Restaurant Server Minimum Wage: 3 Key Takeaways

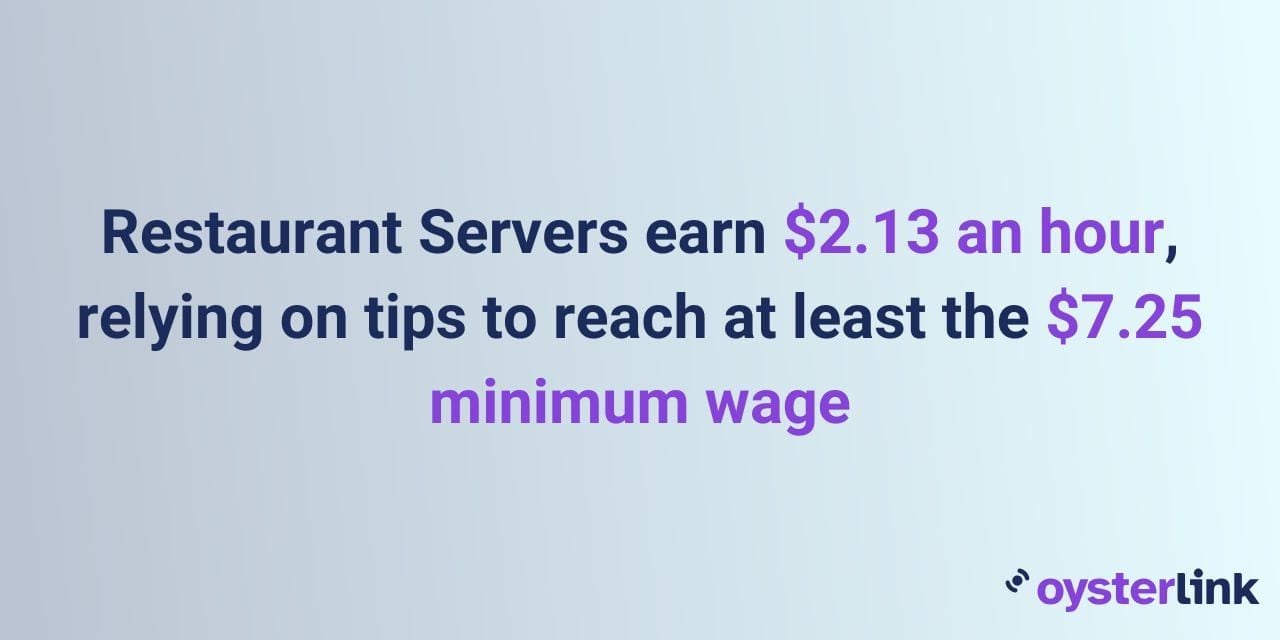

- Under the FLSA, tipped employees like Restaurant Servers earn a minimum cash wage of $2.13/hour.

- Employers can count up to $5.12/hour of a Server's tips toward satisfying the federal minimum wage requirement.

- To qualify for the tipped wage system, employees must receive at least $30 in tips per month, according to federal guidelines.

The restaurant Server minimum wage isn’t as straightforward as many assume - and it’s critical to understand the real numbers behind it.

That's why this guide breaks down the federal, state, and legal factors that shape compensation in the industry.

From the $2.13 federal tipped wage to the states requiring full minimum wage regardless of tips, we’ve distilled the key facts you need to make smart decisions in 2025.

Federal Minimum Wage for Restaurant Servers

The Fair Labor Standards Act (FLSA) sets the foundational rules for minimum wage in the United States.

According to the FLSA, the general minimum wage stands at $7.25 per hour.

However, when it comes to Restaurant Servers — who are classified as tipped employees — the landscape changes significantly.

Restaurant Servers earn a minimum cash wage of just $2.13 per hour.

This lower rate is possible because tips are expected to supplement their income, with the total earnings needing to meet the federal minimum wage of $7.25.

Here’s a quick breakdown of the federal rules regarding the management of minimum wage for Restaurant Servers:

- Minimum cash wage for tipped employees: $2.13 per hour

- Maximum tip credit against minimum wage: $5.12 per hour

- Requirement to be classified as a tipped employee: Must receive more than $30 in tips monthly

Server Minimum Wage by State: Where Servers Earn More

Beyond federal guidelines, individual states have the authority to establish their own minimum wage laws.

