Restaurant Accounting: 3 Key Takeaways

- Only 68% of operators review sales reports consistently, meaning 1 in 3 restaurants lack visibility into key revenue data.

- With 54% of payments via card, reconciling daily credit card entries (with fees/tips) prevents underreporting.

- Inventory and COGS management directly impact 30–40% of a restaurant’s profitability.

Restaurant bookkeeping is crucial for success, especially with tight margins and numerous expenses.

This guide will equip you with the essentials to control costs, stay on top of your numbers, and boost your restaurant’s bottom line.

Understanding Restaurant Accounting Fundamentals and Restaurant Bookkeeping

Restaurant bookkeeping is different from standard business bookkeeping. Money flows are complex with inventory and labor making financial tracking a real challenge.

Yes, it is crucial to keep proper financial records as these are the foundations of any successful food service operation.

The Unique Challenges of Restaurant Bookkeeping

Restaurant sales are unpredictable and often overlooked. Traffic and ticket averages swing wildly based on the day, season, even the weather.

That’s why many operators rely on weekly sales reporting, not monthly, to catch real performance trends faster.

Yet despite this need, only 68% of restaurant operators regularly review their sales reports.

That leaves a third flying blind—unable to adjust to volume shifts, spot underperforming items, or staff efficiently.

Cash vs. Accrual Accounting Methods for Restaurants and Restaurant Journal Entries

The difference lies in when transactions are recorded.

- Cash-basis accounting is simpler. You log income when cash comes in and expenses when cash goes out.

- Accrual accounting records revenue when it's earned and expenses when they’re incurred—regardless of when cash changes hands.

The IRS mandates accrual accounting for restaurants earning over $1 million annually.

Setting Up Your Restaurant Accounting Journal Entries

Your restaurant's chart of accounts (COA) is vital for all financial record-keeping.

Restaurant charts of accounts typically have five main categories:

- Assets: What your restaurant owns: cash, equipment, inventory

- Liabilities: What your restaurant owes: loans, payables, taxes

- Equity: Your ownership: invested capital and retained earnings

- Revenue: Income from food, drinks, catering, merchandise, etc.

- Expenses: All costs - food, labor, rent, utilities, marketing

Restaurant COAs break broad categories into detailed ones, like separating food and beverage sales, or splitting expenses into meat, seafood, and produce.

Each account is tagged with a four-digit GL code making communication with your accountant much easier.

Essential Components of Restaurant Journal Entries

Your ability to create proper journal entries helps track financial activity, maintain accurate records and make informed business decisions.

Debit and credit basics for restaurant transactions

Think of it like a kitchen balance sheet: you want to keep your books balanced, just like you want your food costs and sales to balance.

Every time something happens (you get paid, you buy food, you pay employees), you record two things: one on the debit side (left) and one on the credit side (right).

Here’s the cheat sheet — just five things to know:

- Assets (cash, inventory): ↑ Debit, ↓ Credit

- Liabilities (loans, payables): ↑ Credit, ↓ Debit

- Equity (ownership): ↑ Credit, ↓ Debit

- Revenue (sales): ↑ Credit, ↓ Debit

- Expenses (food, labor): ↑ Debit, ↓ Credit

Required information for complete journal entry documentation

Clear documentation is essential for journal entries to hold up under audits, tax reviews, or internal checks.

Each entry should include a summary header and detailed line descriptions, so anyone (regardless of familiarity) can understand its purpose.

