IT-2104 Form Key Takeaways:

- Use the latest 2025 IT-2104 form from the NY Department of Taxation and Finance website, and update it annually or whenever your personal situation changes.

- Complete each section accurately, particularly your residency status, withholding allowances, filing status, and health insurance eligibility, to ensure correct tax withholding.

- Submit the completed form to your employer, who retains it for payroll purposes—employers must file it with New York State only under specific circumstances (e.g., claiming more than 14 allowances or reporting new hires).

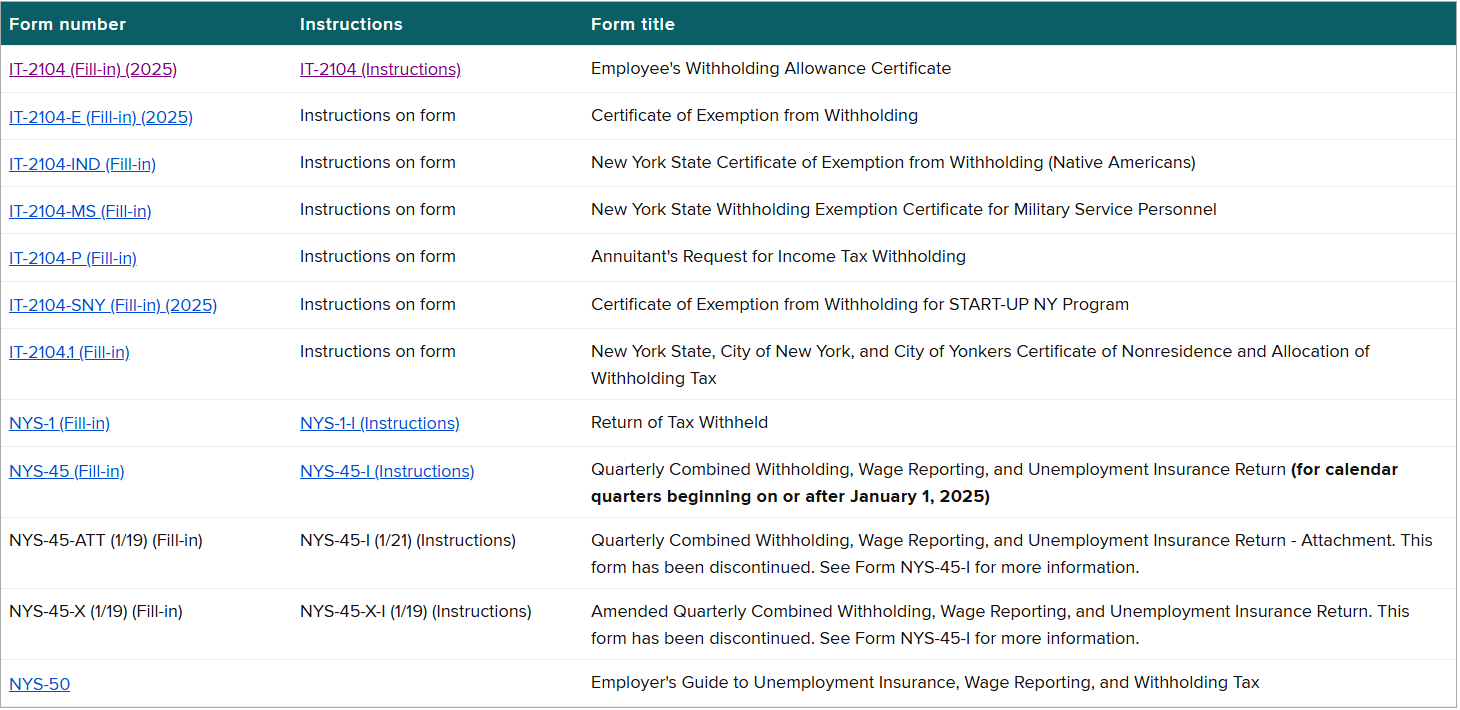

2025 IT-2104 Form: Where to Get It

Here's how to find and download the correct version of the 2025 New York State IT-2104 form for accurate withholding of state and local taxes from your paycheck.

- Official source: The 2025 Form IT-2104 and its instructions are available on the NY State Department of Taxation and Finance website. See the “Withholding tax forms 2024–2025” page, which lists IT-2104 (Fill-in) (2025).

