Restaurant Depreciation: 3 Key Takeaways

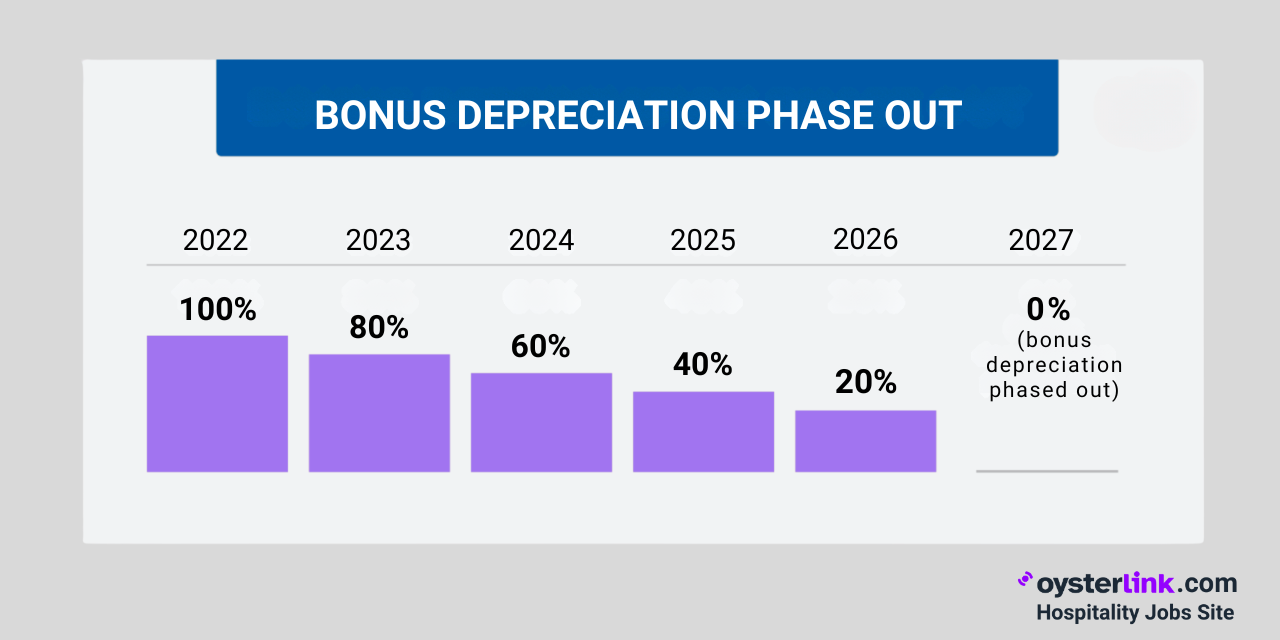

- 2025 bonus depreciation = 40%—and it phases down 60% (2024) → 40% (2025) → 20% (2026) → 0% (2027).

- $4.8B market: cooking gear is 28% = ~$1.34B; the other 72% ≈ $3.46B covers furniture, fixtures, lighting, and more.

- Cooking equipment lasts ~5–10 years in practice—even though you depreciate most of it over 5 years for tax.

Restaurant depreciation can unlock major tax savings — but only if you know how to use it.

In this guide, we’ll break down everything restaurant owners need to maximize depreciation strategies in 2025 — before the rules shift again.

Restaurant Depreciation Basics: What Every Owner Should Know

Understanding what qualifies as depreciable equipment and when to start claiming depreciation helps maximize your tax benefits.

What counts as equipment

The restaurant equipment market is valued at $4.8 billion. Cooking equipment makes up 28% of this total, or about $1.34 billion.

Source: Future Market Insights

This category includes:

- Food storage and preparation systems

- Beverage equipment such as refrigerators and dispensing systems

- Special electrical connections for specific machinery

- Water, gas, and drain hookups for kitchen equipment.

The remaining 72% of the market, worth roughly 3.46 billion, comes from other segments.

These include furniture and fixtures such as dining room tables, chairs, bar stools, booths, decorative lighting, and specialty double-action doors.

When depreciation starts

Depreciation begins the day you place equipment in service to generate income and continues until you fully recover its cost basis or retire it from service.

