Restaurant Balance Sheet: 3 Key Takeaways

- Restaurants that manage balance sheets monthly reduce surprise expenses by up to 40%

- Equity insights help identify profitability and attract investors; top-performing restaurants often maintain 20%+ positive equity.

- Monitoring liabilities can prevent cash flow crises; 75% of failed restaurants cite financial mismanagement as a core issue.

Restaurant balance sheet accuracy can mean the difference between profit and failure in an industry with razor-thin margins — typically just 3–5%.

A balance sheet gives you a real-time snapshot of your financial health, helping you track assets, liabilities, and equity.

In a high-risk business where every dollar counts, mastering this tool is essential for long-term stability and smart decision-making.

What is a Restaurant Balance Sheet?

A restaurant balance sheet serves as a financial snapshot, displaying your restaurant's financial position at a specific moment in time.

Unlike other financial statements that track performance over time, a balance sheet captures your restaurant's current financial standing.

Key parts of a balance sheet

The foundation of your balance sheet rests on three main components that must always remain in balance.

Your assets represent everything your restaurant owns, from kitchen equipment to cash on hand.

Furthermore, liabilities encompass what your restaurant owes, such as vendor bills and equipment leases.

Additionally, equity shows the ownership stake in your business.

These components follow a simple yet crucial equation: Assets = Liabilities + Equity.

Specifically, your assets are typically categorized into three types:

- Liquid Assets: Cash, bank accounts and inventory that can be quickly converted to cash

- Non-Liquid Assets: Kitchen equipment, furniture and buildings

- Intangible Assets: Franchise agreements, copyrights and trademarks

Why balance sheets matter for restaurants

Your balance sheet primarily serves as a vital tool for analyzing financial health and making informed business decisions.

Restaurant owners and investors use this document to assess operational efficiency and plan strategic moves.

The balance sheet helps you track inventory levels and their worth, ensuring you're not ordering too much or too little of supplies.

Moreover, it provides insights into your restaurant's debt management, showing unpaid employee tips, state tax liabilities and operating costs that need attention.

For potential investors, your balance sheet offers essential information about your restaurant's worth and available assets.

This document, when combined with your profit and loss statement, enables you to perform detailed financial analysis and identify opportunities to improve your margins.

Getting Started with Your First Restaurant Balance Sheet

First of all, creating your restaurant's balance sheet requires careful organization and attention to detail.

By following a structured approach, you can build an accurate financial snapshot of your business.

Gathering the right documents

Before starting your balance sheet, collect all essential financial records.

These documents help ensure accuracy and completeness in your financial reporting.

You'll need to gather:

- Bank statements and cash records

- Equipment and property documentation

- Inventory lists and valuations

- Outstanding bills and loan statements

- Employee payroll records

- Tax documents and financial statements

Setting up your spreadsheet

Next, create a well-organized spreadsheet that clearly displays your financial information.

Start by dividing your spreadsheet into three main sections: assets, liabilities and equity.

Subsequently, break these categories into subcategories to track both current and long-term items.

For better organization, create separate tabs for different financial aspects.

This approach helps maintain clarity while inputting various financial elements.

As a result, you'll have a clearer view of your restaurant's financial position at any given time.

