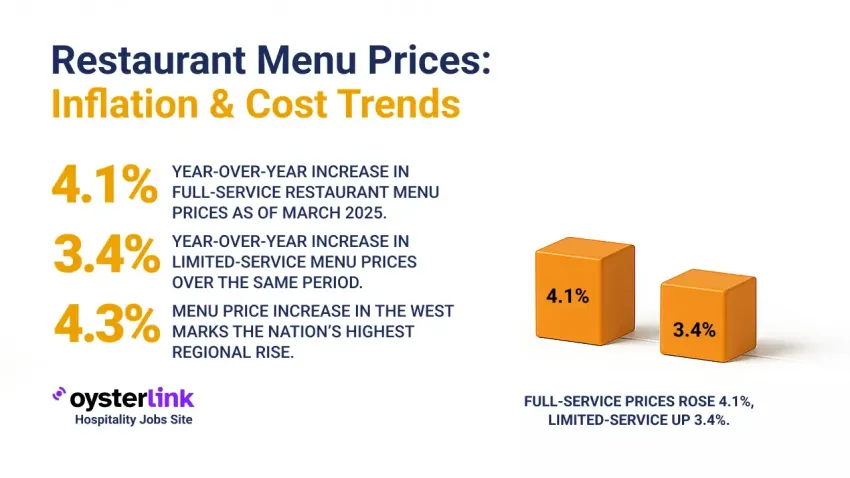

Restaurant Menu Prices Inflation: Key Facts

- Menu prices at full-service restaurants rose by 4.1% year-over-year as of March 2025.

- Limited-service restaurants, where customers order and pay before eating, saw a 3.4% increase over the same period.

- Menu prices rose most in the West (4.3%), followed by the Northeast (3.8%), Midwest (3.6%) and South (3.5%).

Restaurant Managers and owners are raising restaurant menu prices more frequently in response to rising food, labor and operating costs.

This article breaks down what’s driving these price hikes — from wholesale food costs and regional price differences to guest behavior and profit pressure.

How US Inflation Impacts Restaurant Menu Prices

As of June 2025, the U.S. inflation rate rose by 2.7% year-over-year. For restaurant operators, even modest increases in food, labor and utilities add pressure to already thin margins.

The chart below shows monthly changes in overall consumer prices from December 2024 to June 2025 — a reminder that inflation remains a persistent cost factor.

As the cost of ingredients, labor and utilities continues to rise, many restaurants have responded by increasing their menu prices to protect profitability.

Tracking Restaurant Menu Price Increases by Region and Format

As a result of these rising costs, menu prices have climbed across all types of restaurants.

Full-service restaurants saw a 4.1% increase year-over-year, while limited-service venues posted a 3.4% rise over the same period.

These price hikes are happening nationwide, with the West seeing the highest increases (4.3%), followed by the Northeast (3.8%), Midwest (3.6%) and South (3.5%).

In 2024, 93% of quick-service restaurants raised prices to keep up with rising costs.

Operators are adjusting more frequently, some updating their menus every few months, others even more often.

Over the past year, they've faced steady increases in wholesale food cost (up 6.6%), along with labor, rent, utilities and delivery fees.

One analysis suggests that restaurants would need to raise prices by 26.2% just to maintain a 5% pre-tax profit margin. These pricing shifts aren’t arbitrary — they reflect mounting pressure from nearly every area of operations.

What’s Driving Up Restaurant Menu Prices

Menu prices are rising because nearly every cost tied to running a restaurant is going up.

Wholesale food prices are a major factor, with ingredients like beef, poultry, grains and produce climbing steadily. According to the USDA, global demand and weather-related disruptions — such as droughts or floods — have made many staples more expensive.

Supply chain issues add more pressure. Shipping delays, product shortages and higher transport costs often force operators to make last-minute, pricier substitutions.

Labor costs are up, too. Restaurants are paying more to attract and keep workers, especially in competitive markets or states requiring full minimum wage for tipped employees. Wages have increased across all roles, from Dishwashers to Front-of-House Managers.

Non-labor operating costs have also spiked. Rising rent, utilities and insurance strain margins, while delivery platform fees and equipment maintenance costs cut deeper into profits — particularly for independents.

But restaurants aren’t the only ones feeling the strain — guests are adjusting too.

How Diners Are Reacting to Higher Restaurant Menu Prices.

A recent survey showed that 59% of Americans are dining out less frequently. Whether it’s choosing takeout instead of a sit-down meal, skipping the cocktail or splitting a main, guests are watching their spending more closely.

And as behavior shifts, the dynamic between guests and restaurants evolves too. Regulars who used to drop by twice a week might now be coming once every two weeks.

Parents who used to bring the whole family might now opt for pizza at home. When this happens, restaurants have to work even harder to maintain steady traffic and predictable sales.

As guest habits shift, restaurants are rethinking how they operate to stay competitive.

Strategies to Manage Restaurant Menu Price Inflation

You can’t control inflation, but you can control how your restaurant responds. These strategies can help you maintain guest trust and business stability:

- Spotlight seasonal or lower-cost ingredients: Keep dishes interesting without sacrificing profit margins. Local and in-season produce is often cheaper and supports flexibility in your offerings.

- Bundle meals to show value: Pairing a main with a side or dessert can increase the average check while offering perceived value to guests.

- Be upfront about price changes: A simple note on your menu or a quick chat at the table builds transparency and reduces pushback.

- Offer creative off-peak promotions: Specials during slow hours or days can drive traffic without hurting your brand.

- Test changes with your staff and regulars: Before committing to major menu shifts, gather internal and guest feedback. It’ll make rollouts smoother and more effective.

- Use menu engineering to your advantage: Highlight high-margin dishes, cut underperforming items, and tweak layouts to draw attention to profitable choices.

- Adjust portion sizes strategically: Slight reductions can control food costs while maintaining quality — especially if paired with strong presentation or plating.

- Coordinate with nearby restaurants for bulk ordering: Sharing vendors or delivery schedules can help reduce fees and improve purchasing power.

- Leverage tech to ease labor pressure: Digital menus, table-side ordering and automation tools can speed up service, reduce errors and help your staff do more with less.

Restaurant Menu Prices: Conclusion

Rising restaurant menu prices aren’t just a result of inflation — they reflect broader cost pressures across food, labor, operations and guest expectations.

With ingredients getting more expensive and labor demands growing, many restaurants are adjusting pricing more frequently just to stay afloat. As diners pull back and costs climb, smart pricing strategies and operational efficiency are more important than ever.

Loading comments...