State Form W‑4: Employee’s Withholding Certificate: Key Takeaways

- Each U.S. state with an income tax has its own version of the W-4 withholding form for state tax withholding.

- Nine states do not impose a state income tax and therefore do not require a state-specific W-4 form.

- Some states, like Colorado and Pennsylvania, use the federal W-4 for withholding or have unique flat-rate tax withholding.

Understanding the State Form W‑4 is crucial for accurate payroll tax withholding. While federal Form W-4 determines federal income tax withholding, each state with an income tax requires employees to complete its own withholding certificate or uses the federal form with specific rules.

This article explains state-specific withholding forms, exceptions, and key considerations to ensure compliance with state tax laws.

For employers looking to streamline their hiring process and legal compliance, recruitment hospitality job posting compliance provides valuable insights into best practices.

1. Overview of State Form W-4: Employee Withholding Certificates

In addition to the federal Form W-4, most states require an employee to fill out a separate form to determine state income tax withholding. These forms are generally called the state “Employee’s Withholding Certificate” or “Allowance Certificate.” The purpose is to correctly calculate the amount of state income tax withheld from each paycheck.

Each state’s version of the W-4 form may have variations concerning allowances, exemptions, and withholding calculations. Employers rely on these forms to comply with state tax withholding requirements.

Employers looking to improve their hiring strategies may find guidance in guide to hiring a Restaurant Consultant, which can help optimize staff management in various hospitality roles.

States With State-Specific W-4 Forms

Below are examples of state employees’ withholding certificates that are commonly required:

- California: Form DE 4 – Employee’s Withholding Allowance Certificate

- New York: Form IT-2104 – Employee’s Withholding Allowance Certificate

- Texas: No state income tax, no state W-4 required

- Georgia: Form G-4 – State of Georgia Employee’s Withholding Allowance Certificate

- Massachusetts: Form M-4 – Massachusetts Employee’s Withholding Exemption Certificate

States such as Alabama, Arizona, Connecticut, Illinois, Kentucky, Michigan, Oregon, Pennsylvania, and others all have unique forms with slightly differing names and requirements.

Hospitality business owners aiming to reduce turnover and build effective teams may want to explore strategies detailed in strategies to reduce restaurant employee turnover.

2. States Without Income Tax Do Not Require State W-4 Forms

Nine states do not impose a personal income tax at the state level, so employees working in these states are not required to complete state withholding certificates. These states are:

- Alaska

- Florida

- Nevada

- New Hampshire (which only taxes interest and dividends)

- South Dakota

- Tennessee

- Texas

- Washington

- Wyoming

In these states, employers typically only withhold federal income tax, and no state withholding form exists.

3. Special Considerations for Colorado, Delaware, and Pennsylvania

Colorado Uses Federal Form W-4 for State Withholding

Colorado does not have its own state-specific W-4 form. Instead, employers use the federal Form W-4 to calculate Colorado state wage withholding. Employees do not need to fill out a separate state form, but employers must ensure they apply the correct Colorado state income tax rates.

Delaware Requires a Separate State W-4, Not the Federal Form

Delaware’s withholding requirements differ from federal guidelines. The state issues its own W-4 form, the Delaware W-4 Employee’s Withholding Allowance Certificate. Employers cannot accept a generic federal Form W-4 (especially those completed in 2020 or later, which have a redesigned format) for state withholding purposes in Delaware.

This means Delaware employees must complete the state-specific form to properly calculate withholding for state income tax.

Pennsylvania Has Flat-Rate Tax Without State W-4 Form

Pennsylvania does not have a state-specific W-4 form and levies a flat income tax rate on all wage income. Employers withhold Pennsylvania state income tax at this uniform rate regardless of allowances or exemptions.

Employees do not need to submit a state withholding form for Pennsylvania income tax, making the withholding straightforward, though additional local tax forms may be required in some municipalities.

Employers in Pennsylvania can benefit from understanding multi-state payroll requirements to ensure comprehensive compliance across jurisdictions.

4. Importance of Completing State W-4 Accurately

Filling out the correct state withholding certificate accurately benefits both employees and employers. Employees avoid under-withholding, which can result in unexpected tax bills during filing, and prevent over-withholding, leading to excessive tax refunds.

Employers use these forms to comply with state laws, correctly calculate payroll withholding, and avoid penalties for under- or over-withholding. It is best practice to update withholding forms when major life changes occur, such as marriage, the birth of a child, or a change in income.

Efficient employers often rely on resources like tax tips for restaurant owners to better manage their financial obligations and workforce.

Employers Should Collect New Forms Upon Request

Employees have the right to submit new withholding forms to adjust their withholdings at any time. Employers should have procedures to accept and process updated state and federal withholding forms promptly.

Employees Must Be Aware of Both Federal and State Requirements

Since federal and state withholding rules differ, employees must comply with both by completing the federal Form W-4 as well as their applicable state withholding certificate.