- Downloading: Click the “IT-2104 (Fill-in) (2025)” link on the NYS tax forms page to download the fillable PDF form. You can either print the PDF and fill it out by hand or fill it electronically and then print or submit it as your employer allows.

- Other options: Employers may also provide a printed copy or an online payroll portal version. Always use the 2025 revision of IT-2104; do not use an older (pre-2025) version.

Read More: Do Tipped Workers Get Social Secutity?

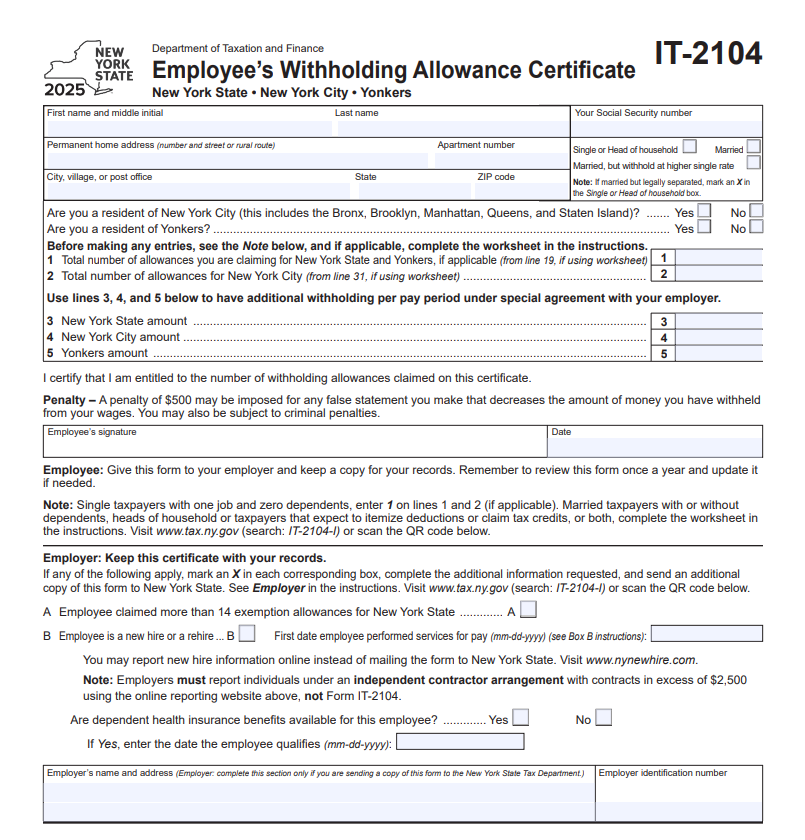

Filling Out IT-2014: Step-by-Step

Follow these steps in order. Refer to the instructions for detailed IT-2104 worksheets and examples if needed.

- Fill in your personal info. Enter your first name, middle initial, last name, Social Security number, and permanent home address on the top lines.

- Check residency boxes. Mark Yes or No for New York City and for Yonkers residency on the form. For example, check “Yes” if you live in any NYC borough, otherwise check “No.” Do the same for Yonkers.

