As a restaurant owner, you’re juggling efficiency, risk and customer satisfaction — all while keeping your loyal guests happy.

With more restaurants switching to cashless payments, you might be wondering: Is it the right move for your place? What if the internet crashes during a busy dinner rush, or a regular insists on paying with cash?

This article breaks down the benefits, potential pitfalls and unexpected challenges of going cashless so you can make an informed decision.

What Going Cashless Means

Going cashless, at its core, means your restaurant ditches bills and coins in favor of digital payments only.

Think standard cards, mobile apps like Apple Pay, Google Wallet — maybe even a QR code for quick orders. In a strictly cashless setup, there’s no paper money on the premises.

Going completely cashless can streamline operations, reduce cash handling errors and speed up the payment process.

It can also enhance safety by minimizing physical exchange and making transactions more secure.

However, it’s important to consider customer preferences and ensure you still accommodate guests who prefer cash or don’t use digital payments.

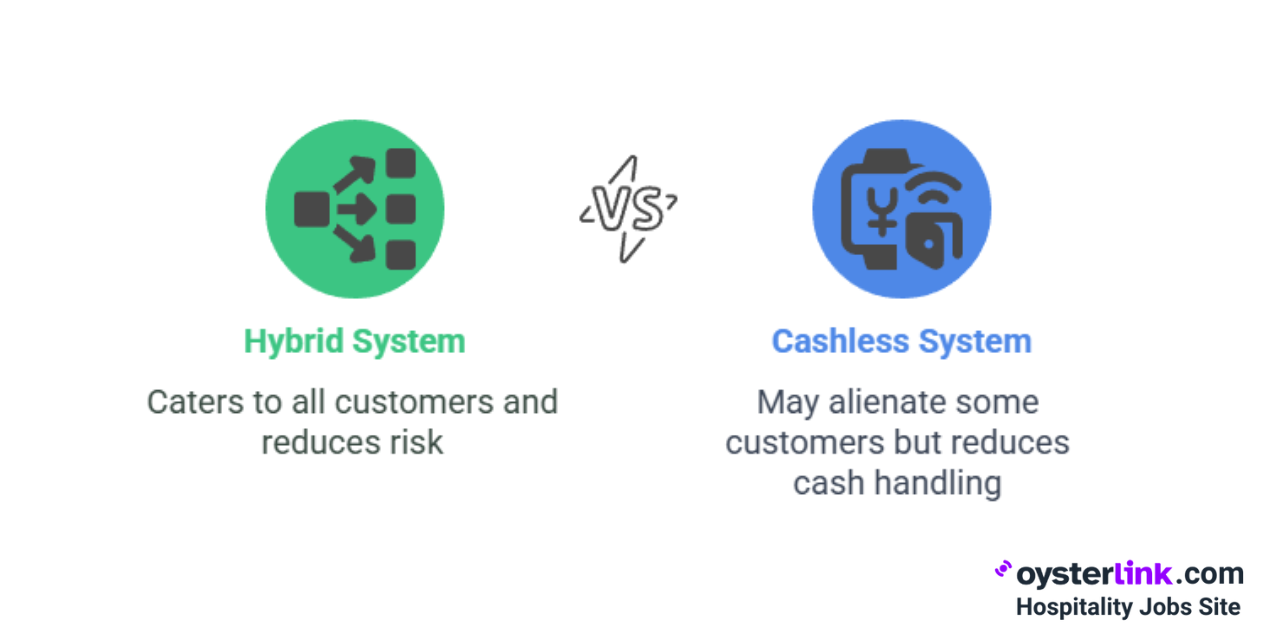

Many restaurants choose a hybrid approach, keeping some cash on hand for rare situations or customer requests. This flexibility helps them stay adaptable and guest-friendly.

Key steps to go cashless

- Check your guests’ payment habits — chat with your Servers, review your POS stats, maybe even a quick informal poll on a Saturday night.

- Make sure your system covers all major cards, popular app payments and contactless options. Actually test each one — tech snafus can sneak up on you.

- Staff training should go beyond button-pushing — prep teams for awkward guest questions (“No cash, you’re serious?”). Humor can go a long way.

- Communicate clearly: Post signs at doors, use table tents and get the word out via social or receipts — preferably all of the above, before any switch.

- Draft a plan B: What if the internet tanks, or you lose terminals mid-service?

