The restaurant industry plays a vital role in the economy and daily life, constantly shifting in response to economic conditions, technological advances and evolving customer tastes.

Recently, this sector has faced both growth opportunities and significant challenges, highlighting the importance of adapting quickly to stay competitive.

In this article, we’ll explore the latest restaurant revenue statistics, emerging trends and what the future holds for restaurants in 2025 and beyond.

Restaurant Revenue: Cautious Trends and Future Outlook

While the restaurant industry is expected to experience growth and expansion, recent data indicates that the journey ahead may not be without hurdles.

For example, about 40% of U.S. restaurants saw a decline in sales last year, emphasizing the challenges many establishments continue to face.

However, looking ahead, the industry is positioned for substantial growth.

In fact, it is projected to reach a $1.5-trillion revenue in 2025 — with around 73.33% of this coming from traditional restaurant sales (e.g., full-service establishments, limited-service restaurants, bars).

That said, profit margins remain thin, with the average U.S. restaurant operating with a net margin of only 3%–5%.

As a result, achieving profitability will increasingly depend on enhancing operational efficiency and maintaining tight cost control.

Still, forecasts predict some significant revenue increases by 2030, driven by technological advancements and evolving consumer preferences.

Full-Service Restaurant Revenue

In 2024, the average annual revenue for full-service restaurants was approximately $1,911,711.

This figure reflects the ongoing growth and resilience of the industry, despite economic fluctuations and evolving consumer preferences.

The revenue generated highlights the significant role that full-service establishments play within the hospitality sector, serving as major contributors to local economies and employment.

Maintaining or increasing this level of revenue requires strategic investment in operational efficiency, menu innovation, customer experience and effective marketing.

Menu Price Gains: Key To Driving Restaurant Sales Growth

In a market that demands constant innovation, finding effective ways to balance menu pricing and customer satisfaction can be challenging.

As consumers become more price-sensitive, restaurants must carefully weigh the benefits of raising prices against the risk of losing customers.

In fact, in 2024, 47% of restaurants increased their menu prices to offset rising operating costs, reflecting the ongoing pressure to maintain profitability.

This price increase is driven by a range of escalating operational costs.

Labor typically accounts for 25%–35% of total sales in most restaurants, and 64% of operators reported exceeding their target labor costs in 2024, further squeezing already thin profit margins.

Additionally, food costs have been rising for operators, with the cost of goods sold (COGS) increasing across the industry.

This trend is echoed in broader inflationary pressures, with the food inflation rate (related to restaurant purchases) up 3.8% in recent months, continuing the rise in expenses faced by restaurants.

Despite these risks, much of the recent sales growth has been driven by menu price increases. However, overall restaurant sales have remained relatively flat over the past two years.

This stagnation is largely due to the offsetting effect of higher prices, which dampens customer volume, combined with increased operating costs that limit profit margins.

New Sales Channels: More Restaurant Revenue

Introducing additional sales channels like catering, event hosting and delivery remains a key strategy for boosting revenue.

About 37% of operators have adopted new channels to diversify and expand their income streams.

Catering, in particular, has become an important part of this diversification, allowing restaurants to go beyond traditional dine-in experiences and tap into new markets.

Stand-alone catering operations, which operate separately from a restaurant’s regular dining service, tend to average 7%–8% profit margins.

This figure is higher than many full-service restaurant models, highlighting why operators are increasingly expanding this channel.

This shift reflects a growing focus on additional revenue streams that can provide more consistent profitability, especially in an industry facing rising operating costs.

