As inflation persists and competition grows, understanding how people choose, spend and return to restaurants is more important than ever.

This report explores key restaurant consumer trends for 2025, backed by credible data and emerging patterns.

How Restaurant Consumer Trends Are Changing the Industry

The global restaurant and foodservice market is projected to reach $4.03 trillion in 2025, up from $3.48 trillion in 2024 — a 7.8% CAGR that reflects more than just economic recovery.

This growth is being fueled by evolving consumer habits, especially around convenience, personalization and tech adoption.

Full-service restaurants are on track to generate $1.65 trillion, while quick-service restaurants (QSRs) are expected to grow from $265.9 billion in 2024 to $381.8 billion by 2033.

Consumers are dividing their spending between full-service experiences, fast-casual convenience and innovative formats like virtual brands and ghost kitchens.

In the U.S., foodservice sales are forecast to hit $1.5 trillion in 2025, employing 15.9 million workers, according to the National Restaurant Association.

That’s a year-over-year increase of 200,000 jobs—largely driven by rising demand for takeout, delivery, and personalized dining experiences.

Restaurants are responding by investing in digital tools, loyalty programs and tech-enabled service models to keep pace with shifting expectations. The expansion of off-premises options and automation isn’t just about cost-saving — it’s a direct response to what today’s guests want.

Restaurant Consumer Spending Trends in 2025

Despite continued inflation, U.S. restaurant spending remains steady.

According to the Bureau of Labor Statistics, consumer spending on food away from home rose 8.1% in 2023 — a sign that Americans are still prioritizing dining out even as prices climb.

In early 2025, OpenTable reported consistent year-over-year growth in seated diner volume, with some weeks showing up to 25% increases compared to 2024.

Spending behavior is also shifting. 91% of diners noticed menu price hike

This suggests that many consumers are dining out less frequently but more intentionally.

Off‑Premises & Takeout Culture

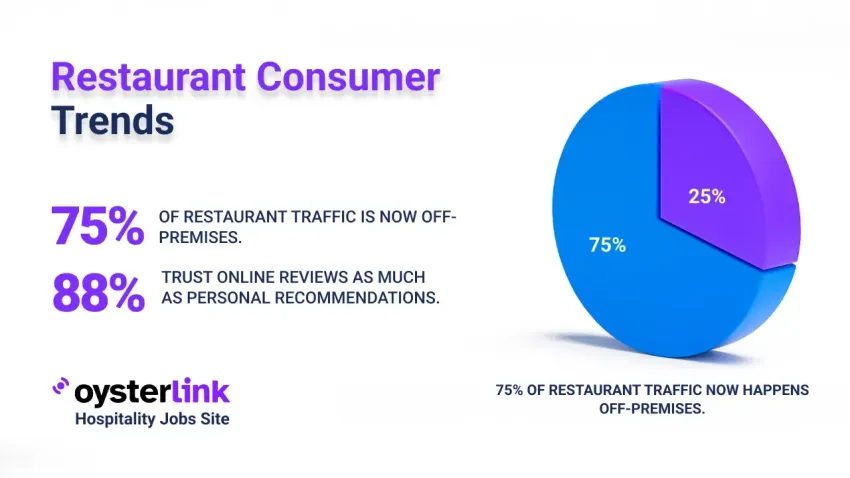

Off-premises dining now accounts for 75% of restaurant traffic, including takeout, delivery and drive-thru.

