Commercial Kitchen Lease: Key Takeaways

- One bad lease decision can drain your finances and cripple your business before it ever finds its footing—don’t rush the process.

- Choose the right type of kitchen space—shared, dedicated, or build-to-suit—based on your current needs and long-term growth strategy.

- In competitive markets, landlords call the shots, so you need to be sharp, strategic and ready to negotiate hard to avoid one-sided terms.

- Base rent is only part of the story—unexpected CAM fees, utilities and insurance costs can quickly double your monthly expenses.

Choosing the right commercial kitchen isn’t just about size or rent—it’s about setting your business up to succeed or fail. With rents averaging $15–$45 per square foot and lease terms lasting 5–10 years, a bad deal can cost you hundreds of thousands.

The Commercial Kitchen Lease Landscape: What You're Really Getting Into

.png)

The commercial kitchen rental market has exploded in recent decades, driven by the rise of food trucks, ghost kitchens, and delivery-only concepts. These specialized spaces range from basic prep kitchens at $12-$20 per square foot to fully equipped culinary facilities commanding $30-$50 per square foot in prime markets.

Unlike traditional commercial real estate, kitchen spaces come with unique considerations that can make or break your operation. Health department requirements, grease trap maintenance, heavy equipment installation, and specialized ventilation systems all factor into lease negotiations.

Smart operators understand these complexities before they sign anything.

Understanding Your Kitchen Space Options

Finding the right kitchen space is one of the biggest decisions for any food business—and the options vary widely in cost, flexibility, and commitment.

Here's a breakdown to help you choose the setup that fits your needs and growth stage:

Shared commercial kitchens

These are the most affordable way to get started, typically costing $15–$25 per hour or $500–$1,500 per month for part-time use. Ideal for caterers, food truck operators, and startups testing new concepts. The trade-off? Limited access hours, shared equipment, and less control over the environment, which can make scaling a challenge.

Dedicated kitchen rentals

With exclusive access to a private, fully equipped kitchen (usually 500–2,000 sq. ft.), these spaces offer more control and consistency. Rents typically range from $2,000–$8,000 per month depending on location, equipment and included services.

This option is great for growing businesses that need regular, reliable access without the upfront cost of building out a kitchen.

Don’t miss: 5 Restaurant Location Strategy Mistakes & How to Avoid Them. Avoid costly missteps and find the perfect spot for your food business.

Build-to-suit kitchen leases

This is the top-tier option—your kitchen, built to your exact specs. These leases often come with generous tenant improvement allowances, but expect long-term commitments (10–15 years) and higher initial involvement. Perfect for well-established operations with specific infrastructure needs and long-term plans.

Market Dynamics Driving Lease Terms

Current market conditions heavily favor landlords in major metropolitan areas. Cities like New York, San Francisco and Los Angeles see commercial kitchen spaces leasing within days of listing, often at asking price or above. This pressure forces tenants into quick decisions that can haunt them for years.

Secondary markets offer better negotiating leverage but fewer amenities and support services. Rural and suburban locations might save 40-60% on rent but could limit your customer base and delivery radius. The key lies in matching your business model to market realities.

Economic uncertainty has created interesting opportunities for savvy negotiators. Some landlords are offering rent deferrals, percentage rent structures, or tenant improvement allowances to secure quality tenants. These concessions can dramatically improve your deal if you know how to ask for them.

.png)

Decoding Lease Structure: Base Rent Is Just the Beginning

Most commercial kitchen leases use either gross rent or triple net (NNN) structures, each with distinct advantages and pitfalls. Gross rent appears straightforward — one monthly payment covers everything. However, landlords typically build operating expenses into the base rate, often at inflated projections.

Triple net leases separate base rent from operating expenses, property taxes, and insurance costs. While base rents appear lower, these additional charges can add 30-40% to your total occupancy cost. Worse yet, you're responsible for expense increases throughout the lease term, creating budget uncertainty.