Understanding these state-specific regulations is crucial, given that they may provide higher minimum wages or different frameworks for tip credits.

That said, here’s a table summarizing the minimum wages for tipped employees by category across U.S. states and Washington D.C.:

| Category | States |

| State requires employers to pay tipped employees full state minimum wage before tips | Alaska, California, Minnesota, Montana (varies based on business type), Nevada, Oregon (varies by region), Washington |

| State requires employers to pay tipped employees a minimum cash wage above the minimum cash wage required under the federal Fair Labor Standards Act ($2.13/hour) | Arizona, Arkansas, Colorado, Connecticut (varies by type of employee), Delaware, District of Columbia, Florida, Hawaii, Idaho, Illinois, Iowa, Maine, Maryland, Massachusetts, Michigan, Missouri, New Hampshire, New Jersey, New Mexico, New York (varies by region), North Dakota, Ohio (varies based on gross receipts), Oklahoma, Pennsylvania, Rhode Island, South Dakota, Vermont, Wisconsin, West Virginia |

| State minimum cash wage payment is the same as that required under the federal Fair Labor Standards Act ($2.13/hr.) | Alabama, Georgia, Indiana, Kansas, Kentucky, Louisiana, Mississippi, Nebraska, North Carolina, South Carolina, Tennessee, Texas, Utah, Virginia, Wyoming |

Restaurant Server Pay Laws: What Job Seekers Should Know

For those considering a position as a Restaurant Server, knowing the minimum wage for this role is critical in assessing earning potential.

When evaluating a Restaurant Server position, here are some important points to consider:

- Tips can often make up a substantial part of a Server's income, sometimes exceeding their hourly wage.

- Factors such as the restaurant's location, reputation and the level of service provided can all influence tipping behavior.

- Knowing state-specific wage laws can help job seekers gauge the competitive landscape.

Tipped Employee Wage Compliance: Key Tips for Employers

For employers in the restaurant industry, understanding the complexities of minimum wage laws for Restaurant Servers is an important responsibility.

It's not only about knowing the legal rules for pay; it's also about creating a fair and supportive workplace.

Staying updated on both federal and state wage regulations is crucial for ensuring compliance and preventing legal issues.

Offering fair compensation is equally important.

Employers should take into account the job's demands, role expectations and local market rates when setting pay.

Implementing clear and transparent tip policies can also make a significant difference by minimizing misunderstandings and conflicts among staff.

Know Your Rights: Restaurant Server Minimum Wage and Legal Protections

It is vital for Restaurant Servers to be aware of their legal rights regarding wages and tips.

Under the FLSA and state laws, tipped employees have specific protections.

Below are key points and resources that can help them navigate and enforce their rights:

Legal rights

Tipped employees are entitled to a minimum cash wage and must be compensated if their total earnings (base pay plus tips) fall below the federal minimum wage.

Additionally, employers cannot keep employees' tips unless it’s a communal tipping system clearly outlined to staff.

Resources for reporting wage theft

If a Restaurant Server suspects wage theft or has disputes regarding tip distribution, they can report issues through various avenues.

Here are some resources available for help:

- U.S. Department of Labor (DOL): The DOL has a Wage and Hour Division where employees can file complaints.

- State Labor Departments: Each state has its own labor department that can address concerns related to tips and minimum wage.

- Legal aid organizations: Many non-profit organizations offer legal assistance to workers facing wage disputes.

- Union support: If a Restaurant Server is part of a union, they should use the union's resources to address grievances regarding pay or tips.

See also: What Is the Minimum Age To Work as a Restaurant Server?

Final Thoughts on Restaurant Server Minimum Wage and Compliance

Understanding the minimum wage for Restaurant servers is crucial for both job seekers and employers in the hospitality industry.

While federal guidelines provide a foundation, state-specific regulations can create significant differences in what Restaurant Servers can earn.

Staying informed about these rules not only helps employees make better career choices but also supports employers in creating compliant and fair workplaces.

For those in the restaurant industry looking for a platform to connect and thrive, consider using OysterLink.

It’s designed to support both Restaurant Servers and employers in finding the right opportunities as well as provide them with the latest hospitality insights.

.png)

.png)

.png)