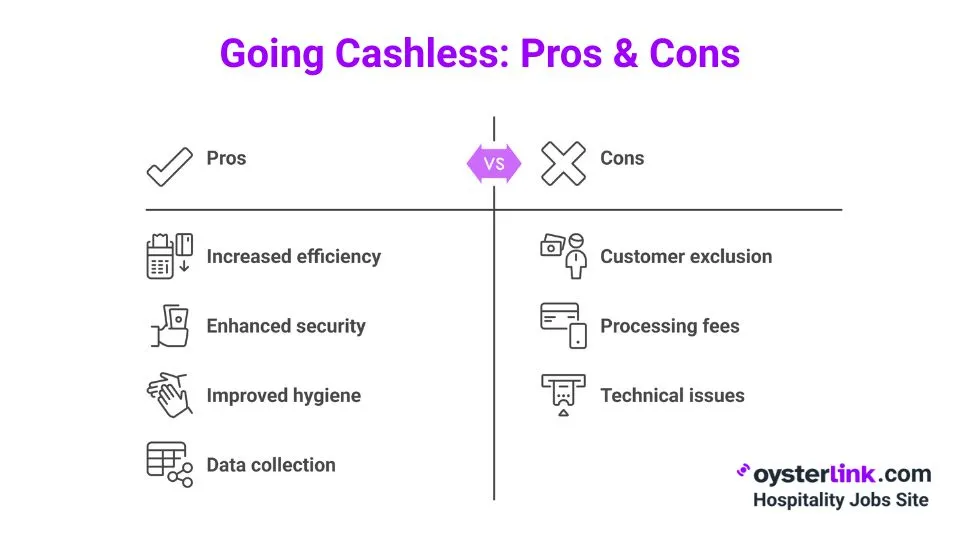

Pros of Going Cashless for Your Restaurant

Now that we’ve covered the basics and the current trends, let’s explore some of the key advantages that make going cashless an appealing option for many restaurateurs:

1. Increased speed and efficiency

Digital payments make checkout much quicker. Staff can flip tables or close tabs faster — and spend less time sorting through a mound of bills late at night. It’s a lifesaver during packed Saturday closes or short-staffed shifts.

2. Enhanced security and reduced theft

With no cash onsite, you lower the risk of theft — internally or otherwise — and don’t have to sweat about mysterious deposit shortfalls.

Plus, those armored car pick-ups? Gone. Every digital transaction leaves a trail, making it easier to track down any oddities if needed.

3. Improved hygiene and customer perception

Less dirty money means less germ-swapping — something that still matters for a lot of guests. Many now see card-only (especially tap-to-pay) as a mark of a modern, health-conscious restaurant.

4. Opportunity for better data collection

With digital receipts, it’s way easier to see who orders what, when and how often. That makes loyalty rewards or segmented promotions a breeze (like “free dessert every third visit”).

Cons of Going Cashless for Your Restaurant

Even though there are many advantages, it’s equally important to be aware of the potential challenges that come with going cashless. These include:

1. Excluding customers without digital access

Not everyone’s keen — or even able — to use cards or apps. Older customers, some low-income folks or international travelers might need cash, period.

Risk: Going full cashless could spark complaints, harsh social media posts or walkouts.

Mitigation: Post clear policies, and make sure your team can handle these chats with real empathy (for instance: “We do keep one cash drawer at the bar if you need it”).

2. Credit card and payment processing fees

Card companies don’t work for free — expect transaction fees, often 1.5%–3%, on each tap or swipe.

High volume or lower-priced spots may find those fees biting into profit. Compare processor rates carefully before making the call.

3. Technical issues and downtime risks

Like any technology, payment systems and Wi-Fi connections can fail — sometimes at the worst possible moments.

To stay prepared, consider these best practices:

- Have a Plan B: keep a hotspot handy, manual slip options or allow emergency cash payments if things go south.

- Your shift lead should know basic troubleshooting.

- Keep IT/emergency numbers within easy reach. (Maybe taped inside a drawer?)

Current Cashless Trends in the Restaurant Industry

Digital payments have seen explosive growth, particularly in urban areas and among customers under 40.

In fact, cashless transactions now account for almost 62% of restaurant payments across the country, highlighting how widespread this trend has become.