Hidden Costs That Destroy Budgets

Rent isn’t the only number that matters. Many restaurant tenants get blindsided by hidden costs that quietly eat away at profits. Here are a few key expenses to watch—and negotiate—before signing a lease:

Common Area Maintenance (CAM) Charges

CAM fees cover shared spaces like parking lots, lobbies, and loading docks. These charges typically range from $2–$8 per square foot each year—but they can jump without warning if the landlord makes big repairs or upgrades. Ask for detailed CAM statements from previous years, and try to negotiate a cap on how much these costs can increase annually.

Utilities

Running a commercial kitchen costs far more than a typical office setup. Equipment like walk-ins, hoods, fryers, and HVAC systems can drive monthly utility bills up to $800–$2,500 for mid-sized restaurants. Always factor these expenses into your lease budget and consider negotiating for energy-efficient equipment requirements to help keep costs in check.

Insurance Requirements

Landlords often require more coverage than a standard business policy. Expect to carry $1–$2 million in general liability, plus property insurance that covers any tenant improvements. Depending on your operation, this could add $3,000–$8,000 per year to your overhead. Know what’s required—and shop around early.

Percentage Rent: The Double-Edged Sword

Many kitchen leases include percentage rent clauses requiring additional payments once sales exceed predetermined thresholds. These arrangements typically kick in at $500,000-$1,000,000 in annual revenue, with landlords taking 5-8% of excess sales.

While percentage rent seems manageable for new operations, successful businesses can find themselves paying double or triple their base rent. Negotiate these thresholds carefully, considering your growth projections and seasonal variations.

Some operators successfully negotiate exclusions for catering sales or third-party delivery revenues.

Equipment and Improvement Clauses: Protecting Your Investment

Outfitting a commercial kitchen is one of the biggest expenses after rent—often $50,000 to $200,000 or more. That’s why it’s crucial to understand what the lease says about equipment ownership, removal rights, and who’s responsible for improvements.

These terms can have a huge impact on your bottom line.

Who Owns What: Equipment Ownership Clarity

Understanding who owns the equipment—and who’s responsible for it—is essential. Without clear terms, you could end up paying for repairs or losing valuable assets at the end of your lease.

Here's how ownership typically breaks down:

- Landlord-provided equipment: It’s convenient, but it comes with strings. You usually can’t upgrade, modify, or remove these items—and you're still on the hook for maintenance and repairs. Some leases even make you responsible for replacing this equipment, which can be a costly surprise.

- Tenant-installed equipment: Gives you full control, but it’s a big upfront investment. Protect yourself by negotiating clear rights to remove your equipment and by making sure any improvements you pay for don’t automatically become the landlord’s property when the lease ends. Watch for clauses that try to claim your improvements—push back hard.

- Hybrid setups: Many leases involve a mix. For example, the landlord might supply essentials like sinks and ventilation, while you bring in ovens, fryers, or specialty gear. These arrangements require a detailed schedule that spells out exactly who owns what—and who maintains it.

Tenant Improvement Allowances: Free Money or Golden Handcuffs?

Landlords often offer tenant improvement (TI) allowances—typically $10 to $50 per square foot—to help cover buildout costs. While that can ease the upfront financial burden, it’s important to read the fine print.

TI allowances usually come with strings attached: longer lease terms, stricter usage rules, and limited control over how the money is spent. Some landlords insist on using their own contractors, which can inflate costs and eat away at the allowance’s real value.

Be sure to negotiate:

- The right to choose your own contractors

- Transparent bidding processes

- Full visibility into project costs and invoices

That way, you keep more control and get the most value out of the allowance.

