Restaurant Tax Deductions: 3 Key Takeaways

- Track expenses in 4 key areas. Save big by deducting food, supplies, wages, and property expenses.

- Set up a cloud system and spend just 15 minutes daily tracking your expenses to avoid costly errors.

- Always file Form 941 for quarterly taxes and Form 940 for unemployment tax. Missing deadlines leads to penalties!

Restaurant tax deductions offer restaurant owners a chance to save on expenses like food, supplies, and employee wages.

Keeping track of these deductions with proper documentation is key to lowering your tax burden.

By staying organized, using cloud accounting, and understanding the right forms and deadlines, you can maximize your savings.

Getting Started with Restaurant Tax Deductions for Restaurant Owners

Running a restaurant is hard work, and every dollar counts.

Did you know you could be saving thousands by claiming the right tax deductions?

From food costs to utilities, there are plenty of expenses you can write off — if you know what to look for.

Let’s break it down so you can keep more of your hard-earned money.

What counts as a tax deduction

For restaurant operations, tax deductions primarily include ordinary and necessary business expenses that directly relate to running your establishment.

These deductions must be reasonable and supported by written documentation.

The IRS specifically allows deductions for food and supply costs, employee wages, benefits and property expenses.

Additionally, you can write off professional services like accounting fees, software subscriptions and legal consultations.

Operating costs such as rent, utilities, maintenance and marketing expenses generally qualify as deductible items.

Key documents you need

Maintaining thorough documentation is essential for claiming tax deductions.

Your records should include:

- Income statements and bank statements

- Expense receipts and payroll records

- Previous tax returns

- Mortgage interest statements (Form 1098)

- State and local tax payment records

Proper bookkeeping practices are crucial for tracking daily expenses.

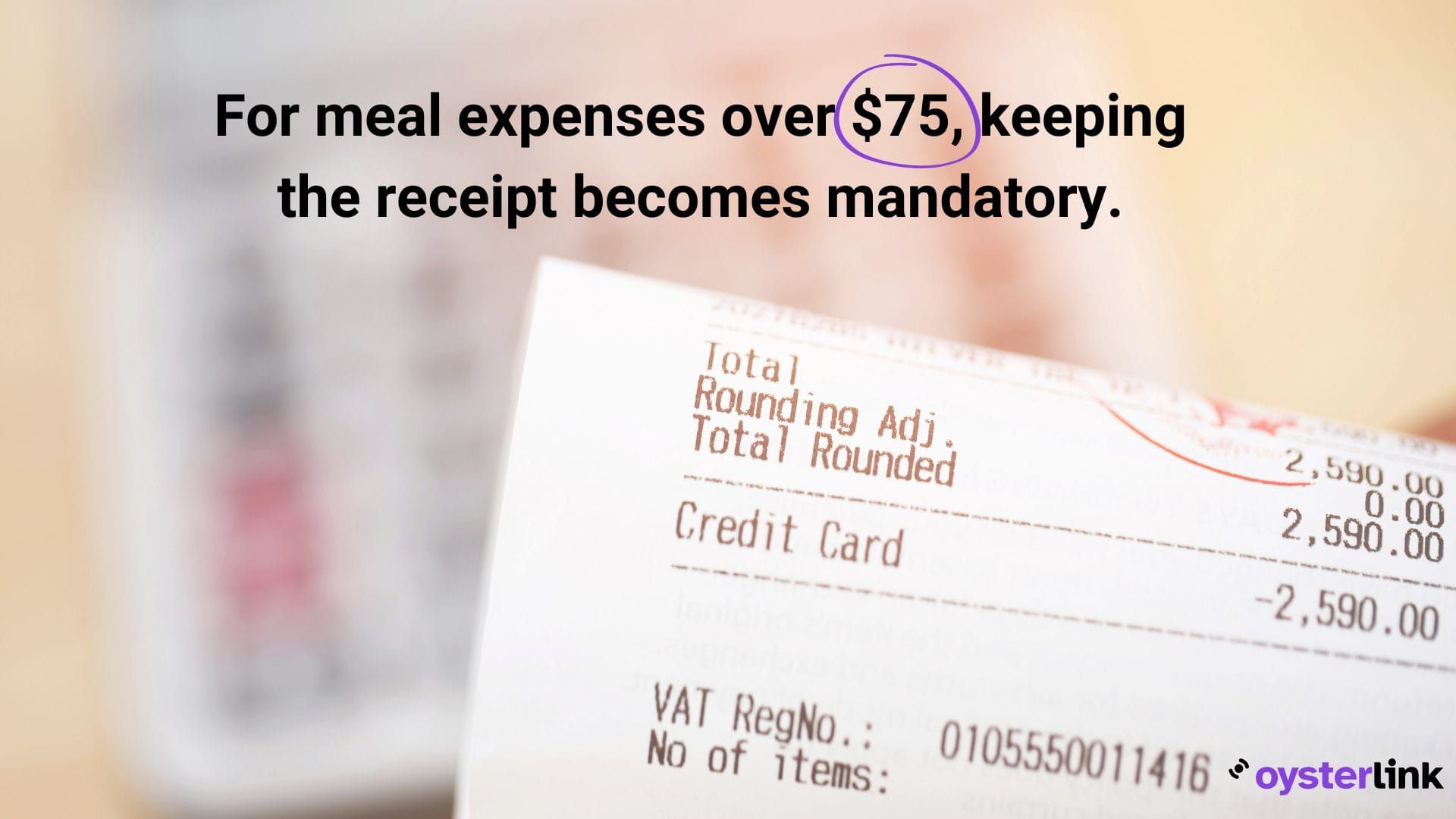

Essentially, you need to document the date, amount and business purpose for each expense.