Below is a breakdown of the most comfortable tech options for full-service restaurant customers across different age groups:

Tech Option | All Adults | Gen Z Adults (18-27) | Millennials (28-43) | Gen Xers (44-59) | Baby Boomers (60-78) |

| Pay the check using a computer tablet at the table | 65% | 67% | 79% | 68% | 47% |

| Place an order using a smartphone app | 63% | 79% | 85% | 67% | 33% |

| Pay the check using contactless or mobile payment options | 62% | 73% | 82% | 64% | 37% |

| Place an order using a computer tablet at the table | 60% | 76% | 76% | 64% | 36% |

| Access the menu on a smartphone using a QR code | 59% | 69% | 78% | 66% | 30% |

| Pay the check using a digital wallet (e.g., Apple Pay, Samsung Pay, Google Wallet, PayPal, Venmo) | 57% | 72% | 80% | 60% | 25% |

| Pay the check using a smartphone app | 55% | 64% | 76% | 63% | 24% |

| Place an order on a smartphone using a QR code | 48% | 60% | 69% | 52% | 21% |

| Pay the check on a smartphone using a QR code | 46% | 58% | 65% | 52% | 16% |

[Source: National Restaurant Association]

Legal Considerations and Local Regulations

Understanding the legal landscape surrounding cashless payments is crucial for restaurant owners.

Regulations vary widely across different states and cities, and staying compliant can help avoid fines or legal issues while ensuring your business aligns with community expectations.

Federal Law

There is no federal law in the United States that requires private businesses to accept cash as payment for goods or services.

Businesses are generally free to set their own payment policies, including refusing cash, unless restricted by state or local laws.

State and local laws

Several states and cities have enacted laws requiring businesses to accept cash, aiming to protect consumers who rely on cash payments, especially unbanked or underbanked populations.

New Jersey, Rhode Island, New York City, San Francisco and Philadelphia have laws mandating that businesses accept cash payments.

For example, New York City requires businesses to accept cash starting from November 2020, with fines for non-compliance.

These laws often include exceptions for certain types of businesses, such as parking facilities or car rentals, but generally cover retail establishments, including restaurants.

Practical implications for restaurants

Restaurants operating in jurisdictions without specific cash-acceptance laws may legally refuse cash, but should remain aware of potential future regulations and community concerns.

Transparency remains key. Clearly communicate your payment policies, including any surcharges or fees, to customers upfront — such as on menus or signage — to avoid confusion and build trust.

Is Going Cashless Right for Your Restaurant?

There's no one-size-fits-all here — it really boils down to your crowd, location, competition and your appetite for risk.

To make an informed decision, consider these steps:

1. Evaluate your customer base

Do most guests use cards or apps, or are you still giving out a lot of change? Try a short guest survey — either at tables, with the check or via email.

Don’t forget to ask your Servers: they usually know who’s still using cash.

Remember: Age, income and neighborhood can make a surprising impact on payment choices.

2. Weigh the costs and benefits

Add up the expected savings (no more balancing cash drawers, less risk of theft, faster closeouts) and stack it against likely extra costs (processing fees, possibly new POS tech).

Sometimes, losing even 5% of loyal guests isn't worth it.

3. Test before full implementation

Start small — run a cashless test during slow weekday hours or just at the bar. Ask staff how it went and track any guest pushback.

Don’t be afraid to course-correct — it’s what the best operators do.

4. Renewal and update of payment systems

Tech changes fast. Take time at least once a year to review payment processors and hardware.

(And if your POS salesperson drops by, press them for info on cheaper, smoother integrations — don't be shy!)

Summary: Your Next Steps

- Talk to your guests and staff — see what payment habits and attitudes come up before deciding

- Pilot cashless in a small way first, and really listen to feedback (good and bad)

- Prep a backup strategy for system failures or confused guests (might want to print the plan, too)

- Review and renegotiate your processing fees — know exactly what you’re paying and what you’re saving

- You don’t have to handle everything on your own — reach out to nearby operators, there’s always something to learn!

About OysterLink

OysterLink is a dedicated platform that connects restaurant professionals with employers. It simplifies the process of finding quality hospitality jobs or recruiting the right talent quickly and effectively.

It offers job seekers salary insights, career advice and top job listings, while providing employers with tools to create compelling job ads, identify suitable candidates and access essential industry resources.

Loading comments...