New Hampshire Cost of Living: Quick Takeaways

- Housing Costs: The average rent for a one-bedroom apartment in New Hampshire remained steady at $1,423 in 2025.

- Transportation Expenses: Transportation costs are notably lower than national averages, with gas prices at $3.50 per gallon and monthly public transit passes around $70.

- Income Levels: Median household income in 2025 is approximately $95,628, reflecting steady growth over the past decade.

- Overall Cost of Living: New Hampshire's overall cost of living is about 13.5% higher than the national average, driven primarily by housing expenses.

New Hampshire offers a diverse living environment with varying costs across housing, utilities, and transportation sectors.

This article provides a comprehensive breakdown of the cost of living in New Hampshire as of 2025, covering expenses from housing to education and beyond.

1. Housing Costs in New Hampshire

Housing expenses form a major part of the cost of living. Below is a historical look at the average rent for a one-bedroom apartment in New Hampshire:

- 2010: Approximately $900

- 2015: Around $1,050

- 2020: Approximately $1,200

- 2024: Reached $1,423

- 2025: Remained steady at $1,423

This trend reflects a steady increase in rental prices over the past 15 years, stabilizing in recent times.

For business owners interested in real estate trends and market strategies, our hospitality real estate market trends spotlight offers valuable insights.

2. Homeownership and Real Estate Trends in New Hampshire

For potential homebuyers, New Hampshire's real estate market has experienced significant growth:

- 2010: Median home price was approximately $200,000

- 2015: Increased to around $250,000

- 2020: Approximately $350,000

- 2024: Median price peaked at $540,000

- 2025: Estimated median price is $504,017

Despite a slight decrease predicted in 2025, real estate prices remain elevated, influencing affordability and market dynamics.

3. Transportation Expenses in New Hampshire

Transportation plays an essential role in daily living costs:

- Public Transit One-Way Fare: Approximately $2.00

- Monthly Public Transit Pass: $70.00

- Fuel Costs: Average price per gallon is $3.50

- Vehicle Maintenance: Estimated annual cost is $1,200

Transportation expenses in New Hampshire are relatively affordable compared to other states, particularly in terms of public transit and vehicle maintenance.

4. Utility Costs in New Hampshire

Monthly utility costs for a typical household typically include:

- Electricity: $125.00

- Internet Services: $140.00

- Total Utilities: $386.00 monthly

Utility expenses, including electricity and internet, contribute significantly to the household budget in New Hampshire.

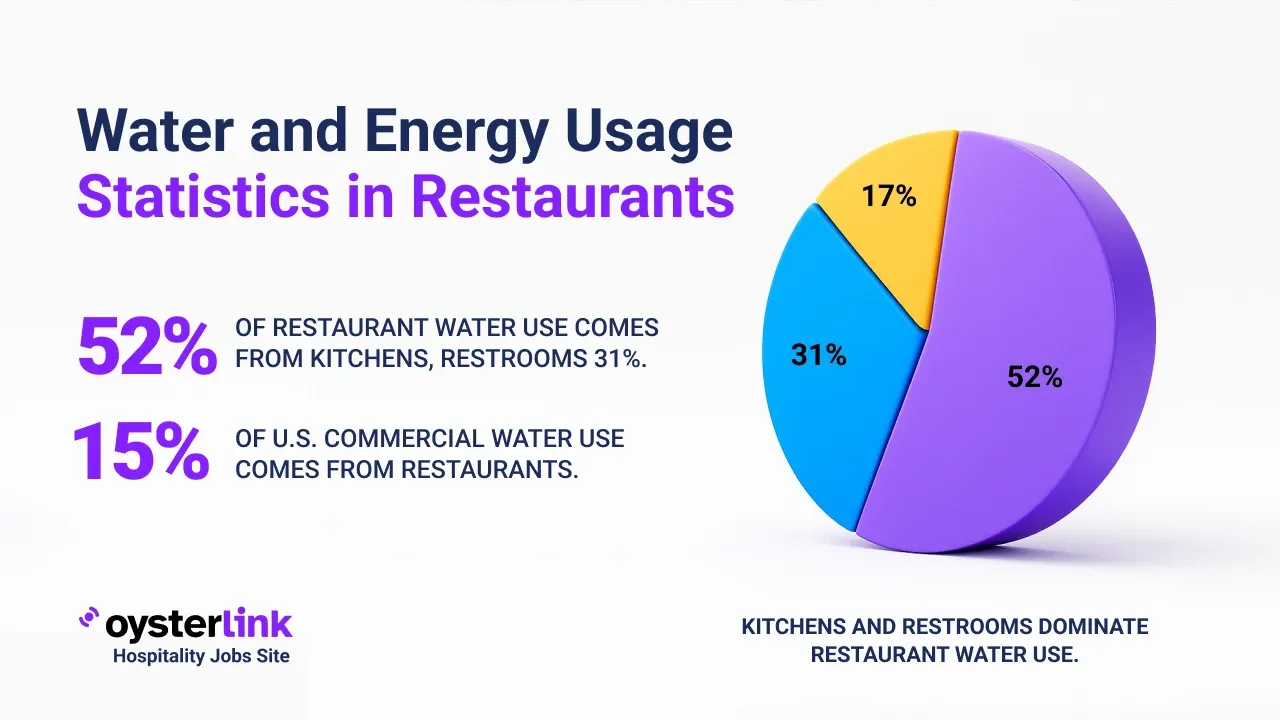

For hospitality employers, understanding operational costs like utilities can help plan budgets effectively. Check out strategies in our restaurant utility costs guide spotlight.

