Tech/wealth center; very high incomes; extremely expensive |

| Seattle–WA | 17,340 | 2,860 | $67,360 | Tech powerhouse; no income tax; high wages |

| Boston–MA–NH | 23,980 | 3,400 | $77,120 | Education/tech hub; strong pay; high living costs |

| Washington–DC–VA–MD | 29,630 | 4,160 | $75,520 | Affluent policy district; steady demand; moderate costs |

| Dallas–TX | 32,870 | 3,690 | $52,950 | Large population; no state income tax (TX); expanding delivery |

New York City

Job Market: The NYC metro has by far the largest restaurant workforce. It employed about 67,980 Cooks and 15,540 Chefs in 2023. This scale reflects thousands of restaurants and the city’s high delivery volume. Chefs there earn roughly $68,410 on average.

Ghost Kitchen Scene: New York is a testbed for delivery-only concepts. Companies like Zuul Kitchens (launching in East Harlem, etc.) and Ghost Kitchen Brands (partnering with Walmart) operate local sites. DoorDash and Uber Eats each cover millions of NYC diners.

The region even saw projects like Kitchen United’s planned NYC facility. All this means constant hiring for kitchen and support roles.

Why It Stands Out: The dense population and tech adoption in NYC drive massive demand. Pay is high (reflecting city costs), and dozens of ghost‐kitchen eateries compete for labor.

The flip side is very strict health and business regulations, and high rents. Still, entrepreneurs are drawn by the huge customer base: even with expensive overhead, New York’s market volume can support many delivery-only brands.

Los Angeles

Job Market: The Los Angeles–Long Beach metro employs about 51,320 Cooks and 9,480 Chefs. Chefs’ annual pay averages $67,150. These figures indicate a large restaurant industry and ample staffing needs.

Ghost Kitchen Scene: L.A. is home to several big ghost‐kitchen providers. Travis Kalanick’s CloudKitchens is headquartered in Los Angeles County, and multiple co-working kitchen spaces (WeWork Kitchens, Kitchen United Pasadena) serve local restaurants.

The city’s very active tech/media sector has spawned numerous virtual brands and delivery-focused startups. DoorDash, Uber Eats, and even regional apps are hugely popular, fueling steady order flows to delivery kitchens.

Why It Stands Out: Southern California’s lifestyle (online ordering, varied cuisine tastes) and weather (no winter slowdowns) favor delivery. Entrepreneur-friendly coasts of the city (Hollywood, North Hollywood) allow lower-rent kitchens.

However, California has high taxes and labor costs. Entrepreneurs weigh these costs against access to one of the nation’s largest consumer markets. Overall, L.A.’s combination of tech investments and massive population makes it a leading hub for ghost kitchen jobs.

Chicago

Job Market: In the Chicago metro there are about 41,870 Cooks and 6,500 Chefs. Average Chef pay is $66,610. This reflects Chicago’s status as the third-largest U.S. city (by metro population) with a huge restaurant sector.

Ghost Kitchen Scene: Chicago’s delivery market has grown rapidly. Kitchen United operates a center in Chicago’s West Loop, and CloudKitchens runs a big facility in Avondale (hosting multi-brand operators).

Major national brands have launched Chicago ghost kitchens; even the late 2020s saw chains like Smashburger (acquired by Jollibee) using Kitchen United kitchens there. Local virtual chains (e.g. Wow Bao outlets) also serve delivery.

Why It Stands Out: Chicago combines big-city demand with lower costs than New York. Real estate in outlying neighborhoods is cheaper, so entrepreneurs can launch without NYC-level rents. The city has strong delivery adoption (drivers on Doordash/Uber, bike couriers in Loop, etc.) and diverse cuisine needs.

Labor costs (and pay) are lower than on coasts, which boosts margins. These factors make Chicago an attractive middle‐of‐country ghost-kitchen hub.

Miami/South Florida

Job Market: The Miami–Fort Lauderdale metro (and greater South Florida) employed about 35,210 Cooks and 5,600 Chefs. Chefs there make roughly $61,880 annually. While a bit lower than coastal hubs, this is a very large pool for a state whose population is booming.

Ghost Kitchen Scene: Miami is seeing a delivery revolution. Florida’s year-round tourism (beaches, events) and multicultural population drive high order volumes.

Notably, REEF Technology – a national leader in containerized kitchens – is based in Miami. REEF has deployed branded mobile kitchens in the city (as in the photo below) for virtual food halls and delivery prep.

Moreover, Kitchen United and local startups are expanding in Broward/Miami-Dade. Major tech players (DoorDash headquarters is in Miami) also boost the ecosystem.

The photo above shows a REEF-powered ghost kitchen trailer (with NBHD branding) set up in Miami. Miami’s warm weather and dense urban cores make it ideal for such deployment: customers order via app, and drivers pick up from these delivery hubs.

Why It Stands Out: Florida has no state income tax, and Miami’s city government has actively courted tech and startup investment. The regulatory environment is generally supportive (permitting can be faster than in NY/CA).

Combined with a strong Latin American diaspora that heavily uses delivery, Miami’s business climate is very friendly to ghost kitchens. Analysts note Miami as one of the country’s most “robust” delivery markets.

In short, Miami offers high demand plus low taxes, making it a prime location for new ghost-kitchen ventures.

Seattle / Pacific Northwest

Job Market: The Seattle–Tacoma–Bellevue area is smaller, with about 17,340 Cooks and 2,860 Chefs. However, it pays extremely well: chefs there average about $67,360 – among the highest in the nation – and Cooks earn ~$44,410. This reflects the high cost of living and tight labor market in the tech hub.

Ghost Kitchen Scene: Seattle’s tech-savvy population is heavily engaged with food delivery apps. Companies like DoorDash and Uber have major operations in the region, and several ghost kitchen spaces (e.g. in Kirkland and Redmond) are dedicated to multi-brand incubators.

