Form A-4 Arizona: Key Takeaways

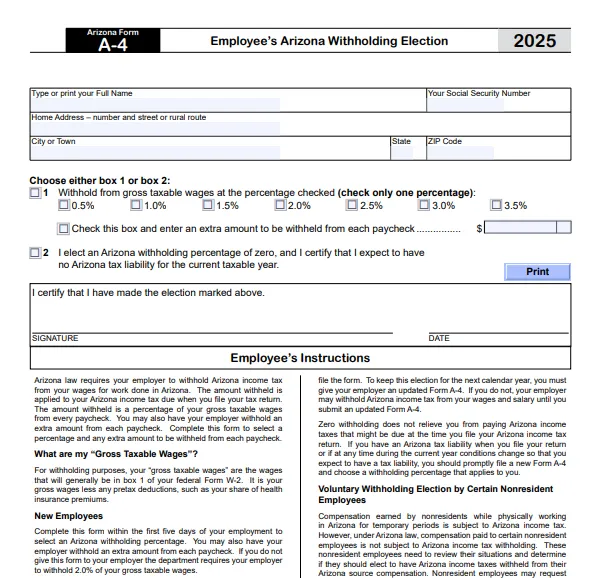

- Purpose – Arizona employees use Form A-4 to choose a state tax withholding percentage or request zero withholding if qualified.

- Timely Submission – New hires must submit it within 5 days or be defaulted to 2.0% withholding by their employer.

- Flexibility – You can change your rate or add extra withholding anytime by submitting a new form to your employer.

Who Needs to Fill Form A-4

- New employees must complete Form A‑4 within the first five days of employment. If they don’t, their employer must default to withholding 2.0% of gross wages.

- Current employees who wish to change their withholding percentage or add extra withholding must submit a new Form A‑4.

- Nonresident employees, even if not required to pay state tax, may still use Form A‑4 to request voluntary withholding.

Arizona Form A-4 Withholding Options Explained

Box 1 – Select a withholding rate (choose one):

- Options range from 0.5% to 3.5%, based on updated tax rates.

- You may also request an extra dollar amount to be withheld each paycheck.

Box 2 – Elect zero withholding if qualified:

- Eligible if you had no Arizona tax liability last year and expect none this year.

- Choosing zero means no withholding, but you must file a new form if circumstances change.

Form A-4 Submission & Timing

- Submit the completed form to your employer, not the Arizona Department of Revenue.

- If you don’t submit on time, your employer uses the default 2.0% rate.

- Elections remain in effect until you file another form to change them.

Special Considerations When Filling Arizona Form A-4

- Voluntary withholding for nonresident employees is an option even if not required.

- Note: Zero withholding doesn’t exempt you from paying Arizona taxes if you owe at year‑end.

Filling Form A-4 in Arizona Summary

| Situation | Action Required | Notes |

|---|---|---|

| New hire | Complete Form A-4 within 5 days | Risks default 2.0% withholding if not done |

| Want to change withholding rate | Submit a new Form A-4 | Works for rate or extra withholding limit |

| Qualified for zero withholding | Check box 2 on Form A-4 | Must qualify and update if liability changes |

| Nonresident wanting withholding | Submit Form A-4 voluntarily | Optional but available |

| No form submitted | Employer withholds at default 2.0% | May under- or over-withhold |

Arizona’s Form A-4 is straightforward but crucial. You determine how much state tax will come out of your paycheck by:

- Picking a withholding rate

- Optionally adding extra withholding

- Or opting out completely if eligible for zero withholding

Just be sure to file it on time, update it when needed, and remember — zero withholding doesn’t eliminate your tax obligations.

Loading comments...