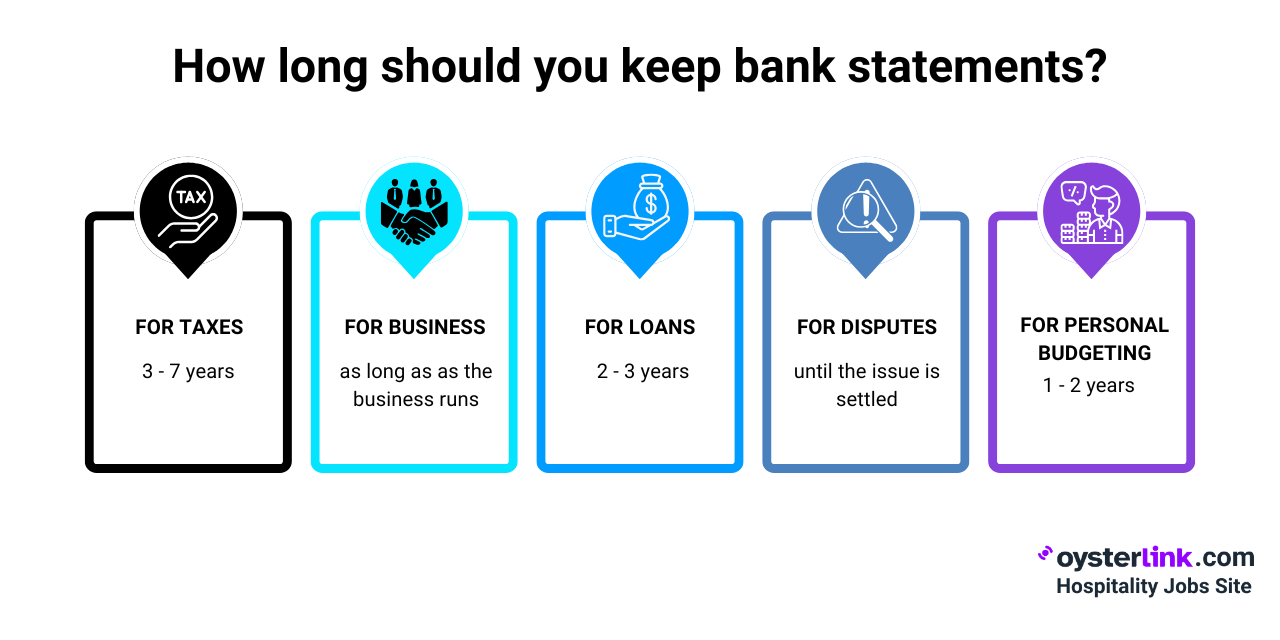

Attach supporting proof like POS reports, vendor invoices, or bank statements, and retain it per your record-keeping policy (usually 7–10 years).

Common restaurant account categories

Journal entries in restaurants typically fall into five essential categories:

- Sales entries track revenue from food, drinks, and merchandise—vital as 54% of payments are by card.

- COGS and inventory entries monitor stock value and item costs.

- Labor entries cover wages, tips, taxes, and benefits.

- Fixed expenses include recurring costs like rent and utilities.

- Period-end entries adjust for inventory, accruals, and depreciation.

Creating Daily Restaurant Accounting Journal Entries

Daily sales records are the foundations of your restaurant's accounting system. Accurate daily entries paint a clear picture of your operation's financial performance.

Extracting data from your POS system reports

Most restaurants use a point-of-sale (POS) system that creates what's commonly called a z-report at the end of each day or shift.

This report keeps transactions in their proper timeframe and prevents Tuesday's sales from showing up in Friday's records.

Your daily sales reports should show detailed breakdowns by category, applied discounts, payment methods, tips collected and service times for each transaction.

Recording revenue by category (food, beverage, merchandise)

Breaking down sales by category will teach you a lot about your business performance.

You should record separate entries for:

- Food sales (primary income source for most restaurants)

- Beverage sales (alcoholic and non-alcoholic)

- Merchandise sales (branded items like t-shirts, cookbooks or sauces)

Revenue categories usually use 4000-series account numbers in your chart of accounts. Each category needs its own account code for tracking.

Handling different payment methods in sales journal entries

Your journal entries should clearly reflect all payment types. Cash sales are recorded by debiting Cash and crediting the relevant Revenue account.

For credit card sales, you debit Accounts Receivable and credit Revenue until the funds are deposited.

Many restaurants group cards like Visa, MasterCard, and Discover if they settle together, while keeping Amex separate if it settles differently.

Accounting for discounts and comps in your sales records

Restaurants typically use either the gross or net sales method to record discounts:

- The gross method shows the full retail price as revenue, then subtracts discounts on the income statement.

- The net method only records the final, discounted amount as revenue.

Comps require careful handling—they’re expenses, not revenue or discounts. Misclassifying them can inflate sales and taxes. Record them as pre-tax reductions to keep reports accurate.

Recording Cost and Expense Journal Entries for Restaurants

Accurate expense tracking is the life-blood of restaurant profitability. Sales entries show your revenue, but expense entries reveal the true story of your financial health.

Inventory and COGS journal entries

Every time your restaurant buys, counts, transfers, or wastes inventory, matching journal entries are required.