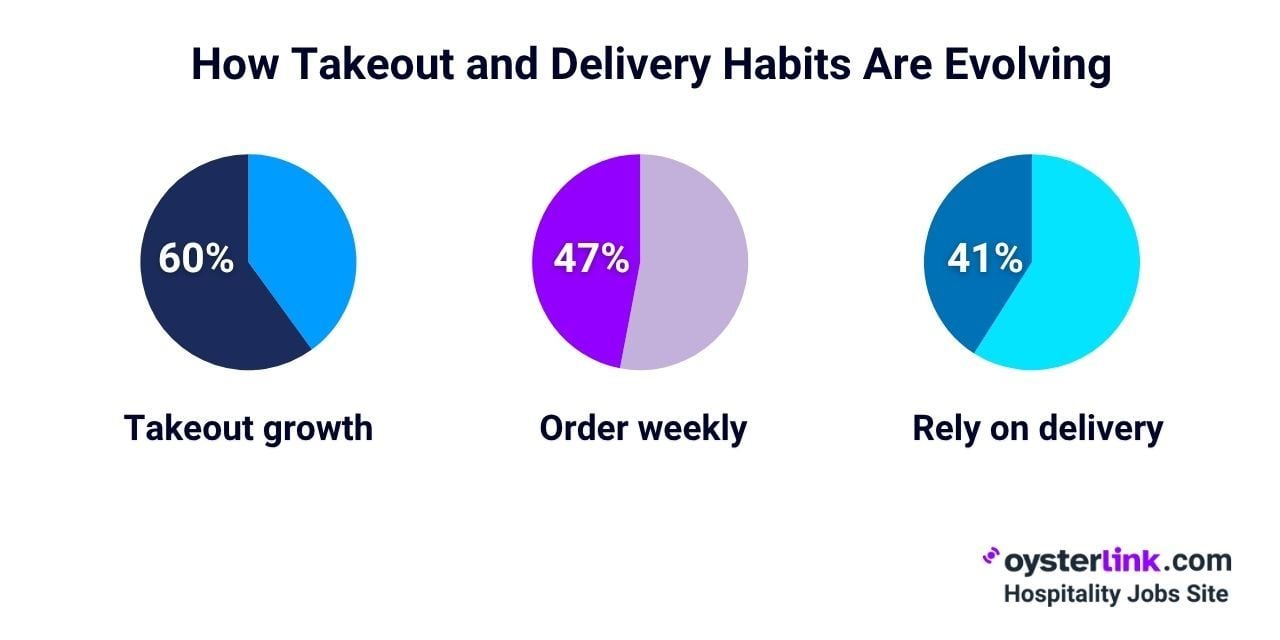

Millennials and Gen Z increased their takeout use by 60% year-over-year. 47% of adults order takeout weekly, and 41% consider delivery essential.

Menus now feature bundled meals, cold snacks and packaged cocktails.

In states with relaxed laws, alcohol-to-go remains common. Many restaurants also run virtual kitchens or have dedicated pickup lanes.

This shift is reshaping consumer restaurant trends.

Digital Ordering

Digital ordering is now firmly embedded in the dining experience. 58% of Millennials prefer self-order kiosks, reflecting a generational shift toward self-service and speed.

This preference is also driving the adoption of other contactless solutions — QR-code menus have become increasingly common, helping restaurants streamline ordering, reduce wait times and improve table turnover during peak hours.

To support this shift, restaurants are also investing in back-of-house technology like kitchen display systems, CRM platforms and AI-powered tools.

These systems not only help manage labor shortages but also enable smarter demand forecasting and more personalized guest interactions.

Diners Value Loyalty, Deals and Pricing Sensitivity

Value remains a driving force in consumer dining decisions, especially in off-premises channels.

Approximately 65% of drive-thru customers and 60% of delivery and takeout customers say that membership or loyalty programs influence their choices, highlighting the growing importance of digital incentives.

Promotions also play a key role. Around 80% of consumers report using Buy One, Get One (BOGO) deals, combo offers and other real-time specials when placing takeout orders.

Rise of Experience and Personalization in Restaurant Consumer Trends

According to a 2025 report by SevenRooms, 74% of diners are more likely to return after a unique or memorable dining experience. This could mean a themed tasting menu, standout service touches or simply being greeted by name.

Personalization — including saved preferences, seating options and tailored menus — requires minimal investment but yields high returns.

Even small gestures like offering a favorite drink or dessert can deepen loyalty. And in a digital-first era, Instagram-worthy presentation often doubles as marketing, as diners share standout experiences across social media platforms.

Social Media’s Role in Restaurant Consumer Trends

Social platforms drive dining decisions: 74% of consumers choose where to eat based on social media and 88% trust online reviews like personal recommendations.

57% reserve through social apps, 40% visit after seeing food photos and 73% switch if online engagement is ignored.

These behaviors, coupled with projected $276.7 billion of global social ad spend, reflect how digital visibility can make or break foot traffic.

Restaurant Consumer Trends Show Rise of Ethical and Health-Conscious Dining

Ethical dining now influences consumer choice. U.S. data mirrors European findings: 75% of diners prefer eco-friendly restaurants; many are willing to pay extra for sustainable packaging and local sourcing.

Health trends hold strong: 59% likely choose seasonal dishes; plant-based menu items are expected by many. Transparency — about sourcing, allergens or calories — is now essential for trust.

Final Thoughts on Restaurant Consumer Trends

Dining habits in 2025 reflect a shift toward convenience, personalization and digital engagement. Consumers are still spending — but with more intention.

Off-premises dining, loyalty rewards and social media influence are now central to how people choose and return to restaurants.

Operators that adapt to these trends — by offering value, embracing technology and delivering standout experiences — are better positioned to thrive.

Today’s restaurant success is no longer just about great food, but about meeting the evolving expectations of a more informed and selective diner.

Loading comments...