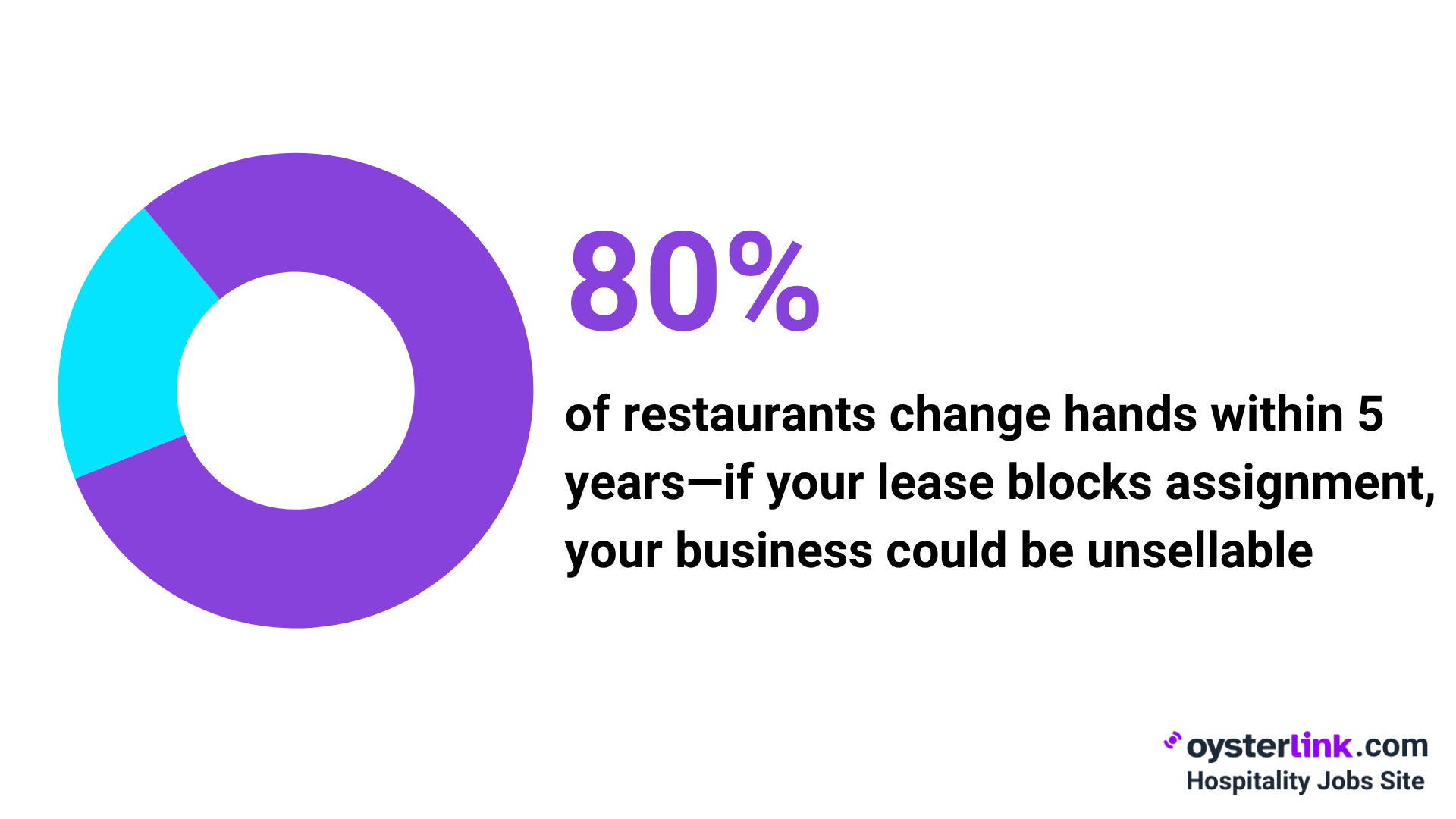

Assignment and Subletting: Your Exit Strategy Matters

In the restaurant world, ownership changes are pretty common—so having clear rights to assign or sublet your lease is really important. If the lease is too restrictive, you could end up stuck in a location that’s not working or miss out on a great opportunity to sell the business.