For purchases, debit Inventory and credit Accounts Payable or Cash to reflect new assets.

Cost of Goods Sold (COGS) is calculated as: Beginning Inventory + Purchases – Ending Inventory.

For example, $1,000 + $1,000 – $500 = $1,500. COGS typically accounts for 30–40% of restaurant revenue.

While software can automate entries, accurate COGS depends on consistent, well-managed inventory practices.

Labor and payroll journal entry procedures

Restaurant payroll journal entries include gross wages, bonuses, payroll taxes, benefits, and tip allocations.

Typically, you debit Payroll Expense and credit Cash or Payroll Payable for hourly wages.

Tips are handled separately, as they aren’t restaurant revenue. You record them by debiting Tips Payable and crediting the employee’s pay.

Both employee and employer portions of payroll taxes must be tracked. Payroll software can automate these entries, using POS data to allocate labor costs by role.

Payroll journal entries depend on accurate wage data. Use OysterLink’s free Hourly to Salary Calculator to convert hourly rates into clear annual figures.

Vendor payment and Accounts Payable entries

Accounts Payable (AP) tracks what your restaurant owes suppliers for food, beverage, and other essentials.

When vendor invoices arrive, you debit the appropriate expense account and credit AP. Once payment is made, you debit AP and credit Cash or Bank.

Restaurants with streamlined AP processes spend up to five times less per invoice than those relying on manual methods.

Modern AP automation tools can extract invoice data, apply the correct general ledger codes, and verify pricing against contracts.

Fixed expense journal entries for restaurants

Fixed expenses cover recurring costs such as rent, utilities, insurance, and depreciation.

These are recorded by debiting the appropriate expense account and crediting either Cash or Accounts Payable.

Depreciation is handled separately, as it represents the gradual use of assets without a direct cash outflow.

For expenses that extend across accounting periods monthly accruals are used to ensure accurate financial reporting by debiting Rent Expense and crediting Accrued Expenses.

Period-End Journal Entries for Restaurants & Restaurant Bookkeeping

Period-end closing stands as a vital accounting practice that restaurant operators need to understand their true financial position.

Creating standard journal entries will give a clear picture of your restaurant's performance in financial statements and lead to better decisions.

Month-end inventory adjustments

Inventory valuation has a direct impact on your cost of goods sold and overall profitability.

At month-end, you need two key journal entries:

- Reverse the prior period’s inventory values to reset your accounts

- Record the new inventory values based on your latest physical counts.

Regular monthly inventory adjustments help identify issues like waste, theft, or portioning errors.

Make every ingredient count, read OysterLink’s guide on Food Waste Reduction.

Accrual entries for outstanding expenses

Accruals match expenses to the period they occur, not when they’re paid, giving a more accurate picture of your restaurant’s financial health.

To record an accrual, debit the appropriate expense account and credit an accrued expense liability. For example, January electricity billed in February should still be recorded in January.

Payroll accruals are also essential, capturing labor costs for days worked in one period but paid in the next. This ensures expenses align with when the work was actually performed.

Reconciliation entries for cash and credit cards

The month-end reconciliation makes sure every dollar earned gets tracked. Your POS reports are compared with actual deposits to spot discrepancies.

Credit card reconciliation has become crucial as digital payments dominate transactions today. The reconciliation entries fix differences between recorded sales and actual deposits.

Depreciation and amortization entries

Restaurant equipment and improvements lose value over time, requiring monthly depreciation entries. Record these by debiting Depreciation Expense and crediting Accumulated Depreciation.

Most restaurants use straight-line depreciation for simplicity.

Typical asset lifespans:

- Buildings (39 years)

- Leasehold improvements (15 years)

- Equipment (5–7 years).

Amortization applies the same method to intangible assets like pre-opening costs. Monthly entries help avoid large year-end adjustments and keep financials accurate.

Conclusion: Restaurant Accounting Journal Entries

Restaurant owners who follow a consistent system for journal entries gain clearer insight into business performance.

Daily sales tracking, expense monitoring, and regular reconciliations create an accurate financial picture that supports smarter decisions.

This approach also simplifies tax compliance, speeds up audits, and highlights cost-saving opportunities.

These core practices protect profits and enable sustainable growth—whether managing POS entries, inventory, or month-end adjustments.

Loading comments...