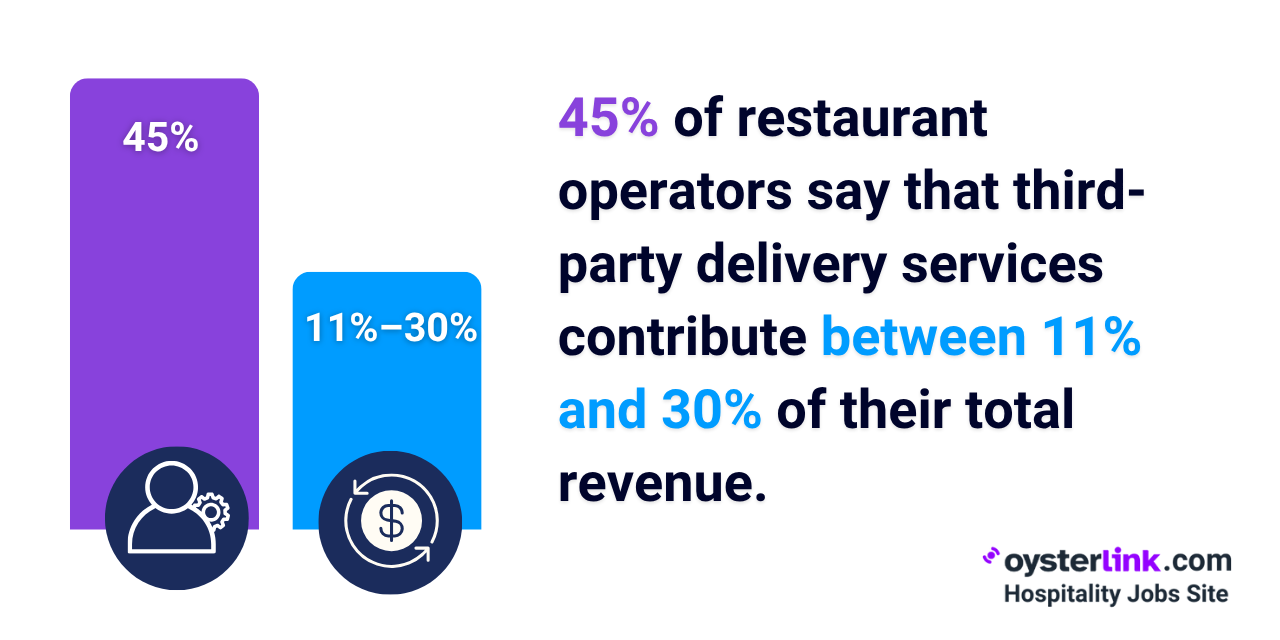

Third-Party Delivery Systems: Restaurant Revenue Impact

The adoption of third-party delivery systems has become a significant driver of revenue growth for most restaurants.

A substantial majority of operators reported increases in sales attributed to these platforms.

For approximately 45% of operators, third-party delivery services contribute between 11% and 30% of their total revenue, underscoring the importance of integrating digital delivery channels into business models.

Leveraging established delivery companies allows restaurants to reach a broader customer base without the need to develop their own delivery infrastructure.

This shift towards digital channels is part of a larger trend in which 58% of restaurant operators plan to increase their IT budgets in 2025.

These investments — which include technology for online ordering, delivery systems, automation and more — help restaurants improve efficiency and stay competitive in an increasingly digital landscape.

Power of Happy Hour: Driving Restaurant Revenue

A large portion of a restaurant or bar’s revenue often comes from a specific time of day — happy hour being a prime example.

In fact, data shows that happy hour sales can account for up to 60.5% of a venue’s total revenue.

This highlights just how important this period is for the bottom line. For business owners, it presents both opportunities and strategic considerations.

Offering happy hour specials not only encourages customers to dine and drink during a designated time, but it also helps boost brand awareness by giving first-time visitors a chance to try the menu at a lower cost.