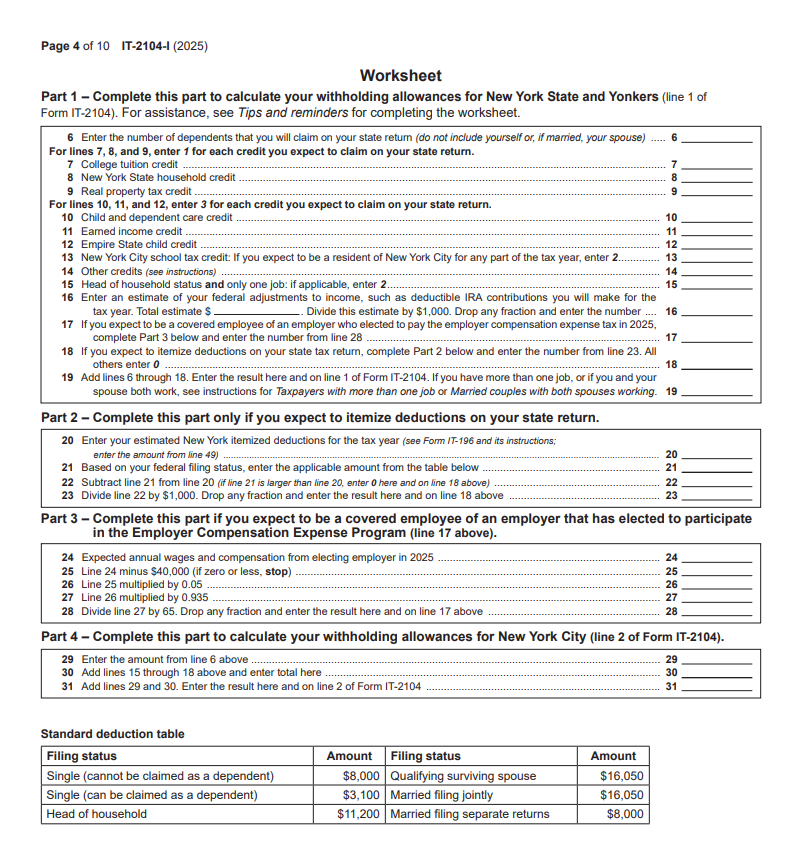

- Compute your allowances (Lines 1–2). Use the worksheet in the instructions to calculate the total number of allowances you will claim. Enter the result for Line 1 (NYS and Yonkers allowances) and Line 2 (NYC allowances). If you have a straightforward situation (single, one job, no dependents), you may simply enter 1 on each line as noted on the form. Otherwise, follow Parts 1 and 4 of the worksheet (or the instructions tables) to figure the correct numbers.

- Enter any additional withholding (Lines 3–5). If you want extra tax withheld each pay period (and have an agreement with your employer), enter the agreed-upon amounts on Line 3 (NY state), Line 4 (NYC), and Line 5 (Yonkers). Leave blank if not applicable.

- Select your filing status. Check one box: “Single or Head of household,” “Married,” or “Married, but withhold at higher single rate”. (If you are married but separated, check “Single or Head of household.”)

- Review the penalties notice. The form reminds you that a false statement that reduces withholding can incur a $500 penalty. Be sure your entries (especially number of allowances) are accurate.

- Employer section (if needed). If you or your employer will send this form to NYS (see “Employer” instructions below), fill in the employer’s name, address, and EIN in the “Employer’s name and address” box. Otherwise you can leave that blank.

- Check Box A if >14 allowances. If you are claiming more than 14 allowances on Line 1 (state/Yonkers) or Line 2 (NYC), you must check Box A on the bottom of the form. (This is rare.) Check “A” and you will also need to send a copy to the NY Tax Department (see Employer instructions).

- Check Box B if new hire. If this is your first day of work (new hire or rehire), enter the first date of employment in Box B and check the “B” box. (This satisfies NY’s new-hire reporting.)

- Answer health insurance question. Check Yes or No for “Are dependent health insurance benefits available…?” If Yes, enter the date you become eligible for dependent coverage.

- Sign and date the form. In the signature area, sign your name and write today’s date. This certifies the allowances you claimed are correct.

Read More: Do Part-Time Workers Qualify for Social Security?

Submitting the IT-2104 Form (For Employees)

- When to submit: Give the completed IT-2104 to your employer when you start a new job. You should also submit a new IT-2104 each year or whenever your tax situation changes (marriage, new child, large income change, etc.).

- How to submit: Typically you hand in the form (paper or scanned PDF) to your employer’s payroll or HR department. Do not file this form with the State yourself (except in the special cases below). Instead, keep a copy for your records and let the employer adjust your withholding based on it.

- Review annually: It’s good practice to review your withholding each year (for example, at tax time) and submit an updated IT-2104 if your allowances should change.

IT-2104 Employer Responsibilities (Processing & Retention)

- Recordkeeping: Treat each employee’s IT-2104 like a payroll record. “Employer: Keep this certificate with your records”. New York law generally requires keeping tax-related records (including withholding certificates) for at least 3 years.

- Applying the form: Employers use the information (residency, marital status, allowances, extra withholding) to determine the amount of NY State, NYC, and Yonkers tax to withhold from the employee’s pay. If the employee checked “Single or Head of household” but is married (or vice versa), make sure the correct box is marked according to the instructions.

- Box A (over 14 allowances): If the employee checked Box A, the employer must send another copy of Form IT-2104 to the New York State Tax Department (Income Tax Audit) because more than 14 allowances were claimed. (Follow the mail instructions in the form’s instructions.)

