Hospitality Real Estate: Key Takeaways

- The global hospitality real estate market is projected to grow by $148.3 billion between 2024 and 2029, at a 15.1% CAGR.

- Cross-border hotel investment rose 54% year-over-year in 2024, increasing total hotel transaction volumes by 16%.

- Global RevPAR grew 3.9% in early 2025, led by strong performance from urban hotels and airport properties.

This article explores the global hospitality real estate market, covering current investment trends, hotel performance metrics, property types, regional patterns and the key challenges and opportunities shaping the sector.

Understanding Hospitality Real Estate Market

The hospitality real estate market refers to the ownership, investment and development of physical properties that serve travelers and guests.

This includes a wide range of assets such as hotels, resorts, casinos, serviced apartments, vacation rentals and mixed-use developments that combine lodging with retail, dining or office space.

It's a major part of the broader hospitality industry, which also includes sectors like food service, entertainment and transportation. Within this broader industry, the real estate segment is growing at an even faster pace.

According to Technavio, hospitality real estate alone is set to grow by $148.3 billion between 2024 and 2029, reflecting a 15.1% CAGR.

Currently, urban hotels are leading this growth due to their appeal to both business and leisure travelers. Airport hotels are also seeing increased demand, thanks to the resurgence of international travel.

Meanwhile, resort properties — which were in high demand during the pandemic — are seeing more moderate performance as travel patterns normalize.

In early 2025, revenue per available room — a key hotel performance metric — increased by 3.7% globally. This signals stronger profit potential for operators and rising investor confidence across the sector.

Looking ahead, revenue growth is expected to come mainly from increased room rates rather than higher occupancy.

Property Types

To better understand where investments are flowing within hospitality real estate, it helps to break down the main types of assets that make up the sector. Each property type attracts different types of travelers and investors, based on demand, location and operational model.

Hotels and Resorts

These remain the foundation of the market. From budget to luxury hotels, they offer short-term lodging, dining, meeting spaces, and entertainment.

Vacation Rentals and Serviced Apartments

Options like Airbnb or extended-stay hotels are rising. They appeal to remote workers, families and budget travelers seeking longer stays.

Mixed-Use and Boutique Developments

These include hotels that are part of larger buildings with shops, offices or homes. Boutique hotels often provide themed or highly personalized experiences.

Casinos

The market includes both physical (land-based) casinos and online platforms. Land-based casinos often exist within large resort complexes. Online casinos require less physical infrastructure but involve significant digital investment.

See also: US Hotel Industry Statistics for 2025

Regional Trends in Hospitality Real Estate Market

In some parts of the world, hotel development and investment are bouncing back quickly due to renewed travel and a surge in international tourism. In other areas, economic uncertainty, government regulations or high borrowing costs are slowing recovery.

One important concept in these trends is cross-border hotel investment, which means money coming from foreign investors to develop or buy hotel properties in another country.

An increase in cross-border activity often signals that international investors see growth potential in a region. Currency fluctuations, domestic tourism policies and changes in traveler behavior also affect how regional markets perform.

In the following sections, we break down what’s happening in key parts of the world and why it matters.

Asia-Pacific (APAC)

APAC continues to be one of the fastest-growing regions for hospitality real estate. In 2024, hotel investment in the region rose by 9%, driven largely by cross-border activity.

Japan alone accounted for nearly half of all foreign hotel investment in the region, benefiting from its strong tourism rebound and investor-friendly environment.