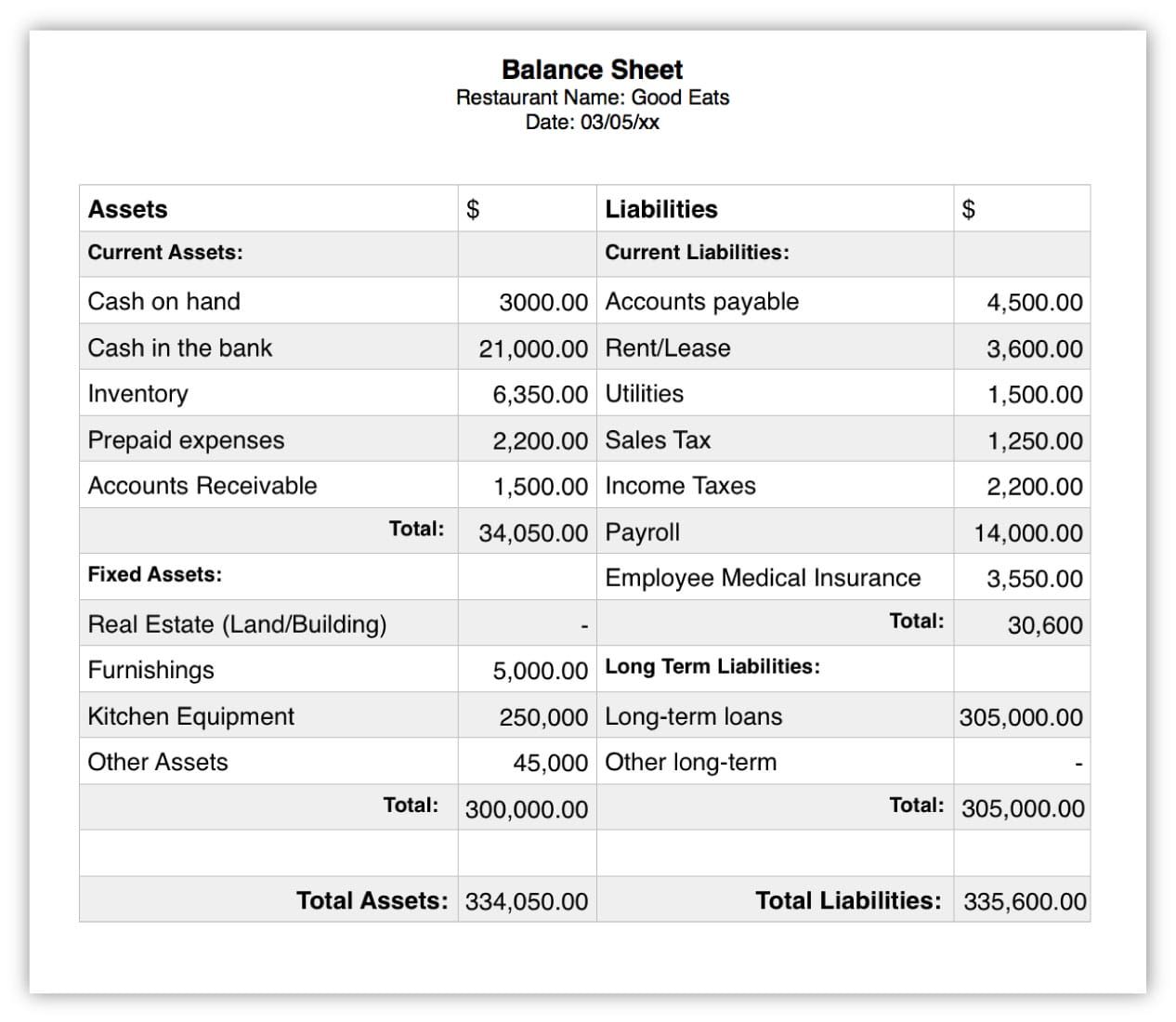

Source: Rezku

Adding Up Your Restaurant Assets: Balance Sheet Restaurant Example

Properly tracking your restaurant's assets forms the backbone of a strong balance sheet.

Understanding each asset category helps maintain accurate financial records and supports better business decisions.

Cash and bank accounts

Managing your restaurant's liquid assets requires meticulous attention to detail.

Your house bank or petty cash needs daily counting to prevent fraud and ensure accurate accounting.

Generally, this includes the cash kept on premises but excludes the day's deposits.

Bank accounts represent another crucial component of your liquid assets.

These accounts should be reconciled regularly to track all incoming payments and outgoing expenses.

Particularly important is maintaining separate accounts for different purposes, such as operations and payroll, to better organize your financial tracking.

Equipment and supplies

Restaurant equipment represents a significant portion of your assets, primarily falling under fixed or non-liquid assets.

The Small Business Association notes that liquidated equipment typically sells for about 20% or less of its retail value.

Consequently, proper maintenance and documentation of your equipment become essential for preserving its value.

When valuing equipment, consider factors like age, condition and brand reputation.

Premium brands such as Hobart, Vulcan and Blodgett typically hold their value better than lesser-known alternatives.

Obviously, equipment that's well-maintained and fully operational commands higher value in the market.

Property value

Your restaurant’s property assets — both the land and the building — are some of the most valuable items on your balance sheet.

Just look at McDonald’s — one of the most successful restaurant brands in the world.

While most people see McDonald’s as a fast-food giant, its real power lies in real estate.

Source: Reader's Digest

The company strategically purchases prime locations, allowing it to control rent, generate additional income, and secure long-term financial stability.

This real estate-driven approach has made McDonald’s one of the largest property owners globally, proving that owning valuable property can be a game-changer in the restaurant industry.

However, property value isn’t static. It fluctuates based on market conditions, location desirability, and property upkeep.

A restaurant in a high-traffic urban center holds far greater value than one in a declining area.

Keeping your property well-maintained and regularly assessed ensures you have an accurate valuation on your balance sheet, helping you make smart financial moves.

Calculating Your Restaurant Liabilities Using Sample Restaurant Balance Sheet

Understanding your restaurant's liabilities helps maintain financial stability and plan for future growth.