Kitchen equipment and restaurant furniture are typically depreciated over 5 years, office furniture over 7 years, and the building structure over 39 years.

The PATH Act established a 15-year recovery period for qualified restaurant property.

Bonus depreciation may be available if the asset is qualified property, placed in service within eligible dates, and used primarily for business.

Depreciation for Restaurant Equipment: 3 Smart Methods Explained

Three primary methods exist for claiming depreciation on your restaurant equipment.

Straight-line method

The straight-line method spreads an asset’s depreciable cost evenly over its useful life.

For example, if you purchase an industrial oven for $10,000 with a $2,000 salvage value and a 5-year life, the $8,000 depreciable cost produces $1,600 in annual depreciation.

Accelerated depreciation

Accelerated depreciation lets you deduct more in the early years of an asset’s life, using methods like the Declining Balance or Double-Declining Balance.

For example, a $1,000 mixer with a $100 salvage value depreciates $270 in year one, $189 in year two, and $132 in year three at a 30% rate.

Under 2023 bonus depreciation rules, you can deduct 80% in 2023, 60% in 2024, 40% in 2025, 20% in 2026, and 0% from 2027 onward. Any remaining value follows the MACRS schedule.

Section 179 expensing

Section 179 offers substantial immediate tax benefits by allowing you to deduct the full purchase price of qualifying equipment in the year of purchase. For 2023, key limits included:

- Maximum deduction: $1,160,000

- Phase-out threshold: $2,890,000

Important considerations for Section 179:

- The deduction cannot create negative taxable income;

- Equipment must be placed in service during the tax year;

- Deduction amount cannot exceed earned income.

If your business expects losses, time accelerated depreciation carefully, as Net Operating Losses can only offset 80% of taxable income.

Under current repair rules, you may deduct costs in full if they involve no major components, qualify as routine maintenance, or affect non-critical systems.

Choosing the right depreciation method depends on your circumstances and goals.

Kitchen Equipment Lifespan in a Restaurant Depreciation Guide

Each piece of equipment in your restaurant has specific depreciation timelines based on IRS guidelines and industry standards.

Cooking equipment timeline

Commercial cooking equipment typically remains functional for 5–10 years, including ovens, deep fryers, grills, steam trays, and cooking vessels.

For tax purposes, the IRS classifies food-prep equipment under “Distributive Trades and Services” and depreciates it over 5 years (MACRS).

Refrigeration systems

Refrigeration units are critical for safe food storage, and their efficiency directly impacts operating costs, so they require close monitoring.

For tax purposes, commercial refrigeration equipment generally uses a 5-year MACRS recovery period, like other kitchen equipment.

This typically includes complete beverage storage systems, cooling units, dispensing mechanisms, dedicated electrical connections, and associated tubing and piping.

Small tools and utensils

Under Rev. Proc. 2002-12, small tools and utensils may be deducted in the year of purchase if they meet specific criteria.

Qualifying items include glassware, flatware, dinnerware, pots and pans, tabletop items, bar supplies, food-prep tools, storage and service items, and small appliances costing $500 or less.

To qualify, they must be used in operations, received and ready for immediate use, and not warehoused for future use.

How to Maximize Tax Savings Through Depreciation for Restaurants

Smart tax planning through depreciation can substantially reduce your restaurant's tax burden.

Understanding the current deduction limits and bonus depreciation options unlocks significant financial advantages for your business.

Maximum deduction limits

2025 Section 179: max $2,500,000, phase-out starts at $4,000,000, and the deduction is fully gone once total qualifying purchases hit $6,500,000.

This primarily benefits small and mid-size restaurants under the $6.5M spend cap; amounts above that may still qualify for bonus depreciation if the property fits those rules.

A cost segregation study can further boost savings by reclassifying parts of your restaurant into 5-, 7-, or 15-year lives instead of 39 years, accelerating deductions.

Bonus depreciation options

Bonus depreciation is 40% in 2025, phasing down from 60% (2024) to 40% (2025), 20% (2026), and 0% (2027).

Unlike Section 179, bonus depreciation can create taxable losses, applies to both new and used property, and remains available after you hit §179 limits.

Apply §179 first, then bonus; together they can yield a near- or full-cost write-off of qualifying purchases, subject to the §179 phase-out.