Make sure those provisions give you the flexibility you might need down the road.

Assignment Rights: Selling Your Business

When it’s time to sell, your ability to transfer the lease can make or break the deal. Here are key lease terms to review and negotiate in advance to keep your exit options open:

- Landlord consent: Most leases require landlord approval to assign or sublet, but the wording matters. Look for a clause that says consent “won’t be unreasonably withheld”—this gives you protection. Avoid language that allows the landlord to deny transfers at their “sole discretion,” which can block even qualified buyers. Push for clear, fair approval standards.

- Financial qualifications: Landlords typically want the new tenant to meet the same financial benchmarks as the original lease. But some will try to impose stricter requirements—like specific industry experience or higher net worth thresholds. Negotiate these upfront so they don’t become deal-breakers later.

- Assignment fees: Expect to pay a fee for assigning your lease—anywhere from $500 to $5,000, plus legal costs. While reasonable fees are standard, excessive charges can scare off buyers and hurt your ability to sell. Make sure the fees are clearly defined and fair.

Subletting: Maximizing Space Utilization

If you’re not using your kitchen around the clock, subletting can be a great way to bring in extra income. Renting out unused time or space to other food businesses could earn you an extra $1,000–$5,000 a month—while helping cover your operating costs.

Just keep in mind, some leases have restrictions. They might limit subletting to certain types of businesses or require landlord approval for each subtenant. That’s why it’s important to negotiate flexible terms that work with your business model from the start.

Personal Guarantees: Limiting Your Risk Exposure

Many commercial kitchen leases require a personal guarantee from the business owner, which means your own assets could be on the line if the business can’t meet its lease obligations.

Over the life of the lease, that guarantee could amount to hundreds of thousands—or even millions—of dollars, so it’s important to understand exactly what you're committing to before you sign.

Negotiating Guarantee Limitations

When it comes to personal guarantees on a lease, there are ways to limit your exposure—if you know what to ask for:

- Dollar caps: These set a maximum amount you're personally responsible for, usually equal to 6–12 months of rent plus some related costs. Landlords may push back, but if your business has solid financials, you’ve got room to negotiate.

- Time limits: A guarantee that expires after 2–3 years of on-time payments and solid performance is a fair ask. It gives landlords peace of mind early on, and rewards tenants who prove themselves.

- Performance triggers: Some agreements allow the guarantee to be reduced or removed once you hit certain milestones—like reaching revenue targets or staying in full compliance for a set period. It’s a smart way to align interests and build trust.

Corporate Guarantees: Alternative Approaches

If you’re looking to avoid putting your personal assets on the line, there are a couple of solid alternatives worth considering—especially for more established businesses.

- Parent company guarantees: If your business has a strong parent company, it can step in to guarantee the lease instead of you personally. This keeps the risk at the corporate level, giving landlords the security they need without tying up your personal finances.

- Letters of credit: Another option is using a letter of credit from a bank. It’s a financial instrument backed by cash you set aside, which the landlord can access if needed. While it requires upfront collateral, it removes personal liability and can be a cleaner, more professional solution.

Conclusion: Lease Smart, Build Strong

Securing the right commercial kitchen lease isn’t just a real estate decision—it’s a long-term business strategy. One bad clause, one missed cost, or one inflexible term can derail even the most promising concept.

Whether you're a first-time food entrepreneur or a seasoned operator expanding into a new market, negotiating your lease with eyes wide open is non-negotiable. The good news? You don’t have to figure it all out alone.

OysterLink is more than a job platform—we’re your career ally in the restaurant and hospitality world. From connecting top talent with trusted employers to offering expert-driven career advice, industry insights and interview guides, we’re here to help you thrive at every stage.

Explore our Career Advice section for more insider guides like this one—covering everything from launching your first venue to managing team dynamics, labor laws and leadership skills.

.webp)

.png)

.png)

.png)