For meal expenses over $75, keeping the receipt becomes mandatory.

Remember to maintain records of estimated tax payments, including payroll and self-employment taxes.

These documents not only support your deductions but also provide protection in case of an IRS audit.

Essential Tax Deductions for Restaurant Owners

Running a restaurant involves numerous tax-deductible expenses that can reduce your overall tax burden.

Understanding these essential costs helps maximize your deductions while maintaining compliance with IRS regulations.

Food and supply costs

The Cost of Goods Sold (COGS) forms a substantial part of your deductible expenses.

This category encompasses raw ingredients, packaging materials and food preparation supplies.

Furthermore, you can deduct costs associated with food waste and spoilage, though the IRS flags spoilage rates above 8% for additional scrutiny.

Key deductible food-related expenses include:

- Raw ingredients and produce

- Canned and packaged foods

- Secondary items like oils, spices and flour

- Food packaging and take-out containers

- Cleaning supplies and kitchen materials

Staff wages and benefits

Employee compensation represents another major deductible expense.

Your staff-related deductions cover wages paid to Kitchen Staff, Managers, Servers, Bartenders, Dishwashers and Hosts.

Particularly noteworthy, employee benefits such as health insurance premiums, retirement contributions and paid vacation time qualify as deductible expenses.

Tips require special attention for tax purposes. While tips are considered income to your Servers, the restaurant must still handle payroll taxes on reported tips.

Consequently, you can deduct the employer portion of these payroll taxes as a business expense.

Property and equipment expenses

Your physical space and equipment generate numerous deductible expenses.

Rent payments, utility costs and regular maintenance all qualify as tax deductions.

Equipment purchases, particularly large kitchen appliances, can be deducted through depreciation over time.

Notably, repairs for essential equipment like ovens, freezers and plumbing systems count as immediate deductions rather than capital improvements.

How to Document Restaurant Tax Deductions Effectively

Proper documentation stands as the cornerstone of successful tax deduction claims.

Initially, establishing an organized system helps protect your restaurant's financial interests and ensures smooth tax filing processes.

Setting up a record system

A cloud-based accounting solution serves as your primary tool for tracking expenses and maintaining financial records.

Set aside dedicated time each day to scan and categorize receipts, ensuring nothing falls through the cracks.

Create separate digital folders for different expense categories including:

- Food and beverage purchases

- Employee payroll documents

- Equipment maintenance records

- Vendor contracts and invoices

- Property-related expenses

- Daily sales reports

Tracking daily expenses

Establish a daily routine to review and analyze your expenses, dedicating 10-15 minutes at day's end to monitor your financial health.

Subsequently, update your books daily to maintain accurate records of everything you spend.

For business meals, save detailed receipts that include the date, amount, location and business purpose.

The IRS requires specific documentation for meal expenses exceeding $75.

Essentially, tracking variances between actual and theoretical food costs helps identify anomalies before they affect your bottom line.

Accordingly, implement a user-friendly log sheet for recording daily transactions.

Include categories for inventory purchases, labor costs, daily sales and miscellaneous expenses.

This systematic approach enables you to spot rising costs promptly and make necessary adjustments to protect your profit margins.

Filing Your Restaurant Tax Return and Maximizing Deductions

Selecting the correct tax forms and meeting filing deadlines marks the final step in securing your restaurant tax deductions.

First of all, understanding which forms apply to your business structure helps ensure accurate filing and maximum benefits.

Forms you need to complete

The IRS requires specific forms based on your restaurant's business structure.

Under these circumstances, sole proprietors and pass-through entities must file Form 941 for quarterly federal tax returns and Form 940 for annual federal unemployment tax.

In addition to these, partnerships need Form 1065 for partnership income, whereas corporations must complete Form 1120 for corporate income tax returns.

Important to realize, restaurant owners must also submit Form W-2 for each employee and maintain Form 4070 for tip reporting.

These documents help track employee compensation and ensure proper tax calculations for both the business and staff members.

When to file

The primary tax deadline falls on April 15, 2025. If you need extra time, file Form 4868 to request a six-month extension, pushing your deadline to October 15, 2025.

Remember that an extension grants additional time for paperwork but not for payment - any taxes owed must still be paid by April 15 to avoid penalties.

For quarterly filers, mark these dates on your calendar and submit returns by the 20th day following each quarter's end.

Missing deadlines can result in added interest and penalties, affecting your restaurant's bottom line.

Working with a tax professional

A qualified tax professional offers expertise beyond basic return preparation.

Tax preparers must hold an IRS Preparer Tax Identification Number (PTIN), and many possess additional credentials like CPA or Enrolled Agent status.

These experts stay current with tax code changes and can advise on business structure decisions that benefit your restaurant.

Professional tax preparers inspect books and records throughout the year, ensuring all income reports accurately and claiming appropriate deductions.

They also provide valuable guidance on excise taxes and employment tax requirements, helping prevent costly mistakes in your filings.

Consider working with a restaurant-focused accounting firm that understands industry-specific challenges.

Conclusion: Key Restaurant Tax Deductions Every Owner Should Know

Tax deductions serve as powerful tools for restaurant owners to reduce their tax burden and boost profitability.

Smart documentation practices paired with thorough knowledge of allowable deductions help protect your business during tax season and potential audits.

Restaurant owners who stay organized throughout the year face fewer challenges during tax filing.

Remember that successful tax management requires year-round attention rather than last-minute scrambling.

Proper tracking of expenses, organized documentation and timely filing will help your restaurant thrive while staying compliant with IRS regulations.

Loading comments...