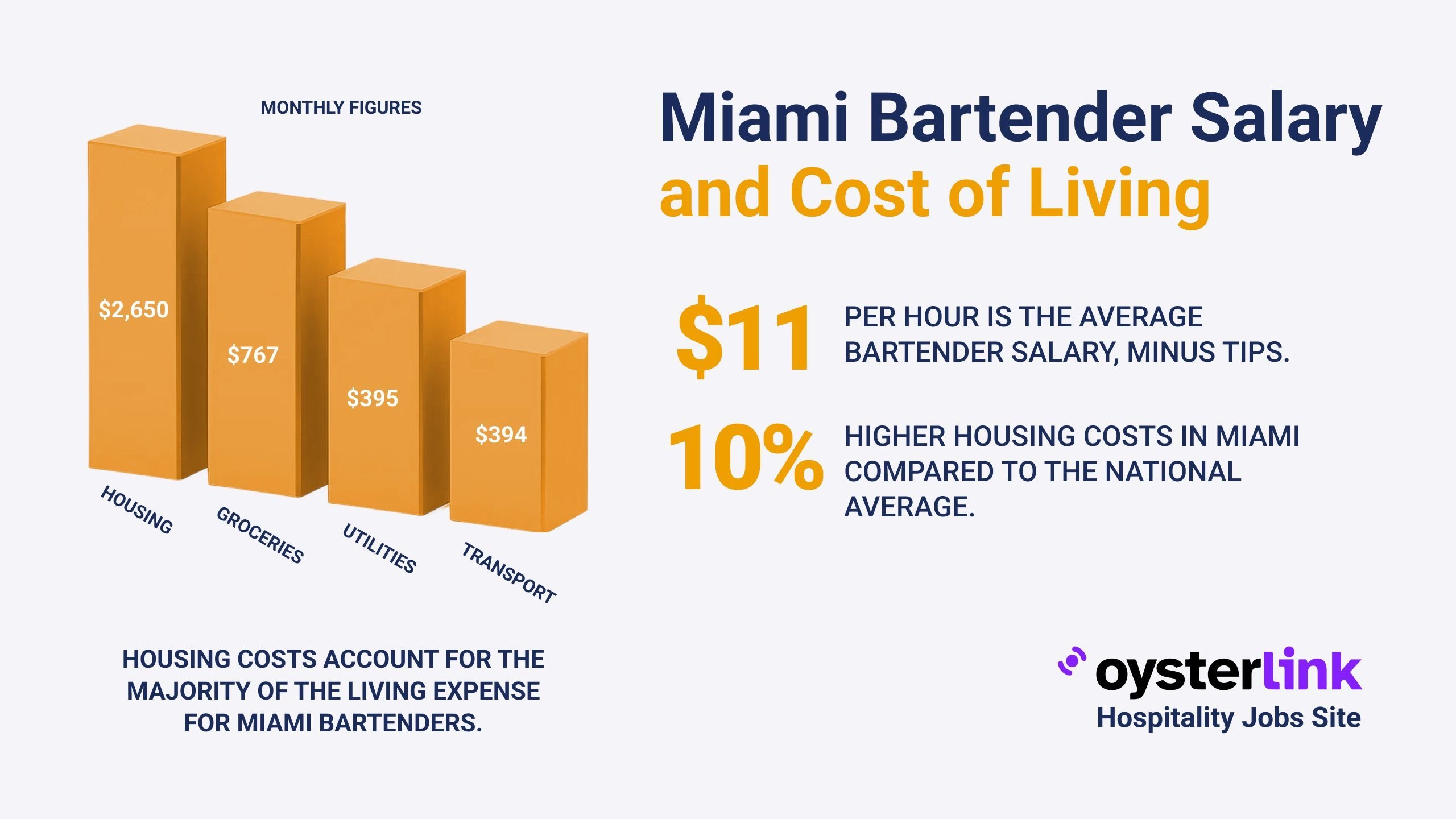

Hospitality professionals, including Bartenders, should understand how state withholding impacts their paychecks and taxes to manage their finances effectively.

5. Resources for State Form W-4 Information

Official government websites provide the most current forms and guidance for state withholding certificates.

- Internal Revenue Service (IRS) – Form W-4 Information

- Delaware Division of Revenue – Delaware W-4 Information

- Colorado Department of Revenue – Withholding Tax Information

- Pennsylvania Department of Revenue – Personal Income Tax Information

- California Employment Development Department – DE 4 Form

Employers seeking to build effective teams in hospitality might consider exploring hiring guides such as how to hire a Restaurant Manager to attract and retain top talent efficiently.

State Form W‑4: Employee’s Withholding Certificate: Conclusion

Employees working in states with income tax responsibilities must complete state-specific withholding certificates in addition to the federal Form W-4. These forms enable employers to withhold the appropriate amount of state income tax, preventing withholding errors.

Understanding which form applies in your state, or knowing if your state has no income tax, is essential for tax compliance. Always refer to official state and federal tax sources for the most accurate, up-to-date forms and instructions.

For those managing hospitality teams, especially in roles like Restaurant Manager, staying informed about payroll and withholding practices supports legal compliance and operational efficiency.

.png)

.png)

.jpg)