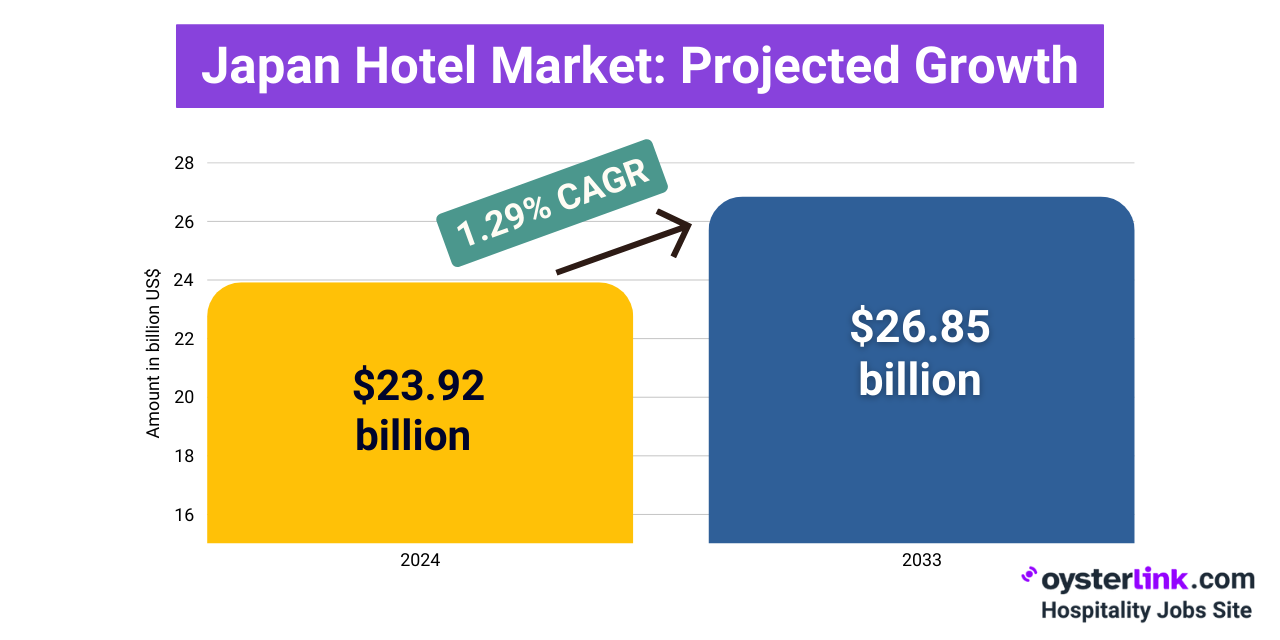

The country’s hotel market is projected to grow to $26.85 billion by 2033, up from $23.92 billion in 2024, according to recent forecasts.

This growth is being driven by a resurgence in inbound tourism, ongoing infrastructure upgrades, and the popularity of culturally themed accommodations and capsule hotels.

These offerings continue to attract a wide range of international travelers, especially as Japan blends traditional hospitality with innovative lodging concepts.

This surge in foreign interest reflects broader investor enthusiasm across the region.

For example, a notable project outside Japan includes a $1.5 billion investment in Vietnam from the Trump Organization and Kinhbac City, covering hotels, resorts, and mixed-use developments., which covers hotels, resorts and mixed-use developments.

Urban hubs and resort destinations across Southeast Asia are also attracting attention due to improving infrastructure and rising middle-class travel.

Europe, Middle East and Africa (EMEA)

The EMEA region experienced significant investment momentum in 2024, with total hotel investment volumes increasing by 65% and cross-border transactions surging by 112%.

The U.K. remains the top market, but Italy, Portugal, and Greece are emerging as attractive alternatives due to strong tourism demand and comparatively lower asset prices.

Institutional investors, like Blackstone, have taken advantage of these conditions, with over €500 million invested in Southern Europe alone — including a €235 million acquisition of the Grand Hyatt Athens.

Investor interest is particularly high in markets offering renovation or repositioning opportunities.

Americas

The Americas, particularly the U.S., remain strategically important despite facing economic headwinds.

In 2024, cross-border hotel investment into the U.S. fell by 17.1%, a drop attributed to elevated interest rates and a strong U.S. dollar, which made acquisitions more expensive for foreign investors.

Despite this decline in foreign investment, local and U.S.-based investors remain optimistic — 94% of investors surveyed by CBRE in 2025 said they plan to keep or increase their investments in U.S. hotels.

Interest is particularly strong in urban markets with limited new supply, as well as in upscale and extended-stay segments that align with shifting traveler needs.

Key Trends in Hospitality Real Estate Market

Several global shifts are influencing how hospitality real estate is developed, operated, and valued. These trends are shaping what types of properties investors are targeting and how hotels are adapting to changing guest expectations.

Experiential and Wellness-Oriented Properties

There is a notable shift toward upscale and upper midscale hotel products that offer value-add opportunities.

Investors are targeting properties designed to deliver immersive guest experiences, wellness features (like spas or yoga spaces) and high-end culinary offerings.

