Restaurant Inflation in 2025 Key Takeaways:

- Labor, food supply and operational costs significantly impact restaurant prices, with staffing expenses alone consuming 50-60% of revenue.

- Since 2019, food costs have increased by 28%, and restaurants face ongoing supply chain challenges, necessitating adjustments like reduced menu sizes.

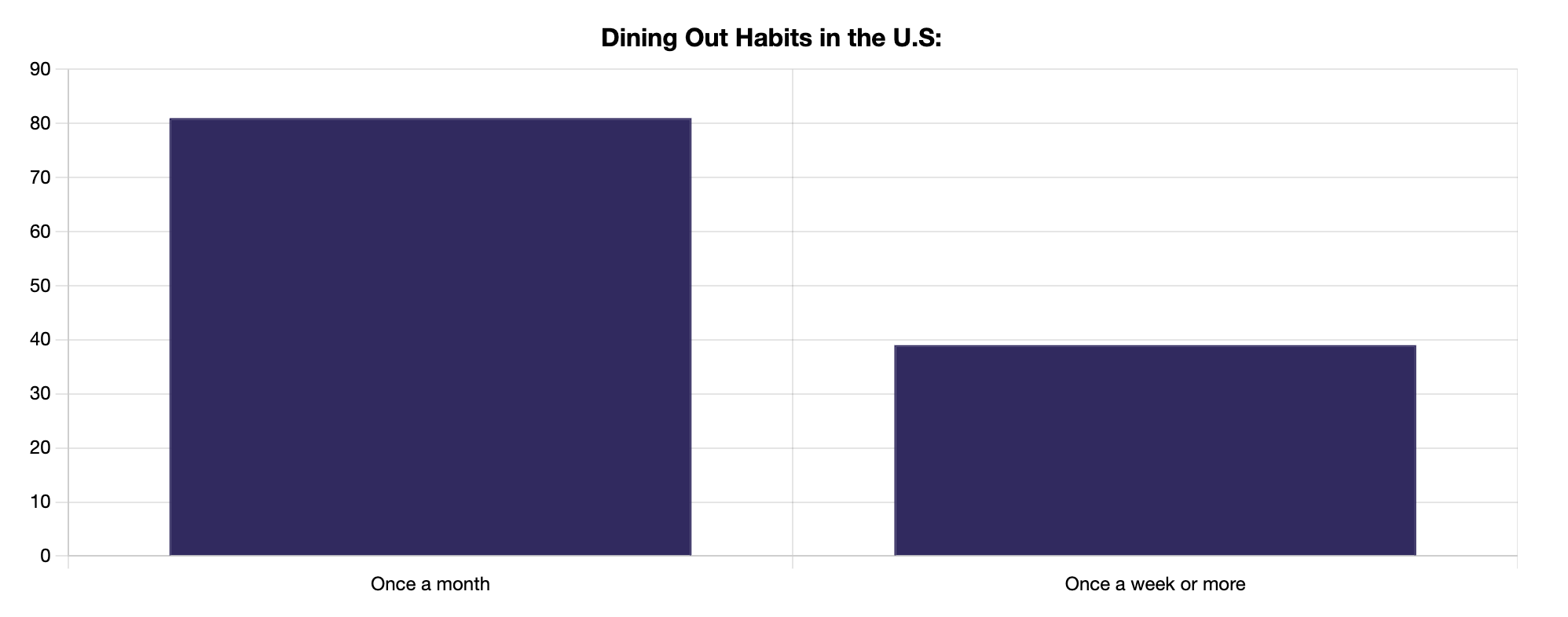

- Consumer dining habits are shifting, with only 39% dining out weekly, while 51% use apps for deals, highlighting growing price sensitivity.

With restaurant inflation in 2025 slowing and the Federal Reserve easing rate adjustments, the year ahead could bring more stable menu prices across dining establishments.

Let’s take a closer look at the economic forces influencing restaurant pricing this year.

The Economic Forces Behind Restaurant Inflation

Restaurant owners face three major cost pressures that influence dining bills: labor, food supplies and operational expenses.

Most establishments now spend 50% to 60% of their revenue on staffing costs alone. These numbers tell the story behind recent menu price adjustments across the restaurant industry.

Impact of labor costs on menu pricing

Staff expenses create the biggest challenge for restaurants today. The industry currently needs 200,000 more workers to meet growing customer demand, pushing wages higher across all positions.

From Dishwashers to Executive Chefs, restaurants pay significantly more for talent than in previous years.

Basic wages represent just one piece of the labor puzzle. Restaurant owners must also handle rising payroll taxes, workers' compensation and health insurance costs — which jumped 6% in 2024.

These expenses directly affect the prices you see on menus.

Supply chain challenges and food costs

Menu changes reflect ongoing supply chain difficulties, with 95% of restaurants reporting delivery delays or ingredient shortages. Many kitchens now adapt their offerings, choosing different meat cuts or adjusting portion sizes to stay profitable.