5. Grocery and Food Expenses in New Hampshire

Grocery costs in New Hampshire are moderately higher than national averages.

Average monthly grocery expenses are approximately $366.83 per person. Dining out varies with meals costing about $15 at casual spots and up to $50 at mid-range restaurants.

6. Healthcare Costs in New Hampshire

Healthcare expenses are a vital consideration:

Employer-sponsored health insurance costs average $125.00 per month, while Silver health insurance plans typically cost around $621.00 per month.

7. Educational Expenses in New Hampshire

Education options come with diverse cost considerations:

- Public Schools: Funded through taxes and free for residents

- Private Schools: Average tuition is about $15,000 annually

- In-state University Tuition: Estimated at $15,000 per year for state universities

These costs vary widely depending on the institution and type of education.

8. Entertainment and Leisure in New Hampshire

Recreational activities also influence living expenses:

- Movie Tickets: Average price is $12 each

- Gym Memberships: Monthly fees average $40

- Dining at Mid-Range Restaurants: Meals typically cost around $50

Annual entertainment and personal care services together amount to approximately $3,268.

9. Taxes and Miscellaneous Fees in New Hampshire

New Hampshire has a unique taxation structure:

- State Income Tax: No state income tax

- Sales Tax: No general state sales tax

- Property Tax: Average property tax rate is 1.93%

Residents benefit from low sales and income tax but pay higher property taxes relative to some states.

Restaurant owners might be interested in our spotlight on restaurant insurance cost for better understanding fixed costs.

10. Childcare and Family Expenses in New Hampshire

Costs related to childcare and family activities include:

- Daycare: Average monthly cost is $1,150

- After-School Programs: Approximately $300 monthly

- Extracurricular Activities: Estimated $100 per month

Families should consider these expenses carefully when budgeting for children.

11. Clothing and Personal Care in New Hampshire

Personal expenses break down as follows:

- Clothing: Monthly spending averages $100

- Personal Care Products and Services: Typically $54 per month

These expenditures vary by lifestyle but align with national averages.

12. Insurance Costs in New Hampshire

Insurance is a significant ongoing expense:

- Health Insurance: Average monthly premium is $125 for employer-sponsored plans

- Auto Insurance: Annual average premium is $2,760

- Homeowners Insurance: Estimated at $1,200 annually

- Renters Insurance: Costs approximately $180 per year

These insurance costs reflect state-specific risk profiles and coverage requirements.

13. Miscellaneous Expenses in New Hampshire

Other expenses that contribute to the cost of living include:

- Entertainment: Annual spending around $2,500

- Personal Care Services: About $768 annually

- Miscellaneous Goods and Services: Approximately $707 per year

These costs vary greatly based on individual preferences and lifestyle choices.

14. Income and Salaries in New Hampshire

Median household incomes have shown steady growth:

- 2010: $60,000

- 2015: $70,000

- 2020: $80,000

- 2023: $95,628

- 2025: Estimated stable at $95,628

This upward trend reflects economic development and increased earning potential within the state.

Hospitality employers who want to learn about how to hire restaurant staff fast can benefit from expert tips in our spotlight, ensuring the best talent to match these income levels.

15. Comparison with National Averages

New Hampshire's cost of living compared to national averages shows the following:

- Overall Cost: Approximately 13.5% higher than the national average

- Housing: Significantly higher at 43% above national average

- Utilities: About 10% higher

- Food: 5% higher than average

- Healthcare: 4% higher costs

- Transportation: 8% lower costs compared to national average

- Goods and Services: 5% higher than average

This data highlights that housing is the main contributor to elevated living costs, while transportation offers some relief financially.

Restaurant owners looking to optimize operations should consider reading our restaurant operations director vs manager spotlight to understand leadership impact on costs.

Our Methodology for New Hampshire Cost of Living Figures

We compile these cost of living details using trusted data repositories such as BLS, Numbeo, Zillow and government reports. When exact data is unavailable, reasonable estimates are employed to provide a reliable depiction of living costs.

New Hampshire Cost of Living: Conclusion

New Hampshire's cost profile in 2025 reflects a state with high housing costs but relatively affordable transportation and no state income or sales tax.

Rising home prices combined with steady income growth define the economic landscape, influencing affordability for residents.

Understanding these factors helps both current and prospective residents plan their finances effectively to enjoy the benefits of living in New Hampshire.

.webp)

.webp)