Dining habits are changing quickly as technology and convenience drive more people to order online. Younger generations are leading this shift, though dine-in still matters for social and special occasions.

This article explores the latest data comparing online ordering and dine-in behavior in 2025 — and what it means for restaurants adapting to both.

Rise of Online Ordering

Online ordering has shifted from a convenient option to a dominant dining behavior.

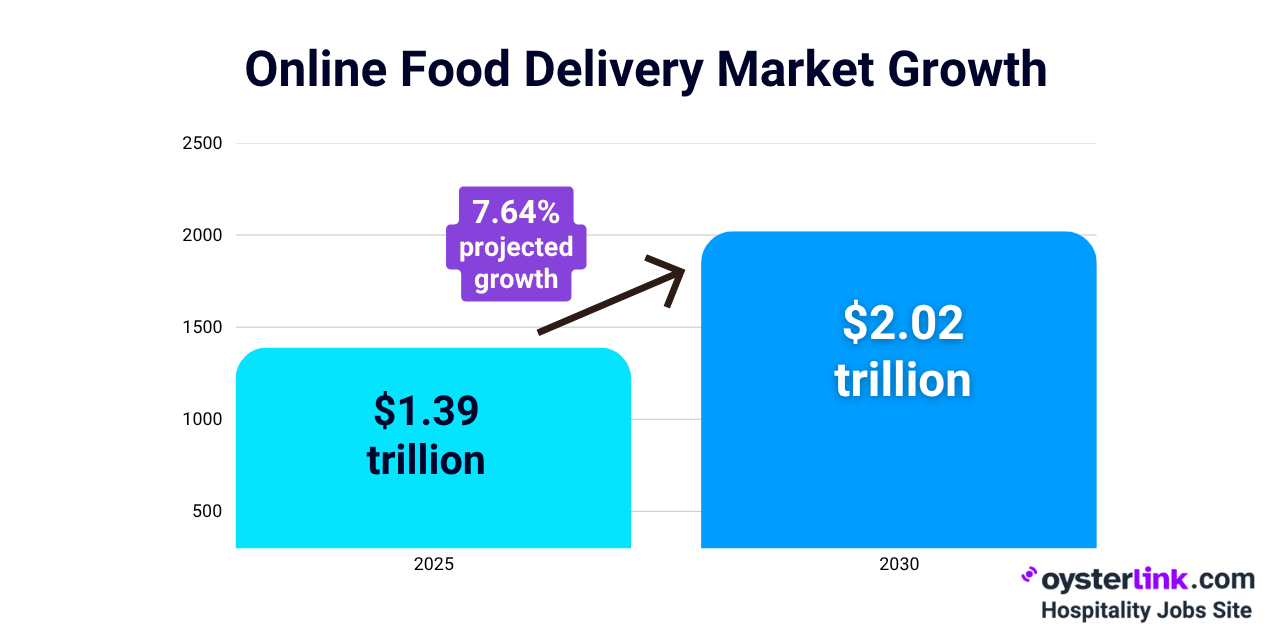

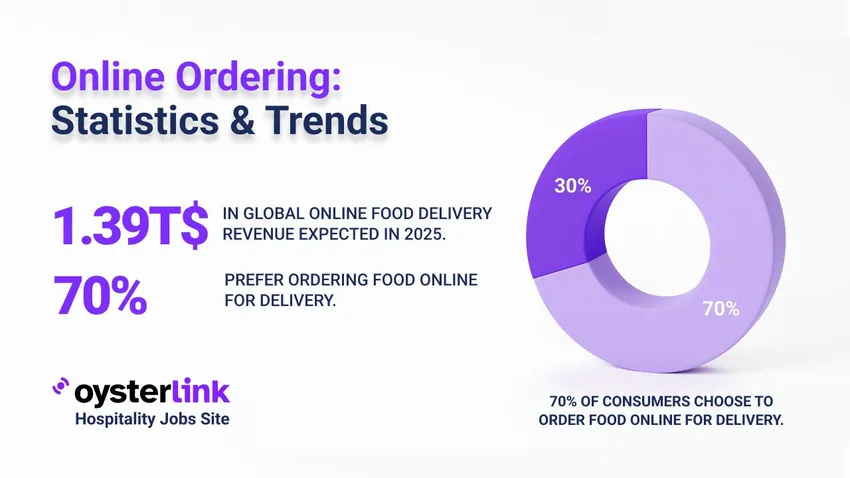

According to Statista, the global online food delivery market is expected to generate $1.39 trillion in revenue in 2025 — a number that reflects more than just post-pandemic habits.

