Restaurant Industry Sales: Key Statistics

- Eating and drinking places registered total sales of $97.4 billion in May 2025.

- After adjusting for menu price inflation, eating and drinking place sales were up 1.4% between May 2024 and May 2025.

- $1.5 trillion: the total number of restaurant sales expected by the end of 2025.

- Sales among the nation’s 500 largest restaurant chains increased 3.1% in 2024, but that was the lowest annual increase in 10 years.

The restaurant industry is always changing, significantly influencing the U.S. economy, customer experiences and employment trends.

For stakeholders to make smart decisions, they need to understand critical sales figures and trends.

This report will highlight key restaurant industry sales statistics, current trends and forecasts for 2025 that will help you better understand where the market is headed.

Restaurant Industry Sales Continue To Climb

Despite recent fluctuations, consumer spending within the restaurant sector continues to exhibit overall growth.

Although May recorded a slight decline, it is crucial to consider the larger trend.

Notably, total consumer spending in restaurants rose by 5.3% compared to the same period last year.

This steady growth shows that people continue to be interested in dining out and visiting bars.

Overall, these trends point to a positive outlook for the food industry, even with some short-term ups and downs.

Adjusted Restaurant Industry Sales Growth: Steady Progress Despite Inflation

Although nominal sales figures suggest growth, a more accurate assessment considers the impact of price increases.

After adjusting for menu price inflation, eating and drinking place sales increased by 1.4% between May 2024 and May 2025.

This represents the third consecutive month with real sales growth exceeding 1%, indicating sustained upward momentum in industry performance.

May 2025: A Temporary Restaurant Industry Sales Dip

In May 2025, eating and drinking establishments reported total sales of $97.4 billion when seasonally adjusted. This marks a 0.9% drop from the revised $98.3 billion recorded in April.

It is the first decline in restaurant sales in three months and the largest monthly drop in over two years.

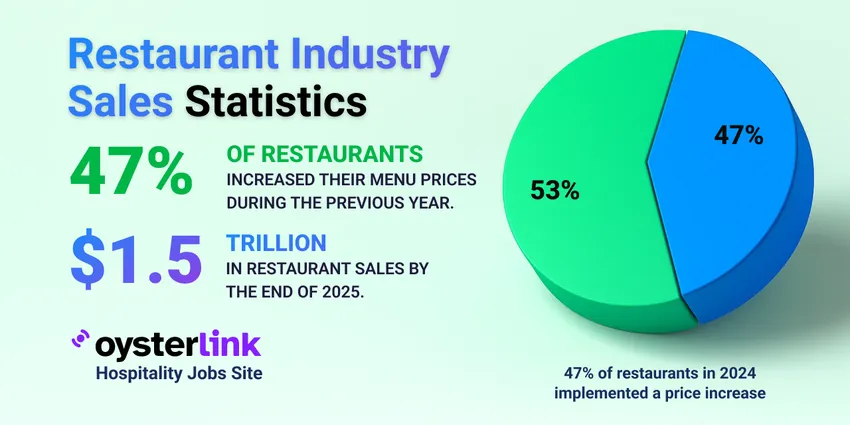

Restaurant Industry Sales To Reach $1.5 Trillion by end of 2025

Projections for 2025 indicate that total restaurant sales are anticipated to reach approximately $1.5 trillion by the end of the year.

Despite ongoing economic challenges, the outlook remains optimistic. There are significant opportunities for growth and expansion within the industry in the coming years.

Recent Sales Performance of Major Restaurant Chains

Contrary to the perception that only small, independent restaurants are facing challenges, major chains are also experiencing softening sales.

The overall health of the restaurant industry reflects this trend, with growth rates slowing across sectors.

In 2024, the combined sales of the nation’s 500 largest restaurant chains increased by only 3.1%. This marks the slowest growth rate in a decade, excluding the temporary slowdown caused by the COVID-19 pandemic in 2020.

A notable example is Red Lobster, a prominent chain in the seafood sector. The chain continued to face sales declines, with nearly a 23% drop to $1.68 billion.

Additionally, its restaurant count decreased by 20%, down to 518 locations.

Average Annual Revenue for Full-Service Restaurants

Data for 2024 indicates that revenue distribution among full-service restaurants is more evenly spread than typically perceived.

The average annual revenue per location was about $1,911,711. This reflects the total market capacity available to a wide range of establishments, not just high performers.

See also: Restaurant Revenue Statistics, Trends & Predictions for 2025

How Much Revenue Converts to Profit in Restaurants

While revenue growth is positive, it does not necessarily translate to higher earnings.

In 2024, the average profit margin for full-service restaurants was approximately 9.8%, highlighting the limited proportion of revenue that translates into profit within the industry.

Managing Operational Costs Through Menu Price Adjustments

In 2024, a significant trend emerged in the restaurant industry: Nearly half (47%) of establishments implemented menu price increases.

This adjustment reflects the ongoing need to balance profit margins and operational costs in a changing market environment.

Expanding Online Ordering: A Key Driver of Revenue Growth

Although many restaurants have adjusted menu prices, expanding online ordering capabilities has emerged as a significant driver of revenue.

While overall profits have remained relatively stable, shifting sales toward online channels has created a notable impact on revenue distribution.

Data indicates that restaurants that implemented online ordering experienced an average sales increase of 16%.

This underscores the importance of digital sales channels in enhancing revenue streams and adapting to evolving consumer preferences.

Lack of Reporting Is Harmful to Restaurants

Accurate measurement of key business metrics is essential for restaurant success. Without proper data collection and analysis, restaurants cannot identify areas for improvement or adapt effectively to market changes.

While a majority of industry professionals recognize the importance of monitoring vital statistics, not all are taking the necessary steps.

Recent data reveals that only 68% of restaurant operators review sales reports regularly.

Methodology for These Restaurant Industry Sales Statistics

The data and insights presented in this report are primarily sourced from comprehensive industry research and reports from the National Restaurant Association (NRA), as well as leading restaurant technology providers Toast and TouchBistro.

These organizations gather extensive quantitative and qualitative information through surveys, industry analyses and point-of-sale data, providing a reliable foundation for understanding current trends and performance metrics within the restaurant sector.

The combination of these reputable sources ensures a well-rounded perspective on market conditions, consumer behavior and operational challenges affecting the industry in 2025.

Loading comments...