Local hospitality startups have also embraced virtual brands. The former WeWork Kitchen in West Seattle and other co-ops help chefs experiment with delivery-only concepts.

Why It Stands Out: Washington State has no personal income tax, which effectively boosts take-home pay. The Seattle area’s high broadband penetration and tech adoption mean customers are very comfortable ordering online.

Entrepreneurs benefit from a strong tech network (e.g. potential integrations with Amazon/tech platforms) and active investment community (local VCs fund foodtech).

Regulatory burden is moderate (Seattle relaxed some kitchen zoning rules recently), so starting a ghost kitchen can be relatively straightforward. In summary, Seattle combines high wages, large delivery demand from a wealthy customer base, and favorable tax policy, making it an attractive ghost-kitchen hub.

San Francisco Bay Area

Job Market: The San Francisco–Oakland–Hayward metro has roughly 20,660 Cooks and 4,820 Chefs. Chefs earn about $67,150 on average. The wider Bay Area (including San Jose) boasts some of the highest restaurant wages nationally (e.g. ~$42,650 for Cooks).

Ghost Kitchen Scene: Silicon Valley’s well-heeled consumers and innovation culture have fostered many delivery concepts. DoorDash (founded in SF) once launched a shared ghost kitchen facility in Redwood City that served local restaurants. Startup kitchens (like San Francisco’s CloudKitchens site) and food-tech programs (e.g. incubators at SF State) support virtual brands.

Many Bay Area restaurants have added delivery-only menus to tap UberEats/Grubhub orders.

Why It Stands Out: The Bay Area’s huge tech workforce and high GDP per capita mean very large potential order volume. However, the downsides are steep real estate and labor costs. Entrepreneurs often have access to capital (venture and angel investors) and advanced tech infrastructure (5G networks, crowdsourcing apps), but must navigate strict city regulations and high taxes.

In sum, San Francisco offers top-tier spending power and tech support for ghost kitchens, albeit with very high overhead.

Washington, D.C. Metro

Job Market: The Washington–Arlington–Alexandria area has about 29,630 cooks and 4,160 chefs. Chefs earn around $75,520 annually. This reflects a sizable economy (government, services, tech) with many restaurants catering to professionals.

Ghost Kitchen Scene: The D.C. area’s busy government and lobbying industry sustains high lunch/dinner delivery. Local ghost-kitchen ventures are expanding in the suburbs (northern Virginia, Maryland).

For example, a Virginia-based incubator launched Frontier Kitchen (shared kitchens) near Arlington. International diversity (embassies, contractors) also drives demand for varied cuisines.

Why It Stands Out: D.C. has a wealthy customer base and dense urban pockets, making it a stable market for delivery. It has moderate business costs compared to NYC/SF, and it’s a policy hub (some city incentives exist for food businesses).

State taxes are modest (VA/DC income tax rates are average), and gig-economy platforms thrive (Washingtonians are heavy app users). These factors make D.C. a favorable but not extreme location for ghost kitchen expansion.

Other Emerging Hubs

Several other metros show strong potential:

- Boston, MA: With ~23,980 Cooks and 3,400 Chefs, Boston pays some of the highest Chef salaries ($77,120). Its tech and education centers generate demand for delivery, and Kitchen United has opened a facility near Boston. The high cost of living is offset by robust venture interest in food startups.

- Dallas–Fort Worth, TX: Over 32,000 Cooks and 3,690 Chefs work in the Dallas metro, but Chefs earn only ~$52,950. Texas has no income tax, which makes entrepreneurship more lucrative. DFW’s large suburban population means high delivery usage, and kitchen rents are low.

- Houston, TX: Houston has a similarly large workforce (~30,000 Cooks) and low taxes. The city is a growing tech center, and several ghost-kitchen operators have announced locations there.

- Atlanta, GA: Atlanta’s metro employs ~31,300 Cooks. It has an expanding startup ecosystem and is relatively affordable. Ghost kitchens (and gig drivers) are rapidly scaling with the city’s booming population.

- Orlando, FL: Tourism-driven Orlando had ~24,890 cooks. Its 18-month pandemic reopening and large workforce have produced heavy delivery demand; Orlando often ranks among the top 10 U.S. delivery markets.

Each of these cities offers a mix of growing delivery demand and either low operating costs or strong entrepreneurial support. However, New York, Los Angeles, Chicago and Miami remain the clear leaders for sheer volume of ghost kitchen jobs and opportunities.

Conclusion

For job seekers, ghost kitchen roles (chefs, cooks, packers, logistics, support) are easiest to find in America’s largest delivery markets.

- New York, LA, Chicago and Miami top the list in 2025, with many job openings and competitive pay.

- Seattle and Boston stand out for some of the highest pay, thanks to affluent markets.

- Southern and Midwest metros (Dallas, Atlanta, Houston) offer lower costs and no income tax, which can boost take-home earnings and make ghost-kitchen startups more viable.

For entrepreneurs, cities that combine high delivery volumes with supportive business conditions are ideal.

California and New York provide huge customer bases (but also high rents/regulation), whereas Florida and Texas offer booming demand with lighter taxes.

Tech hubs like Seattle and San Francisco add infrastructure and investor interest.

In all cases, growth of the gig economy and third-party apps underpins the opportunity: DoorDash (≈60% U.S. share), Uber Eats, and others now connect consumers to ghost kitchens nationwide.

As of early 2025, job seekers in the ghost-kitchen space will find the most openings and highest wages in major metropolitan areas – especially NYC, LA, Chicago, Miami, Boston and Seattle – while entrepreneurs should target these delivery-strong cities (or pro-business states) for new ghost-kitchen ventures.

Loading comments...