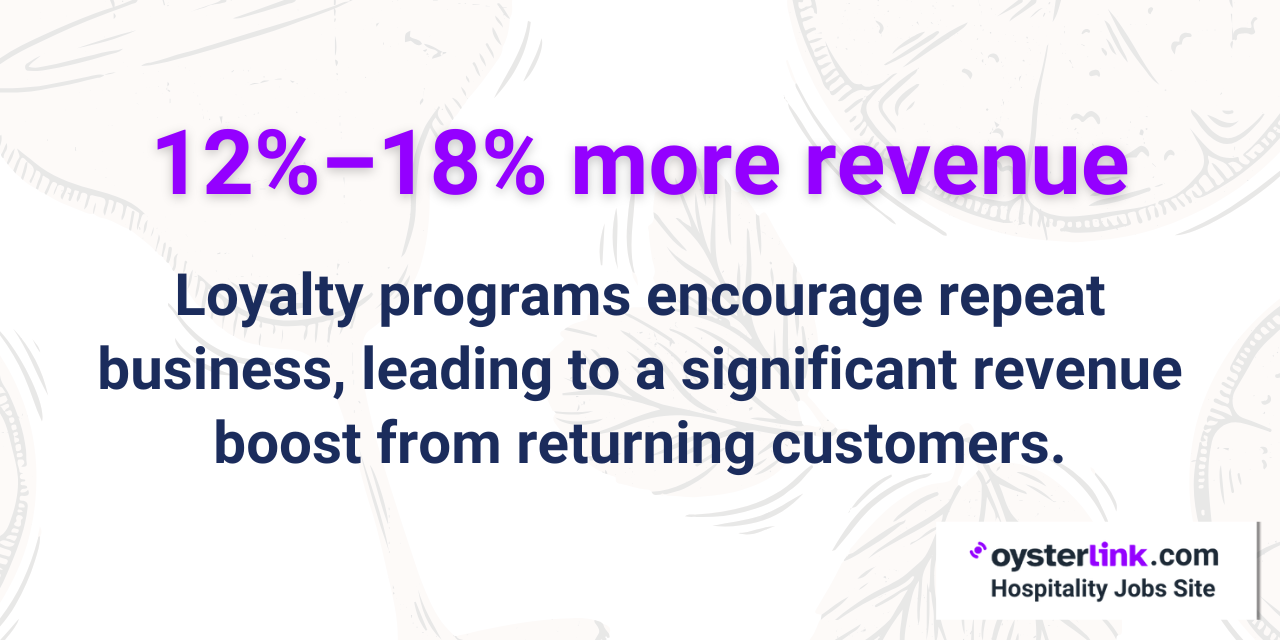

Loyalty Programs: Driving Incremental Revenue

Loyalty programs are another effective strategy for driving long-term revenue.

Industry data shows that members of these programs generate 12%–18% more in additional revenue annually compared to non-members, highlighting their impact on repeat business

By rewarding customers for their continued patronage, loyalty programs encourage more frequent visits and larger spending.

These programs also provide valuable insights into customer preferences, allowing businesses to tailor marketing efforts and promotions.

In addition to boosting revenue, loyalty programs help build stronger customer relationships, which are more cost-effective than constantly acquiring new customers.

As a result, these contribute to sustainable growth and provide a predictable revenue stream.

The Importance of Marketing: Building Brand Awareness

Marketing and brand awareness play a vital role in a restaurant’s success.

On average, restaurants invest about 3% to 6% of their revenue into marketing efforts, highlighting how essential these strategies are.

One highly effective digital channel is Facebook, with 73% of operators using it to drive revenue.

While Facebook remains the dominant platform, TikTok has seen a rise in usage. Nearly half of restaurant operators (48%) now use TikTok for marketing, a significant increase from just 26% in 2023.

This shift is partly driven by Gen Z’s preference for TikTok as a search engine, as well as the platform's ability to provide organic content with a wide reach through its ‘For You Page’ discovery tool.

To better understand the platforms driving restaurant marketing efforts, here's a breakdown of the most commonly used social media platforms by operators.

For business owners and stakeholders, these figures underscore the importance of adopting proven marketing methods to stay competitive and grow in a crowded market.

Methodology

The restaurant revenue statistics, trends and predictions in this article are derived from recent industry reports and analyses by the National Restaurant Association, Bureau of Labor Statistics, Touchbistro, Restaurant365, Deliverect, Smartbridge and Technomic.

About OysterLink

OysterLink is a dedicated platform that links hospitality professionals with employers, simplifying the process of finding quality jobs or sourcing skilled talent quickly.

For job seekers, it offers insights into salary ranges, career advice and access to top job opportunities.

For employers, it provides tools to create targeted job listings, evaluate candidates and access industry-specific resources to support their hiring goals.

Loading comments...