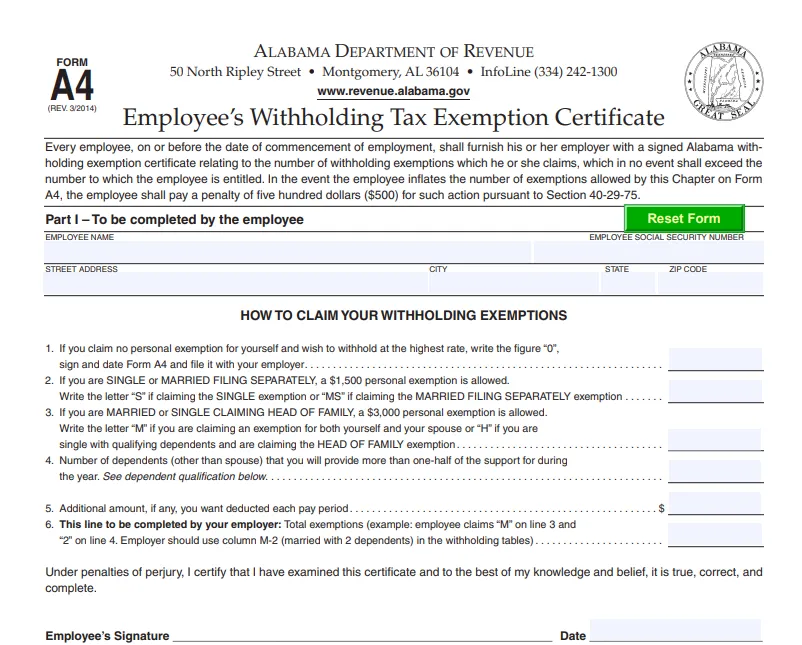

Form A-4 Alabama: Key Takeaways

- Purpose – Alabama employees use Form A-4 to set state income tax withholding based on exemptions and dependents.

- Accuracy Matters – Claim the correct status, dependents, and extra withholding to avoid underpayment or penalties.

- Updates Required – File a new form within 10 days of changes that reduce your exemptions or alter filing status.

Key Parts of Alabama Form A-4

1. Employee Information

You start by filling in basic personal details: full name, Social Security number, home address, city, state, and ZIP code.

2. Claiming Exemptions (Lines 1–3)

You must choose one of the following:

- Line 1: Write “0” if you claim no personal exemption and want the highest withholding.

- Line 2: Enter “S” if single, or “MS” if married filing separately—this allows a $1,500 exemption.

- Line 3: Use “M” if married (both you and your spouse), or “H” if single claiming head of family—this allows a $3,000 exemption.

3. Dependents (Line 4)

If you selected “H” (head of family) or “M,” and expect to support dependents, enter the number of dependents you support more than half of the year.

4. Optional Additional Withholding (Line 5)

If you anticipate owing more tax (perhaps from other income streams), you can request an additional amount to be withheld from each paycheck.

5. Employer’s Calculation (Line 6)

This field is filled out by the employer, combining your exemption code (like “M”) with the number of dependents (e.g., M‑2) to determine withholding using state tables.

6. Signature

You must sign and date the form, certifying its accuracy. Without this, employers cannot process payroll correctly.

Form A-4 Alabama Special Exemptions & Changes

Military Spouse Exemption

If you’re married to an active-duty service member whose home of record is not Alabama, you may claim exemption from withholding under MSRRA. You’ll need to check the relevant box and attach Form DD‑2058 to your A‑4.

Exempt Status Based on Zero Liability

If you had zero Alabama income tax liability last year—and received a full refund of any withholding—you can claim exempt. Simply check the box, sign, date, and you don’t need to fill in lines 1–5.

When to Update Your Form A-4

- Increase in exemptions: Submit a new Form A‑4 anytime that your exemptions increase (e.g., a new dependent).

- Decrease in exemptions (divorce, someone else claiming your dependent): File a revised form within 10 days of the change.

- Other decreases (death of spouse or dependent): You must submit a new form by December 1 of the same year.

Legal Considerations & Penalties

If you knowingly claim more exemptions than you’re entitled to, the state may impose a $500 penalty. Employers must monitor excessive claims (eight or more dependents, for instance) and may need to withhold at the highest rate if filings appear suspect.

Alabama A-4 Form Summary

| Section | What to Do |

|---|---|

| Employee Info | Provide full personal details |

| Exemption Selection | Choose only one: “0,” “S/MS,” or “M/H” |

| Dependents | List number if applicable (especially for “H” or “M”) |

| Extra Withholding | Optional: specify an additional dollar amount |

| Employer Section | Employer combines your code/dependents for withholding |

| Signature | Required for validity |

| Special Cases | Military spouse or full-exempt status available |

| Updates & Penalties | Update within 10 days for decreases; penalties for fraud |

Final Thoughts

Form A-4 may seem straightforward, but its impact on your paycheck and compliance with Alabama law is significant. Whether you're claiming exemption, head of family, or adjusting for dependents, it's essential to fill it out accurately, sign it, and know when to revise it.

Loading comments...