With a projected growth rate of 7.64% annually, the market is on track to reach $2.02 trillion by 2030, signaling a long-term consumer shift toward digital dining.

This growing demand is reshaping the competitive landscape. As diners increasingly choose to eat from home, major delivery platforms have solidified their positions.

DoorDash now controls 67% of the U.S. food delivery market, while Uber Eats holds 23%, leaving limited space for smaller services to gain traction.

For restaurants, online ordering is a key driver of repeat business.

Customers who order digitally visit 67% more often, making it a powerful tool for building loyalty and boosting revenue.

Why Consumers Prefer Online Ordering

Food delivery news reports that 70% of customers say they prefer to order food online and have it delivered. It’s fast, it’s easy, and it fits into their daily routines.

This habit isn’t just occasional. 60% of U.S. consumers place a delivery or takeout order at least once a week, showing that off-premise dining has become a regular part of how people eat—not just something they do when they don’t feel like cooking.

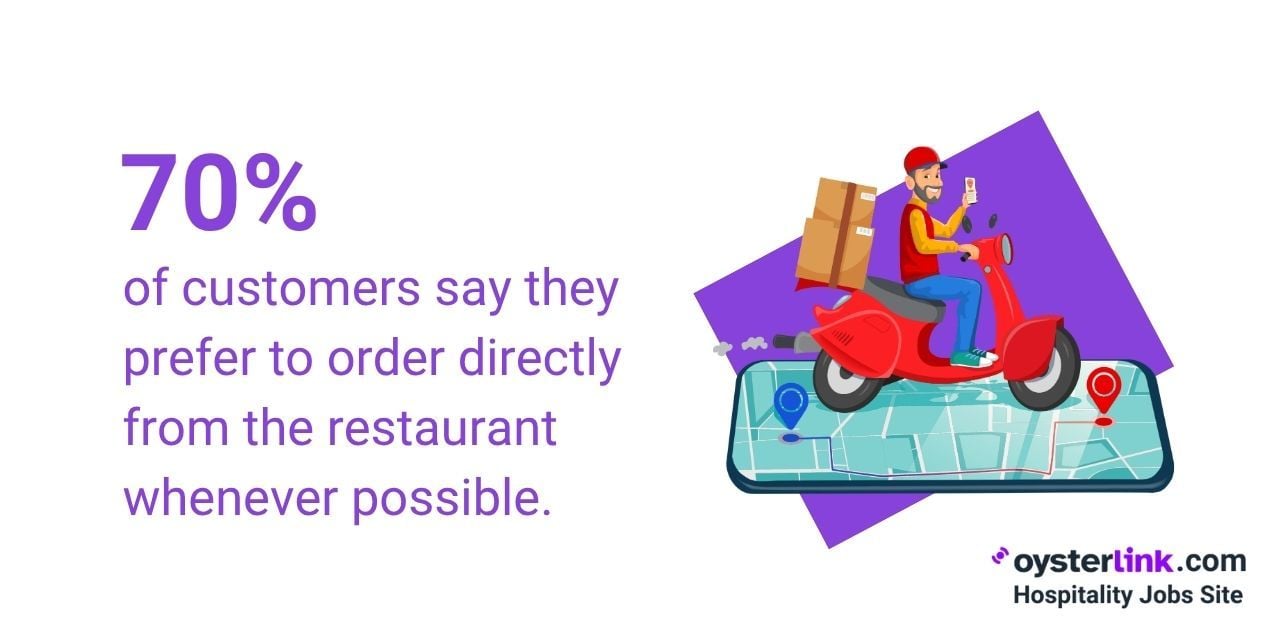

As this behavior grows, restaurants are starting to rethink how they offer online ordering. While third-party apps like DoorDash and Uber Eats are widely used, they come with high fees and less control over the customer experience.

That’s why many restaurants are now investing in their own websites and apps. It’s a smart move — especially since 70% of customers say they’d rather order directly from the restaurant when they can.

By building their own ordering systems, restaurants can keep more of their profits, collect useful customer data and create a smoother, branded experience. In the long run, this helps them build stronger relationships with their most loyal diners.

Power of Online Ordering and Visibility

In today’s restaurant industry, what customers see online often shapes where they decide to eat.

Whether someone’s looking for delivery or planning a night out, their first stop is usually a quick online search. According to TripAdvisor, 94% of diners say that online reviews influence their dining decisions.

A few positive or negative comments can sway someone toward or away from your restaurant. That makes reputation management just as important as food quality.

Responding to reviews, updating listings and keeping details like hours and menus accurate can make a big difference in getting people through the door — or clicking “order now.”