Tax depreciation is usually faster than book, and you can keep books on straight-line while claiming accelerated tax for returns—just reconcile the difference.

Setting Up Your Restaurant Depreciation System the Right Way

A well-organized system helps maximize tax benefits and ensures compliance with IRS regulations.

Record keeping essentials

Keep a detailed fixed-asset register—it’s the foundation of sound depreciation. Record acquisition cost, transportation, installation, and other direct setup costs.

Accurate records let you track lifecycles and schedules, maintain service history, and quickly report acquisition costs, depreciation history, and current values.

Software tools

Modern depreciation software automates calculations and centralizes asset tracking, cutting manual entry and errors.

Key features: automatic depreciation by asset class, customizable schedules, multi-location lifecycle tracking, and integrations with QuickBooks, Xero, and more.

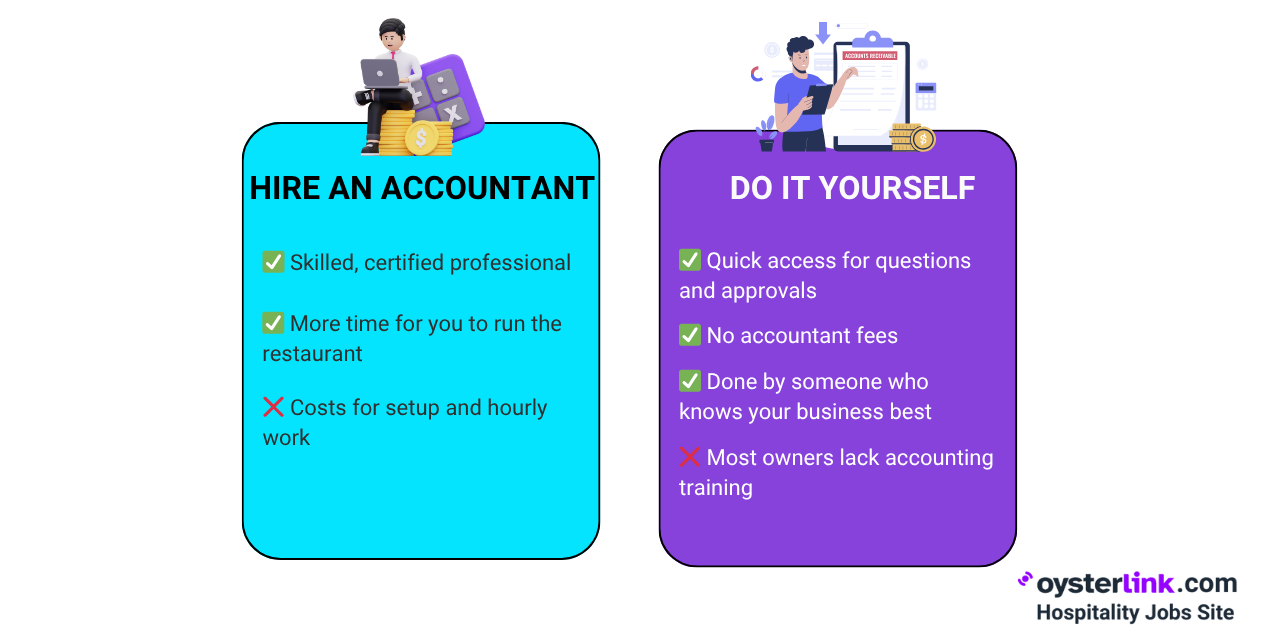

Working with accountants

Work with a restaurant-savvy CPA. They’ll categorize assets correctly, maximize depreciation, and handle filings - including prior-year catch-ups.

For missed depreciation, they can file amended returns and/or Form 3115.

Create a fixed-asset policy to keep methods consistent. Use solid documentation and software to streamline prep, support planning, and stay IRS-compliant.

Conclusion: Make Restaurant Depreciation Work for You

Remember that depreciation rules continue changing, especially regarding bonus depreciation rates.

Therefore, staying current with regulations and planning strategically becomes essential for restaurant owners.

Through careful asset management, detailed record keeping and professional guidance, you can turn depreciation into a powerful tool for business growth and tax savings.

Loading comments...