These features help differentiate properties in competitive markets and appeal to a broader, experience-driven clientele.

Technology

From mobile check-in to smart thermostats, technology is reshaping how hotels operate and how guests experience their stay. Near-field communication (NFC), Internet of Things (IoT), artificial intelligence (AI) and data analytics are helping personalize services and cut costs.

Lifestyle and Wellness

Hotels are offering more than just a place to sleep. Wellness centers, spas, fitness programs, and healthy dining options are now standard in many upscale properties.

Guests also seek out experiences, like food tours or local adventures, which makes lifestyle and boutique hotels more appealing.

Sustainability

Investors are increasingly drawn to hotels that meet environmental, social and governance (ESG) standards.

This includes using energy-efficient systems, reducing waste and earning green building certifications. ESG compliance now plays a major role in property value and investor decisions.

See also: Sustainability in Hospitality: Challenges, Solutions and Business Benefits

Flexible Business Models

Brands are shifting to franchise or third-party management models. This allows rapid expansion without direct operating responsibilities.

Nearly half of branded hotels globally are managed by third parties, highlighting a growing trend in franchise and third-party management models within the hospitality industry.

Risks and Challenges in the Hospitality Real Estate Market

While the outlook is strong, several challenges are shaping how — and where — investors approach hospitality real estate:

- Higher costs: Labor, construction materials and borrowing costs are rising globally. This reduces profit margins and makes new developments harder to finance.

- Regulatory hurdles: Zoning laws, licensing regulations and local ordinances — especially those targeting short-term rentals like Airbnb — differ widely between markets. Navigating these complexities can delay projects or limit expansion.

- Economic uncertainty: Inflation, interest rate volatility, currency fluctuations and geopolitical instability (such as conflicts or trade disruptions) can reduce travel demand and delay investor decisions.

- Market saturation: In some popular cities, new hotel openings have outpaced guest demand. This oversupply puts downward pressure on room rates and occupancy, making it harder for existing properties to stay profitable.

- Tech disruption: Booking platforms like Airbnb and Booking.com have reshaped how travelers select and reserve lodging. This shift forces traditional hotel operators to compete not just on location and amenities, but also on digital convenience and pricing visibility.

To see how these risks are influencing investor sentiment and development trends, watch the video below:

Leading Companies in the Hospitality Real Estate Market

Several companies stand out as leaders in the hospitality real estate market for their scale, influence on investment trends, technological innovation and ability to adapt to evolving guest expectations.

These companies represent different facets of the industry, from hotel ownership and operations to data-driven optimization and investment strategy.

Global Hospitality Brands

- Hilton Worldwide

- Marriott International

- Wyndham Hotels & Resorts

- InterContinental Hotels Group (IHG)

- Choice Hotels

These hotel groups manage thousands of properties worldwide, including many under franchising or third-party management agreements.

Their strong brand portfolios, loyalty programs and innovation in guest experience make them top choices for investors seeking stable returns and international recognition.

See also: Top Hotel Brands in 2025 & What Sets Them Apart

Top Investors and REITs

- Apple Hospitality REIT

- Host Hotels & Resorts

- Pebblebrook Hotel Trust

These (REITs) play a critical role in the hospitality real estate market by acquiring, owning, and managing large portfolios of hotel properties.

They focus on high-traffic urban centers and leisure destinations, providing consistent returns to shareholders through income from room bookings and long-term asset appreciation. Their decisions influence development pipelines, brand partnerships and market-level investment confidence.

Tech and Data Innovators

- IDeaS Revenue Solutions

- HotelPort

- OTA Insight

These companies are not traditional hotel owners but play a key role in shaping how hospitality properties are run.

Their platforms use artificial intelligence, predictive analytics and system integrations to help hotels optimize pricing, streamline operations and enhance the guest experience. Their tools are increasingly seen as essential for competitive performance in the digital-first travel economy.

Hospitality Real Estate Market: Conclusion

The outlook for hospitality real estate remains strong, but the path forward will require adaptability and forward-thinking strategies.

As demand grows for luxury, wellness-focused and experience-driven properties, investors are prioritizing asset classes that deliver long-term value and guest satisfaction.

We can expect continued growth in:

- <

Loading comments...