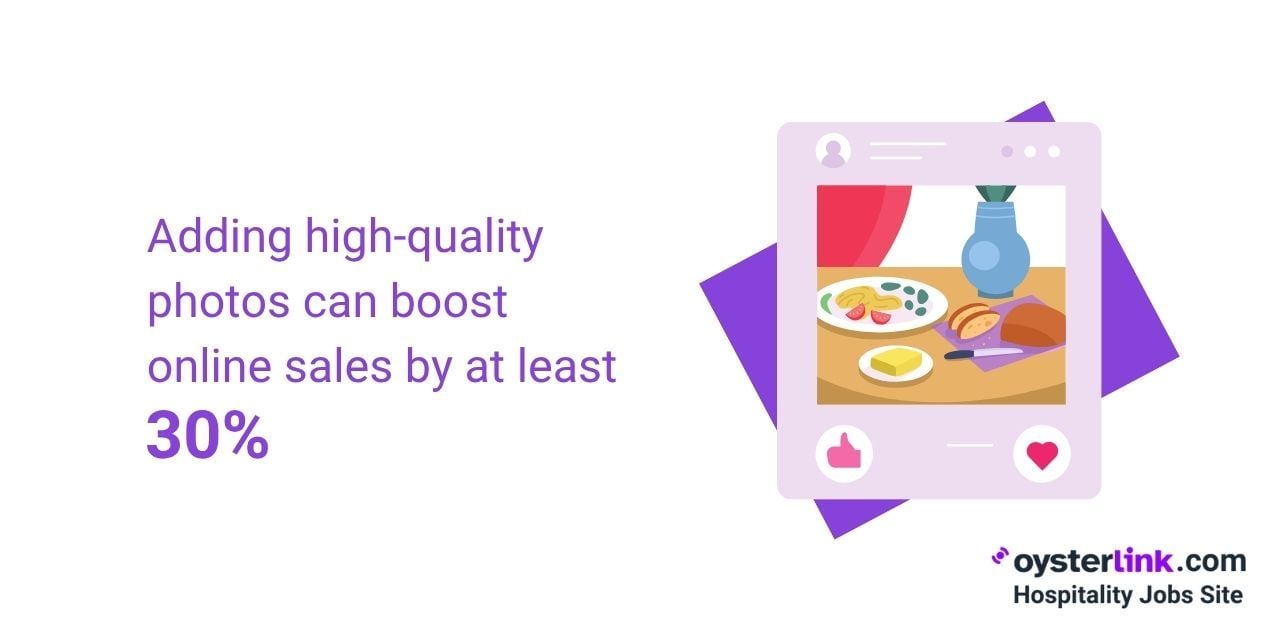

But it’s not just about what people read — it’s also about what they see. Visuals carry a lot of weight, especially in the digital space.

Research from Meero found that adding high-quality photos to your online page can boost sales by at least 30%. After all, sometimes people eat with their eyes first.

When a menu item looks appealing in a photo, it’s more likely to get ordered.

Together, strong reviews and appealing visuals help build trust. They create a sense of consistency and professionalism, which matters to customers — especially those trying your restaurant for the first time.

Whether you're offering dine-in, takeout or delivery, showing up well online helps convert browsers into buyers.

How Online Ordering Is Reshaping Dining Habits for Millennials and Gen Z

Much of the shift toward online ordering is being driven by younger generations — specifically millennials and Gen Z.

These two groups have different habits, priorities and expectations compared to older diners, and their preferences are reshaping how restaurants operate.

Let’s start with millennials.

Data shows that millennials dine in only 42% of the time, meaning the majority of their food consumption happens outside the traditional restaurant setting — whether through takeout, delivery or on-the-go meals.

This group also shows different behavior around tipping. About 10% of millennials say they don’t tip when dining out, compared to only 3% of older generations.

This could reflect shifting views on service fees, especially as tipping norms evolve in response to delivery and counter-service models.

Looking ahead, convenience will only grow in importance for this group.

By 2026, 80% of Millennials are expected to be parents. Between work, family responsibilities and limited time, delivery becomes not just a preference — but a necessity.