Primarily, these financial obligations fall into three main categories that require careful tracking and management.

Current bills and payments

Short-term financial obligations shape your restaurant's immediate financial health.

These current liabilities include any payments due within one year, such as utilities, short-term loans, interest payments and building rent.

Besides monthly expenses, current liabilities encompass equipment rent and medical plan payments for staff.

Monitoring current liabilities helps prevent cash flow problems.

Essentially, restaurant owners must keep a close eye on this balance sheet category to ensure enough liquid cash exists for meeting short-term obligations.

This practice allows for better financial planning and helps identify potential cash shortages before they become critical.

Long-term loans

Long-term liabilities extend beyond the 12-month horizon and often support major business investments.

These obligations typically include extended lease agreements, deferred income taxes and capital leases.

Although less common in the restaurant industry, long-term liabilities play a crucial role in expansion and improvement projects.

Restaurant owners should monitor long-term debt to identify growing obligations early.

This oversight helps maintain sustainable debt levels and ensures the business can meet its extended financial commitments.

During financial planning, consider how these long-term obligations affect your restaurant's overall financial health.

Employee wages

Wage-related liabilities represent a significant portion of your restaurant's financial obligations.

These include accrued wages before payroll, employee benefits and any deferred compensation.

Restaurant owners must track both current wage obligations and long-term benefit commitments.

Proper management of wage liabilities involves accurate tracking of hours worked, overtime pay and benefit calculations.

This meticulous approach helps prevent payroll issues and ensures timely compensation for your staff.

Instead of viewing wage liabilities as mere expenses, consider them investments in your team's productivity and satisfaction.

Accordingly, maintaining detailed records of all wage-related obligations supports better financial planning.

This practice helps restaurant owners anticipate payroll needs and manage cash flow effectively while ensuring compliance with labor regulations.

Understanding Restaurant Equity in Financial Statements

Restaurant equity represents the financial value remaining after subtracting all liabilities from your total assets.

Primarily, this financial metric shows your true ownership stake in the business, making it a crucial component of your balance sheet.

Owner investments

Building a successful restaurant starts with a strong financial foundation, and that often begins with owner investments.

Whether from savings, family, or investors, these funds provide the essential capital to launch and sustain your business.

Take this real-world example - a restaurant owner’s father invested $40,000 to help kickstart the business.

This capital was crucial because, in the early stages, restaurants require significant funding to cover startup expenses.

The money was used to purchase kitchen equipment, furnish the dining area with tables and chairs, and stock up on initial inventory such as ingredients and supplies.

Similarly, many restaurant owners choose to bring in business partners who contribute funds in exchange for ownership shares, combining financial support with strategic expertise.

Unlike loans, equity investments are debt-free, giving restaurants a stronger foundation for growth.

Retained earnings

Retained earnings form a significant portion of your restaurant's equity, representing all profits kept within the business rather than distributed as dividends.

These earnings serve multiple purposes in strengthening your restaurant's financial position.

Your retained earnings reflect smart financial decisions about profit allocation.

Hence, you might choose to reinvest these funds into:

- Kitchen equipment upgrades

- Restaurant expansion projects

- Emergency fund establishment

- Debt reduction initiatives

The decision to retain earnings or distribute them as dividends typically rests with management, though shareholders can influence this choice through majority voting.

Therefore, maintaining a balance between reinvestment and distribution becomes crucial for long-term success.

Retained earnings fluctuate based on your restaurant's performance and financial decisions.

Primarily, these changes occur through:

- Net income additions from profitable periods

- Dividend payment deductions

- Operating loss impacts

Understanding your retained earnings helps track your restaurant's growth over time.

Meanwhile, a positive retained earnings balance often signals financial strength, indicating consistent profitability in previous years.

Likewise, this metric helps potential investors evaluate your restaurant's financial health and management effectiveness.

Your retained earnings calculation follows a straightforward formula: Beginning Retained Earnings + Net Income - Dividends Paid.

Therefore, tracking these components helps you maintain accurate financial records and make informed decisions about profit allocation.

The relationship between retained earnings and business growth deserves careful consideration.

Certainly, growth-focused restaurants might retain more earnings for expansion, while established venues might opt for higher dividend distributions.

Ultimately, your decision should align with your restaurant's strategic goals and market opportunities.

Final Steps: Complete Balance Sheet for Restaurant Business Review

Remember that your balance sheet is more than just numbers on paper — it's a powerful tool for building a thriving restaurant business.

Start organizing your financial documents today, maintain consistent records and use this knowledge to make data-driven decisions that support your success.

Loading comments...