- Box B (new hire): For a new hire (Box B), the employer must report the employee to NY’s New Hire program within 20 days of hiring. You may either mail the form to NYS Tax Department – New Hire Notification (PO Box 15119, Albany NY 12212-5119) or submit the information online via NY’s New Hire Reporting Center. Employers of independent contractors (contracts > $2,500) must also report via the New Hire Center.

- Dependent health insurance: If Box B is checked, ensure the Yes/No and date for dependent health insurance are provided, as this is required for new-hire reporting.

- No state filing otherwise: In normal cases (Box A and B not checked), do not send the form to the State; simply keep it with payroll records. NY Tax Dept. does not require annual submission of IT-2104 unless the special boxes apply.

IT-2104 Tips, Caveats, and 2025 Changes

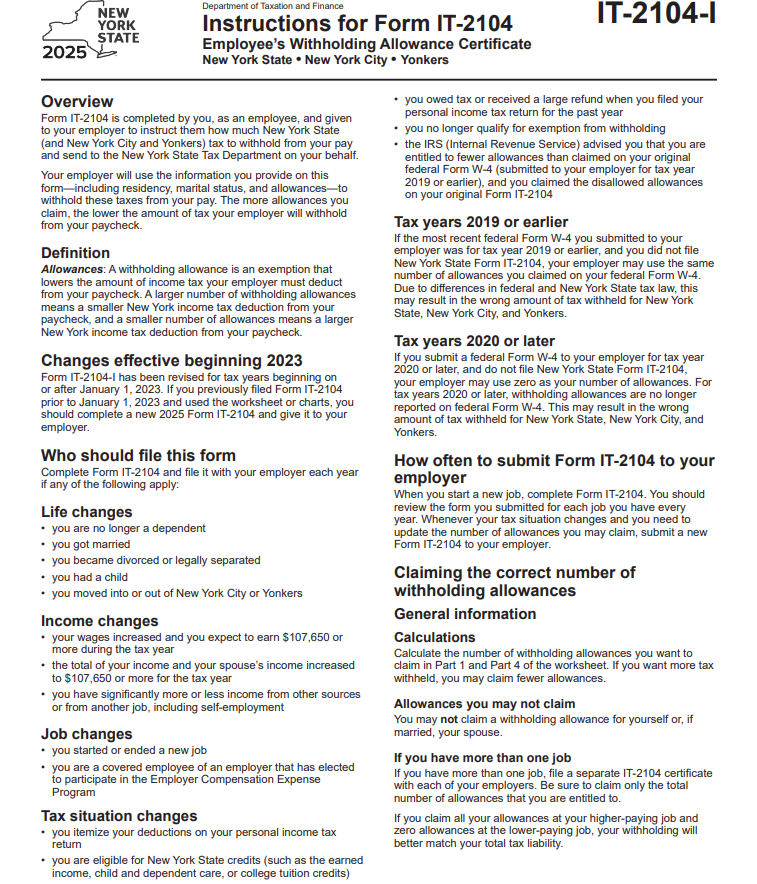

- Use current-year form: The IT-2104 form and worksheet were revised effective Jan 1, 2023. Even if you used an older IT-2104, you should complete the new 2025 form and worksheet.

- One job = one form: If an employee has multiple jobs, file a separate IT-2104 for each employer. Be careful to allocate your total allowances across jobs to avoid under- or over-withholding. (A common strategy is to claim most allowances at the higher-paying job and fewer or zero at the lower-paying job.)

- Annual review: Life or financial changes (marriage, divorce, new child, moving in/out of NYC, significant income change, itemizing deductions, claiming credits, etc.) should prompt you to update your IT-2104. For example, expect to file a new form if you got married or had a child.

- Default allowances: If none of the special circumstances apply, note the built-in shortcut: Single w/one job, no dependents = 1 allowance on lines 1 and 2. Otherwise, use the worksheet.

- Accuracy matters: The form explicitly warns that a false statement to reduce withholding can incur a $500 penalty. Always report allowances truthfully.

- Seek help if needed: The IT-2104 instructions (IT-2104-I) contain worksheets, tables, and examples for calculating allowances and extra withholding. You can find them on the NY tax website or by searching “IT-2104-I”. Employers or payroll providers may also guide you.

Loading comments...