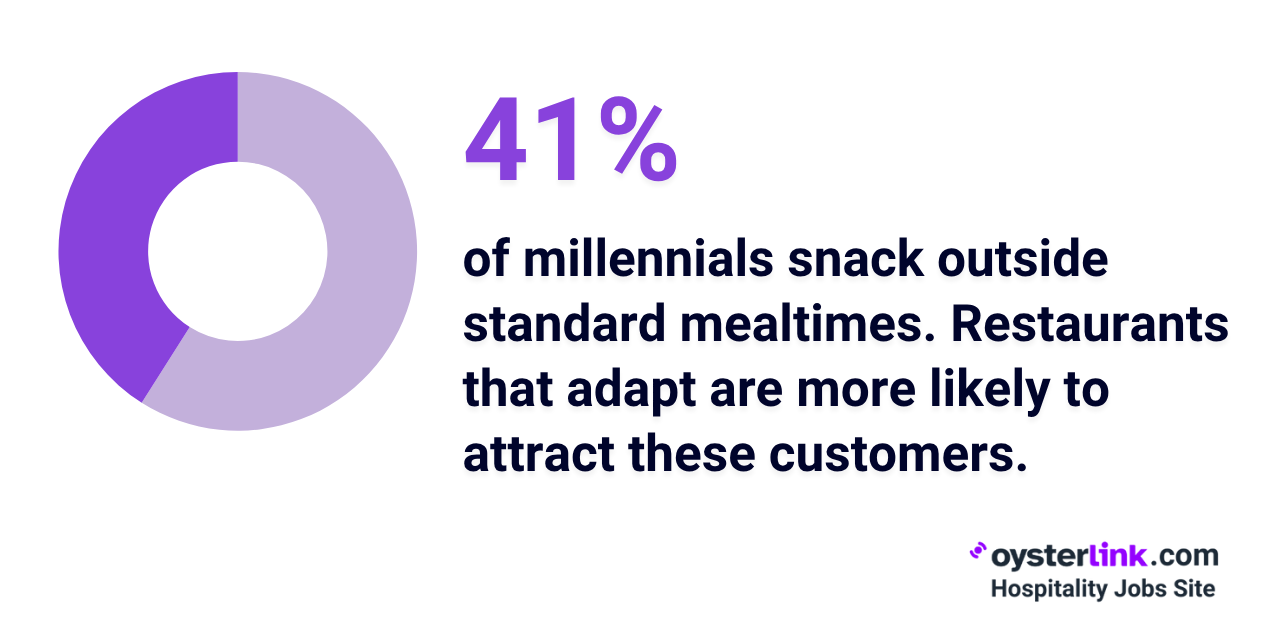

Their daily routines are also changing how and when they eat. About 41% of millennials report snacking during off-peak hours, suggesting that the standard three-meal structure is becoming less relevant.

Restaurants that can cater to non-traditional dining times — like offering flexible delivery hours or snack-portion menu items — are more likely to meet these evolving needs.

Gen Z, on the other hand, is growing up with food delivery as a default option.

This group is even more digitally connected, and their preferences reflect that. 69% of Gen Z consumers prefer ordering delivery over dining in, making them the most delivery-focused generation to date.

They’re comfortable navigating multiple apps, reading reviews and ordering with just a few taps. For Gen Z, food is about speed, customization and digital convenience.

Together, these trends mark a clear generational shift. As millennials and Gen Z become the majority of the dining population, the demand for fast, flexible and app-based ordering will only increase.

Restaurants that understand these habits — and adapt their offerings accordingly — will be better positioned to keep up.

Online Ordering Is Growing — But Dine-In Still Counts

While online ordering is booming, dine-in service still plays a valuable role in the restaurant experience. Not every meal is meant to be eaten on the couch — many customers still crave the atmosphere, service and social setting that comes with eating out.

In fact, 42% of diners say they eat out at least once a week or more, showing that traditional dining still has a strong place in many people’s routines. And it’s not just about frequency — it’s also about value.

The average dine-in check in the U.S. is $54, a number that typically includes higher-margin items like drinks, desserts and add-ons that don’t always translate to delivery.

But while dine-in guests are willing to spend more, they also expect more. 33% of diners say they rarely make a reservation, which can make managing table flow difficult, especially during peak hours.

On top of that, 42% say a wait time over 30 minutes would deter them from dining at a restaurant, a clear sign that speed and efficiency still matter — even for those seeking an in-person experience.

See also: 50+ Hospitality Industry Statistics in 2025

Online Ordering Statistics vs Dine-In: Conclusion

The shift toward online ordering is more than a temporary change — it’s a reflection of how today’s diners live, work and eat.

With billions flowing into the food delivery market and younger generations driving demand, digital convenience is now a core part of restaurant strategy.

At the same time, dine-in experiences still matter, offering value and atmosphere that apps can’t replace.

Restaurants that succeed in 2025 and beyond will be the ones that do both well — combining strong digital tools with a dining experience worth showing up for.

Loading comments...