Food costs paint a stark picture, showing a 28% increase since 2019. This sharp rise forces restaurants to carefully evaluate every ingredient, from kitchen staples to specialty products.

Energy and operational expense effects

Energy costs hit restaurants particularly hard. The average restaurant burns through five to seven times more energy per square foot compared to other commercial buildings. This high energy demand drives up operational costs significantly.

Quick-service restaurants face even steeper energy bills, using up to 10 times more energy per square foot than typical commercial spaces.

These substantial operational expenses, combined with other financial pressures, continue pushing menu prices upward.

See also: Restaurant Utility Costs Guide (+ Essential Tips To Save Money)

Restaurant Inflation: Industry Response

Smart menu adjustments and strategic pricing help restaurants balance rising costs while keeping customers happy.

Restaurant owners now employ precise calculations and creative solutions to protect both their bottom line and your dining experience.

Menu engineering and portion adjustments

Streamlining menus and fine-tuning portions isn’t just a trend — it’s a smart strategy. In fact, 31% of restaurants have reduced menu size to improve kitchen efficiency and cut waste.

By analyzing exactly how much food guests consume, restaurants are making small but impactful adjustments.

For instance, trimming a salad portion from 16 ounces to 14 ounces might seem minor, but across thousands of daily orders, it can translate into significant savings without compromising guest satisfaction.

These small, data-driven changes are helping restaurants thrive in a challenging economic climate.

Value meal offerings and promotions

Major restaurant chains compete for your business through strategic meal deals. Popular options include:

- McDonald's and Burger King: $5 value meals

- Wendy's: $3 breakfast deals

- Applebee's: All-you-can-eat promotions

While most value meals are priced at cost — or even as loss leaders — they thrive by prompting customers to include additional items in their orders.

Technology adoption to control costs

Restaurant kitchens are becoming more efficient with the adoption of modern technology. Advanced inventory systems monitor every ingredient in real time, while automated ordering systems streamline operations and reduce labor expenses.

Data plays a pivotal role in shaping restaurant operations. Comprehensive management systems analyze popular dishes, peak dining hours and ingredient usage to help owners optimize menu pricing and promotions.

These tools also enable precise forecasting, ensuring kitchens are well-prepared for busy periods while minimizing waste.

Consumer Spending Patterns in Restaurants

As dining habits continue to evolve, restaurants are adapting to shifting consumer behaviors driven by economic challenges.

From changes in how often people dine out to the ways they seek value, understanding these patterns is crucial for restaurant owners and operators.

Changes in dining frequency and ordering habits

While 81% of Americans dine out at least once a month, the frequency of weekly visits has dropped. Only 39% of Americans continue to dine out weekly, marking a 9% decline from previous years.

Despite this decrease in frequency, consumers remain loyal to restaurants, carefully choosing when and where to dine.

Economic pressures, particularly rising prices, are influencing how customers order and spend.

Many diners, 51%, turn to restaurant apps to discover deals and discounts, while 43% still rely on traditional mail coupons to save. These shifts highlight a growing emphasis on value as consumers adapt to higher costs.

This combination of loyalty and adaptability underscores the resilience of diners and emphasizes the importance for restaurants to offer strategic promotions and value-driven options during these challenging times.

Price sensitivity across demographics

Income levels shape restaurant choices significantly. Half of consumers earning under $25,000 yearly still dine out weekly, though less often than before.

Meanwhile, 84% of consumers making over $150,000 keep their weekly dining routine unchanged.

Strategic Pricing and Long-Term Adjustments

As the industry moves through 2025, restaurants are increasingly adopting flexible pricing strategies to accommodate both rising costs and evolving customer expectations.

While some may continue to focus on short-term promotions or value deals, others are exploring long-term adjustments to their pricing models.

This includes dynamic pricing systems that adjust menu prices based on factors like demand, peak hours and ingredient availability.

Moreover, many restaurants are investing in staff training and retention programs to reduce turnover and keep labor costs under control.

These long-term efforts not only help mitigate rising expenses but also ensure that the dining experience remains high-quality despite the ongoing economic challenges.

Inflation and Restaurant Prices: A Look Ahead to 2025

Restaurant prices are finally showing signs of relief after years of sharp increases, with 2025 projections indicating a modest 1.9% inflation rate.

This shift comes after a challenging period marked by steep food cost surges and evolving consumer dining habits.

Menu engineering, value-driven promotions and technology upgrades are helping restaurants adapt to economic realities while maintaining quality service.

From streamlined menus to efficient portion sizes, every change is designed to protect both the bottom line and the dining experience.

Looking ahead, restaurants are not only focusing on short-term adjustments but also embracing long-term strategies such as dynamic pricing and employee retention programs to stabilize their operations.

For restaurant owners navigating these complex challenges, platforms like OysterLink offer valuable tools and resources.

Loading comments...